Big Data as a Service (BDaaS) Market Report Scope & Overview:

Get More Information on Big Data as a Service (BDaaS) Market - Request Sample Report

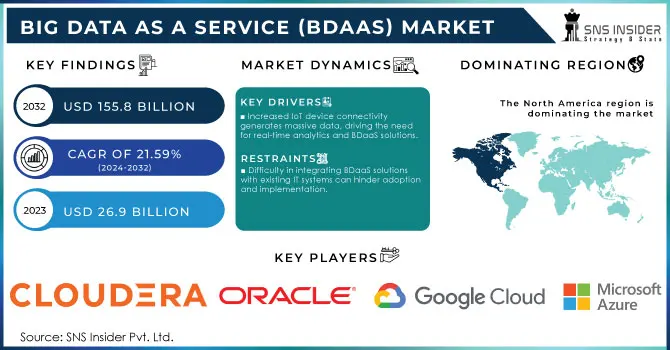

Big Data as a Service (BDaaS) Market was valued at USD 26.9 billion in 2023 and is expected to reach USD 155.8 Billion by 2032, growing at a CAGR of 21.59% from 2024-2032.

The Big Data as a Service (BDaaS) market is expanding rapidly due to the increasing demand for data-driven decision-making and digital transformation across industries. BDaaS offers flexible cloud-based solutions that allow organizations to handle and analyze large data sets without requiring expensive infrastructure. Companies use these services to gain actionable insights, improve efficiency, and develop new strategies. BDaaS providers deliver a variety of solutions, such as Hadoop-as-a-Service and Data Analytics-as-a-Service, enabling businesses to simplify data management. The market’s growth is primarily driven by the rising adoption of cloud computing, increased IoT connectivity, and the growing reliance on advanced analytics for gaining a competitive advantage. As data generation continues to surge, businesses need real-time analytics, which in turn boosts the demand for BDaaS. Additionally, stricter regulatory and compliance requirements, especially in sectors like finance and healthcare, are encouraging companies to adopt BDaaS to securely and efficiently manage their data.

For example, Amazon Web Services (AWS) offers BDaaS solutions such as Amazon Redshift and Amazon EMR (Elastic MapReduce), which provide flexible data processing and analysis capabilities. In 2023, AWS reported a significant increase in demand for these services, with customers like Airbnb using BDaaS to process vast amounts of data in real-time, enhancing both customer experience and operational efficiency. The increasing use of AI, machine learning, and predictive analytics will drive further adoption of BDaaS across sectors like retail, manufacturing, and healthcare, where real-time data insights are essential for innovation and competitiveness. For instance, According to a 2023 report, 50% of organizations have adopted AI in at least one business function, up from 40% in 2022, indicating a strong trend toward integrating AI technologies.

In summary, the BDaaS market is on track for sustained growth, fueled by expanding data volumes, rising cloud adoption, and the demand for real-time insights, positioning it as a key enabler of modern business strategies.

Big Data as a Service (BDaaS) Market Dynamics

Drivers

-

The shift to cloud-based infrastructure enables scalable and cost-effective data management solutions.

-

Increased IoT device connectivity generates massive data, driving the need for real-time analytics and BDaaS solutions.

-

BDaaS reduces the need for expensive in-house infrastructure, attracting businesses looking to optimize costs.

One of the advantages of Big Data as a Service (BDaaS) in the BDaaS market is that it saves money on expensive equipment and infrastructure at home. In the past, handling and processing large volumes of data demanded significant investments in servers, storage, advanced analytics tools, together with ongoing maintenance and specialized IT personnel.

As a cloud-based solution, BDaaS lifts this financial weight by enabling companies to leverage scalable, on-demand data management and analytics resources. If a company needs storage or processing power, it need only purchase the resources that they require and nothing more; thus, reducing capital and operational expenses.

Providing an example, companies can rapidly access large data sets without increasing physical infrastructure, lowering hardware costs and minimizing downtime. Other benefits of BDaaS include flexibility, since organizations can adjust the scale of their data operations whenever necessary to not invest in infrastructure that they do not need. This economical approach is useful especially for small and medium scale enterprises (SMEs) who have budget constraints, while larger organisations can utilize the power of data without worrying about managing hardware. To sum up, BDaaS is cost-effective for businesses as it reduces the expense of managing and maintaining in-house infrastructure by delivering a cloud-native, scalable data service that scales as per business needs.

The growing requirement of real-time analytics is fueled by the new business use cases emerging from billions of connected Internet of Things (IoT) devices, with rapidly increasing demand for Big Data as a Service (BDaaS). With the advent of an increasing number of connected devices, such as sensors, smart home gadgets, industrial appliances and more, we find ourselves in the middle of a continuous data generation storm. Such data includes everything from operational metrics to customer behaviors and environmental conditions, all of which need real-time analysis for businesses to make fast decisions, streamline processes and provide better customer experience. These intimidatingly large and complex datasets can be efficiently managed and analyzed with BDaaS — scalable, cloud-based tools that free organizations from investing in expensive on-premises infrastructure. With BDaaS they can process IoT data faster, which means that real-time analytics will be powered so companies get actionable insights promptly and respond proactively. For example, in industries such as manufacturing and logistics, real-time IoT analytics can help keep tabs on equipment health and performance, conducting predictive maintenance to avoid costly downtimes.

In the real time data analysis of IoT, some industries like retail and healthcare also gets advantage. This allows retailers to spy on the different behaviors of customers, better manage supplies, and send specific requests for offers to customers, while also allowing health care providers to monitor patients from any distance and provide essential services. To summarize, IoT devices are becoming significantly more connected, creating a massive amount of data that needs real-time processing. This is where BDaaS solutions come to the rescue making the advent of IoT a major market driver for BDaaS growth.

Restraints

-

Difficulty in integrating BDaaS solutions with existing IT systems can hinder adoption and implementation.

-

A shortage of skilled data analysts and IT professionals can limit organizations' ability to leverage BDaaS effectively.

-

Inconsistent or poor-quality data can undermine the effectiveness of BDaaS solutions, leading to unreliable insights.

The data processing is the most important part to achieve effective analytics and insights from the Big Data as a Service (BDaaS) market. Weak data or variable quality can immediately diminish the benefit gained from BDaaS solutions. When organizations use BDaaS to analyze data, they expect insights to be accurate, reliable and meaningful enough to support their strategic decisions. But when the real data is erroneous resulting from being wrong, incomplete or inconsistent then misleading results can be obtained.

In critical areas of health and finance, for instance, bad data can cause improper patient diagnoses or financial imbalances. These errors then also endanger operational efficiency but even more seriously compliance and regulatory functions. While under a BDaaS umbrella, organizations often combine data across disparate sources like IoT devices, social media, and transactional systems. If any of these sources give inaccurate information, it will bias the analytics and cause decisions to be based on wrong data.

Also, dependency on BDaaS may exacerbate poor data quality. With organizations depending on these services for real-time insights and decision-making, the impact of imperfect data become magnified. Corporates may adopt BDaaS solutions without resolving the fundamental causes of poor data quality, thus losing out on improvement opportunities and wasting monetary resources.

Implementing BDaaS is only going to increase the risks associated with data governance and quality if enterprises do not sort their processes prior to on-boarding a BDaaS solution. The importance of accuracy, completeness and consistency is paramount if BDaaS is to provide value to an organization with dependable insights when pivoting strategy based on the desire for growth in a competitive environment.

Big Data as a Service (BDaaS) Market Segment Analysis

By Deployment

The public cloud segment dominated the market in 2023, capturing a revenue share of 62.8%. Public cloud platforms utilize a pay-as-you-go pricing model, which enables organizations to bypass the significant capital expenditures tied to on-premises infrastructure. This approach is especially advantageous for small and medium-sized enterprises that require big data analytics capabilities without the financial burden of expensive hardware. Additionally, public cloud services offer scalability, allowing businesses to modify their data storage and processing capabilities based on demand, which helps maximize resource utilization and effectively manage costs.

Conversely, the hybrid cloud segment is expected to register the highest compound annual growth rate (CAGR) throughout the forecast period. Hybrid cloud solutions allow organizations to allocate resources dynamically between public and private clouds in response to real-time demands and workload needs. This adaptability is particularly beneficial for companies encountering varying data volumes or sudden spikes in data processing requirements. By combining the public cloud's scalability with the private cloud's control, businesses can efficiently manage their big data workloads, achieving both high performance and cost-effectiveness. Their unique flexibility and scalability features fuel the increasing demand for hybrid cloud deployments.

By Solution

In 2023, the data analytics-as-a-service (DAaaS) segment dominated the market and accounted for the largest revenue share in the market as different industry organizations are realizing that deriving business insights from data will thus play a key role amid rapid changes and disruptions. The DAaaS market has been primarily fueled by this trend. DAaaS solutions allow businesses to analyze large data volumes quickly and effectively while also delivering actionable insights that drive strategic decisions. Demand for these solutions is particularly robust among industries such as retail, finance, healthcare, and manufacturing in which data insights enhance customer experiences, streamline operations, and boost competitive advantages. One of the reasons for DAaaS's increasing adoption is its own ability to carry out real-time, data-driven insights.

However, Hadoop-as-a-Service (HaaS) segment anticipated to grow at fastest compound annual growth rate (CAGR) during the forecast period. HaaS provides a solution that makes it easier to manage the complexities of Hadoop infrastructure by providing a managed service responsible for technical aspects like setup, configuration and maintenance. With this intuitive model enterprise no more requires an IT team to deploy Hadoop based big data solution. HaaS minimizes the technical challenges associated with Hadoop, thus making big data analytics available to a larger set of companies, including those who might not have substantial in-house expertise.

By End-Use

In 2023, the BFSI segment held the largest revenue share in the market. Hence, it is vital to stress upon groomed risk solutions and fraud detection in this industry. The rise in transaction complexities along with a fast increase in cyberattacks demands complex data analytics too. With fast and accurate tools for real-time big data analysis, BDaaS helps BFSI organizations identify any irregular patterns, predict trends-for risk management, and a quicker identification of fraud. The proactive ability to mitigate risks and enhance security is one of the leading factors for BDaaS adoption in the BFSI sector.

However, manufacturing segment is anticipated to grow at the largest Compound Annual Growth Rate (CAGR) during the forecast period. In order to meet customer expectations and adhere to industry standards, it is imperative that manufacturers uphold high product quality as well as performance. BDaaS platforms make it easier for manufacturers to analyse quality control data, production metrics, and customer feedback that enables them to track and improve product quality. With the help of big data analytics, manufacturers can easily locate the problems and make necessary corrections on time besides improving their production processes continuously. This effort to manufacture superior quality products and eliminate defects are driving the growth of this BDaaS solutions that provide necessary tools for efficient quality management.

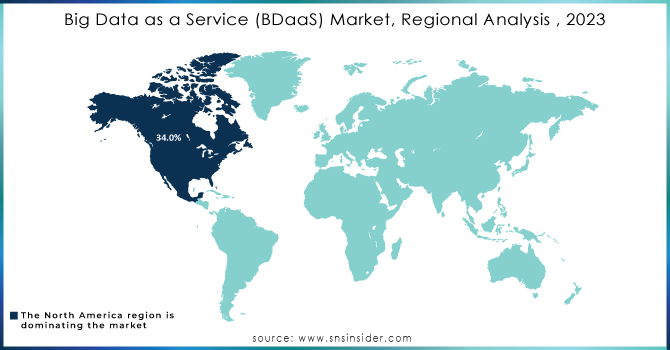

Regional Analysis

The North America dominated the market and represented revenue share of more than 36.1%, in 2023. Cloud computing has been widely adopted across the region with several businesses already leveraging different services on the cloud. This existing infrastructure and the natural progression toward cloud has made it easy for BDaaS to take advantage of being a cloud-based solution. Organizations in North America are gradually adopting the cloud for their data workloads due to its scalability, flexibility and cost-efficiency. This robust cloud attitude propels the rise of BDaaS because organizations Are looking to turn out to be greater aligned with region solutions big data that suits their infrastructures, and their cloud strategy.

During the forecast period, Asia Pacific BDaaS market is expected to grow at the highest compound annual growth rate (CAGR). The increased adoption of cloud computing throughout the region is driven by an increased need for flexible, scalable, and affordable IT solutions. BDaaS is a cloud-based service that takes an advantage of this trend by giving local businesses the ability to use sophisticated data analytics tools without major capital investment in infrastructure. BDaaS is also witnessing an increase in the Asia Pacific due to a growing acceptance of cloud technologies and a shift towards cloud-based solutions. And companies are leveraging BDaaS to take advantage of cloud computing and enhance data analytics.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major key players with their Services

-

Amazon Web Services (AWS) - Amazon Redshift

-

Microsoft Azure - Azure Synapse Analytics

-

Google Cloud Platform (GCP) - BigQuery

-

IBM - IBM Cloud Pak for Data

-

Oracle - Oracle Big Data Service

-

Cloudera - Cloudera Data Platform

-

Hortonworks - Hortonworks Data Platform

-

SAP - SAP Data Intelligence

-

Teradata - Teradata Vantage

-

Snowflake - Snowflake Data Cloud

-

Domo - Domo Business Cloud

-

Qlik - Qlik Sense

-

Sisense - Sisense for Cloud Data Teams

-

Tableau (Salesforce) - Tableau Cloud

-

Hewlett Packard Enterprise (HPE) - HPE Ezmeral Data Fabric

-

Alteryx - Alteryx Designer

-

Palantir Technologies - Palantir Foundry

-

Apache Cassandra - Apache Cassandra as a Service

-

Splunk - Splunk Cloud

-

Zoho - Zoho Analytics

B2B User

-

Netflix

-

LinkedIn

-

Spotify

-

Vodafone

-

Zoom

-

Mastercard

-

PayPal

-

Siemens

-

Coca-Cola

-

Instacart

-

eBay

-

American Express

-

Nasdaq

-

Charles Schwab

-

Boeing

-

Unilever

-

JP Morgan Chase

-

Instagram

-

Verizon

Recent Developments

In June 2024, China introduced Ocean Cloud, its inaugural open marine big data service platform, at an event in Xiamen held in conjunction with World Oceans Day. The platform is designed to enhance the integration and accessibility of marine data, facilitating improved information exchange on both national and global scales through a global ocean three-dimensional observation network.

In December 2023, DxVx entered into a partnership with LG CNS to jointly develop a bio-healthcare big data platform that incorporates artificial intelligence (AI). This collaboration aims to strengthen DxVx's capabilities in personalized precision medicine by utilizing AI for advanced data analysis and enhancing healthcare solutions.

| Report Attributes | Details |

| Market Size in 2023 | USD 26.9 billion |

| Market Size by 2032 | USD 155.8 Billion |

| CAGR | CAGR of 21.59 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Public Cloud, Private Cloud, And Hybrid Cloud) • By Component {Solution (Hadoop-As-A-Service, Data-As-A-Service, And Data Analytics-As-A-Service), Services}, • By Enterprise Size (Small and Medium-Sized Business, And Large Enterprises) • By End-Use (BFSI, Manufacturing, Retail, Media & Entertainment, Healthcare, IT & Telecommunication, Government, And Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Accenture, Amazon Web Services, inc., Google LLC, Hewlett Packard Enterprise Development lp, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., GoodData, Hitachi Vantara, Teradata |

| Key Drivers | •The shift to cloud-based infrastructure enables scalable and cost-effective data management solutions. •Increased IoT device connectivity generates massive data, driving the need for real-time analytics and BDaaS solutions. •BDaaS reduces the need for expensive in-house infrastructure, attracting businesses looking to optimize costs. |

| Market Opportunities | •Difficulty in integrating BDaaS solutions with existing IT systems can hinder adoption and implementation •A shortage of skilled data analysts and IT professionals can limit organizations' ability to leverage BDaaS effectively •Inconsistent or poor-quality data can undermine the effectiveness of BDaaS solutions, leading to unreliable insights. |