Incident Response Market Report Scope & Overview:

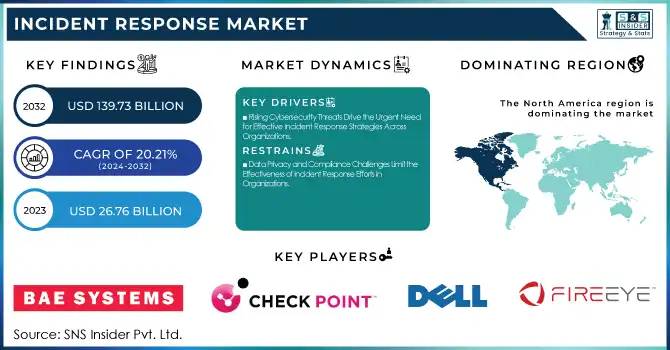

The Incident Response Market was valued at USD 26.76 billion in 2023 and is expected to reach USD 139.73 billion by 2032, growing at a CAGR of 20.21% from 2024-2032. This report includes insights on the adoption rates of emerging technologies, response time metrics, technology utilization, and the cost of cyber incidents. As organizations face increasing cyber threats, the demand for efficient incident response solutions is rising, fueled by the need for faster response times and advanced technologies to mitigate the financial impact of cyber incidents. Market growth is driven by increasing awareness and regulatory pressures.

To get more information on Incident Response Market - Request Free Sample Report

Incident Response Market Dynamics

Drivers

-

Rising Cybersecurity Threats Drive the Urgent Need for Effective Incident Response Strategies Across Organizations

As cyberattacks become more sophisticated, organizations are confronted with greater demands to shield sensitive information and important systems. The proliferation of threats like ransomware, phishing, and data breaches has created an imperative for businesses to proactively adopt robust incident response measures. Such incidents can result in significant monetary losses, reputational harm, and regulatory fines, which make companies take quick, decisive steps. The need for quick detection, containment, and remediation of cybersecurity incidents is now necessary to limit damage and maintain business continuity. Therefore, organizations are increasingly investing in sophisticated incident response solutions to protect their assets and address the increasing expectations of a dynamic cyber threat environment.

Restraints

-

Data Privacy and Compliance Challenges Limit the Effectiveness of Incident Response Efforts in Organizations

In the response to the incident, the requirement for accessing and analyzing sensitive information can pose extensive data privacy issues. Organizations are faced with a delicate balance between the urgency of discovering and fixing security incidents and the responsibility of keeping personal and confidential information safe. In most situations, it could be a breach of privacy laws or regulatory conditions such as GDPR, HIPAA, or other data protection regulations, which might create legal issues. This presents a sensitive dilemma for incident response teams, who need to make sure that their activities do not unintentionally trigger additional compliance infractions or subject the organization to lawsuits and penalties. Consequently, the intricacies of data privacy and compliance can limit the velocity and efficacy of incident response efforts, especially for highly regulated sectors.

Opportunities

-

AI, Automation, and Cloud Security Drive Significant Growth Opportunities in the Incident Response Market

The convergence of AI and machine learning into incident response procedures is transforming the sector, enabling quicker, more effective detection and remediation of cyberattacks. Automated tools are able to process large amounts of data in real-time, detect anomalies, and trigger responses automatically, thereby cutting down on the time to contain security incidents. Moreover, the growing shift to cloud infrastructure offers scope for customized incident response solutions for cloud security. Managed Detection and Response solutions are also increasingly popular, providing enterprises with cost-effective solutions and professional assistance. In addition, as cybersecurity regulation becomes more stringent, the demand for compliant incident response solutions increases, coupled with an increasing demand for professional training services to create professional response teams, particularly among small and medium-sized enterprises.

Challenges

-

Coordination and Communication Challenges Delay Effective Incident Response During Cybersecurity Incidents

During cybersecurity breach, efficient coordination among internal teams, third-party vendors, and law enforcement can be challenging, particularly under stress. The intricacy of keeping all parties on the same page in real-time can result in response delays, amplifying the overall effect of the attack. Furthermore, the ever-changing threat landscape makes it challenging for organizations to remain one step ahead of cybercriminals, who often use new tactics and malware. Limited budgets, as well as specialized professionals, are additional complexities faced in incident response. Also, the increased intricacy of IT environments, such as multi-cloud infrastructures, contributes to inefficiency in incident management. Since organizations focus on ensuring business continuity and not disrupting it through downtime, having an efficient mechanism of communication and prompt decision-making becomes essential for handling cyber threats.

Incident Response Market Segment Analysis

By Component

The Services segment led the Incident Response Market with the largest revenue share of nearly 57% in 2023 because the demand for specialized, real-time incident response and recovery, spearheaded by experienced professionals, was on the rise. Companies are more inclined towards outsourcing such services to expert agencies to ensure effective, prompt mitigation of cyberattacks. The higher level of cyberattack complexity and lack of sufficient skilled personnel in-house also lead businesses to make an investment in managed services, hence leading the segment.

The Solution segment shall grow at the fastest CAGR of around 20.64% from 2024-2032 as businesses are increasingly leveraging automated, AI-based solutions to detect and respond to cybersecurity breaches more quickly. Cloud computing has increased with growing demand for cost-effective, efficient, and scalable incident response systems, thus leading to the growth. Businesses are spending more on these proactive technology-based solutions in order to counter the changing threat landscape.

By Organization Size

The Large Enterprises sector led the Incident Response Market in the highest revenue share of approximately 68% in 2023 owing to their larger IT infrastructure, complex operations, and increased exposure to cyberattacks. These enterprises allocate hefty budgets and focus on strong, comprehensive incident response practices. Their greater spending on cybersecurity and the need for regulatory compliance render them the main buyers of incident response solutions and services.

The SMEs segment is expected to grow at the fastest CAGR of approximately 21.44% during 2024-2032, as small and medium-sized businesses are increasingly acknowledging the significance of cybersecurity in protecting business operations. As cyberattacks on SMEs increase, these companies are investing in cost-effective, scalable incident response solutions. The increasing use of cloud-based services and managed detection and response solutions further drives the segment's high growth.

By Vertical

The IT & Telecom sector led the Incident Response Market with the largest revenue share of approximately 22% in 2023 because of the essential role played by these sectors in preserving communication networks and data services. The rising intensity and new wave of cyberattacks aimed at infrastructure and sensitive information in this sector necessitate the need for sophisticated, real-time incident response mechanisms. These sectors are also subject to stringent regulatory compliance needs, which further enhance demand.

The Healthcare & Life Sciences segment would expand at the fastest CAGR of approximately 23.65% during 2024-2032, with this sector experiencing mounting threats to sensitive patient data as well as critical systems. Growing healthcare digitization and mounting pressure to comply with stringent data protection legislation is fueling demand here. Cybersecurity spending is picking up pace to safeguard patient privacy, business continuity, and regulatory compliance with healthcare-specific requirements.

By Security Type

The Network Security segment led the Incident Response Market with the largest revenue share of approximately 31% in 2023 because of the growing sophistication and number of cyber threats aimed at organizational networks. Since organizations are reliant on interconnected systems, protecting their network infrastructure from such attacks as DDoS, malware, and ransomware is a priority. The growing number of network vulnerabilities and continuously evolving attack methods fuel high demand for sophisticated network security solutions.

The Endpoint Security market is anticipated to witness the fastest CAGR of approximately 22.46% during 2024-2032 due to growing numbers of devices like laptops, mobile phones, and IoT devices being used as entry points for cyberattacks. Remote work and the adoption of BYOD policies have bolstered the demand for endpoint protection. This trend fuels investment in advanced endpoint security solutions to avoid breaches and maintain constant protection.

By Service Type

The Assessment and Response segment led the Incident Response Market with the largest revenue share of around 39% in 2023 because it plays a critical role in detection, evaluation, and immediate mitigation of cybersecurity threats. Organizations value quick response to reduce damage from incidents such as data breaches and ransomware attacks. The segment's leadership is fueled by the growing demand for instant threat evaluation and effective response measures to guarantee business continuity and reduce financial loss.

The Incident Response Planning and Development sector is expected to grow at the fastest CAGR of nearly 23.53% during the forecast period from 2024-2032, with firms focusing more on establishing strong, proactive defense. Increasing awareness regarding the importance of overall preparation to counter cyber threats is fuelling demand. More companies are putting money into designing elaborate incident response plans for the purpose of quicker and efficient mitigation, adherence to regulatory compliance, and overall firm resilience.

Regional Analysis

North America led the Incident Response Market with the largest revenue share of approximately 39% in 2023 because of its highly developed technological infrastructure, high level of cybersecurity awareness, and large vendors of cybersecurity technology. The region is confronted with a broad array of sophisticated cyber threats, which have driven high levels of expenditure on incident response solutions. Moreover, robust data protection laws and compliance mandates fuel demand for robust cybersecurity solutions, further establishing North America's leadership in the market.

The Asia Pacific region is anticipated to expand at the fastest CAGR of approximately 22.69% during 2024-2032, fueled by the fast-paced digitalization and growing cyber threats in the region. The increasing usage of cloud computing, mobile technologies, and IoT devices is broadening the attack surface, causing an increasing demand for strong incident response solutions. Governments and enterprises are also spending significantly on cybersecurity to safeguard sensitive information and keep up with changing regulations, which is driving the market forward.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BAE Systems (Managed Detection and Response, Threat Intelligence Services)

-

Check Point Software Technologies Ltd. (Incident Response Service, Threat Extraction)

-

Cisco Systems, Inc. (Cisco Threat Response, Cisco SecureX)

-

Cylance Inc. (CylancePROTECT, CylanceOPTICS)

-

Dell Inc. (Dell SecureWorks Incident Response, Dell Data Security)

-

FireEye, Inc. (FireEye Helix, FireEye Endpoint Security)

-

International Business Machines Corporation (IBM Resilient Incident Response, IBM QRadar)

-

Kaspersky Lab (Kaspersky Incident Response, Kaspersky EDR)

-

McAfee, LLC (McAfee MVISION EDR, McAfee Advanced Threat Defense)

-

Palo Alto Networks, Inc. (Cortex XSOAR, Palo Alto Networks Next-Generation Firewall)

-

Symantec (Symantec Endpoint Protection, Symantec Incident Response Services)

-

Verizon (Verizon Incident Response, Verizon Managed Detection and Response)

-

NTT Security (NTT Managed Security Services, NTT Threat Intelligence)

-

Trustwave (Trustwave Managed Security Services, Trustwave Threat Detection and Response)

-

Rapid7 (InsightIDR, Managed Detection and Response)

-

CrowdStrike (Falcon Incident Response, Falcon Endpoint Protection)

-

Optiv (Optiv Managed Detection and Response, Optiv Security Consulting)

-

Resolve Systems (Resolve Incident Management, Resolve Automated Playbooks)

-

Kudelski Security (NSS Labs Threat Intelligence, Kudelski Cyber Threat Intelligence)

-

Swimlane (Swimlane Security Orchestration, Swimlane Incident Response)

-

LogRhythm (LogRhythm SIEM, LogRhythm Incident Response Automation)

-

Carbon Black (Carbon Black Response, Carbon Black Cloud)

Recent Developments:

-

In 2025, Cylance introduced its Smart Antivirus for mobile devices, leveraging AI to provide advanced protection against cyber threats on Android and iOS platforms.

-

In August 2024, IBM introduced a new generative AI-powered cybersecurity assistant designed to enhance threat detection and response services, accelerating incident response capabilities

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 26.76 Billion |

| Market Size by 2032 | USD 139.73 Billion |

| CAGR | CAGR of 20.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Service Type (Retainer, Assessment and Response, Tabletop Exercises, Incident Response Planning and Development, Advanced Threat Hunting, Others) • By Security Type (Web Security, Application Security, Endpoint Security, Network Security, Cloud Security) • By Organization Size (SMEs, Large Enterprises) • By Vertical (BFSI, Government, Healthcare & Life Sciences, Retail & E-Commerce, Travel & Hospitality, Manufacturing, IT & Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BAE Systems, Check Point Software Technologies Ltd., Cisco Systems, Inc., Cylance Inc., Dell Inc., FireEye, Inc., International Business Machines Corporation, Kaspersky Lab, McAfee, LLC, Palo Alto Networks, Inc., Symantec, Verizon, NTT Security, Trustwave, Rapid7, CrowdStrike, Optiv, Resolve Systems, Kudelski Security, Swimlane, LogRhythm, Carbon Black |