Bio-Based Coatings Market Report Scope & Overview:

Get More Information on Bio-Based Coatings Market - Request Sample Report

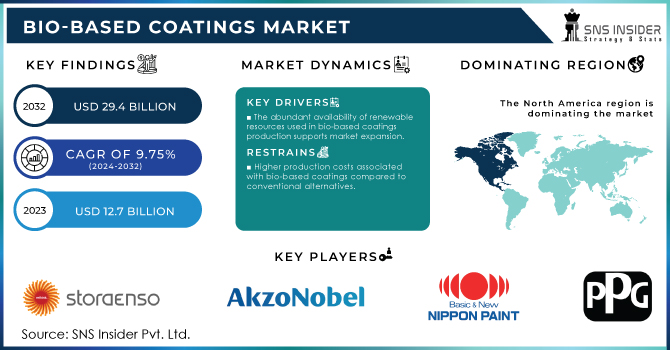

The Bio-Based Coatings Market Size was valued at USD 12.7 billion in 2023 and is expected to reach USD 29.4 billion by 2032 and grow at a CAGR of 9.75% over the forecast period 2024-2032.

The growth of the bio-based coatings market is fueled by increasing environmental concerns and regulations favoring sustainable solutions. Consumer demand for eco-friendly products, coupled with advancements in biotechnology, drives innovation in bio-based coating formulations. Rising awareness about the harmful effects of traditional coatings on human health and the environment prompts industries to adopt bio-based alternatives. Government initiatives and incentives for the development and utilization of renewable resources further stimulate market growth. Additionally, the expanding application areas of bio-based coatings across various industries such as paint and coatings, automotive, construction, and packaging contribute to market expansion.

The bio-based coating market is increasingly driven by the worldwide trend of minimizing the dependency on fossil fuels reflected by numerous industries seeking to reduce their carbon footprints. To some extent, this development could be attributed to regulatory imperatives and should certainly be viewed within the broader context of corporate responsiveness and alignment with sustainability guidelines.

For example, in 2023, the European Union strengthened its commitment to reduce greenhouse gas emissions by 55% by 2030 under the European Green Deal, thus encouraging companies to replace petroleum-based products with less polluting alternatives. Consequently, it appears evident that the growing demand for bio-based coatings is motivated by the prohibition of other types of products and the necessity to reduce environmental pollution.

Moreover, recent example of such developments is the introduction of the new range of bio-based coatings by AkzoNobel that also occurred in 2023. According to the company’s representatives, these coatings “use bio-based resins and are made from renewable sources, and designed to meet the strictest environmental standards set by governments. Alternatively, the U.S. Department of Energy highlights that bio-based products, including coatings, are expected to “reduce the generation of carbon dioxide by 50%.

The funds increased the value of investments dedicated to the promotion of bio-based industries, including coatings. Simultaneously, leading manufacturers, such as PPG Industries Inc. and Sherwin-Williams Co., also witnessed a rise in R&D investments aimed at delivering new bio-based technologies. The combined efforts from both public and private sectors ensure that sustainable coatings become more widespread and widely available in the foreseeable future.

Drivers

-

The abundant availability of renewable resources used in bio-based coatings production supports market expansion.

The bio-based coatings market is greatly facilitated by the presence of renewable resources sufficient in their supply. These resources are required for the production of environmentally-friendly coatings, and they often include such products as plant oils, starches, cellulose, and other by-products of the agricultural sector. They are readily available and can be sourced in a sustainable manner, which allows for the creation of a stable supply chain for the manufacturers of bio-based coatings. The abundant presence of these resources that is often across the globe ensures that the production of such coatings will not stop and guarantees that their price will always be competitive with the petroleum-based options. It is also facilitated by there being a demand by the incumbent market for more eco-friendly options. The development of agriculture and governmental encouragement to develop renewable resources further ensures the presence of these raw materials. The U.S. Department of Agriculture is an example of a governmental institution promoting this development: in 2023, they increased the indemnity percentage for growers who grow commodity crops used in bio-based materials. The availability of these resources is one of the driving forces of the market’s growth, as it allows for the production of bio-based coatings on a large and consistent scale.

Restrain

-

Higher production costs associated with bio-based coatings compared to conventional alternatives

The higher production costs associated with bio-based coatings present a significant restraint to their widespread adoption. Compared to conventional petroleum-based alternatives, bio-based coatings often involve more expensive raw materials and complex manufacturing processes, leading to higher overall costs. This price difference can be a barrier for cost-sensitive industries and consumers, limiting the market's growth potential. Despite the environmental benefits, the premium pricing of bio-based coatings makes them less competitive, particularly in markets where cost-efficiency is a priority. As a result, the higher production costs remain a key challenge that the industry must address to achieve broader market penetration

Market Segmentation

by Resin Type

In 2023, polyurethane resin held a significant revenue share around 48.26% in the bio-based coatings market. Its widespread use across various sectors, including automotive, construction, and furniture, contributed to its significant market presence. The resin's ability to provide durable and high-performance coatings, coupled with increasing demand for eco-friendly alternatives, propelled its prominence in bio-based coating formulations.

by Application

The architectural application segment is expected to grow with the highest CAGR during the forecast period. The heightened awareness among consumers and builders regarding the environmental impact of traditional coatings has prompted a shift towards eco-friendly alternatives. Additionally, stringent regulations and standards promoting sustainability in construction projects have amplified the demand for bio-based coatings. Moreover, continuous innovation in bio-based coating technologies has resulted in formulations that offer comparable performance to conventional coatings, further driving adoption in the architectural sector.

Regional Analysis

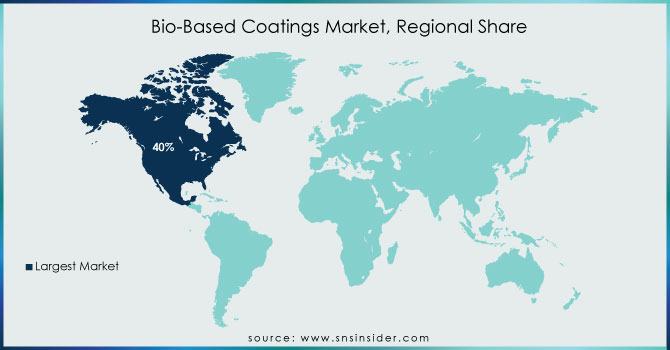

North America dominated the Bio-Based Coatings Market with the highest revenue share of more than 40% in 2023. The region's robust infrastructure and well-established manufacturing facilities facilitate the production and adoption of bio-based coatings. Secondly, stringent environmental regulations and increasing consumer awareness drive the demand for sustainable coating solutions in North America.

Asia Pacific is expected to grow at the highest CAGR in the Bio-Based Coatings Market during the forecast period. The region's rapid industrialization and urbanization fuel demand for eco-friendly coating solutions across diverse sectors such as construction, automotive, and electronics. Secondly, supportive government initiatives promoting sustainable practices and environmental conservation encourage the adoption of bio-based coatings. Additionally, the burgeoning middle-class population's increasing awareness of environmental issues and preference for greener alternatives further propels market growth in Asia Pacific.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The Key Players are Stora Enso OYJ, AkzoNobel N.V., Nippon Paint Holdings Co., Ltd., PPG Industries, Sherwin-Williams Company, Bioweg and Ginkgo Bioworks, Dow, and BASF SE, DSM Coating Resins, Nanotechnology & Other Players.

Recent Development:

-

In November 2023, KIA Motors started utilizing bio-based paint provided by AkzoNobel for the interior of its groundbreaking EV9 electric SUV. This marks the first instance in which the automaker has opted for an interior bio-based coating.

-

In March 2023, Stora Enso and Kolon Industries entered into a Joint Development Agreement to advance and commercialize bio-based polyesters and their various applications, along with renewable binder resin formulations. These applications have the potential to encompass a wide range of industries, including packaging, car tire reinforcements, and the production of films for high-value products like electronics, panels, and displays.

-

In February 2023, Bioweg and Ginkgo Bioworks are partnering to develop enhanced bio-based materials, particularly bacterial cellulose variants, to combat microplastic pollution.

-

In July 2022, Dow partnered with BSB Nanotechnology to utilize premium rice husk-based specialty silica in personal care products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.74 Billion |

| Market Size by 2031 | USD 26.82 Billion |

| CAGR | CAGR 9.7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Polyurethane, Alkyd, Acrylic, and Others) • By Application (Architectural, Packaging, Transportation, Woodworking, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stora Enso OYJ, AkzoNobel N.V., Nippon Paint Holdings Co., Ltd., PPG Industries, Sherwin-Williams Company, Bioweg and Ginkgo Bioworks, Dow, and BSB Nanotechnology |

| Key Drivers | • Growing awareness about environmental issues and the need for sustainable solutions are driving the demand for bio-based coatings. • The abundant availability of renewable resources used in bio-based coatings production supports market expansion. |

| Market Restraints | • Higher production costs associated with bio-based coatings compared to conventional alternatives |