Rare Earth Metals Market Report Scope & Overview:

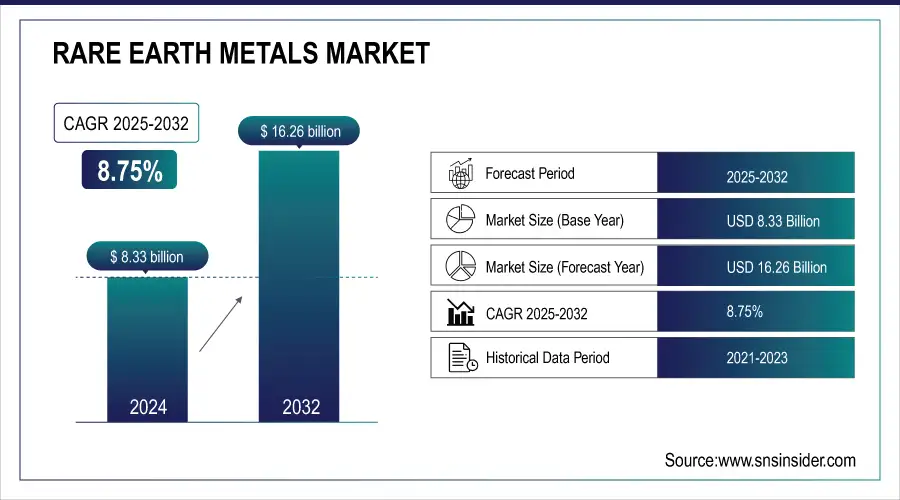

The Rare Earth Metals Market size was valued at USD 8.33 billion in 2024 and is expected to reach USD 16.26 billion by 2032, at a CAGR of 8.75% from 2025-2032.

The rare earth metals market is experiencing significant shifts driven by growing global demand for these critical elements, especially in electronics, clean energy, and defense sectors. The market dynamics are heavily influenced by geopolitical tensions, technological advancements, and the need for energy transition materials. Companies are increasingly focused on ensuring a stable supply chain, as rare earth metals are crucial for a wide range of applications such as electric vehicle batteries, wind turbines, and military technologies. For instance, in December 2024, analysts discussed how China could potentially use rare earths as a retaliatory tool against the U.S., highlighting the importance of these elements in international trade relations. This type of geopolitical maneuvering further emphasizes the strategic value of rare earths in global politics.

In terms of recent developments, companies are ramping up efforts to ensure sustainable sourcing of rare earths, particularly with China's dominant position in the market. For example, in January 2022, China merged three state-owned entities in the rare earth sector, namely China Northern Rare Earth Group, to strengthen its pricing power and improve efficiency. This move is expected to have a lasting impact on global supply chains and market pricing. Meanwhile, in June 2024, Brazil joined the race to reduce China's hold on the rare earth industry by announcing plans to ramp up its production efforts, signaling further diversification in the global supply chain.

Market Size and Forecast:

-

Market Size in 2024 USD 8.33Billion

-

Market Size by 2032 USD 16.26 Billion

-

CAGR of 8.75% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

To Get more information on Rare Earth Metals Market - Request Free Sample Report

As for innovation in extraction processes, a study published in July 2024 revealed advances in mining rare earth metals from electronic waste, a breakthrough spearheaded by researchers at ETH Zurich, offering an alternative to traditional mining methods and helping reduce environmental impacts. Additionally, in January 2025, the government of India took a major step by announcing the creation of two new companies aimed at producing rare earth metals and expanding renewable energy capabilities, highlighting the country’s increasing efforts to secure its supply of these critical resources.

Rare Earth Metals Market Trends:

- Growing integration of rare earth elements in next-generation electronics such as AR/VR devices, AI systems, and 5G infrastructure.

- Increasing innovation in sustainable and cost-effective extraction methods from unconventional sources like coal ash and e-waste.

- Rising investment in recycling technologies to recover rare earths from end-of-life electronic products.

- Expanding applications of rare earths in high-efficiency components for data storage, telecommunications, and LED manufacturing.

- Shift toward diversifying global supply chains to reduce dependency on traditional mining regions and ensure resource security.

Rare Earth Metals Market Growth Drivers:

-

Rising Demand for Electric Vehicles and Renewable Energy Technologies Drives the Growth of Rare Earth Metals Market

-

Surge in Demand for High-Performance Electronics and Advanced Technologies Increases Rare Earth Metals Consumption

The continuous advancement of high-performance electronics and cutting-edge technologies is driving a substantial increase in the consumption of rare earth metals. Key components of modern electronics, including smartphones, flat-panel displays, LED lights, and hard drives, rely on rare earth elements such as lanthanum, cerium, and europium. Additionally, developments in advanced technologies, including augmented reality (AR), virtual reality (VR), artificial intelligence (AI), and 5G networks, depend heavily on rare earths to produce miniature, high-efficiency components. As global demand for these technologies expands across consumer, industrial, and commercial applications, the need for rare earth elements continues to grow. The ongoing evolution of these technologies, especially in sectors like telecommunications, consumer electronics, and data storage, underscores the critical role that rare earths play in driving innovation and shaping the future of the electronics industry.

Rare Earth Metals Market Restraints:

-

Environmental Impact of Mining and Processing Rare Earth Metals Hinders Market Expansion

The mining and processing of rare earth metals have significant environmental implications, which pose a considerable challenge to the market's growth. Mining operations often result in the destruction of ecosystems, land degradation, and pollution due to the release of toxic chemicals, such as sulfuric acid and radioactive materials, into surrounding areas. These environmental issues have prompted increased scrutiny from regulators, environmental groups, and local communities, particularly in regions where rare earths are abundant, such as China and the U.S. Moreover, the processing of rare earth elements generates considerable waste, further exacerbating environmental concerns. Companies are under pressure to adopt cleaner, more sustainable mining practices, but the complex and high-cost nature of these alternatives slows down the transition. Therefore, the environmental impact of rare earth metal extraction and refining remains a critical restraint for the market's growth.

Rare Earth Metals Market Opportunities:

-

Expansion of Rare Earth Recycling Initiatives and Circular Economy Models Creates New Growth Prospects

-

Technological Breakthroughs in Efficient Rare Earth Extraction from Non-Traditional Sources Unlock Market Potential

Technological breakthroughs in the efficient extraction of rare earth elements from non-traditional sources are unlocking new market potential. Recent innovations have made it possible to extract rare earth metals from unconventional sources such as coal ash, phosphate deposits, and electronic waste. These new extraction methods provide an opportunity to tap into vast untapped reserves of rare earths that were previously considered too difficult or expensive to exploit. Companies are focusing on developing these alternative extraction techniques to reduce the environmental impact and lower the cost of sourcing rare earth metals. As these technologies continue to advance and scale, they can provide a more diverse and secure supply of rare earths, driving market expansion and reducing reliance on traditional mining practices.

Rare Earth Metals Market Segment Analysis:

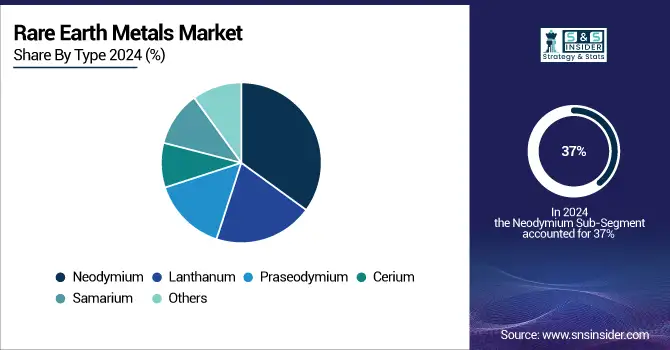

By Type

In 2024, neodymium dominated the Rare Earth Metals market with a market share of approximately 37%. Neodymium is crucial for manufacturing high-strength permanent magnets used in various applications, including electric motors, wind turbines, and audio equipment. The surge in demand for electric vehicles (EVs) and renewable energy technologies has significantly boosted the consumption of neodymium-based magnets, making them essential for enhancing energy efficiency and performance. For instance, neodymium-iron-boron (NdFeB) magnets are widely used in EV motors, providing higher torque and efficiency compared to traditional magnets. This increasing reliance on neodymium in critical industries has solidified its position as the leading segment in the rare earth metals market.

By Application

In 2024, the magnets application segment dominated the Rare Earth Metals market with a market share of about 40%. This dominance is primarily driven by the growing demand for high-performance magnets in various sectors, including automotive, electronics, and renewable energy. Magnets made from rare earth elements, particularly neodymium, are essential in electric motors, generators, and magnetic resonance imaging (MRI) machines, among other applications. The rising adoption of electric vehicles and the expansion of renewable energy sources, such as wind turbines, have significantly increased the demand for these magnets. For example, neodymium magnets are crucial in the efficiency and performance of electric drivetrains, which are vital for the success of modern EVs, highlighting the importance of this application in the rare earth metals market.

By End-Use Industry

In 2024, the electronics end-use industry segment dominated the Rare Earth Metals market, capturing a market share of approximately 35%. This growth is primarily attributed to the extensive use of rare earth metals in various electronic devices, including smartphones, tablets, and laptops. Rare earth elements like lanthanum and cerium are essential for producing high-quality display screens, batteries, and other components. Additionally, the increasing demand for advanced technologies such as 5G, artificial intelligence, and the Internet of Things (IoT) further drives the need for rare earth metals in electronics. For instance, cerium is widely used in polishing compounds for semiconductor wafers, underscoring the critical role of the electronics sector in shaping the rare earth metals market landscape.

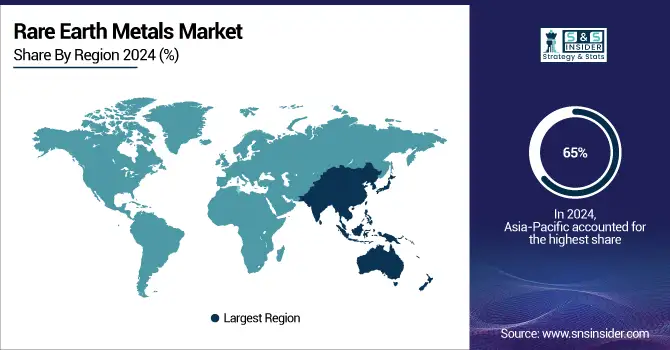

Rare Earth Metals Market Regional Analysis:

Asia Pacific Rare Earth Metals Market Insights

In 2024, Asia-Pacific dominated the Rare Earth Metals Market, accounting for a market share of approximately 65%. This dominance is largely driven by China's unparalleled role as the leading producer and supplier of rare earth elements globally. China accounted for over 85% of the global rare earth production, supported by its abundant reserves and well-established refining and processing infrastructure. The country’s efforts to consolidate its rare earth industry, such as merging major state-owned enterprises into China Rare Earth Group, have further strengthened its control over the market, enabling it to maintain pricing power and secure global supply chains. For instance, China Northern Rare Earth (Group) High-Tech Co., Ltd., one of the largest producers, ensures a consistent supply of magnets, catalysts, and other applications. In addition to China, other key contributors in the region include India and Australia.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Rare Earth Metals Market Insights

North America emerged as the fastest-growing region in the Rare Earth Metals Market in 2024, with a CAGR of approximately 10%. The region's growth is primarily driven by the increasing focus on reducing dependency on Chinese supply chains and strengthening domestic production capabilities. The United States, in particular, is leading this growth with initiatives to boost rare earth mining and refining operations. For example, MP Materials, a prominent U.S.-based company, has ramped up production at its Mountain Pass mine in California, which is the only operational rare earth mine in the country. Additionally, the U.S. government has provided significant financial support to develop a sustainable supply chain, including investments in processing facilities and partnerships with countries like Australia and Canada.

Europe Rare Earth Metals Market Insights

Europe’s rare earth metals market is expanding due to increasing demand from renewable energy, electric vehicles, and advanced electronics industries. The region’s focus on green energy transition and strategic autonomy is driving investments in local mining and recycling initiatives. Governments are implementing policies to reduce dependency on Chinese imports, promoting projects in countries like Sweden and Estonia. The rise in wind turbine and EV motor production further boosts rare earth metal consumption across Europe.

Latin America (LATAM) and Middle East & Africa (MEA) Rare Earth Metals Market Insights

Latin America and MEA are emerging as promising regions in the rare earth metals market, driven by resource exploration and growing industrial applications. Countries such as Brazil and South Africa are investing in rare earth mining to support energy, defense, and electronics sectors. Favorable geology and supportive government policies are attracting foreign investments. Increasing demand for sustainable materials and regional value chain development is expected to strengthen their roles in global rare earth supply.

Rare Earth Metals Market Key Players:

-

MP Materials

-

China Northern Rare Earth High-Tech

-

Lynas Rare Earths

-

Iluka Resources

-

China Minmetals Rare Earth

-

Jiangxi Ganzhou Rare Earth Group

-

Shenghe Resources

-

Arafura Resources

-

Neo Performance Materials

-

Avalon Advanced Materials

-

Texas Mineral Resources Corp

-

Ucore Rare Metals

-

American Rare Earths

-

Energy Fuels

-

AEM REE

-

Rare Element Resources

-

Mkango Resources

-

USA Rare Earth

-

Materion Advanced Materials

-

Idaho Strategic Resources

Competitive Landscape for Rare Earth Metals Market:

China Northern Rare Earth High-Tech (Northern Rare Earth) is a leading Chinese producer of rare earth metals and alloys, specializing in mining, separation, and downstream processing. The company supplies critical rare earth elements like neodymium and dysprosium for magnets, electronics, and clean energy applications, supporting both industrial and high-tech markets.

-

In November 2025: The China Northern Rare Earth High-Tech announced the launch of 30 modernisation projects (88 % start‑rate), including a 50,000‑ton neodymium‑iron‑boron (NdFeB) magnet‑materials line and an 8,000‑ton rare‑earth metal expansion (bringing capacity to 15,000 tons) as part of its high‑end and green production push.

Lynas Rare Earths, headquartered in Australia, is a major global supplier of rare earth elements outside China. The company focuses on mining, processing, and producing neodymium and praseodymium for high-performance magnets used in electric vehicles, renewable energy, electronics, and advanced technologies, strengthening supply chain diversity in the global rare earth market.

-

In June 2024: Lynas announced a new process at its Malaysian operations will produce separated heavy rare‐earth metals, specifically dysprosium (Dy) and terbium (Tb), starting mid‑2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.33 Billion |

| Market Size by 2032 | USD 16.26 Billion |

| CAGR | CAGR of 8.75% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Lanthanum, Praseodymium, Cerium, Neodymium, Samarium, Others) •By Application (Magnets, Catalysts, Metallurgy, Phosphors, Ceramics, Polishing, Others) •By End-Use Industry (Electronics, Automotive, Energy, Defense & Aerospace, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

MP Materials, China Northern Rare Earth High-Tech, Lynas Rare Earths, Iluka Resources, China Minmetals Rare Earth, Jiangxi Ganzhou Rare Earth Group, Shenghe Resources, Arafura Resources, Neo Performance Materials, Avalon Advanced Materials, Texas Mineral Resources Corp, Ucore Rare Metals, American Rare Earths, Energy Fuels, AEM REE, Rare Element Resources, Mkango Resources, USA Rare Earth, Materion Advanced Materials, Idaho Strategic Resources. |