Contactless Payment Market Size & Overview:

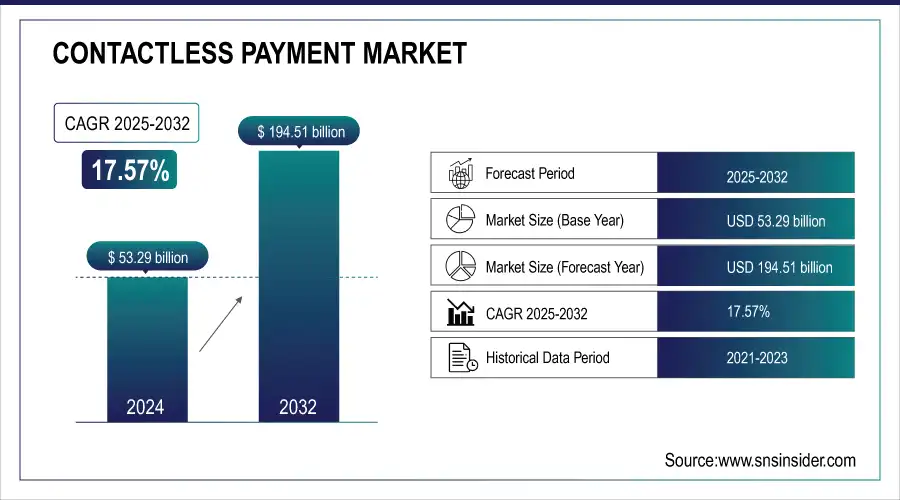

The Contactless Payment Market was valued at USD 53.29 billion in 2024 and is expected to reach USD 194.51 Billion by 2032, growing at a CAGR of 17.57% over the forecast period 2025-2032.

Get more information on Contactless Payment Market - Request Sample Report

Increasing demand from consumers for quick, safe, and accessible payment solutions is fuelling growth in the contactless payment market. The development of technologies, like NFC and RFID, has made contactless payments much more practical and efficient. These solutions are also helping consumers by bringing down transaction timings, avoiding cash, and providing easy integration with smartphones and wearables, which is making these solutions even more popular. Moreover, the increasing penetration of digital wallets including Apple Pay, Google Pay, and Samsung Pay has boosted this market as these wallets are providing an easy platform for contactless transactions. Apple Pay leads the digital wallet market in the UK with 67%, over double the share of PayPal by 30%. Google Pay has the highest share of users surveyed for both in-store (82%) and online (80%) users in the country, as compared to any other country surveyed, in India.

Market Size and Forecast:

-

Contactless Payment Market Size in 2024: USD 53.29 Billion

-

Contactless Payment Market Size by 2032: USD 194.51 Billion

-

CAGR: 17.57% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Contactless Payment Market Trends

-

Rapid adoption of NFC-enabled cards and mobile wallets across retail, transportation, and hospitality sectors.

-

Growing preference for tap-and-go payments due to convenience, speed, and hygiene concerns post-pandemic.

-

Expansion of digital banking and fintech platforms facilitating contactless transactions globally.

-

Integration of wearable devices (smartwatches, rings) for seamless payments.

-

Increasing adoption in public transport systems and smart cities for efficient fare collection.

-

Rising investment in secure authentication technologies like tokenization, biometrics, and encryption.

-

Government initiatives promoting cashless economies in emerging markets.

Contactless Payment Market Growth Drivers

-

IoT and 5G Integration Drive Seamless and Secure Contactless Payments Across Diverse Environments

IoT-Enabling payment solutions are revolutionizing the face of contactless payment. Connected devices including smartwatches, fitness bands, and even IoT-connected home appliances are now coupled with payment facilities that are expanding the scope of payment. Such devices not only improve user convenience but also create new spaces for businesses to deliver seamless payment experiences in diverse environments including smart homes, retail outlets, and mass transit systems. The increase in the number of IOT devices and effective connectivity network that 5G provided, allows data to be transferred at a much faster and more secure rate during contactless transactions. Especially in tech-advanced parts of the world, like North America and Asia-Pacific, where IoT-based adoption is fast emerging. By the end of 2024, the number of connected IoT devices is expected to reach 18.8 billion, a 13% increase from the previous year. Global 5G connections surpassed 2 billion in Q3 2024, with 170 million new connections added during that period. These advancements in IoT and 5G significantly improve the speed, security, and reliability of contactless payments.

-

Rising Biometric Authentication Boosts Security and Expands Contactless Payments in Digital Banking and Beyond

The major factor is the increase of biometric authentication technologies that provide greater security and confidence in contactless payments by users. Fingerprint scanning, facial recognition, and iris scanning, among other innovations, are making their way into the payment system to stop fraud and unauthorized transactions. Such solutions help alleviate consumer data security concerns, especially during critical high-value transactions. In addition, regulatory authorities worldwide are promoting the use of secure authentication methods, and the growing penetration of data protection laws is further propelling the implementation of biometrics in payment systems. Europe, for instance, has a strong customer authentication (SCA) requirement under its Payment Services Directive 2 (PSD2), which is conducive to using biometrics for better authentication. While this technological evolution reinforces consumers confidence it also opens new scopes of contactless payments in segments such as healthcare and hospitality, where secure and accurate verification is crucial. In 2024, over 60% of biometrically verified payments are conducted remotely. Additionally, 330 million new bank accounts are expected to be established digitally by 2025, up from 184 million in 2020, reflecting the growing trend of digital banking and biometric authentication adoption.

Contactless Payment Market Restraints

-

Navigating Cybersecurity Risks and Regional Disparities in the Growth of Contactless Payment Technology

The largest risk is the exposure to cyber threats such as data breaches and unauthorized access, which could erode consumer confidence. While encryption or tokenization technology has enhanced security, the rapidly changing upstream nature of cyberattacks creates new risks. Another challenge is the disparity in technology across regions. Developed markets have solid infrastructure for contactless payments, whereas contactless and NFC payments still need reliable infrastructure in many emerging economies, including NFC-enabled terminals and reliable Internet connectivity. Lack of penetration in certain regions combined with this digital divide restricts the amount of the market that the market can develop. Further, weakening market growth is the hesitance of consumers to switch to new technology, especially in older demographic groups or cash-dependent economies.

Contactless Payment Market Segment Analysis

By Type

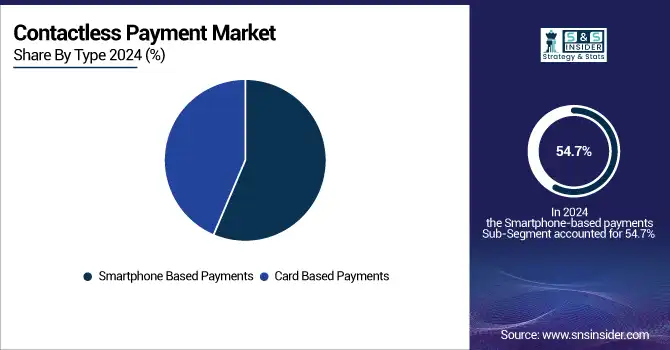

Smartphone-based payments are dominant and will account for the majority of the market share at 54.7% in 2024, reflecting the broader penetration of smartphones and mobile wallets like Apple Pay, Google Pay, and Samsung Pay. Using near-field communication (NFC) technology, these platforms allow the user to make payments without using cards or cash. Furthermore, smartphones bring digital payments as the way people make purchases, pay bills, and do peer-to-peer transfers, often through mobile apps. Loyalty program integration, real-time notifications, and ease of use have all contributed to their stronghold on the market.

During the period from 2025 to 2032, card-based payments are predicted to grow at the highest CAGR as the infrastructure has developed and upgrades to contactless technology are becoming more prevalent. With the support of financial institutions and governments, the global rollout of contactless-enabled cards has resulted in more seamless and attractive card payments. The ease of simply tapping your card to complete a transaction and the rising limits for contactless transactions are prompting consumers and merchants to embrace this method. Meanwhile, areas with significant penetration of traditional cards are migrating to contactless cards, adding yet another layer between legacy payment systems and innovative digital solutions, enabling them to continue their rapid growth for the next decade.

By Application

The retail sector held the highest share in 2024, accounting for 41.1%, due to high transaction volume and widespread adoption of contactless payment technology in retail outlets. The deployment of NFC-enabled point-of-sale (POS) terminals was driven by the need of retailers for seamless and fast checkout experiences. The convenience of having contactless payments along with loyalty programs and mobile wallets has made its usage even more frequent. Also, with the increasing consumer adoption rate of cashless payments, the retail segment is the largest cornerstone of the contactless payment service ecosystem due to its contribution to urban and technologically advanced regions.

The hospitality industry will develop at the highest CAGR for the period 2025 to 2032, due to the growing digital transformation initiatives & increasing requirements for personalized and efficient experiences for guests. To enhance productivity and customer satisfaction, hotels, restaurants, and travel operators are embracing contactless payment solutions. The hygiene concerns that arose post-pandemic have only expedited the move to contactless solutions such as mobile check-ins, QR code payments, and digital tipping. Moreover, a higher number of inbound and outbound tourist movements has led to the need for a more universal contactless payment solution, making the hospitality sector poised to adapt to this newfound technology at the fastest rate.

Contactless Payment Market Regional Analysis

North America Contactless Payment Market Insights

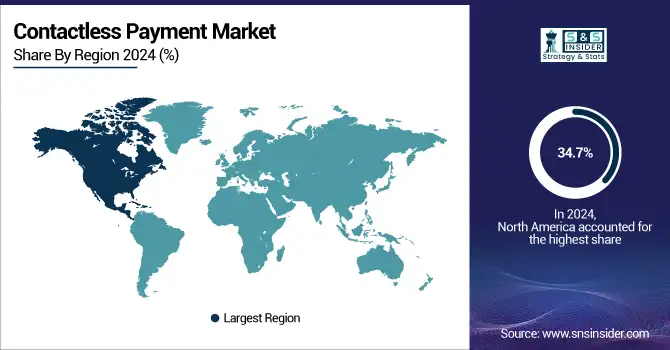

In 2024, North America held a 34.7% share of the contactless payment market and is expected to remain a dominant region throughout the forecasted period due to its sophisticated digital payment ecosystem combined with significantly high adoption rates for smartphones and digital wallets. With a high density of NFC-enabled POS terminals and cashless transaction culture, the region builds this environment high for acceptance of digital wallets. Virtually, applications to pass in travelers, such as contactless on the homes of a number of Walmart, one more mainstream retail post in the US, and Target, not to socialize with Apple Pay and Google Pay entrance of portable installment usage. Contactless credit and debit cards are a popular option in Canada thanks in large part to institutions like Interac, whereas this form of payment hasn't gained nearly as much traction in other regions of the globe, allowing the country to lead in the market.

Need any customization research on Contactless Payment Market - Enquiry Now

Asia Pacific Contactless Payment Market Insights

Asia Pacific is projected to register the highest CAGR over the forecasted timeframe, as a result of fast-growing digitalization in economies, rising smartphone adoption, and governments striving for cashless ecosystems. In fact, there is examples from China, where Alipay and WeChat Pay have completely taken over with QR code and NFC payments ranging from retail purchases to transportation. In India, for example, it was the rapid scalability of the Unified Payments Interface (UPI) that led to apps such as PhonePe and Google Pay that paved the way for easy contactless payments. Similarly, the Suica and Pasmo cards used in Japan to facilitate transportation and retail highlight the growing trend towards contactless systems in the region.

Europe Contactless Payment Market Insights

The Europe Contactless Payment Market is witnessing strong growth in 2024, driven by high smartphone penetration, mature digital banking infrastructure, and increasing adoption of NFC-enabled cards and mobile wallets. Key markets such as the U.K., Germany, and France are seeing rapid adoption of contactless payments in retail, transportation, and hospitality sectors. Consumer preference for fast, secure, and hygienic transactions post-pandemic is fueling market expansion. Furthermore, government initiatives promoting cashless payments and the growing integration of wearable devices are accelerating the adoption of contactless solutions across the region.

Latin America (LATAM) Contactless Payment Market Insights

The LATAM Contactless Payment Market is expanding steadily in 2024, supported by growing smartphone penetration, fintech adoption, and digital banking services. Countries such as Brazil, Mexico, and Argentina are emerging as major adopters of contactless payment solutions in retail, transportation, and e-commerce. Local merchants are increasingly implementing NFC-enabled POS systems to enhance transaction efficiency. Government programs promoting financial inclusion and cashless economies are further boosting the adoption of secure, convenient, and fast payment solutions across the region.

Middle East & Africa (MEA) Contactless Payment Market Insights

The MEA Contactless Payment Market is gaining momentum in 2024, driven by rapid urbanization, increasing smartphone usage, and the expansion of digital banking services. Countries like the UAE, Saudi Arabia, and South Africa are seeing growing adoption of contactless payments in retail, transportation, and hospitality. Consumer preference for seamless, secure, and fast transactions, along with government initiatives promoting cashless economies, is fueling market growth. Additionally, partnerships between local banks, fintech companies, and global payment providers are enhancing the reach and adoption of contactless payment solutions.

Contactless Payment Market Competitive Landscape

Mastercard

Mastercard is a global payments technology company offering secure and innovative payment solutions across digital and physical channels.

-

In September 2024, Mastercard chose India to pilot its Payment Passkey Service, using biometric authentication for secure, password-free online payments. The initiative aims to enhance online shopping security and streamline checkout for millions of consumers.

PayPal

PayPal is a leading digital payments platform enabling secure, convenient, and fast online transactions for individuals and businesses globally.

-

In September 2024, PayPal launched its PayPal Complete Payments platform in China, enabling local merchants to accept cross-border payments from global customers. The service aims to streamline international trade and enhance payment convenience for businesses.

Square

Square is a global fintech company providing payment processing, point-of-sale solutions, and financial services for businesses of all sizes.

-

In July 2024, Square launched Tap to Pay on iPhone in France, allowing local businesses to accept contactless payments directly on their devices. The service aims to streamline payment processes and enhance flexibility for merchants.

Contactless Payment Market Key Players

Some of the major players in the Contactless Payment Market are:

-

Visa (Visa Contactless Cards, Visa Tap to Pay)

-

MasterCard (MasterCard Contactless, MasterPass)

-

PayPal (PayPal Wallet, Venmo)

-

Square (Square Reader, Cash App)

-

Apple (Apple Pay, Apple Card)

-

Google (Google Pay, Google Wallet)

-

Samsung (Samsung Pay, Samsung Wallet)

-

Amazon (Amazon Pay, Amazon One)

-

Alipay (Alipay App, Alipay Wallet)

-

WeChat Pay (WeChat Wallet, WeChat Mini Programs)

-

Adyen (Adyen Payment Platform, Adyen POS Terminal)

-

Stripe (Stripe Terminal, Stripe Issuing)

-

Ingenico (Ingenico Move/5000, Ingenico AXIUM EX8000)

-

Worldpay (Worldpay Total, Worldpay Dashboard)

-

FIS (FIS Digital One, FIS RealNet)

-

Fiserv (Clover POS Systems, Clover Go)

-

NXP Semiconductors (MIFARE ICs, NFC Controllers)

-

Infineon Technologies (SECORA Pay, NFC Security Solutions)

-

IDEMIA (IDEMIA Contactless Cards, IDEMIA Digital Payment Solutions)

-

Thales (Thales EMV Cards, Thales Contactless Payment Solutions)

Some of the Raw Material Suppliers for Contactless Payment companies:

-

Gemalto (Thales Group)

-

Giesecke+Devrient GmbH

-

Samsung Electronics Co., Ltd.

-

Texas Instruments Incorporated

-

CPI Card Group Inc.

-

HID Global Corporation

-

Watchdata Technologies Ltd.

-

Eastcompeace Technology Co., Ltd.

-

Wuhan Tianyu Information Industry Co., Ltd.

-

CardLogix Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 53.29 Billion |

| Market Size by 2032 | USD 194.51 Billion |

| CAGR | CAGR of 17.57% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Smartphone Based Payments, Card Based Payments) • By Application (Retail, Transportation, Healthcare, Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Visa, MasterCard, PayPal, Square, Apple, Google, Samsung, Amazon, Alipay, WeChat Pay, Adyen, Stripe, Ingenico, Worldpay, FIS, Fiserv, NXP Semiconductors, Infineon Technologies, IDEMIA, Thales |