Gas Sensor Market Report Scope & Overview:

The Gas Sensor Market was valued at USD 1.9 Billion in 2023 and is expected to reach USD 4.2 Billion by 2032, growing at a CAGR of 9.05% from 2024-2032.

To Get more information on Gas Sensor Marke - Request Free Sample Report

The gas sensor market significantly contributes to environmental monitoring and industrial safety. The measurement and detection of the presence of gases in different environments is done using gas sensors which are vital for safety, efficiency, and regulatory purposes. Stringent government regulations regarding air quality and emissions, and increased awareness of environmental and occupational safety issues are driving the adoption of these sensors. For example, adopting Euro 7 emission standards in the automotive industry has fuelled the requirement for sophisticated gas sensors for controlling and monitoring automotive emissions.

Advancements in sensor technologies, such as miniaturization, enhanced sensitivity, and incorporation of IoT functionalities are fueling the growth of the market. Gas sensors based on modern technology like metal oxide semiconductors or photoionization detection gas sensors are being miniaturized and efficiently designed to work in portable and wearable devices. One recent example of advancement in technology is gas sensors embedded in smart home devices for real-time monitoring of air quality.

The growth of the gas sensor industry is supported by strong statistics. In 2023, sales of gas sensors for air quality monitoring increased by over 15% compared to 2022, driven by rising demand in polluted urban areas and stricter regulatory measures. Additionally, the use of gas sensors in healthcare for respiratory monitoring, as well as in ventilators and patient monitoring systems, saw a 20% annual increase. Overall, the gas sensor market is poised for continued growth, fueled by technological advancements, regulatory changes, and the increasing demand for improved air quality and safety monitoring. The evolution of sensor design and the rise of smart technologies will further drive new applications and market opportunities in the coming years.

Market Dynamics

Drivers

-

Integration of gas sensors in smart home devices for real-time air quality monitoring is gaining traction.

Rising consumer awareness about indoor air quality and the development of IoT-aided devices have become a significant market for gas sensors and gas sensors integrated into smart home devices have emerged as a noteworthy trend in the gas sensor market. These sensors, which can detect dangerous gases like carbon monoxide, nitrogen dioxide, and volatile organic compounds, are now built into smart devices such as air purifiers, thermostats, and ventilation systems, providing real-time monitoring and alerts to help homeowners enhance air quality and stay safe. The use of interconnected devices is becoming more common as people become more accustomed to smart home ecosystems designed to work together to provide higher levels of convenience and efficiency. For example, if a smart hub has a gas sensor that detects poor air quality, it could turn on an air purifier or balance the ventilation. The mobile apps have only boosted their popularity further, by allowing people to conveniently monitor and control them remotely.

Multi-functional gas sensors are being developed by industry stalwarts such as Honeywell and Bosch, which focuses on consumer-centric small and low-power gas sensors. In addition to this, increasing focus on health problems caused by substandard indoor air, like asthma and allergy, is pushing the uptake of such solutions even further.

-

Growing awareness of occupational safety necessitates gas sensors for detecting hazardous gases in industrial environments.

-

Innovations like miniaturization, enhanced sensitivity, and IoT integration are expanding the scope of gas sensor applications.

Restraints

-

Gas sensors, especially those with continuous monitoring capabilities, can increase power consumption in portable and IoT devices.

Continuous monitoring of gas sensors is essential for the real-time detection of harmful gases, ensuring safety and compliance. However, this functionality often requires a constant power supply, which can impact the energy efficiency of portable and IoT devices. This is a significant concern in the gas sensor market, as high energy consumption affects the usability and adoption of battery-powered applications such as wearables, smart home devices, and portable air quality monitors. The need for sensors to remain active at all times for detection, signal processing, and data transmission, especially in IoT systems, further increases power demands. For example, gas sensors integrated into smart home devices need to frequently communicate with other devices and cloud platforms, which adds to the energy load.

Gas sensors, particularly those with continuous monitoring capabilities, can lead to higher power consumption in portable and IoT devices. For instance, typical gas sensors like electrochemical and metal oxide sensors consume around 10–100 mW during operation. Continuous monitoring, required in applications like air quality monitoring or healthcare, can cause a significant increase in energy demand, especially in battery-powered devices. In contrast, low-power alternatives such as semiconductor-based sensors can consume as little as 1–5 mW but may sacrifice some accuracy or sensitivity. The energy consumption of these sensors is crucial for the design of IoT systems, where power efficiency is essential for longer battery life. As a result, balancing sensor performance with power consumption remains a key challenge for device manufacturers.

-

Advanced gas sensors with IoT integration and enhanced sensitivity are expensive, limiting their adoption in cost-sensitive markets.

-

Challenges such as cross-sensitivity, calibration drift, and limited lifespan affect sensor performance and reliability.

Segment Analysis

By Product

The carbon dioxide sensors segment led the market in 2023 and represented a revenue share of more than 35%. Indoor air quality monitoring in homes, office buildings, automotive, healthcare, etc. are the major applications in the carbon dioxide sensors market. Several companies are working on MEMS-based carbon dioxide sensors, with applications in a wide range of industries.

The carbon monoxide sensors segment is expected to register the fastest CAGR during the forecast period. High incidences of deaths due to carbon monoxide poisoning are fuelling the demand for carbon monoxide sensors. The growth of the carbon monoxide sensors market is driven by the high workplace safety regulations by the government. As is well-known, carbon monoxide poisoning in the U.S. has prompted the government to implement mandatory carbon monoxide detectors in certain states. Therefore, certain US states including Connecticut, California, Maryland, Illinois, and Maine require school buildings to be fitted with a carbon monoxide detector.

By Type

The wired segment dominated the market and accounted for more than 58% of the revenue in 2023. Wired gas sensors come with the advantages of being low maintenance, saving space, economical, and more accurate. In many circumstances, these tend to be the most reliable systems, which directly connect the sensor to the device reading the input and therefore, are recommended for application in a mine, oil rig, or nuclear power plant. The growing use of wired gas sensors in residential applications is also among the major contributors to the segment growth.

Wireless gas sensors are expected to register the fastest CAGR during the forecast period, High scalability and flexibility, cost-efficiency, and portability are the benefits offered by Wireless sensors cover many industries, including the petrochemical, manufacturing, and oil & gas industries. These sensors enable remote contaminant monitoring, Remote and base stations can be operated which will minimize the chance of leakage and explosion of hazardous gases in the oil and gas & gas sector.

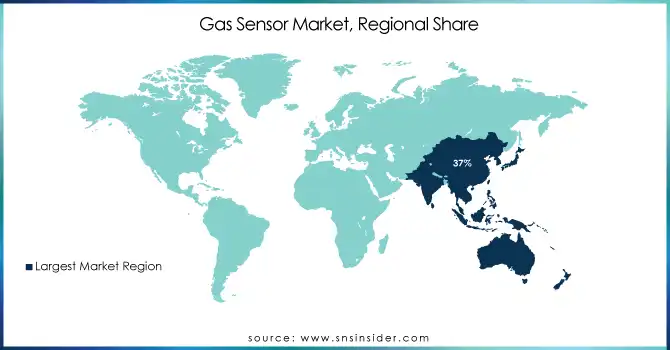

Regional Analysis

In 2023, Asia Pacific dominated the market and contributed over 37% of the total revenue. The increase in the urbanization in the region also increased the gas sensors demand. In addition, smart city projects are one of the main keys of the governments of the Asia Pacific region, which too possesses great growth opportunities for smart sensor devices.

Europe is expected to register the fastest CAGR during the forecast period. The stringent norms concerning gas emissions and the compatible need for emissions surveys are anticipated to propel regional industry growth. All vehicle OEMs in Europe must offer gas sensor technologies to meet safety requirements. Stringent pollution control measures in Europe are expected to drive the adoption of gas sensors, especially in the automotive sector. Besides, the market growth is driven by the continuous development of high-end gas sensors by various regional market players.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

The Major Players are Honeywell, Bosch, Figaro Engineering, Senseair, Alphasense, Amphenol Advanced Sensors, MSA Safety, Figaro Engineering Inc., GFG Gas Detection, City Technology, Dynament, Sick AG, Edinburgh Sensors, Figaro, International Sensor Technology, Amphenol and others are listed in the final report.

RECENT DEVELOPMENT

September 2024: Honeywell Analytics launched the GasAlert Micro 5, a portable gas detection device designed for hazardous environments, enhancing user experience and data logging capabilities.

January 2024: Teledyne introduced a new infrared sensor for its OLCT 100 XPIR fixed gas detector, enhancing stable and reliable methane detection measurements for industrial, utility, and laboratory markets.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 1.9 Billion |

|

Market Size by 2032 |

USD 4.2 Billion |

|

CAGR |

CAGR of 9.05 % From 2024 to 2032 |

|

Base Year |

2022 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2021 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Oxygen (O2)/Lambda Sensors, Carbon Dioxide (CO2) Sensors, Carbon Monoxide (CO) Sensors, Nitrogen Oxide (NOx) Sensors, Methyl Mercaptan Sensor, Others) |

|

Regional Analysis/Coverage |

North America (USA, Canada, Mexico), Europe |

|

Company Profiles |

Honeywell, Bosch, Figaro Engineering, Senseair, Alphasense, Amphenol Advanced Sensors, MSA Safety, Figaro Engineering Inc., GFG Gas Detection, City Technology, Dynament, Sick AG, Edinburgh Sensors, Figaro, International Sensor Technology, Amphenol |

|

Key Drivers |

• Growing awareness of occupational safety necessitates gas sensors for detecting hazardous gases in industrial environments. |

|

Restraints |

• Advanced gas sensors with IoT integration and enhanced sensitivity are expensive, limiting their adoption in cost-sensitive markets |