Biopreservation Market Report Scope & Overview:

To Get More Information on Biopreservation Market - Request Sample Report

The Global Biopreservation Market Size was valued at USD 3.5 Billion in 2023 and is expected to reach USD 14.3 Billion by 2032, growing at a CAGR of 17.0% over the forecast period 2024-2032.

The Biopreservation Market is at a massive growth due to increased investment and government policies across the world. The adoption of biopreservation technologies has been significantly driven by government initiatives, especially in areas aligned with healthcare and life sciences. Based on the most recent statistics from the U.S. Department of Health and Human Services (HHS), the U.S. government invested around $2.3 billion for health research in 2023, including biopreservation technologies like tissue preservation and cryopreservation. These investments are to help improve the utility of biopreservation for use in clinical practice and to support the biopreservation of biological specimens for research. Also, the World health Organisation (WHO) has recognized the need for sustainable preservation of biological material to ensure better quality of medical research and better health outcomes around the world.

As biopreservation methods evolve, governments are also enforcing stricter regulatory frameworks to facilitate the preservation of biological materials safely and effectively. Guidelines for biopreservation practices have also been developed by the U.S. Food and Drug Administration (FDA) with particular emphasis on organ transplantation and tissue engineering applications. These regulations coupled with programs such as the NIH funding agenda have also aided the popularization of biopreservation technologies. Recent data from the EU Horizon 2020 framework revealed a total of over €500 million in funding for innovative health technologies (including biopreservation solutions) disbursed just this year, 2023. Such policies and investments generate a solid atmosphere for the growth of the biopreservation market, thus becoming an integral part of the modern healthcare infrastructure. Supported by government initiatives, the biopreservation industry is projected to grow further, and further biopreservation companies will be providing solutions in areas like biobanking, regenerative medicine, and tissue engineering.

Market Dynamics

Drivers

-

The growing use of regenerative treatments for chronic diseases and degenerative disorders is expanding the need for biopreservation. Techniques are crucial for preserving cells and tissues, which are essential for the success of these therapies.

-

Significant investments in biobanks for storing biospecimens, such as stem cells and tissue samples, are fueling market growth.

-

The development of next-generation cryopreservation technologies and hypothermic storage solutions has made biopreservation more efficient and accessible, enhancing market opportunities.

Increasing demand for regenerative medicine is driving the biopreservation market. Regenerative medicine offers tremendous potential, with emerging therapies relying on the storage of biological material like stem cells, tissues, and organs. Type ROF Regenerative medicine is attracting interest as it has the potential to cure diseases that have been difficult to treat using conventional methods such as neurological disorders, heart disease, and trauma-induced tissue loss. According to the World Stem Cell Clinic report, stem cell treatments are becoming more convenient as medical advancements show better results in the treatment of arthritis, chronic pain, and other conditions. Furthermore, with the increased research activities on tissue engineering and organ regeneration, especially in developing/regional countries, the worldwide stem cell market is also contributing to the growing demand for effective biopreservation technologies.

Storing biological materials under ultra-low temperatures or cryopreservation facilities is particularly essential since it allows the preservation of cells/tissue over a long term without sacrificing the quality of the cell tissue. For example, California Cryobank, one of the pioneers in stem cell storage, has been ramping up its biopreservation efforts to accommodate the expansion of regenerative therapies.

Restraints:

-

The sophisticated equipment and processes required for biopreservation are expensive, limiting widespread adoption, particularly in low-resource settings.

-

The process of freezing and thawing biological specimens can lead to tissue damage, affecting the long-term stability of preserved samples.

-

Emerging low-cost preservation technologies, like room-temperature storage, could potentially limit the market for traditional biopreservation methods.

The high cost of biopreservation technologies is the main factor limiting the biopreservation market. Cryopreservation and cloning are costly, complex processes that require specialized equipment like cryopreservation tanks and temperature-controlled storage systems. Also, these systems require specialized training, and frequent maintenance, both of which increase costs. Consequently, this makes it challenging for smaller labs or institutions with budget restrictions to implement these technologies. Low- and middle-income countries are especially burdened by this economic strain due to less efficient research and medical preservation resources. Additionally, variations in the preservation capabilities from simple preservation methods where cells do not grow to complex extract sub-typing methods exert a financial burden, constituting an obstacle to wider market penetration.

Biopreservation Market Segmentation Analysis

By Product

The global biopreservation market was dominated by the equipment segment in 2023, accounting for a large revenue share of the market at 76%. The major share is due to the importance of biopreservation equipment since biopreservation is a key technology, which plays a major role in the efficient storage and preservation of biological materials at ultra-low temperatures. The essential devices in this segment are freezers, refrigerators, cryogenic storage systems, and liquid nitrogen storage tanks commonly used in biobanking and other types of research. The recent explosion in the utilization of state-of-the-art cryopreservation equipment, especially for cell and tissue storage, is a result of its capability to maintain the structure and function of biological samples.

This dominance was fueled by a surge in demand for biopreservation solutions for use in healthcare, research, and biotechnology. Cryopreservation has recently gained significance in life sciences as well as with the U.S. party politics (medical-engineering-biological marriage-making machine) with the organ transplantation breakthrough. According to the U.S. National Institutes of Health (NIH), the organ transplant space has been growing at a rate of 7.8% each year since 2019; and industry growth has been directly linked with preservation technology advancements. This is further highlighted by the European Commission which has so far invested more than €100 million in biopreservation infrastructure throughout the Horizon 2020 program. Driven by the need for tailored storage conditions for patient-specific biological materials, the advent of personalized medicine has also contributed to the growing demand for advanced biopreservation equipment.

By Application

In 2023, the biobanking segment accounted for the largest share of 69% of the global biopreservation market. Numerous breakthroughs are based on biobanks, organizations that collect, store, and distribute biological samples for research. Such biorepositories are crucial to the advancement of medical research, ranging from genetic disease studies to the delivery of personalized medicine. Finally, the U.S. government has taken notice of the NIH set aside $1.5 billion in 2023 for biobanking efforts. These investments aim to promote better preservation of biological materials so that they remain useful for research into the future.

Furthermore, the regenerative medicine segment is projected to grow at a higher compound annual growth rate (CAGR) during the forecast period. This increase in biopreservation is largely attributed to the growing areas of stem cell research, tissue engineering, and gene therapy where access to well-defined, high-quality biological materials is supported by the use of biopreservation technologies. With applications in everything from degenerative disease to traumatic injury, its rapid growth is supported by government-backed funding initiatives. According to a report by the U.S. Food and Drug Administration (FDA), a fourfold increase has been observed in the number of regenerative medicine therapies approved each year over the past five years, a trend that is expected to continue as technology and regulatory frameworks evolve.

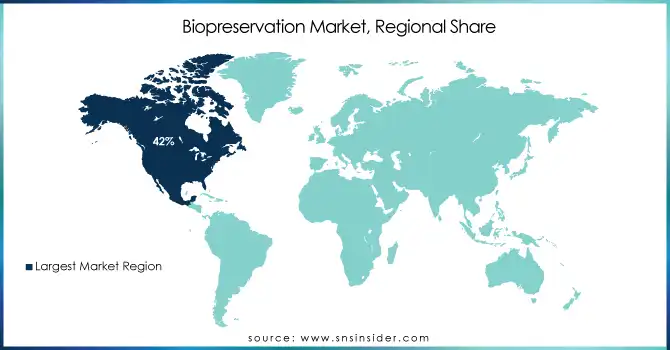

Regional Analysis

North America captured a 42% share of the global biopreservation market in 2023. Strong healthcare infrastructure, investments through government, and technological advancements in biopreservation solutions are the responsible factors for this leading region. The U.S., in particular, has been a global leader in biopreservation due to its strong biotechnology sector, which receives substantial funding from federal agencies such as the NIH and the Department of Defense.

During the forecast period, the Asia-Pacific area is predicted to record the highest CAGR. The growth is primarily due to rising healthcare improvements, increasing clinical trials, and government support for biotechnology developments. With the proliferation of biotech and healthcare industries in regions such as China, Japan, and India, biopreservation sustainable technologies are gaining momentum in these countries. In 2023, the government of China as part of the “Made in China 2025” funding plan is investing more than $400 million into biotechnology research including biopreservation infrastructure to support drug development and clinical trials and preservation of biological samples. With the ongoing establishment of healthcare and research avenues in this region, the need for biopreservation solutions will increase sharply, making Asia-Pacific a primary growth market.

Do You Need any Customization Research on Biopreservation Market - Enquire Now

Recent News and Developments

-

In January 2024, The U.S. National Institutes of Health (NIH) announced a new $300 million initiative to further develop biopreservation technologies in service of organ transplantation, and improving how long preserved organs remain viable through sophisticated cryopreservation techniques.

-

In 2024, Thermo Fisher Scientific launched its latest line of high-performance ultra-low temperature (ULT) freezers, the Thermo Scientific TSX Universal Series. This innovation is a liberating milestone in extending functionality, increasing reliability, reducing sustainment, and enhancing performance.

-

In 2023, Avantor announced its partnership with Tobin Scientific, a global leader in biopharma cold chain services. The partnership is intended to offer US biopharma clients comprehensive logistics solutions for climate-sensitive storage and transportation in conjunction with sophisticated laboratory relocations and research facility moves.

Key Biopreservation Market Companies

Service Providers / Manufacturers:

-

Thermo Fisher Scientific (Thermo Scientific TSX Ultra-Low Freezer, Thermo Scientific CryoSure Cryopreservation System)

-

Avantor (J.T.Baker® Cryogenic Vials, VWR® Cryopreservation Kits)

-

Sigma-Aldrich (Merck Group) (CryoStor® Cell Freezing Media, CryoEM™ Cryo-Electron Microscopy Products)

-

Panasonic Healthcare (ThermoScientific TSX Ultra-Low Freezer, MDF-DU702VX ULT Freezer)

-

BioCision (CoolBox™ Cryo-Tissue Storage System, BioCision® CoolBox™ CFT)

-

Haier Biomedical (Haier ULT Freezer, Haier Biomedical ULT Freezer Cabinets)

-

Sartorius AG (BIOSTAT® STR, Sartorius Cell Culture Media)

-

B Medical Systems (B Medical Systems ULT Freezer, B Medical Systems Cryo Vials)

-

Nuaire (NU-954U ULT Freezer, NU-8600 ULT Freezer)

-

VWR International (VWR® CellFreezing Medium, VWR® Freezing Vials)

Users of Biopreservation

-

Johns Hopkins University

-

Harvard Medical School

-

GSK

-

Pfizer

-

Novartis

-

Bristol-Myers Squibb

-

Stanford University

-

Scripps Research

-

Oxford University

-

Duke University

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.5 Billion |

| Market Size by 2032 | USD 14.3 Billion |

| CAGR | CAGR of 17.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Equipment {Freezers, Refrigerators, Consumables [Vials, Straws, Microtiter Plates, Bags], Liquid Nitrogen}, Media {Pre-formulated, Home-brew}, Laboratory Information Management System (LIMS)) • By Application (Regenerative Medicine {Cell Therapy, Gene Therapy, Others}, Bio-banking {Human Eggs, Human Sperms, Veterinary IVF}, Drug Discovery) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Avantor, Sigma-Aldrich (Merck Group), Panasonic Healthcare, BioCision, Haier Biomedical, Sartorius AG, B Medical Systems, Nuaire, VWR International. |

| Key Drivers | • The growing use of regenerative treatments for chronic diseases and degenerative disorders is expanding the need for biopreservation. Techniques are crucial for preserving cells and tissues, which are essential for the success of these therapies. • Significant investments in biobanks for storing biospecimens, such as stem cells and tissue samples, are fueling market growth. |

| Restraints | • The sophisticated equipment and processes required for biopreservation are expensive, limiting widespread adoption, particularly in low-resource settings. • The process of freezing and thawing biological specimens can lead to tissue damage, affecting the long-term stability of preserved samples. |