Biosurfactants Market Report Scope & Overview

Get E-PDF Sample Report on Biosurfactants Market - Request Sample Report

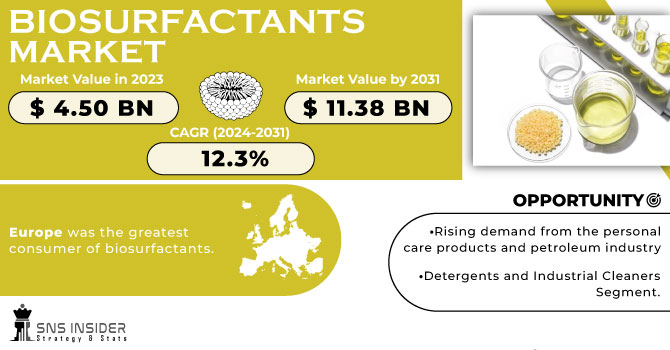

The Biosurfactants Market Size was valued at USD 3.85 Billion in 2023 and is expected to reach USD 6.82 Billion by 2032, growing at a CAGR of 6.57% over the forecast period of 2024-2032.

The biosurfactants market is expanding rapidly as industries seek sustainable and biodegradable alternatives to conventional surfactants. Our report explores raw material analysis, assessing key feedstocks like vegetable oils and microbial sources, along with their availability and cost trends. A detailed cost structure analysis highlights production expenses, including fermentation and energy consumption, shaping market pricing. Investment and funding trends showcase venture capital inflows and government initiatives accelerating innovation. With a strong focus on sustainability and environmental impact, the report evaluates biodegradability, carbon footprint, and regulatory incentives driving adoption. Additionally, an in-depth demand-supply gap analysis identifies production constraints and emerging opportunities, offering a strategic outlook on market potential. This comprehensive study provides key insights into biosurfactant industry dynamics.

Market Dynamics

Drivers

-

Increasing Utilization of Biosurfactants in Oil Spill Remediation Enhances Market Growth

The growing frequency of oil spills and industrial waste discharge has intensified the demand for effective and eco-friendly cleanup solutions, boosting the adoption of biosurfactants in oil spill remediation. These naturally derived surfactants possess superior emulsification and dispersion properties, making them highly efficient in breaking down hydrocarbons and enhancing microbial degradation. Unlike synthetic surfactants, biosurfactants are biodegradable and non-toxic, aligning with stringent environmental regulations imposed by governments and global agencies. The oil and gas industry is actively seeking sustainable alternatives for spill management, further driving the market demand. Additionally, biosurfactants exhibit high surface activity even at low concentrations, reducing the amount required for effective remediation. Advancements in biotechnology are improving production efficiency, making biosurfactants more commercially viable for large-scale environmental applications. As awareness regarding their effectiveness increases, biosurfactants are expected to become an integral part of oil spill mitigation strategies. With ongoing research and collaborations between environmental organizations and biosurfactant manufacturers, the market is poised for substantial growth, offering long-term sustainability benefits.

Restraints

-

High Production Costs and Complex Fermentation Processes Limit Commercial Viability

Despite their environmental benefits, biosurfactants face significant challenges in terms of high production costs and complex fermentation processes. The microbial fermentation required for biosurfactant synthesis is resource-intensive, requiring precise control of parameters such as pH, temperature, and nutrient supply. Additionally, the downstream purification process is costly, adding to the overall expense of production. Unlike synthetic surfactants, which can be mass-produced using cost-effective chemical synthesis, biosurfactants require specialized bioreactors and fermentation facilities, increasing capital investments. The use of expensive raw materials, such as refined oils and sugars, further contributes to high production costs. Although research efforts are focused on optimizing biosurfactant production through genetic engineering and process modifications, scalability remains a key limitation. The market adoption of biosurfactants is significantly hindered in price-sensitive industries such as household cleaning and industrial detergents, where cost competitiveness is a primary factor. Until production technologies advance further to achieve cost parity with synthetic surfactants, the high expenses associated with biosurfactant manufacturing will continue to restrain market growth.

Opportunities

-

Rising Demand for Biosurfactants in Sustainable Nanotechnology Applications Expands Market Scope

The integration of biosurfactants into nanotechnology applications is creating new opportunities across various industries, including pharmaceuticals, cosmetics, and environmental remediation. Biosurfactants are being explored as natural stabilizing agents in nanoparticle synthesis, enhancing the dispersion, solubility, and bioavailability of active ingredients. Their ability to self-assemble into nanostructures makes them valuable in drug delivery systems, allowing for targeted and controlled release of therapeutic compounds. In the cosmetics industry, biosurfactant-stabilized nanocarriers are being used to improve the delivery of active ingredients in skincare and haircare formulations. Additionally, biosurfactants are gaining attention in green nanotechnology by facilitating environmentally friendly nanoparticle synthesis, reducing the use of toxic chemicals. Researchers are also investigating their potential in wastewater treatment and soil remediation, where biosurfactant-functionalized nanomaterials can enhance contaminant removal efficiency. As nanotechnology continues to revolutionize multiple sectors, the demand for biosurfactants in these innovative applications is expected to rise, offering lucrative growth opportunities for manufacturers and research institutions.

Challenge

-

Regulatory and Certification Complexities Pose Barriers to Biosurfactant Commercialization

The commercialization of biosurfactants is hindered by stringent regulatory requirements and complex certification processes. Regulatory agencies impose strict guidelines on microbial strains used in biosurfactant production, necessitating extensive safety and efficacy testing. Additionally, the certification process for labeling biosurfactants as “biodegradable,” “organic,” or “eco-friendly” varies across regions, leading to inconsistencies in market regulations. Compliance with diverse regulatory frameworks increases both the time and cost required for product approvals, limiting new entrants in the market. The lack of globally harmonized standards further complicates international trade, making it challenging for manufacturers to expand their market reach. Until clearer regulatory pathways are established and certification processes are streamlined, biosurfactant commercialization will face delays and additional costs.

Segmental Analysis

By Product

Glycolipids dominated the Biosurfactant Market in 2023 with a market share of 38.9%. Within this category, Sophorolipids emerged as the leading subsegment, accounting for approximately 22.5% of the Glycolipids market. Sophorolipids have gained prominence due to their superior emulsification properties, biodegradability, and lower toxicity, making them a preferred choice in industries such as detergents, personal care, and bioremediation. Companies like Evonik and Saraya Co., Ltd. have been actively investing in the large-scale production of sophorolipids due to their increasing application in eco-friendly cleaning products. Additionally, the European Chemicals Agency (ECHA) has been promoting biosurfactants, encouraging manufacturers to replace synthetic surfactants with sustainable alternatives like sophorolipids. With rising environmental concerns and stringent regulations by organizations like the Environmental Protection Agency (EPA) on petroleum-based surfactants, sophorolipids continue to gain traction in various industrial applications.

By Application

Household Detergents & Cleaning Products dominated the Biosurfactant Market in 2023 with a market share of 28.5%. This segment’s growth is fueled by the increasing consumer demand for sustainable and non-toxic cleaning products, driven by regulatory policies and environmental concerns. Governments across Europe and North America are promoting green chemistry initiatives, compelling detergent manufacturers like Ecover and Unilever to adopt biosurfactants in their formulations. The European Union’s ban on phosphates in detergents has further accelerated the shift toward biosurfactants, as they provide comparable or superior cleaning efficacy while being environmentally friendly. Additionally, organizations such as the Roundtable on Sustainable Palm Oil (RSPO) are advocating for bio-based surfactants, further boosting the demand for biosurfactants in household cleaning applications.

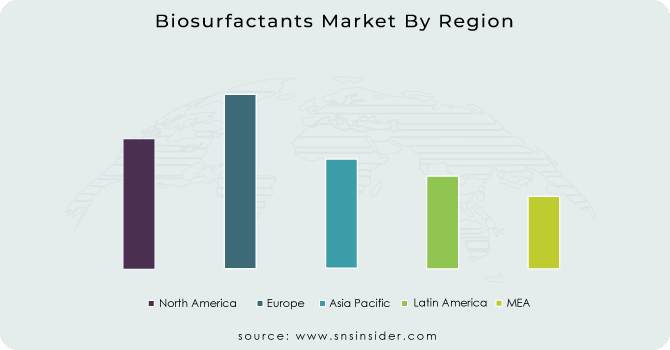

Regional Analysis

Europe dominated the Biosurfactant Market in 2023 with a market share of 42.3%. This dominance is driven by stringent environmental regulations, increasing consumer awareness, and strong industrial adoption of biosurfactants in personal care, household cleaning, and food industries. The European Chemicals Agency (ECHA) and REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations have significantly reduced the use of synthetic surfactants, encouraging manufacturers to shift toward bio-based alternatives. Germany is the leading country in the region due to its well-established chemical industry and strong investment in sustainable surfactant production, with companies like Evonik Industries and BASF SE leading biosurfactant innovation. France and the Netherlands are also key players, with heavy investment in sustainable consumer goods and partnerships with biosurfactant manufacturers. The European Union’s push for carbon neutrality by 2050 and incentives for bio-based products have further accelerated biosurfactant adoption, ensuring Europe’s continued dominance in the market.

On the other hand, North America emerged as the fastest-growing region in the Biosurfactant Market, projected to grow at a significant growth rate during the forecast period. The increasing demand for eco-friendly detergents, personal care products, and bioremediation solutions is fueling market growth, driven by the rising awareness of sustainable alternatives and regulatory support. The United States is the leading country in this growth, with companies like Locus Bio-Energy, Stepan Company, and Logos Technologies heavily investing in biosurfactant production. The Environmental Protection Agency (EPA) and U.S. Department of Agriculture (USDA) are promoting bio-based chemicals, providing tax incentives for sustainable surfactants. Additionally, the Canadian government has launched green chemistry initiatives to encourage industries to adopt biosurfactants in cleaning and industrial applications. The rising trend of green consumerism, coupled with stringent regulations on synthetic surfactants, is accelerating the market expansion in North America, positioning it as the fastest-growing region in the industry.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

AGAE Technologies LLC (Rhamnolipids)

-

Allied Carbon Solutions Co., Ltd. (Sophorolipids, Mannosylerythritol Lipids)

-

Biotensidon GmbH (Rhamnolipids, Lipopeptides)

-

Conagen Inc. (Sophorolipids, Custom Fermentation-Based Biosurfactants)

-

EcoSynthetix (Bio-based Emulsifiers, Starch-based Surfactants)

-

GlycoSurf LLC (Glycolipid Biosurfactants, Green Surfactants)

-

Holiferm Limited (Sophorolipids, Fermentation-Based Biosurfactants)

-

Jeneil Biotech, Inc. (Sophorolipids, Rhamnolipids)

-

Kaneka Corporation (Sophorolipids, Biodegradable Surfactants)

-

Locus Bio-Energy Solutions (Glycolipid Biosurfactants, Microbial Surfactants)

-

Logos Technologies (Stepan Company) (Glycolipids, Fermentation-Derived Surfactants)

-

Mango Materials (Biopolymer-based Surfactants, Fermentation-Derived Biosurfactants)

-

Rhamnolipid Inc. (Rhamnolipids, Glycolipid-Based Surfactants)

-

Saraya Co., Ltd. (Sophorolipids, Glycolipid Biosurfactants)

-

Synthezyme LLC (Custom Biosurfactants, Fermentation-Based Surfactants)

-

TeeGene Biotech (Glycolipids, Rhamnolipids)

-

TensioGreen (Rhamnolipids, Sophorolipids)

-

Terranol (Sophorolipids, Biodegradable Surfactants)

-

WHEATOLEO (Sugar-Based Biosurfactants, Green Surfactants)

-

Wheatoleo (Alkyl Polyglucosides, Sugar-Based Surfactants)

Recent Developments

-

October 2024: Belgian startup AmphiStar launched AmphiCare and AmphiClean, the first biosurfactants made entirely from organic waste and side streams. These products offer biodegradable alternatives for personal and home care markets, aligning with circular economy principles.

-

September 2024: Evonik introduced TEGO Wet 570 Terra and TEGO Wet 580 Terra, biosurfactants derived from natural resources for coatings and inks. These products provide excellent pigment wetting and are compliant with EU Ecolabel standards.

-

July 2024: Holiferm partnered with Green Pyramid to conduct formulation trials using Holiferm's biosurfactants. This collaboration aimed to develop sustainable products for the personal care and household cleaning sectors.

-

March 2024: McDermott achieved mechanical completion of a pioneering biosurfactants project, marking a significant milestone in sustainable chemical production. This project underscores McDermott's commitment to advancing environmentally friendly technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.85 Billion |

| Market Size by 2032 | USD 6.82 Billion |

| CAGR | CAGR of 6.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Glycolipids [Rhamnolipids, Trehalolipids, Sophorolipids], Lipopeptides & Lipoproteins [Surfactin, Lechenysin], Phospholipids & Fatty Acids, Polymeric Biosurfactants, Particulate Biosurfactants, Others) •By Application (Household Detergents & Cleaning Products, Industrial & Institutional Cleaners, Personal Care & Cosmetics, Agriculture & Agrochemicals, Oilfield Chemicals & Petroleum Industry, Food Processing & Beverages, Pharmaceuticals & Healthcare, Textiles & Leather Processing, Environmental Bioremediation & Waste Treatment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Jeneil Biotech, Inc., Saraya Co., Ltd., Allied Carbon Solutions Co., Ltd., Holiferm Limited, Biotensidon GmbH, AGAE Technologies LLC, GlycoSurf LLC, Logos Technologies (Stepan Company), Synthezyme LLC, TeeGene Biotech and other key players |