Industrial Cleaning Chemical Market Report Scope & Overview:

The Industrial Cleaning Chemical Market Size was valued at USD 42.89 Billion in 2023 and is expected to reach USD 65.37 Billion by 2032, growing at a CAGR of 4.80% over the forecast period of 2024-2032.

Get More Information on Industrial Cleaning Chemical Market - Request Sample Report

As demand for Industrial Cleaning Chemicals rises and hygiene standards accelerate, the market is adapting on a global scale aided by regulatory forces and sustainability objectives. The report pinpoints key production and consumption data with information on important manufacturing hubs and demand trends. The global distribution of the trade flow is identified with extensive import and export analysis. The regulatory and compliance framework is analysed in relation to safety and environmental mandates. Investment and funding trends highlight evolution in R&D and strategic acquisitions. A push towards eco consciousness is causing a trend towards environmental impact analysis and sustainability encompassing greener formulations and circular economy initiatives. Moreover, an end-user’s procurement and cost analysis reveal the pricing structures, bulk-buy advantages, and cost-effective procurement approaches influencing the market.

Industrial Cleaning Chemical Market Dynamics

Drivers

-

Rising Adoption of Green Cleaning Solutions and Sustainable Industrial Cleaning Chemical Products Enhances Market Demand

Sustainable and biodegradable cleaning products are revolutionizing industries across the globe to reduce their environmental footprint while complying with regulations regarding chemical emissions. Concerns about toxic residues, wastewater contamination, and occupational health hazards are driving the demand for environmentally friendly industrial cleaning agents. Companies are substituting traditional solvents and surfactants for plant-based alternatives and bio-derived enzymes that not only lower chemical footprints but also enable equivalent cleaning performance. Organizations including the United Nations and environmental agencies also promote green chemistry, driving further demand. Increasing consumer preference toward sustainability has induced businesses to implement green cleaning chemicals in their enterprises so as to enhance reputation and corporate social responsibility initiatives. Additionally, industrial end-users are continuously leveraging closed-loop systems for effluent disposal, which provides sustainability plus long-term cost savings. As green certifications proliferate across industries, manufacturers adopting sustainable innovations can corner a healthy segment of the market.

Restraints

-

High Raw Material Costs and Supply Chain Disruptions Affect the Profitability of Industrial Cleaning Chemical Manufacturers

The industrial cleaning chemicals market is highly reliant on raw materials that include surfactants, solvents, and enzymes among others, prices for which are prone to fluctuations caused by supply chain bottlenecks. Geopolitical tensions, global trade restrictions, and increasing crude oil prices heavily influence the cost of relevant raw materials. Drastic shortages of essential ingredients, especially in the course of financial disruptions or pandemics, create provide bottlenecks that impeded manufacturing and delivery timelines. In addition, rising transportation costs and tariffs on chemical inputs hit manufacturers in the pocket. Maintaining competitive pricing against competitors with potentially high margins can be challenging for companies while ensuring product quality and regulatory compliance as regulations can limit profit margins. Supply chain volatility and dependence on global markets create uncertainties, impacting overall market stability.

Opportunities

-

Advancements in Biotechnology and Enzyme-Based Cleaning Formulations Drive Innovation in Industrial Cleaning Chemicals

Growing adoption of biotechnology in the formulation of industrial cleaning chemicals is providing new revenue generation opportunities for players in the market. Enzyme based cleaners come from biological sources and provide cleaning solutions with lower toxicity and minimal environmental impact. These bio-based formulations are highly effective in degrading organic contaminants, grease and biofilms without resorting to harsh chemicals. Sectors like healthcare, food and beverage, and wastewater treatment are increasingly adopting enzyme-based cleaners for improved operational efficiency and meeting sustainability objectives. Such advancements in microbial and probiotic cleaning technologies extend the diverse field of industrial cleaning solutions. This presents a market expansion opportunity due to an increase in consumer and regulatory preference for non-toxic and biodegrade alternative products.

Challenge

-

Intense Competition and Price Wars Among Manufacturers Create Market Challenges for Industrial Cleaning Chemical Companies

The industrial cleaning chemical market is fragmented, with a large number of global and regional players competing for market share. Intense competition with other companies who are willing to charge less for the same quality pose major challenges, resulting in price wars and lower profit margins. Moreover, low-cost alternatives from unorganized sectors only add to the competition, forcing established players to keep innovating and differentiating their products. For manufacturers, finding the right balance between product quality and price competition continues to pose a major challenge. Moreover, often, loyalty is a function of pricing and not brand equity, making a case for sustainable go-to-market. In this increasingly competitive environment, businesses have the challenge of balancing affordability, quality and regulation compliance to enable growth.

Industrial Cleaning Chemical Market Segmental Analysis

By Ingredient Type

Surfactants dominated and accounted for the largest share of 35% of the industrial cleaning chemicals market in 2023. This dominance is because surfactants reduce surface tension, they are essential for cleaning formulations, and help remove dirt, grease and contaminants from the surfaces. They can be used in many different industries, from manufacturing to healthcare to food processing. According to American Cleaning Institute, surfactants provide cleaning efficiency with environmental safety. Moreover, organizations such as the Environmental Protection Agency (EPA) have accepted the role of surfactants in the creation of environment-friendly cleaning products, which has further propelled their use in industrial applications.

By Product type

The general cleaners dominated and accounted for approximately 30% of the industrial cleaning chemicals market in 2023. Commercial Laundry detergents that cater to a wide array of environments such as commercial offices, industrial facilities, public spaces, etc. are critical for maintaining hygiene across all environments. They are essential to everyday maintenance due to their broad-spectrum efficacy in eliminating different contaminants. Some general cleaners should be used regularly to maintain standards of cleanliness, particularly in high traffic areas, the Centers for Disease Control and Prevention (CDC) recommends. In addition, as per the hygiene protocols such as Occupational Safety and Health Administration (OSHA) protocols that are mandated in work environment has spurred the demand for effective general cleaning agents.

By Form

The liquid segment dominated the industrial cleaning chemicals market and accounted for about 60% of the market share in 2023. Liquid cleaning agents are favored for their easy application, quick dissolution and compatibility with dispensing systems, which enable them to be used for various industrial cleaning tasks. They are preferred in sectors such as healthcare and food processing for their ability to penetrate and remove stubborn residues. Infection control strategies depend on the use of liquid disinfectants. (World Health Organisation - Definition of Liquid Disinfectants) Also, industry reports show a trend of liquid formulations being preferred due to their effectiveness and ease of use for large cleaning purposes.

By Application

In 2023, the refining & petrochemical application segment dominated and accounted for the largest share in the industrial cleaning chemicals market, representing approximately 35% of total market share. This cleaning industry needs special cleaning agents to clean the heavy-duty pollutants, make the instruments efficient, and driver the safety standards. Regular cleaning stops corrosion, fouling and operating interruptions in refineries and petrochemical plants. That is why the American Petroleum Institute (API) emphasizes the importance of strict cleaning procedures to protect both operational integrity and safety. Additionally, government regulations regarding the environment force the utilization of effective cleaning chemicals to prevent the release of harmful emissions and waste, thus supporting the demand for this segment even more.

By End-User

The manufacturing & commercial offices segment dominated accounting for about 30% in the industrial cleaning chemicals market in 2023. Such environments require daily cleaning to promote employee health, meet occupational health and safety regulations, and support productivity levels. In commercial offices leading to high footfall and the machinery in manufacturing units call for cleaning solutions to avoid contamination and equipment malfunction. The International Facility Management Association (IFMA) organization outlines how straightforward cleaning can improve workplace productivity and safety. The need for industrial cleaning chemicals has also been boosted by post-pandemic directives from health authorities that have placed a greater emphasis on cleanliness in such settings.

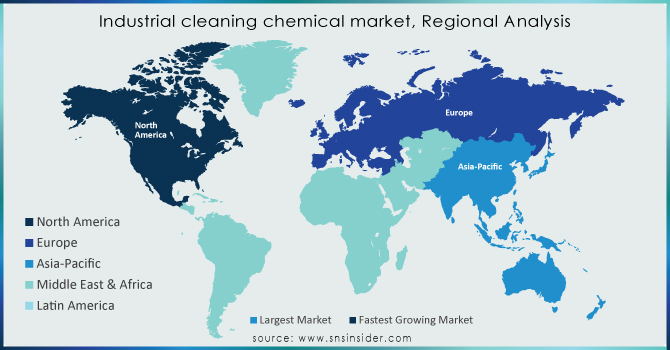

Industrial Cleaning Chemical Market Regional Outlook

The Asia Pacific region dominated the industrial cleaning chemicals market with a market share of almost 35.5% in 2023. The growth of the region is primarily supported by the factors such as swift industrialization, growing manufacturing sectors, and rising consciousness towards cleansing of work areas. With substantial production capabilities and development in sectors like automotive, healthcare, and food processing, China, India, and Japan dominate the market. As the largest manufacturing base in the world, China has had a growing demand for industrial cleaning chemicals, and the government is promoting strict sanitation measures. Industrial output in 2023 increased 4.6%, according to China’s National Bureau of Statistics, driving demand for cleaning chemicals at production facilities. India has also become an important contributor as its food processing industry is growing exponentially owing to several government initiatives such as ‘Make in India’ and FSSAI regulations that encourage hygiene compliance. With its robust technology and strict environmental policies, Japan has seen a significant demand for eco-friendly cleaning products.

Moreover, North America region emerged as the fastest growing region at a significant CAGR in the industrial cleaning chemicals market during the forecast period. This expansion is driven by stricter regulations pertaining to sanitation, increasing consumer awareness regarding workplace hygiene, and the high market presence of leading manufacturers of cleaning chemicals. This growth is primarily fueled by the United States due to high demand from commercial offices, healthcare facilities, and food processing plants. A major factor aiding in this effort is the United States Environmental Protection Agency (EPA), which advocates for sustainable and biodegradable cleaning products while is encouraging industries to embrace environmentally friendly solutions. Moreover, Canada is also gaining wide range of growth, mainly in the healthcare and hospitality sectors, with the Canadian Centre for Occupational Health and Safety (CCOHS) highlighting stringent hygiene regulations. Meanwhile, the growing manufacturing footprint in Mexico is also spurring demand for industrial cleaning chemicals in the automotive & electronics industries, due to USMCA trade agreement.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Albemarle Corporation (Bromine-based Industrial Cleaners, Flame retardant chemicals)

-

BASF SE (Alkoxylates, BASF Detergents, Degreasers)

-

Clariant (Bio-based Surfactants, Detergent Solutions, Industrial Cleaning Solutions)

-

Croda International PLC (Industrial Cleaners, Degreasers, Surfactants)

-

Dow Inc. (DOW™ Industrial Cleaners, DOW™ Surfactants, Detergents)

-

Diversey Holdings Ltd. (Suma, Diversey Clax, Diversey Oxivir)

-

Diversey Inc. (Suma, Clax, Oxivir)

-

Ecolab Inc. (Ecolab KAY® QSR, Ecolab 3M™ Clean-N-Glide, Ecolab Peroxide)

-

Evonik Industries AG (Evonik Surfactants, Avanse Detergents, Industrial Cleaners)

-

Henkel AG & Co. KGaA (Loctite Cleaner, Industrial Detergents, Surfactants)

-

Huntsman International LLC (Texcare, Araldite, Polyurethane Cleaner)

-

Kimberly-Clark Corporation (Kimtech wipes, Scott® Professional Cleaning products, K-C Professional Industrial Cleaning solutions)

-

Procter & Gamble (Dawn Professional, Mr. Clean, Professional Degreasers)

-

Pilot Chemical Corp. (Pilot Cleaners, Degreasers, Surfactants)

-

Reckitt Benckiser Group plc (Lysol Professional Cleaner, Finish Industrial Cleaners)

-

Solvay SA (Solvay Surfactants, ActinoGuard, Industrial Degreasers)

-

Spartan Chemical Company (Spartan Clean, Tri-Base, Xtreme Industrial Cleaner)

-

Stepan Company (Stepan Surfactants, Stepanol, Industrial Degreasers)

-

The Clorox Company, Inc. (Clorox Commercial Solutions, Clorox Pro, Industrial Degreasers)

-

3M (3M™ Heavy Duty Cleaner, 3M™ Industrial Degreasers, 3M™ Scotchgard Cleaner)

Recent Highlights

-

February 2025: Jelmar launched a high-performance industrial cleaner that focuses on formulate to dissolve tough grease and grime and makes them ideal for industrial cleaning applications.

-

November 2024: OZONO introduced revolutionary eco-friendly cleaning technology to the Australia & New Zealand Region, providing chemical-free cleaning solutions that transform tap water into atomyzing aqueous ozone to effectively clean and sanitize.

-

November 2024: Brenntag and I&I teamed up with Arxada under an agreement to distribute exclusive cleaning and biocide solutions portfolio, building on key end-markets (Homecare and I&I) through new innovative products in the Nordics and Benelux areas.

-

June 2024: Solenis acquired Lilleborg, a leading provider of professional cleaning solutions based in Norway, leveraging the acquisition to bolster its position in Norway and expand its food and beverage offerings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 42.89 Billion |

| Market Size by 2032 | USD 65.37 Billion |

| CAGR | CAGR of 4.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Ingredient Type (Surfactants, Solvents, Chelating Agents, PH Regulators, Solublizers/ Hydrotropes, Enzymes, Others) •By Product Type (General Cleaners, Metal Cleaners, Dish Washing, Commercial Laundry, Disinfectants, Others) •By Form (Liquid, Powder, Gel, Others) •By Application (Refining & Petrochemical, Metals, Power Generation, Others) •By End-User (Manufacturing & Commercial Offices, Healthcare, Retail & Food Service, Hospitality, Automotive & Aerospace, Food Processing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Ecolab Inc., Henkel AG & Co. KGaA, Dow Inc., 3M, Clariant, Evonik Industries AG, Procter & Gamble, Kimberly-Clark Corporation, The Clorox Company, Inc. and other key players |