Biphenyl Market Size:

Get More Information on Biphenyl Market - Request Sample Report

The Biphenyl Market Size was valued at USD 1.5 billion in 2023 and is expected to reach USD 2.3 billion by 2032 and grow at a CAGR of 4.8% over the forecast period 2024-2032.

The biphenyl market is characterized by a growing demand driven by its diverse applications across several industries, particularly in the manufacturing of chemicals, agrochemicals, and the petroleum sector. Biphenyl, primarily used as a heat transfer fluid and a solvent, has gained attention due to its effectiveness in facilitating thermal transfer in high-temperature processes. The chemical's stability and non-corrosive nature make it an attractive option for use in industrial applications, including heat exchangers and thermal oils, which are essential for various manufacturing processes. This rising demand for efficient heat transfer solutions is significantly influencing market dynamics, as industries strive for improved energy efficiency and sustainability.

Recent developments in the biphenyl market have been notably shaped by the advancements in the petrochemical sector, where companies are enhancing production methods to meet the increasing demands. For instance, the introduction of advanced distillation techniques has allowed for higher purity levels of biphenyl, which is crucial for its applications in specialty chemicals. The growing emphasis on the production of high-performance materials is pushing manufacturers to innovate and improve their product offerings. Furthermore, companies are focusing on expanding their production capacities and optimizing existing facilities to cater to the evolving requirements of various end-user industries, which include pharmaceuticals, plastics, and personal care products.

Sustainability initiatives are also gaining traction within the biphenyl market, prompting organizations to explore eco-friendly alternatives and production processes. Recent investments in research and development are aimed at synthesizing biphenyl derivatives that exhibit lower environmental impact while maintaining high efficiency. This shift is being fueled by stringent regulations surrounding chemical production and usage, pushing manufacturers to adopt greener practices. The movement towards sustainability is not only influencing production techniques but also enhancing the market appeal of biphenyl as an environmentally responsible option for industries aiming to reduce their carbon footprint.

Moreover, the global expansion of the automotive and electronics sectors is significantly contributing to the demand for biphenyl, as it plays a crucial role in the production of various components. Its use in manufacturing insulating materials for electronic devices and heat-resistant coatings for automotive applications underscores its versatility. Companies are actively engaging in collaborations and strategic partnerships to develop innovative applications for biphenyl, aiming to leverage its properties for enhanced product performance. The focus on innovation, combined with a commitment to sustainability, is positioning biphenyl as a key player in the evolving landscape of industrial chemicals, driven by the need for efficient and environmentally conscious solutions.

Market Dynamics:

Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts the Biphenyl Market Growth

The increasing emphasis on sustainability is a significant driver for the biphenyl market. Industries across the board are transitioning towards greener alternatives, seeking products that align with environmental regulations and consumer preferences for eco-friendly solutions. Biphenyl, known for its effectiveness as a heat transfer fluid and solvent, fits this mold. Its ability to provide efficient thermal management without compromising safety or environmental standards has made it a preferred choice in various applications. Industries such as pharmaceuticals, electronics, and petrochemicals are incorporating biphenyl into their processes due to its non-toxic nature and potential for reducing overall carbon footprints. Moreover, stringent government regulations aimed at minimizing hazardous materials in manufacturing processes are compelling businesses to adopt safer, more sustainable chemicals like biphenyl. As companies strive to innovate and implement sustainable practices, the demand for eco-friendly biphenyl products is expected to grow, propelling the market forward. This trend not only aligns with global environmental goals but also enhances brand image, offering competitive advantages to manufacturers who prioritize sustainability in their product offerings.

-

Advancements in Petrochemical Production Technologies Fueling Biphenyl Market Expansion

The rapid evolution of petrochemical production technologies is a vital driver for the growth of the biphenyl market. With advancements in extraction and refining processes, manufacturers are achieving higher purity levels and improved efficiency in biphenyl production. Techniques such as advanced distillation and catalytic cracking are being increasingly utilized, resulting in enhanced yield and reduced energy consumption. This is particularly important as industries demand high-quality biphenyl for various applications, including heat transfer fluids, solvents, and chemical intermediates. Furthermore, innovations in production methodologies are enabling companies to scale up operations while maintaining cost-effectiveness, which is crucial in a competitive market. As the petrochemical sector continues to innovate, it is not only meeting the rising demand for biphenyl but also improving the overall sustainability of its operations. This technological progress is driving the market by ensuring a consistent supply of high-quality biphenyl products that meet industry standards and customer expectations, thereby reinforcing its position as a critical component in various manufacturing processes.

Restraint:

-

Regulatory Challenges Impacting Biphenyl Production and Usage

Despite its advantages, the biphenyl market faces significant challenges due to stringent regulatory frameworks surrounding chemical production and use. Governments worldwide are imposing regulations aimed at minimizing the environmental impact of chemical substances, and biphenyl is no exception. These regulations often involve complex compliance procedures, requiring manufacturers to invest substantial resources in research, testing, and reporting to ensure their products meet safety and environmental standards. Such compliance can lead to increased production costs, which may be passed on to consumers, ultimately affecting market demand. Additionally, the potential for penalties or restrictions on the use of biphenyl in certain applications poses risks for manufacturers. This regulatory landscape can create uncertainty in the market, making it challenging for companies to plan their operations effectively. As the landscape of chemical regulations continues to evolve, it will be essential for manufacturers to stay informed and adaptable to navigate these challenges while maintaining their competitive edge in the biphenyl market.

Opportunity:

-

Emerging Applications in the Electronics Sector Present New Opportunities for Biphenyl Market Growth

The expansion of the electronics sector is presenting new opportunities for the biphenyl market, as the demand for advanced materials continues to rise. Biphenyl is increasingly being recognized for its beneficial properties in applications such as insulating materials and thermal management systems for electronic devices. As electronics become more compact and energy-efficient, the need for effective thermal solutions is paramount. Biphenyl's stability and heat resistance make it an ideal candidate for applications in this rapidly evolving industry. Manufacturers are now exploring innovative formulations and product designs that leverage biphenyl's properties to enhance the performance of electronic components, including semiconductors and circuit boards. This trend is driving research and development initiatives focused on creating specialized biphenyl derivatives that cater to specific industry needs. As the electronics sector grows and evolves, the demand for biphenyl is expected to increase, offering manufacturers the chance to expand their product portfolios and capture a larger share of this emerging market segment. The potential for collaboration between biphenyl producers and electronics manufacturers further amplifies these growth opportunities, paving the way for innovative applications and solutions.

Challenge:

-

Supply Chain Disruptions Challenge Biphenyl Market Stability

The biphenyl market is currently challenged by supply chain disruptions that are affecting production and distribution processes. Global events, such as geopolitical tensions, natural disasters, and the ongoing impacts of the pandemic, have highlighted the vulnerability of supply chains across various industries. For biphenyl producers, these disruptions can lead to delays in sourcing raw materials, increased transportation costs, and uncertainty in delivery schedules. Such challenges not only hinder the ability to meet rising market demand but also complicate inventory management, leading to potential revenue losses. Additionally, as manufacturers strive to maintain consistent quality and availability of biphenyl products, fluctuations in supply can cause pricing instability, which may deter potential customers. Companies in the biphenyl market must develop robust contingency plans and diversify their supply chains to mitigate these risks. This may involve seeking alternative suppliers, investing in localized production facilities, or enhancing logistical capabilities to ensure a steady flow of materials and finished products. The ability to navigate these supply chain challenges will be crucial for sustaining growth and maintaining competitiveness in the biphenyl market.

Key Market Segments

By Product Type

In 2023, the Pure Biphenyl segment dominated the biphenyl market, holding an estimated market share of approximately 65%. This dominance is attributed to the widespread use of pure biphenyl as a high-performance heat transfer fluid in industrial applications, particularly in processes requiring efficient thermal management. For example, in the petrochemical and chemical processing industries, pure biphenyl is often utilized due to its excellent thermal stability and non-corrosive nature, making it ideal for high-temperature operations. Additionally, the demand for pure biphenyl in the manufacturing of specialty chemicals and as a solvent further reinforces its leading position in the market. As industries increasingly prioritize efficiency and performance, the preference for pure biphenyl continues to grow, driving its market share higher compared to derivatives.

By Application

In 2023, the Heat Transfer Fluids application segment dominated the biphenyl market with an estimated market share of around 50%. This dominance is largely due to the increasing demand for efficient thermal management solutions across various industries, such as petrochemicals, manufacturing, and energy production. Biphenyl is favored in heat transfer applications due to its high thermal conductivity and stability at elevated temperatures. For instance, in power plants and chemical processing facilities, biphenyl-based heat transfer fluids are critical for maintaining optimal operating conditions. The ability to manage heat effectively enhances energy efficiency, making biphenyl an attractive choice for companies seeking to optimize their processes. As industries continue to expand and innovate, the reliance on biphenyl for heat transfer applications remains strong, contributing to its significant market share.

By End-User Industry

In 2023, the Chemical Industry segment dominated the biphenyl market, with an estimated market share of about 40%. The chemical industry utilizes biphenyl primarily as a solvent and as a precursor in the synthesis of various chemical intermediates, driving its demand significantly. For example, biphenyl is commonly used in the production of pharmaceuticals and agrochemicals, where it serves as a critical building block in the formulation of active ingredients. Additionally, the chemical industry's growing focus on innovation and efficiency further enhances the attractiveness of biphenyl, as manufacturers seek high-quality solvents that provide consistent performance. As chemical production scales up globally, the reliance on biphenyl in this sector solidifies its position as a dominant player, reflecting the sector's broader trends toward enhanced productivity and sustainability.

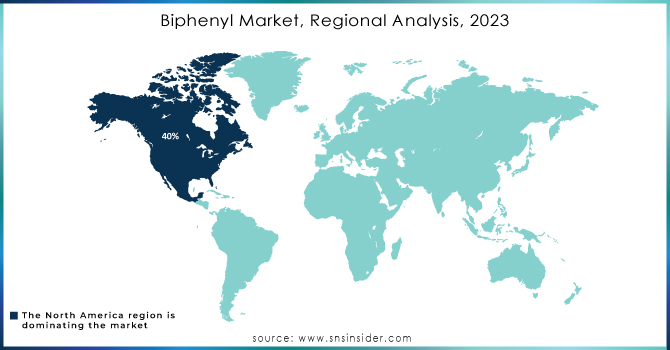

Regional Analysis

In 2023, North America emerged as the dominant region in the biphenyl market, with an estimated market share of approximately 40%. This significant share is primarily driven by the robust presence of key industries, including petrochemicals, pharmaceuticals, and chemicals manufacturing, which heavily utilize biphenyl for various applications. The United States, in particular, is home to numerous large-scale chemical plants and refineries that leverage biphenyl for heat transfer fluids and as a solvent in chemical processes. For example, companies in the petrochemical sector have increasingly adopted biphenyl for its effective thermal management properties, particularly in high-temperature operations. Furthermore, stringent regulations promoting the use of eco-friendly and efficient chemicals have reinforced the adoption of biphenyl in North America, ensuring its leading market position.

Moreover, in 2023, the Asia-Pacific region emerged as the fastest-growing market for biphenyl, with a CAGR of approximately 6%. This growth can be attributed to the rapid industrialization and increasing demand for chemicals in countries such as China and India, where the expansion of the chemical and pharmaceutical sectors is particularly notable. As these economies continue to develop, the demand for biphenyl as a chemical intermediate and heat transfer fluid is expected to rise significantly. For instance, the burgeoning electronics and automotive industries in the Asia-Pacific region are driving the need for advanced materials and thermal management solutions, further enhancing the uptake of biphenyl. Additionally, favorable government policies aimed at boosting domestic manufacturing and sustainability initiatives are likely to support this growth trajectory, making the Asia-Pacific region a key player in the biphenyl market's future.

Need Any Customization Research On Biphenyl Market - Inquiry Now

Key Players

-

AkzoNobel N.V. (biphenyl, diphenyl ether)

-

BASF SE (biphenyl, 4-bromobiphenyl)

-

Dow Inc. (biphenyl, heat transfer fluids)

-

Eastman Chemical Company (biphenyl, phenol)

-

FMC Corporation (biphenyl derivatives, herbicides)

-

Huntsman Corporation (biphenyl, thermal transfer fluids)

-

Merck KGaA (biphenyl, 4,4'-diphenyl)

-

Solvay S.A. (biphenyl, specialty chemicals)

-

Tokyo Chemical Industry Co., Ltd. (TCI) (biphenyl, 4-iodobiphenyl)

-

Wacker Chemie AG (biphenyl, silicone fluids)

-

Aldrich Chemical Company (biphenyl, biphenyl-4-carboxylic acid)

-

Alfa Aesar (biphenyl, biphenyl-3,4-dicarboxylic acid)

-

ChemSpider (biphenyl, biphenyl-2,2'-dicarboxylic acid)

-

Daiichi Kankyou Engineering Co., Ltd. (biphenyl, biphenyl derivatives)

-

Fluor Corporation (biphenyl, heat transfer fluids)

-

Indo Gulf Fertilizers & Chemicals Corporation (biphenyl, chemical intermediates)

-

LyondellBasell Industries N.V. (biphenyl, specialty chemicals)

-

Reliance Industries Limited (biphenyl, petrochemicals)

-

SABIC (biphenyl, specialty chemicals)

-

Sigma-Aldrich Corporation (biphenyl, biphenyl-d4)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.5 Billion |

| Market Size by 2032 | US$ 2.3 Billion |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Pure Biphenyl, Biphenyl Derivatives) •By Application (Chemical Intermediates, Heat Transfer Fluids, Agricultural Chemicals, Pharmaceuticals, Others) •By End-User Industry (Chemical Industry, Agriculture, Pharmaceuticals, Food and Beverage, Textiles, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eastman Chemical Company, BASF SE, Dow Inc., Merck KGaA, AkzoNobel N.V., FMC Corporation, Huntsman Corporation, Tokyo Chemical Industry Co., Ltd. (TCI), Wacker Chemie AG, Solvay S.A. and other key players |

| Key Drivers | • Growing Demand for Eco-Friendly Products in Various Industries Boosts the Biphenyl Market Growth • Advancements in Petrochemical Production Technologies Fueling Biphenyl Market Expansion |

| RESTRAINTS | • Regulatory Challenges Impacting Biphenyl Production and Usage |