Lithium-Ion Battery Materials Market Report Scope & Overview:

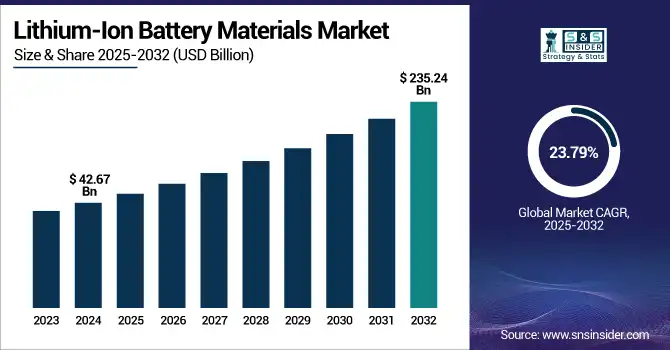

The Lithium-Ion Battery Materials Market size was valued at USD 42.67 billion in 2024 and is expected to reach USD 235.24 billion by 2032, growing at a CAGR of 23.79% over the forecast period of 2025-2032.

To Get more information on Lithium-Ion Battery Materials Market - Request Free Sample Report

The lithium-ion battery materials market is growing with significant developments in the advancement of EVs and the technology of batteries. A former quite noticeable trend is thus the move to Lithium Iron Phosphate (LFP) chemistries, as they are safer and more price-effective. Lithium-sulfur and solid-state batteries are offering competitive alternatives in the battery materials market as well. Companies, such as Lyten are spending more than USD 1 billion on lithium-sulfur production in the U.S. to disentangle themselves from foreign supply chains.

In 2023, lithium demand for batteries jumped more than 30%, to around 140 kilotons, according to the International Energy Agency. The U.S. Department of Energy also points out that the U.S.-based facilities recycled more than 35,000 tons of lithium-ion raw-material battery feeds in 2023.

These lithium-ion battery materials market trends and government-supported recycling initiatives are driving a stronger, more sustainable future for the lithium-ion battery market.

Lithium-Ion Battery Materials Market Dynamics:

Drivers

-

Expansion of Domestic Recycling Infrastructure Enhances Material Availability.

Domestic recycling facilities augment manifestation in the lithium-ion battery materials market, enabling a reliable stream for the essential raw materials.

In 2023, the U.S. battery recyclers could recover more than 35,000 to 65,000 tons of battery materials, and were online to increase capacity as much as 76,000 tonnes in two to four years.

This growth helps to minimize dependence on foreign markets for materials and to facilitate product recycling, contributing to sustainability objectives. Rising availability of recycled materials helps stabilize the lithium-ion battery materials market share and support the growth of electric vehicles and renewable-based energy storage solutions.

-

Government Investments Propel Recycling and Reuse Technologies.

Large investments made by the government is fostering rapid advancements in battery recycling and technologies’ reuse, and is contributing toward the drive the lithium-ion battery materials market share.

-

For instance, in December 2023, the U.S. Department of Energy announced a USD 37 million investment to reduce the cost of recycling electric vehicle batteries, which could eventually make recycling a much more profitable process.

These kinds of investments will help stimulate the creation of new recycling methods and will support the long-term supply of LIB raw materials. These measures are aimed at being not only environmentally beneficial, but also at improving the competitiveness of our domestic lithium-ion battery materials companies by lowering production costs and lessening reliance on foreign resources.

Restraints

-

Environmental Concerns Over Mining Practices Impede Market Growth.

Environmental issues associated with the extraction of lithium-Ion battery raw materials pose significant challenges to the lithium-ion battery materials market. Mining activities for materials, such as lithium and cobalt can lead to habitat destruction, water pollution, and carbon emissions. These environmental impacts have led to increased scrutiny and regulatory pressures, potentially slowing down mining operations. Such challenges can disrupt the supply chain, affecting the availability and cost of raw materials, thereby hindering the market growth. Addressing these environmental concerns is crucial for the sustainable expansion of the market.

-

Supply Chain Vulnerabilities Due to Geopolitical Factors Hinder Market Expansion.

The lithium-ion battery materials market is susceptible to supply chain disruptions caused by geopolitical tensions. A significant portion of critical materials, such as cobalt and rare earth elements are sourced from regions with political instability. Trade restrictions, export bans, or conflicts can lead to material shortages and price volatility. These uncertainties can deter investment and complicate long-term planning for lithium-ion battery materials companies, negatively impacting the overall market stability and growth prospects.

Lithium-Ion Battery Materials Market Segmentation Analysis:

By Material

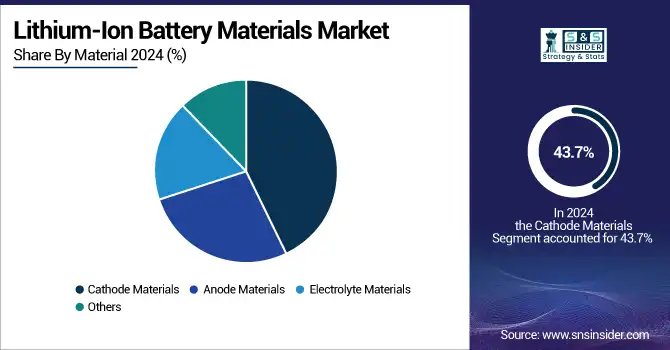

In 2024, the cathode materials segment led the lithium-ion battery materials market, capturing a 43.7% share. Within this segment, the lithium nickel manganese cobalt (NMC) cathodes were predominant, favored for their high energy density and balanced performance. NMC's widespread adoption in electric vehicles (EVs) and consumer electronics underscores its dominance. The U.S. Department of Energy highlights NMC's role in advancing battery technology for EVs, emphasizing its importance in achieving longer driving ranges and improved safety. Additionally, the European Battery Alliance supports NMC development to bolster Europe's battery manufacturing capabilities.

Anode Materials emerged as the fastest-growing segment in 2024, with a CAGR of 24.63%. Graphite-based anodes, particularly synthetic graphite, dominated this segment due to their high conductivity and stability. The surge in EV production and the push for higher battery capacities have intensified the demand for advanced anode materials. According to the International Energy Agency, the global EV stock exceeded 10 million in 2024, driving the need for efficient anode materials. Furthermore, initiatives by the U.S. Geological Survey to secure domestic sources of graphite underscore the strategic importance of anode materials in the battery supply chain.

By Battery Type

Lithium Nickel Manganese Cobalt (NMC) batteries were the dominant type in the lithium-ion battery materials market, representing 38.2% of the total share in 2024. Their use in electric vehicles and high-performance applications makes them a preferred choice. NMC batteries are known for their balanced properties, offering high energy density and long cycle life, which is essential for EV manufacturers aiming to extend driving range. Research from government bodies, such as the U.S. Department of Energy and European Union investments have propelled advancements in NMC technologies, securing its market leadership.

Lithium Iron Phosphate (LFP) batteries have witnessed the highest growth in 2024, with a CAGR of 24.83%. LFP batteries are gaining popularity due to their improved safety profile and lower cost compared to NMC. Increasingly, LFP is being adopted by Chinese EV manufacturers and being integrated into energy storage systems. According to the China Association of Automobile Manufacturers, LFP batteries accounted for a large share of new EV sales in China in 2024, making it a key growth driver in the global battery materials market.

By Application

Electric Vehicles (EVs) were the most dominant application segment with a 49.8% share of the market in 2024. The segment’s growth is driven by the increasing focus on reducing greenhouse gas emissions and transitioning to renewable energy sources, further propelling global EV adoption. Government initiatives, such as tax incentives and regulations aimed at reducing internal combustion engine vehicles, further bolster the EV market. According to the International Energy Agency, over 10 million electric cars were sold globally in 2024, significantly boosting the demand for lithium-ion battery materials, particularly cathode and anode materials.

The Industrial segment was the fastest growing, with a CAGR of 24.41% in 2024. The increasing use of lithium-ion batteries in applications, such as industrial robots, material handling equipment, and backup power systems contributes to this growth. As industries transition toward more sustainable energy solutions, lithium-ion batteries are becoming a crucial component in energy storage systems and electric machinery. The rising demand for automated systems and energy-efficient technologies drives the growth in industrial applications.

Lithium-Ion Battery Materials Market Regional Outlook:

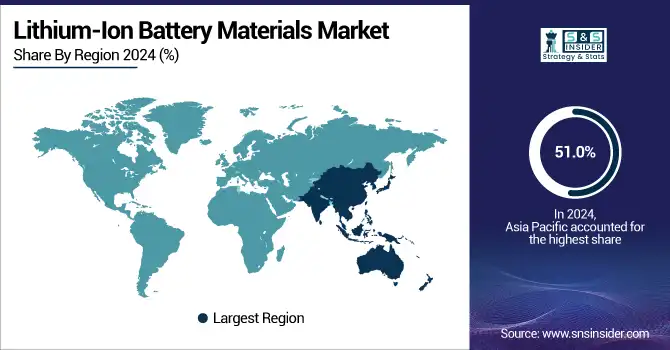

Asia Pacific, with 51.0% market share, leads the lithium-ion battery materials market due to China’s manufacturing capabilities and government policies promoting EV adoption. China’s “Made in China 2025” initiative fosters global dominance in battery production. Japan and South Korea also contribute significantly, with companies, such as LG Chem and Panasonic, leading innovation in battery technologies. The region’s strong government support and vast production facilities make it the central hub for lithium-ion battery raw materials, solidifying Asia Pacific’s leading market position.

North America is the fastest-growing region with a significant CAGR of 25.32% in the lithium-ion battery materials market due to government support for EV adoption and green technologies. The U.S. leads with significant investments in EV manufacturing, battery production, and infrastructure. Companies including Tesla and General Motors are key companies in the market. Additionally, the U.S. government initiatives, such as funding for battery recycling and lithium extraction from Nevada, further boost the market's growth, solidifying North America's pivotal role in the global battery materials supply chain.

Europe holds a 22.3% market share in 2024, driven by the EU’s push for sustainability and EV adoption. Germany, France, and Sweden are leading with significant investments in local battery production and recycling technologies. The EU’s Green Deal and local initiatives, such as Northvolt’s battery manufacturing in Sweden, enhance Europe’s position in the market. Additionally, automakers, such as Volkswagen and BMW are increasing their EV production, further strengthening the region’s prominence in lithium-ion battery materials.

Latin America is witnessing significant growth in the lithium-ion battery materials market due to rich lithium reserves in Chile and Argentina, with Chile holding the largest reserves globally, which further attracts foreign investments in mining and processing. Meanwhile, the Middle East & Africa is experiencing growth driven by electric vehicle adoption and renewable energy projects, with countries, such as South Africa, focusing on lithium extraction and Saudi Arabia promoting electric mobility through Vision 2030. Both regions are positioning themselves as key players in the global battery materials supply chain.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major lithium-ion battery materials market companies include Umicore, BASF SE, Sumitomo Metal Mining Co., Ltd., POSCO Future M, BTR New Material Group Co., Ltd., L&F Co., Ltd., Ecopro BM Co., Ltd., Shanshan Technology, Ganfeng Lithium Co., Ltd., and TODA KOGYO CORP.

Recent Developments:

-

April 2024: Green Li-ion launched North America's first commercial-scale plant for recycling lithium-ion engineered battery materials, supporting the growing demand for sustainable battery materials in electric vehicles and energy storage.

-

November 2023: Toshiba made advancements in high-capacity lithium-ion batteries aimed at improving electric vehicle performance by reducing charging times and extending battery life, contributing to the growth of the EV market.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 42.67 billion |

| Market Size by 2032 | USD 235.24 billion |

| CAGR | CAGR of 23.79% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Material (Anode Materials, Cathode Materials, Electrolyte Materials, Others) •By Battery Type (Lithium Nickel Manganese Cobalt, Lithium Iron Phosphate, Lithium Manganese Oxide, Lithium Nickel Cobalt Aluminum Oxide, Lithium Cobalt Oxide, Others) •By Application (Portable Devices, Electric Vehicles, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Umicore, BASF SE, Sumitomo Metal Mining Co., Ltd., POSCO Future M,BTR New Material Group Co., Ltd., L&F Co., Ltd., Ecopro BM Co., Ltd., Shanshan Technology, Ganfeng Lithium Co., Ltd., TODA KOGYO CORP. |