Pentanediamine Market Report Scope & Overview:

Get E-PDF Sample Report on Pentanediamine Market - Request Sample Report

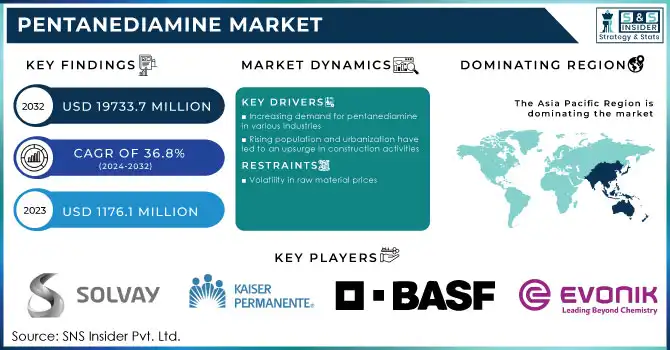

The Pentanediamine Market Size was valued at USD 1,176.1 Million in 2023 and is expected to reach USD 19,725.5 Million by 2032, growing at a CAGR of 36.8% over the forecast period of 2024-2032.

The Pentanediamine Market is witnessing significant growth, driven by its expanding applications in nylon production, coatings, and adhesives. Understanding the logistics and distribution channels is crucial, as regional supply chain efficiency directly impacts market competitiveness. The report provides an in-depth raw material analysis, highlighting sourcing trends and cost fluctuations that shape production economics. With rising demand, investment opportunities for new entrants are emerging, particularly in bio-based alternatives and sustainable manufacturing. A detailed cost-benefit analysis of pentanediamine versus alternative chemicals offers insights into its competitive positioning in diverse applications. Moreover, leading manufacturers are adopting sustainability initiatives, integrating eco-friendly production processes and regulatory compliance to align with global environmental goals. This comprehensive market report delves into these critical aspects, equipping stakeholders with valuable intelligence to navigate the evolving landscape of the Pentanediamine Market.

Market Dynamics

Drivers

-

Growing Investment in High-Purity Pentanediamine for Advanced Pharmaceutical and Biomedical Applications Expands Market Scope

The pharmaceutical and biomedical industries are increasingly leveraging high-purity pentanediamine for specialized applications, including drug synthesis, biomedical coatings, and controlled drug release systems. Pentanediamine serves as a critical building block in the production of biocompatible polymers, enhancing the stability and efficiency of drug formulations. With the rise of precision medicine and advanced drug delivery technologies, demand for high-quality pentanediamine derivatives is surging. Regulatory approval for novel biomedical coatings and implant materials further strengthens the market’s expansion into healthcare. Additionally, pentanediamine-based compounds are gaining traction in antimicrobial coatings used in medical devices, reducing hospital-acquired infections and improving patient safety. The rising investment in pharmaceutical-grade pentanediamine production is fostering innovation in formulation chemistry, allowing for new applications in controlled-release drugs and bioactive materials. As research advances, pentanediamine’s role in next-generation pharmaceuticals and biomaterials will solidify its importance in the healthcare industry, driving sustained market growth.

Restraints

-

High Production Costs and Limited Availability of Raw Materials Restrict Large-Scale Commercialization of Pentanediamine

Despite its growing demand, pentanediamine production faces challenges due to high manufacturing costs and limited raw material availability. The extraction and purification of bio-based pentanediamine involve complex processes, increasing the overall cost of production. The dependence on specific feedstocks, such as plant-derived diamines, leads to supply chain fluctuations and cost volatility. Furthermore, synthetic pentanediamine production is constrained by strict environmental regulations governing petrochemical-based derivatives. These factors create pricing pressures, making pentanediamine less competitive against lower-cost alternatives. Limited large-scale production infrastructure further restricts market expansion, with manufacturers facing capital-intensive investments to scale up operations. The lack of established supply networks and regional production hubs results in a fragmented market structure, leading to inconsistent supply and pricing variations. Unless significant cost-reduction strategies and raw material innovations are implemented, the large-scale commercialization of pentanediamine will remain restricted.

Opportunities

-

Expanding Research and Development in Bio-Based Pentanediamine Creates New Growth Avenues for Sustainable Material Innovations

The increasing shift toward bio-based chemicals has opened new research and development opportunities for the pentanediamine market. Leading manufacturers and research institutions are focusing on cost-effective and scalable production of bio-derived pentanediamine using innovative biochemical pathways. Advances in biotechnology, enzymatic conversion, and fermentation processes have the potential to reduce production costs while improving product purity and performance. Additionally, growing investments in bioengineering and sustainable feedstock cultivation are driving innovation in renewable pentanediamine sources. As industries seek green alternatives to traditional petrochemicals, bio-based pentanediamine is emerging as a promising solution for sustainable polymers, adhesives, and coatings. Companies investing in biorefinery technologies and bio-catalytic processes stand to gain a competitive edge, tapping into the fast-growing eco-friendly materials market.

Challenge

-

Complex Supply Chain and Logistics Constraints Affecting Global Distribution and Cost Efficiency of Pentanediamine

The pentanediamine market faces significant supply chain challenges, particularly due to logistics constraints, raw material sourcing limitations, and fluctuating transportation costs. As pentanediamine production is concentrated in specific regions, global distribution requires efficient supply chain management to maintain cost efficiency. Limited availability of domestic production units in key consuming markets results in high import dependency, increasing logistical complexities. Additionally, raw material procurement challenges related to agricultural and petrochemical feedstocks introduce supply disruptions. Rising freight costs, regulatory trade barriers, and geopolitical factors further affect market stability and pricing. Addressing these supply chain issues requires strategic regional production expansions, investment in resilient logistics infrastructure, and diversified raw material sourcing to ensure a stable and cost-effective supply network.

Segmental Analysis

By Type

Synthetic pentanediamine dominated the market in 2023 with a 62.5% market share due to its well-established production infrastructure, cost efficiency, and high-performance characteristics in industrial applications. Synthetic pentanediamine is widely used in nylon production, coatings, and adhesives, where consistency and scalability are critical. The dominance of synthetic pentanediamine is further reinforced by its widespread availability and cost-effectiveness, making it the preferred choice for manufacturers. According to the American Chemistry Council (ACC), synthetic-derived chemical intermediates continue to lead industrial applications due to their proven performance reliability and stable supply chains. Additionally, despite the rising focus on bio-based alternatives, government policies and industry investments still heavily favor synthetic production due to its ability to meet bulk demand across multiple sectors. Major chemical companies such as BASF and Toray Industries have been investing in synthetic pentanediamine production, further strengthening its market dominance.

By Application

Nylon production (polyamides) dominated the pentanediamine market in 2023 with a 45.6% market share as it remains the primary application for pentanediamine, particularly in industries such as automotive, textiles, and engineering plastics. Pentanediamine is a crucial precursor in manufacturing high-performance polyamide materials, which offer excellent mechanical strength, heat resistance, and chemical stability. The increasing demand for lightweight materials in automotive manufacturing, as reported by the European Automobile Manufacturers’ Association (ACEA), has driven significant growth in nylon-based composites, further boosting pentanediamine demand. Additionally, companies such as Evonik and Arkema have expanded their polyamide production facilities, reinforcing the dominance of this segment. With continuous innovations in high-performance polymers and rising global production capacities, the nylon production segment remains the most significant contributor to pentanediamine consumption.

By End-Use Industry

The automotive industry dominated the pentanediamine market in 2023 with a 32.8% market share as manufacturers increasingly rely on high-performance polyamides for lightweight vehicle components. The growing demand for fuel-efficient and electric vehicles (EVs) has led to a surge in polyamide-based materials, where pentanediamine plays a vital role. According to the International Energy Agency (IEA), the EV market saw record growth in 2023, prompting automakers to adopt lightweight materials to improve battery efficiency and vehicle performance. Major automotive manufacturers such as BMW, Tesla, and Toyota are actively incorporating polyamide-based composites into engine components, structural parts, and battery casings, highlighting pentanediamine’s crucial role in vehicle manufacturing. Additionally, government regulations focusing on reducing carbon emissions and improving fuel efficiency have accelerated the demand for lightweight and durable materials, further cementing the automotive sector’s dominance in the pentanediamine market.

Regional Analysis

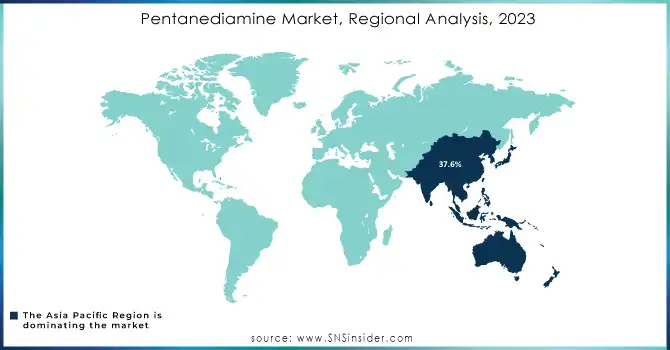

Asia Pacific dominated the pentanediamine market in 2023 with the largest market share of around 38.5%, primarily due to its well-established chemical manufacturing infrastructure, increasing demand for polyamides, and rapid industrialization. China, as the global leader in nylon production and polymer synthesis, played a crucial role in this dominance. According to the China Petroleum and Chemical Industry Federation (CPCIF), China's chemical industry experienced a significant annual growth rate in 2023, with expanding applications of pentanediamine in resins, coatings, and adhesives. Additionally, Japan and South Korea contributed significantly due to their advancements in high-performance materials for automotive and electronics sectors, where pentanediamine-based polyamides are widely used. India also saw increased demand from the textile and coatings industries, supported by rising investments in specialty chemicals. Southeast Asian countries, including Thailand and Vietnam, emerged as attractive manufacturing destinations due to lower production costs and increasing foreign investments in the polymer and adhesives sectors.

Additionally, Asia Pacific is also the fastest-growing region in the pentanediamine market during the forecast period, with a substantial growth rate, fueled by rising demand for sustainable materials, increasing R&D investments, and expanding end-use industries such as automotive, textiles, and construction. China is leading this growth with aggressive expansions in bio-based polymer production, aligning with its carbon neutrality targets for 2060, as per the National Development and Reform Commission (NDRC). Japan, with its focus on high-performance materials, is witnessing strong demand for pentanediamine-based resins in electronics and automotive applications. Meanwhile, South Korea’s major chemical manufacturers, such as LG Chem and SK Innovation, are expanding their production capacities to cater to the growing demand for advanced coatings and adhesives. Additionally, Southeast Asian countries, particularly Thailand and Indonesia, are attracting significant investments in the polymer sector, driven by favorable trade policies and expanding industrial bases, further accelerating regional growth.

Need Any Customization Research On Pentanediamine Market - Inquiry Now

Key Players

-

Cathay Biotech Inc.

-

Kaiser Bio

-

Shandong Siqiang Chemical Group

-

Hefei TNJ Chemical Industry Co., Ltd.

-

Shanghai Deborn Co., Ltd.

-

Zhejiang Boadge Chemical Co., Ltd.

-

Shandong Runyu Chemical Co., Ltd.

-

Hunan Huateng Pharmaceutical Co., Ltd.

-

Xiamen Hisunny Chemical Co., Ltd.

-

Nanjing Chemical Material Corp.

-

Ningxia Yipin Biotechnology Co., Ltd.

-

Shandong Chuangyue Chemical Co., Ltd.

-

Zhejiang Eppen Biotech

-

Hubei Hongxin Chemical Co., Ltd.

-

Shandong Minji Chemical Co., Ltd.

-

Xingfa Chemicals Group

-

Yantai Yitian Biotechnology Co., Ltd.

-

Anhui Jin’ao Chemical Co., Ltd.

-

Changzhou Jintan Hengxin Chemical Co., Ltd.

-

Tianjin Zhongxin Chemtech Co., Ltd.

Recent Developments

-

April 2023: Solvay announced its collaboration with Ginkgo Bioworks to develop sustainable biopolymers, specialty chemicals, and materials. These innovations can be utilized across various industries, ranging from home and personal care to agriculture and food production.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1,176.1 Million |

| Market Size by 2032 | USD 19,725.5 Million |

| CAGR | CAGR of 36.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Synthetic, Bio-based) •By Application (Nylon Production (Polyamides), Coatings & Adhesives, Resins & Polymers, Pharmaceuticals, Agrochemicals, Others) •By End-Use Industry (Automotive, Textile, Construction, Chemical, Healthcare, Agriculture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cathay Biotech Inc., Kaiser Bio, Shandong Siqiang Chemical Group, Hefei TNJ Chemical Industry Co., Ltd., Shanghai Deborn Co., Ltd., Zhejiang Boadge Chemical Co., Ltd., Shandong Runyu Chemical Co., Ltd., Hunan Huateng Pharmaceutical Co., Ltd., Xiamen Hisunny Chemical Co., Ltd., Nanjing Chemical Material Corp. and other key players |