Oilseeds Market Report Scope & Overview:

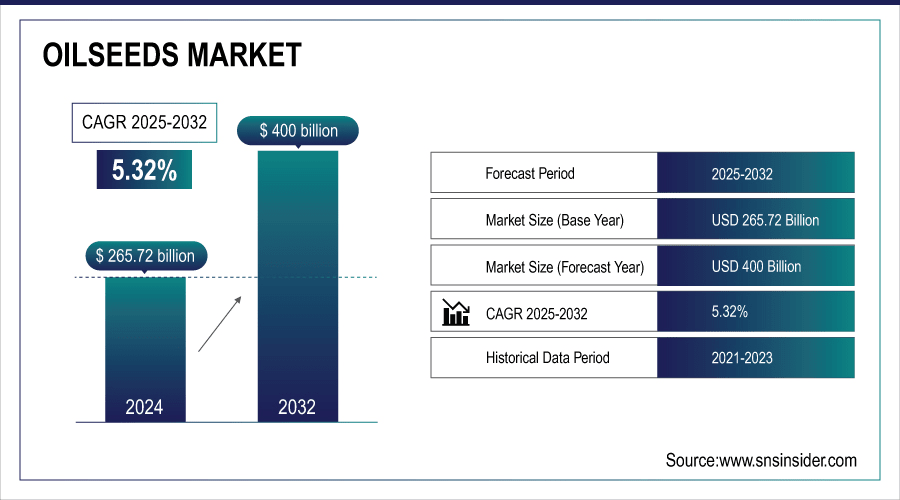

The Oilseeds Market size was valued at USD 265.72 Billion in 2024 and is projected to reach USD 400 Billion by 2032, growing at a CAGR of 5.32% during 2025-2032.

The global market includes detailed insights into trends, drivers, restraints, opportunities, and segment analysis across type, application, product, and end-user. Increasing demand for edible oils, rising health consciousness, and expanding industrial applications are driving growth. Innovations in processing, enhanced distribution networks, and growing consumer awareness of nutritional benefits are expected to further support market expansion, ensuring steady growth throughout the forecast period.

-

Over 50% of households worldwide have started using cold-pressed oils for cooking due to health benefits.

-

Around 40% of edible oils produced globally are now used in processed foods and snacks.

To Get More Information On Oilseeds Market - Request Free Sample Report

Oilseeds Market Trends:

-

Rising global consumption of edible oils is driven by changing dietary habits, urbanization, and population growth.

-

Consumers are increasingly preferring plant-based oils for cooking, food processing, and industrial applications.

-

The food processing industry’s reliance on vegetable oils for snacks, baked goods, and packaged foods strengthens market demand.

-

Health-conscious consumers are shifting toward healthier, low-trans-fat, and organic oil alternatives.

-

Oilseeds are being increasingly adopted for their nutritional benefits, including high protein, fiber, and essential fatty acids.

-

Functional foods and fortified oilseed-derived products are gaining traction, creating new growth opportunities for manufacturers globally.

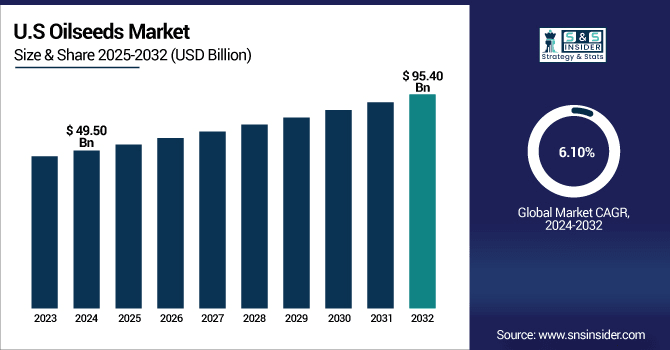

The U.S. Oilseeds Market size was valued at USD 49.50 Billion in 2024 and is projected to reach USD 95.40 Billion by 2032, growing at a CAGR of 6.10% during 2025-2032.

The U.S. market growth is driven by rising domestic consumption of edible oils, expanding livestock feed production, and government policies promoting sustainable agriculture. Increasing awareness of plant-based nutrition and health benefits further fuels demand. Technological advancements in cultivation and processing are improving productivity and efficiency, enabling manufacturers to serve both domestic and export markets effectively.

Oilseeds Market Growth Drivers:

-

Increasing Global Demand for Edible Oils Is Driving Oilseeds Market Expansion Across Various Regions and Applications

The rising global consumption of edible oils due to changing dietary habits, population growth, and urbanization is significantly boosting the oilseeds market. Consumers are increasingly preferring plant-based oils for cooking and food processing, resulting in higher demand for raw oilseeds like soybean, sunflower, and rapeseed. The food processing industry’s reliance on vegetable oils for manufacturing snacks, baked goods, and packaged foods further strengthens market growth. Additionally, health-conscious consumers are shifting towards healthier oil alternatives, which is prompting manufacturers to expand production and distribution, driving sustained market growth globally.

-

Over 55% of households have increased their weekly use of plant-based oils in cooking over the past three years.

-

Around 45% of packaged snacks and baked goods now contain vegetable oils derived from soybean, sunflower, or rapeseed.

Oilseeds Market Restraints:

-

Price Volatility and Dependence on Climatic Conditions Could Restrain Oilseeds Market Growth Globally

Fluctuating global oilseed prices caused by supply-demand imbalances, geopolitical tensions, and trade restrictions can adversely impact market growth. Additionally, oilseed cultivation is highly sensitive to climatic conditions, such as rainfall, temperature, and soil fertility, leading to production uncertainty. Natural disasters like droughts or floods may cause significant yield losses, affecting both domestic and international supply chains. Such unpredictability increases operational costs for farmers and manufacturers. These challenges, coupled with rising input costs for fertilizers and labor, could restrain the expansion of the global oilseeds market during the forecast period.

Oilseeds Market Opportunities:

-

Rising Consumer Awareness of Health Benefits Offers Significant Growth Potential for Oilseeds Market Globally

Increasing awareness of the health benefits of plant-based oils and proteins is opening new avenues for the oilseeds market. Consumers are adopting oilseeds for their nutritional value, including high protein, fiber, and essential fatty acids. This trend is promoting oilseed-derived products in food, snacks, and dietary supplements. Functional foods and fortified oils using oilseed extracts are gaining traction, boosting demand. Manufacturers are innovating to provide healthier, low-trans-fat, and organic options, allowing them to cater to health-conscious customers. This consumer-driven opportunity supports sustained growth across global markets during the forecast period.

-

Over 60% of health-conscious consumers globally have included sunflower or flaxseed oils in their daily diets.

-

Over 60% of health-conscious consumers globally have included sunflower or flaxseed oils in their daily diets.

Oilseeds Market Segment Analysis:

-

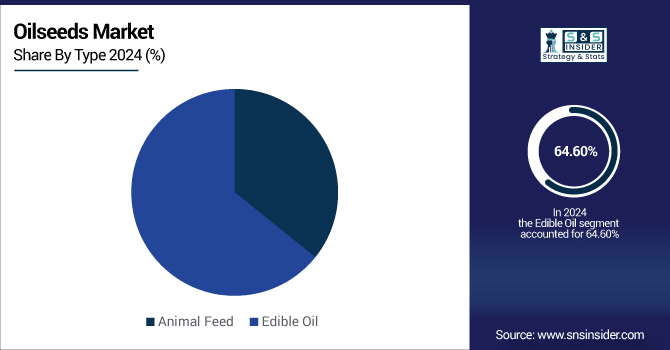

By Type, Edible Oil held the largest share of around 64.60% in 2024, and is projected to be the fastest-growing segment with a CAGR of 5.60%.

-

By Application, Vegetable Oil segment dominated the market with approximately 68% share in 2024, and is expected to register the highest growth with a CAGR of 5.60%.

-

By Product, Sunflower accounted for the leading share of nearly 28.70% in 2024, whereas Rapeseed segment is anticipated to be the fastest-growing segment with a CAGR of 5.50%.

-

By End-User, Household or Residential Area segment led the market with about 52.10% share in 2024, and is forecasted to grow the fastest at a CAGR of 5.80%.

By Type, Edible Oil Leads Market and Registers Fastest Growth

Edible Oil segment dominated the Oilseeds Market with the highest revenue share of about 64.60% in 2024 due to widespread use in cooking, food processing, and industrial applications. Rising health consciousness and preference for plant-based oils further support demand. Cargill, Incorporated has been expanding its edible oil portfolio to meet growing consumer needs. The Edible Oil segment is expected to grow at the fastest CAGR of 5.60% from 2025-2032 due to increasing demand for cold-pressed, organic, and fortified oils globally.

By Application, Vegetable Oil Segment Dominate and Shows Rapid Growth

Vegetable Oil segment dominated the Oilseeds Market with the highest revenue share of about 68% in 2024 due to high household consumption and extensive use in processed foods. Consumers are increasingly choosing oils for health and nutrition benefits. Archer Daniels Midland Company (ADM) has launched innovative vegetable oil products to cater to these evolving preferences. The Vegetable Oil segment is expected to grow at the fastest CAGR of 7.50% from 2025-2032, driven by rising demand for heart-healthy and plant-based oils in cooking and food manufacturing.

By Product, Sunflower Segment Lead While Rapeseed Segment Registers Fastest Growth

Sunflower segment dominated the Oilseeds Market with the highest revenue share of about 28.70% in 2024 due to its high oil yield, nutritional benefits, and versatility for cooking and industrial use. Bunge Limited has been actively investing in sunflower oil production to capitalize on this demand. Rapeseed segment is expected to grow at the fastest CAGR of 5.50% from 2025-2032 due to its increasing use in biodiesel, functional foods, and health-conscious cooking, supported by technological improvements in cultivation and extraction methods.

By End-User, Household or Residential Area Segment Lead and Grows the Fastest

Household or Residential Area segment dominated the Oilseeds Market with the highest revenue share of about 52.10% in 2024 due to high direct consumer demand for cooking oils and snacks. Convenience and awareness of nutritional benefits further support consumption. Conagra Brands, Inc. has expanded household-friendly packaging and premium oil products to meet this trend. The Household segment is expected to grow at the fastest CAGR of 5.80% from 2025-2032 due to increasing urbanization, disposable income, and preference for organic, fortified, and cold-pressed oils in homes.

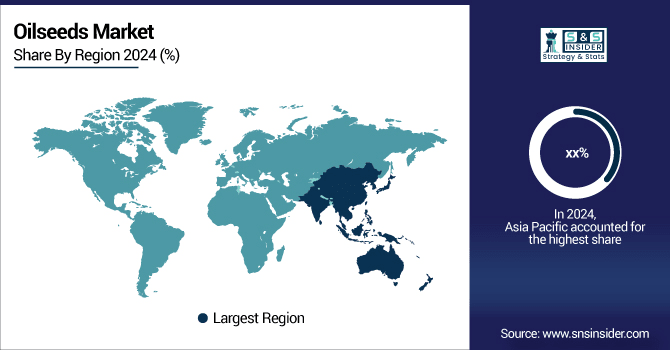

Asia Pacific Oilseeds Market Insights:

The Asia Pacific region is expected to grow at the fastest CAGR of 6.20% from 2025-2032, driven by rising population, urbanization, increasing disposable income, and growing health awareness. Expansion of oilseed cultivation, technological adoption, and government initiatives in countries like India and China are accelerating market growth. Companies are investing in modern processing and distribution networks to meet rising demand across this region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Oilseeds Market Insights:

North America dominated the Oilseeds Market in 2024 due to advanced cultivation techniques, high-quality seed availability, and strong processing and distribution infrastructure. High consumption of edible oils and a robust food processing industry further support its leading position. Cargill, Incorporated has been a key player in supplying high-quality oilseeds and innovative oil products, reinforcing North America’s dominance in the global market.

Europe Oilseeds Market Insights:

Europe’s oilseeds market is driven by rising demand for healthy and plant-based oils, supported by strong food processing and industrial applications. Increasing consumer preference for organic and fortified oils, along with government initiatives promoting sustainable agriculture, enhances production and supply. Key players are investing in advanced processing technologies and distribution networks, ensuring consistent availability and supporting steady market growth across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Oilseeds Market Insights:

The Middle East & Africa and Latin America oilseeds markets are growing due to rising demand for edible oils, expanding food processing industries, and increasing health awareness. Key countries such as UAE, Saudi Arabia, Brazil, and Argentina are boosting production through advanced cultivation and processing techniques, supporting steady market growth across both regions.

Competitive Landscape Oilseeds Market:

Archer Daniels Midland Company (ADM) is a global leader in agricultural processing and food ingredients, specializing in oilseed crushing, processing, and distribution. Its soybean oil is widely used in cooking and food processing due to its nutritional value, while sunflower oil is valued for its high-quality fatty acids and versatility in both food and industrial applications. ADM focuses on sustainability, innovation, and providing high-quality edible oils to meet global consumer and industrial demand.

-

In August 2025, ADM announced the closure of its Bushnell, Illinois plant in August 2025 as part of efforts to streamline its soy protein production network, aiming to reduce expenses by $500 million to $700 million over three to five years.

Cargill, Incorporated is a multinational agribusiness firm engaged in oilseed processing, trading, and manufacturing. Its canola oil is recognized for heart-healthy properties and widespread culinary use, while rapeseed oil serves both food and industrial applications due to its high omega-3 content. Cargill emphasizes sustainable sourcing, technological innovation, and meeting rising consumer demand for plant-based oils, maintaining a strong global presence in the oilseeds industry.

-

In November 2024, Cargill experienced a significant drop in canola prices, with premiums falling over $50 per metric ton. This decline was attributed to technical sell-offs and funds exiting long positions.

Bunge Limited is a global agribusiness and food company focused on oilseed production, refining, and trading. Its palm oil is widely used in cooking, bakery products, and processed foods, while soybean meal serves as a key protein source for animal feed and industrial applications. Bunge prioritizes supply chain efficiency, sustainable farming practices, and delivering high-quality, versatile oilseed products to international food and industrial markets.

-

In December 2024, Bunge sourced 97% of its palm oil volumes from suppliers with robust NDPE (No Deforestation, No Peat, No Exploitation) commitments, aligning with sustainability goals.

Oilseeds Market Key Players:

Some of the Oilseeds Market Companies are:

-

Archer Daniels Midland Company (ADM)

-

Bunge Limited

-

Cargill, Incorporated

-

Louis Dreyfus Company (LDC)

-

Wilmar International Limited

-

Olam International

-

COFCO Corporation

-

AG Processing Inc. (AGP)

-

Noble Group

-

Richardson International Limited

-

Viterra (formerly Glencore Agriculture)

-

Marubeni Corporation

-

Amaggi Group

-

SLC Agrícola

-

Kerry Group

-

Euralis Semences

-

KWS SAAT SE & Co. KGaA

-

Syngenta Group

-

Bayer CropScience AG

-

Corteva Agriscience

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 265.72 Billion |

| Market Size by 2032 | USD 400 Billion |

| CAGR | CAGR of 5.32% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Animal Feed and Edible Oil) • By Application (Oilseed Meal and Vegetable Oil) • By Product (Sunflower, Soybean, Peanut, Cottonseed, Rapeseed and Others) • By End-User (Household or Residential Area, Commercial or Corporate sector and Automobiles) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Archer Daniels Midland Company (ADM), Bunge Limited, Cargill, Incorporated, Louis Dreyfus Company (LDC), Wilmar International Limited, Olam International, COFCO Corporation, AG Processing Inc. (AGP), Noble Group, Richardson International Limited, Viterra (formerly Glencore Agriculture), Marubeni Corporation, Amaggi Group, SLC Agrícola, Kerry Group, Euralis Semences, KWS SAAT SE & Co. KGaA, Syngenta Group, Bayer CropScience AG and Corteva Agriscience. |