Nuts Market Report Scope & Overview:

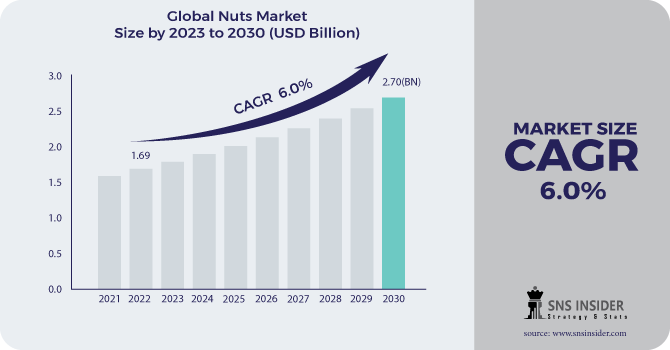

Nuts Market Size was valued at USD 1.69 billion in 2022 and is expected to reach USD 2.70 billion by 2030, and grow at a CAGR of 6% over the forecast period 2023-2030.

Nuts are sold as single assortments and as blends. The nuts most generally sold as single assortments are peanuts, almonds, and cashews. Similar nuts are likewise broadly utilized in blends, as are walnuts, Brazil nuts, filberts (otherwise called hazelnuts), and macadamia nuts.

Peanuts, which represent a significant part of the nut market, are accessible in numerous assortments. These incorporate dry cooked and honey broiled, as well as global seasoned adaptations like wasabi or stew peanuts. Almonds are now and then enhanced with smoke seasoning or an appetizing enhancement. It has been less normal to find seasoned assortments of different nuts, yet the special cases for this standard are expanding in number.

Numerous nutritionists accept nuts are sound. Nuts have no cholesterol, they contain monounsaturated or potentially polyunsaturated fats, are plentiful in fiber, and contain vitamin E. Eating nuts, in this way, may assist with forestalling coronary illness. Different advantages of nut utilization include:

-

Hazelnuts help the resistant framework and battle weariness,

-

Peanuts are suggested for memory and assist with lessening hypertension,

-

Almonds are a decent wellspring of calcium to battle osteoporosis,

-

Walnuts help bone strength and assist with keeping nerves and muscles solid, and

-

Macadamias are helpful to the sensory system and skin.

Market Dynamics:

Driving Factors:

-

Longer Shelf-life of edible nuts.

-

Rising well-being mindfulness prompted developing dietary examples.

Restraining Factors:

-

Excessive cost Of Processing Techniques.

-

Accessibility and fluctuating expenses for nuts as a natural substance.

Opportunities:

-

Growing acceptance of a healthy lifestyle.

-

Growing application range for nuts and subsidiaries.

Challenges:

-

Neglecting to satisfy the quality guidelines of GFSI.

-

Inventory network the board complexities and nature of nut items.

Impact of Covid-19:

The nuts and nutmeals market has not been quite impacted by the COVID-19 pandemic as individuals changed their needs and put more into purchasing solid and resistance-supporting food items. The astoundingly expanded deals of nuts and nutmeals items were seen through internet-based stores during the COVID-19 period, which supported the interest in the market examined. A great many people liked to purchase bigger amounts all at once, dreading running out of items. Consequently, enormous bin sizes stayed a critical justification for the food of nuts and nutmeals across all districts. Further, more players ventured into the scene. For instance, against nibble, a games sustenance firm, sent off another line of sound tidbit blends in March 2020.

Market Estimation:

By application, the oats and lunch rooms portion is projected to encounter the quickest development in the market during the figure time frame

There is a huge interest in the utilization of cereals and cafés given their capacity to meet dietary necessities, for example, low-sugar, low-fat and plant-based. The expansion in optional ways of managing money, which has been essentially visible in a couple of years has contributed to the development of the snacks industry, thus energizing the lunchrooms market.

By type, the nut glue portion is projected to represent the biggest offer in the market during the gauge time frame.

Nut glue is generally utilized as a nut spread on bread, cakes, and rolls. The advancement of innovation and expansion in purchaser attention to the dietary properties have prompted the improvement of different nut items. Properties like the better taste, surface, variety, high protein, clean name, and maintainability, have brought about the development of plant-based food items. Going about as a plant-based protein source, nut and almond glue have numerous medical advantages.

Key Market Segmentation:

Based on Type:

-

Nut butter

-

Nut pastes/Marzipan pastes/Persipan pastes

-

Nut fillings with cocoa

-

Nut fillings without cocoa

-

Caramelized nuts

-

Nut flours

Based on nut type:

-

Almonds

-

Hazelnuts

-

Walnuts

-

Cashews

-

Peanuts

-

Pistachios

-

Macadamias

-

Pecans

-

Pine nuts

-

Brazil nuts

Based on the application:

-

B2B Industrial food manufacturers

-

Chocolate confectionery products

-

Bakery products

-

Ice cream and frozen desserts

-

Cereals & snack bars

-

Beverages

-

Savory products

-

-

B2B Foodservice & bakeries

-

Bakery shops

-

Foodservices

-

.png)

Regional Analysis:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

The critical expansion in the pace of heftiness rate in areas like the US has set out development open doors for dinner substitution refreshments, better nibble things, and sustenance bars. Hence, individuals are settling on a better way of life, with more tendency toward wellbeing by helping food items. The expansion in the utilization of palatable nuts as a healthful item and as a fixing in various food sections, like grains, tidbits, treats, and candy parlor items, has helped in setting out development open doors for nut items producers.

Key Players:

Diamond Foods, Inc., Archer Daniels Midland Company, Olam International, Blue Diamond Growers, Mariani Nut Company, Select Harvests, GNC Global Nut Company AG, Waterford Nut Company, Farm Breeze International LLC, and others.

Olam International-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 1.69 Billion |

| Market Size by 2030 | US$ 2.70 Billion |

| CAGR | CAGR 6% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Category (Conventional, Organic) • by Type (Almonds, Brazil Nuts, Cashews, Chestnuts, Hazelnuts, Hickory Nuts, Macadamia Nuts, Pecans, Pine Nuts, Pistachios, Walnuts, Peanuts, and Others) • by Coating Type (Coated, Uncoated) • by Form (Whole, Diced/Cut, Roasted, Granular), by End-User (Household/Retail, Food Service Sector, Café, Catering, Others) • by Distribution Channel (Store-Based Retailers, Non-Store Retailers) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Diamond Foods, Inc., Archer Daniels Midland Company, Olam International, Blue Diamond Growers, Mariani Nut Company, Select Harvests, GNC Global Nut Company AG, Waterford Nut Company, Farm Breeze International LLC, and others. |

| Key Drivers | •Longer Shelf-life of edible nuts. •Rising well-being mindfulness prompted developing dietary examples. |

| Market Challenges: | •Neglecting to satisfy the quality guidelines of GFSI. •Inventory network the board complexities and nature of nut items. |