Bitumen Market Key Insights:

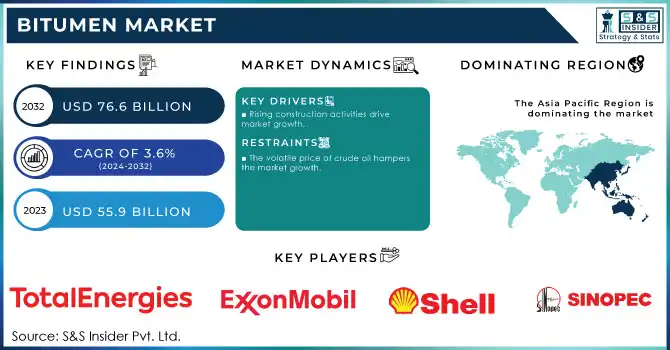

The Bitumen Market Size was valued at USD 55.9 Billion in 2023. It is expected to grow to USD 76.6 Billion by 2032 and grow at a CAGR of 3.6% over the forecast period of 2024-2032.

Get More Information on Bitumen Market - Request Sample Report

An increasing emphasis on environmental sustainability is causing a major transition towards bitumen production strategies. And polymer-modified bitumen (PMB) could be a preferred option thanks to its high durability, high flexibility, and great performance in terms of climate adaptability. PMB contains styrene-butadiene-styrene (SBS) and other polymers helping the product to resist deformation, cracking, and aging, allowing these asphalt pavements to be used in high-vigorous roads and harsh climates. Furthermore, this increased lifespan lessens road repairs and maintenance, reducing the overall road construction carbon footprint.

Recently, governments and industry stakeholders have adopted sustainable practices, such as warm mix asphalt technologies which require less energy and release fewer greenhouse gases at the time of production. Based on global sustainability objectives and stringent environment-related regulations, the demand for modified bitumen solutions in infrastructure and construction industries is decently increasing, which can be correlated to this trend.

In 2023, Shell introduced a new range of eco-friendly PMB products designed for high-traffic roads and extreme weather conditions, aligning with global sustainability goals. Similarly, Oil India Limited has advanced its production capabilities by incorporating cutting-edge technologies to manufacture high-performance PMB materials compliant with international standards.

Innovative processes to recycle bitumen are redefining how roads are built by minimizing the environmental footprint of its asphalt while maximizing the sustainable potential of our infrastructure. All these innovations include Warm Mix Asphalt (WMA), an important technology which decreases the production temperature of asphalt mixes, resulting in less energy consumption and greenhouse gas emissions. WMA consists of the same materials as conventional hot mix asphalt, but with either an additive or a special method of production which achieves the desired performance state at 30–40°C lower than conventional temperatures; subsequently, it is a more sustainable option. This not only reduce the amount of fuel used for producing but also increases the safety as the workmen will be less exposed to the heating and fumes.

Asphalt production from RAP saved 26 million barrels of asphalt binder used in 2021 and reduced the need for 89 million tons of virgin aggregate. In 2021, a total of 94.6 million tons of RAP were used. Such practices ensure cost saving and resource conservation as well. Use of asphalt materials such as RAP and reclaimed asphalt shingles (RAS) are also recycled and this has helped the industry save more than $3.5 billion and save 62 million cubic yards of landfill space.

Bitumen Market Dynamics

Drivers

-

Rising construction activities drive market growth.

The growth of the bitumen market is mainly attributed to the increasing construction activities. With the pace of urbanization ever-increasing around the world, especially in developing economies, the appetite for infrastructure development across roads, highways, and bridges is stronger than ever before. This construction boom, was mainly driven by the state investment in infrastructure and the involvement of private capital in real estate projects. Large-scale infrastructure projects focused on improving transportation networks and increasing urbanization in the case of the Indian and Chinese regions are creating significant top-down demand for bitumen, particularly for road paving.

The recent passing of infrastructure bills, such as the Infrastructure Investment and Jobs Act (2021), has, by way of magnifying the current construction activities, expanded the demand for bitumen of premium quality in the U.S. This is driven by the fact that construction activities lead to rising consumption of traditional and modified bitumen products for road surfacing and other applications, the growth of the market is directly proportional to the aforementioned factor.

Restraint

-

The volatile price of crude oil hampers the market growth.

the fluctuating prices of crude oil highly restrain the growth of the bitumen market. Being a derivative of crude oil and a byproduct of its refinery, the price of bitumen is closely linked to the price of crude, which means that any change in this dynamic will affect the production cost. If the crude oil prices increase, it raises the price of Bitumen, which ultimately increases the price from the end-users of the construction industry perspective. Such volatility can destabilize long-term infrastructure projects, where bitumen is an integral element used in road construction and maintenance. High oil prices, for example, can incur budget overruns among construction companies, delaying and/or cutting projects down the by-profit size scale. Furthermore, in markets such as emerging markets where infrastructure development is heavily dependent on bitumen, a sudden hike in price also impacts public and private sector budgets stretching them and reducing less demand for bitumen.

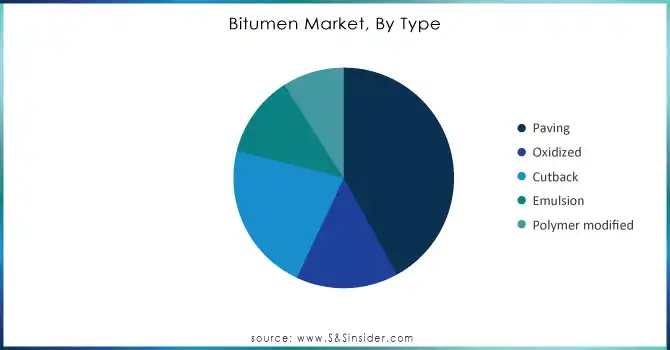

Bitumen Market Segmentation Analysis

By Type

The paving segment held the largest market share around 62% in 2023. The paving segment leads the bitumen market since the demand for bitumen in road construction-related infrastructure development is high. Bitumen is used extensively in asphalt for road surfacing due to its durability, flexibility, and weather resistance, making it suitable for high-traffic roads, highways, and urban roads. The rapidly rising world population is shifting rapidly to cities, and particularly in developing countries, this is leading to significant pressure on roads and transportation solutions. Large-scale infrastructure projects in emerging economies, especially India and China, rely on bitumen for road construction for the paving segment, therefore propelling the demand.

Need Any Customization Research On Bitumen Market- Inquiry Now

By Application

The roadway segment held the largest market share around 42% in 2023. It owing to its essential function in the construction and maintenance of roads, highways, and urban infrastructure. Bitumen is the main ingredient that is used to produce the asphalt needed to make long-lasting road pavement. In recent years, the burgeoning population in urban areas with increasing vehicle traffic and transportation systems has prompted a rising need for quality roads, especially in developing nations. Massive road projects to boost the transportation networks in India, China, and various other regions in the Middle East are a few of the examples that promote the consuming ability of bitumen. Government initiatives like the U.S. Infrastructure Investment and Jobs Act (2021) that provided significant funding for the development and improvement of roads have also supported the demand for bitumen in roadways60.

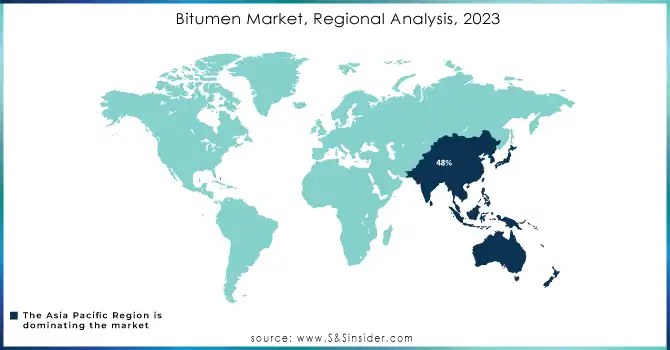

Bitumen Market Regional Overview

Asia Pacific held the largest market share around 48% in 2023. Asia Pacific bitumen market is the largest contributor to the bitumen market owing to the burgeoning rate of industrialization and infrastructure development coupled with the ever-growing construction industry in the region. With the huge investments being made in roadways, highways, and urban infrastructure projects, countries such as China, India, and Japan, quickly consume most of the bitumen produced. In particular, China has invested enormous sums into transportation networks through its Belt and Road Initiative, building enormous road networks through Asia, Europe, and Africa. In India, the same trend could be seen with a slew of road construction projects – both under government infrastructure schemes and private sector.

In addition, the increasing industrial base in the Asia Pacific region, which bolsters bitumen demand for road, airport, and port construction, would further contribute to the growth of this market segmentation. With sustainable infrastructure also becoming a priority for the region, many countries are shifting to the use of modified bitumen and recycled asphalt to build higher durability, eco-friendly roads. This ever-moving combination of swift industrialization, massive infrastructure developments, and government backing makes Asia-Pacific the leader in the global bitumen market owing to its market share far ahead of all other regions.

Key Players in Bitumen Market

-

Sinopec (Fully Refined Bitumen, Semi-Refined Bitumen)

-

Royal Dutch Shell (Asphalt, Modified Bitumen)

-

ExxonMobil (Paving Bitumen, Polymer-Modified Bitumen)

-

TotalEnergies (Industrial Bitumen, Hard Bitumen)

-

BP (Bitumen Emulsion, Cutback Bitumen)

-

Indian Oil Corporation (Oxidized Bitumen, Penetration Grade Bitumen)

-

Chevron (Hot Mix Asphalt, Cold Mix Asphalt)

-

Marathon Petroleum (Rubber-Modified Bitumen, Straight Run Bitumen)

-

Hindustan Petroleum Corporation (Bitumen Emulsion, Performance Graded Bitumen)

-

Reliance Industries (Industrial Bitumen, Road Construction Bitumen)

-

Kraton Polymers (Polymer-Modified Bitumen, SBS Modified Bitumen)

-

Lukoil (Oxidized Bitumen, Bitumen for Roofing)

-

Nynas (Bitumen for Road Construction, Polymer-Modified Bitumen)

-

Valero Energy (High-Performance Bitumen, Bitumen Emulsion)

-

SK Innovation (Asphalt Binder, Asphalt Modifier)

-

Petróleos Mexicanos (Pemex) (Bitumen for Paving, Bitumen for Industrial Use)

-

Suncor Energy (Cutback Bitumen, Emulsified Bitumen)

-

Vitol Group (Oxidized Bitumen, Paving Bitumen)

-

China National Petroleum Corporation (CNPC) (Modified Bitumen, Industrial Bitumen)

-

PetroChina (Straight Run Bitumen, Polymer-Modified Bitumen)

Recent Development:

-

In 2023, Shell launched an innovative bitumen product designed to enhance road durability and reduce environmental impact. The new product, which is part of their low-carbon solutions portfolio, focuses on improving the longevity of roads while lowering carbon emissions during the construction process.

-

In 2023, ExxonMobil expanded its bitumen production capacity with the opening of a new plant in Asia. This move was driven by the increasing demand for high-quality bitumen for road construction, particularly in emerging markets.

-

In 2022, TotalEnergies made a significant investment in the bitumen market by opening a new bitumen production facility in the Middle East. The facility focuses on producing high-performance bitumen products that are in demand for both traditional road surfacing and specialized applications, such as airport runways

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 55.9 Billion |

| Market Size by 2032 | US$ 76.6 Billion |

| CAGR | CAGR of3.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Paving, Oxidized, Cutback, Emulsion, Polymer modified) • By Application (Roadways, Waterproofing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sinopec, Royal Dutch Shell, ExxonMobil, TotalEnergies, BP, Indian Oil Corporation, Chevron, Marathon Petroleum, Hindustan Petroleum Corporation, Reliance Industries, Kraton Polymers, Lukoil, Nynas, Valero Energy, SK Innovation, Petróleos Mexicanos (Pemex), Suncor Energy, Vitol Group, China National Petroleum Corporation (CNPC), PetroChina. and Others |

| Key Drivers | • Rising construction activities drive market growth. |

| Restraints | • The volatile price of crude oil hampers the market growth. |