Process Oil Market Report Scope & Overview:

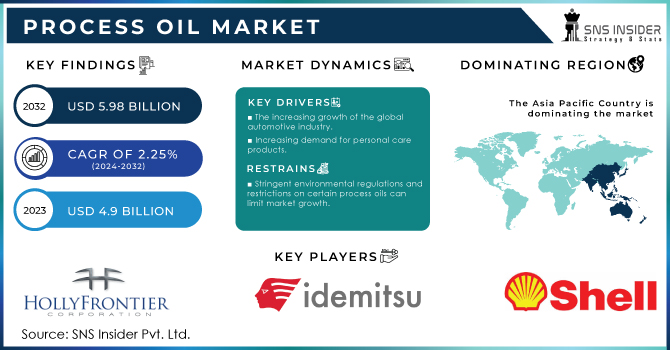

The Process Oil Market Size was valued at USD 5.00 billion in 2024 and is expected to reach USD 5.98 billion by 2032 and grow at a CAGR of 2.24% over the forecast period 2025-2032.

Supply chain dynamics and the regulatory landscape are important for the process oil market, as they define how materials move and establish production standards, respectively. They are now adopting sustainability initiatives to fulfill increasing environmental requirements. The economy is impacted significantly, by the market driving industrial growth, and investment trends fueling innovation. Policy developments are also important since government actions on trade and tariffs can influence the direction of the market. This report covers all the facets to consider, and we provide a detailed market analysis in this report.

Get More Information on Process Oil Market - Request Sample Report

Market Size and Forecast:

-

Market Size in 2024: USD 5.00 Billion

-

Market Size by 2032: USD 5.98 Billion

-

CAGR: 2.24% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Process Oil Market Trends

-

Rising demand for sustainable and bio-based process oils as industries shift toward eco-friendly and low-carbon alternatives.

-

Increasing adoption of treated distillate aromatic extract (TDAE) and mild extraction solvents (MES) due to regulatory restrictions on polycyclic aromatic hydrocarbons (PAHs).

-

Strong demand from the automotive tire and rubber industries, driven by expanding vehicle production and replacement tire markets.

-

Growing use of process oils in personal care, adhesives, sealants, and plastics, expanding beyond traditional rubber applications.

-

Technological advancements in refining processes, enabling production of low-viscosity, high-performance process oils with better stability.

-

Rising consumption of naphthenic process oils in electrical and industrial applications due to their superior solvency and thermal stability.

Process Oil Market Growth Drivers

-

Rising Demand for Process Oils in Automotive and Manufacturing Sectors Fuels Market Growth

The process oil market is primarily driven by the automotive and manufacturing sectors. Process oils are becoming increasingly important to many industries including automotive, rubber, and plastics, due to the growing demand for high-performance lubricants, additives, and processing fluids. Growing demand from end-users for the effective properties of process oils drives market growth, along with the ongoing growth of industries that require process oils, such as tires, coatings, and plastics. Additionally, the automotive industry is crucial since there is a growing prime for lubricants and oils used in the production and maintenance of vehicles for operations as well as longer operating times. These industries are expected to fuel the growth of the process oil market, as the demand for high-grade functional process oil increases, subsequently driving the growth of the market.

Process Oil Market Restraints

-

Fluctuating Raw Material Prices and Supply Chain Disruptions Hinder Process Oil Availability

Fluctuations in raw material prices and supply chain disruptions is one of the restraining factors in the process oil market. The prices of raw materials crucial for process oil production specifically crude oil and petrochemicals are exposed to volatility from numerous factors, including geopolitical tensions, natural calamities, and worldwide supply chain complications. These fluctuations in its availability can create instability for the market, with regards to the supply and also the price of process oils. Supply chain disruptions can also cause delays in production and distribution, resulting in shortages and rising costs. Such intangible factors would derail market confidence and this would delay the development of the process oil industry.

Process Oil Market Opportunities

-

Growing Demand for Bio-Based and Renewable Process Oils Creates New Market Opportunities

Increasing consumer demand for the use of greener products may open up potential growth avenues in the process oil market, due to the possibility of developing both bio-based and renewable oils. Bio-based process oils can prove to be highly competitive with rising consumer preference towards environmentally friendly or renewable alternatives, as they derive from natural resource-based plant oils rather than petroleum-based material. Bio-based process oils have fewer adverse environmental effects and can, therefore, be used by industries to achieve sustainability. Growth by the advancement of green technologies serves as an opportunity for growth with innovations in renewable process oils to satisfy the aspirations of more sustainable industries.

Process Oil Market Challenge

-

Ensuring Consistent Quality Standards Across Global Markets Presents Challenges in Process Oil Production

A challenge for manufacturers is to have the same quality standards for process oils in different parts of the world. Regional differences in production methods, availability of feedstocks, and environmental regulations can result in oil quality variability. Such inconsistencies can impact their performance and reliability, complicating efforts by companies to maintain uniformity over different ranges of products. Quality control becomes more challenging as companies expand into pertinent markets and different regions, and must be mindful of the international standards vs. regional differences. This challenge puts customer satisfaction at risk and poses an obstacle to the process oil market growth.

Process Oil Market Segment Analysis

By Type

The naphthenic segment dominated the process oil market in 2023 and accounted for a market share of approximately 45%. Due to their high performance, naphthenic oils are widely used in lubricants and rubber processing; they are very thermally stable and have lower volatility compared to paraffinic oils, being available for extreme applications. As a case in point, the Rubber Manufacturers Association (RMA) focuses on the importance of utilizing high-quality naphthenic oils in tire manufacturing, as they improve the quality and efficacy of the tires. Moreover, since manufacturers are opting for naphthenic oils over alternatives (such as aromatic oils) which are vulnerable and facing criticism for their health hazards, the government regulations on the use of low-toxicity and environment-friendly products are driving the market.

By Function

In 2023, the Extender Oil segment dominated the process oil market and accounted for approximately 40% market share. Extender oils play an important role in several applications, including rubber and adhesive formulations, where they are used to enhance the properties of end products. Extender oils are essential for rubber compounding because they are used to improve the flexibility and performance of rubber compounds (American Chemical Society (ACS), 2023). Also, the adoption of extender oils is increasing across the globe because of high-performance and environmentally friendly formulations, as well as efforts from manufacturers to comply with regulatory restrictions and limit the incorporation of harmful substances in the products.

By Technology

The Conventional Route dominated the process oil market in 2023 with a market share of approximately 50%. This is because the conventional route uses a well-established infrastructure, production methods, and manufacturing that would minimize costs and maximize efficiency. According to the API, conventional refining processes produce oils that are very good quality and satisfactory to most industries such as the automotive and manufacturing ones. So far, alternate technologies such as gas-to-liquid and bio-based oils have received more interest, but conventional processes are still considered highly reliable and scalable.

By Application

The Rubber Processing segment dominated the process oil market in 2023 with a market share of approximately 35%. The growth in this segment is on account of the increased demand for rubber products in the automotive and construction sectors. According to the International Rubber Study Group, the automobile sector accounts for the most rubber consumed, with very large quantities used in tires as well as other car parts. The demand for premium process oils in rubber manufacturing is strong because it encourages high performance and long use of the final products, leaving the segment with a world-standard grip on the market. The application of rubber processing continues to grow as more industries look to make operations more efficient and sustainable.

Process Oil Market Regional Analysis

Asia Pacific Process Oil Market Insights

The Asia Pacific region dominated the process oil market and accounted for the largest market share as of 2023, approximately 48.6%. This dominance is due to the strong industrial growth and rise in demand for process oils in countries such as China and India. China holds the leading position in process oils consumption as the country has the biggest manufacturing industries, especially, rubber and automotive. In China, which produced over 500 million tires in 2022 according to the China Rubber Industry Association, naphthenic and paraffinic oils are critical for tire production. India has also experienced a second driver, that of demand, as India's nascent automotive sector continues to improve with the Society of Indian Automobile Manufacturers reporting a 15% rise in the total production of vehicles for 2022. Moreover, government initiatives such as "Make in India" aimed at promoting manufacturing are boosting the demand for process oils in versatile applications, further cementing its dominance in the region.

North America Process Oil Market Insights

However, North America is expected to be the fastest-growing region in the process oil market, with a CAGR of 3.8% from 2024-2032. Key sectors such as automotive, rubber processing, and consumer goods are among the key drivers of this growth. American auto manufacturers like Ford and General Motors need premium process oils for tire manufacturing. The U.S. Environmental Protection Agency (EPA) even promoted sustainable oils and helped the rising market to grow. Growth has been further fuelled by Canada’s manufacturing sector, especially oil and gas. Growing demand for process oils in pharmaceuticals, adhesives, and coatings has been one of the trends driving market growth. Rising demand for eco-friendly and compliant production methods among manufacturers is propelling the use of more sustainable process oils and driving the market further in North America. North America is a fast-growing market due to industrial demand and sustainability initiatives.

Europe Process Oil Market Insights

Europe holds a significant share in the Process Oil Market in 2024, supported by strong demand from the automotive, tire, and industrial manufacturing sectors. Countries such as Germany, the U.K., and France are leading adopters, with refineries and specialty chemical producers focusing on sustainable and low-PAH process oils. Stringent EU environmental regulations, combined with advancements in rubber compounding and green tire production, are driving demand, while the growing electric vehicle industry is expected to further boost consumption.

Latin America (LATAM) Process Oil Market Insights

The LATAM Process Oil Market is steadily expanding, driven by the growth of the automotive aftermarket, construction activities, and the demand for rubber-based products. Brazil, Mexico, and Argentina are key contributors, with rising use of process oils in tire manufacturing, industrial lubricants, and adhesives. Regional players are forming collaborations with global suppliers to enhance production efficiency, while the focus on low-cost and high-performance materials is supporting wider market adoption.

Middle East & Africa (MEA) Process Oil Market Insights

The MEA region is witnessing growing adoption of process oils, fueled by industrial diversification, petrochemical investments, and infrastructure development projects. Countries such as the UAE, Saudi Arabia, and South Africa are key markets, with expanding applications in rubber processing, textiles, and polymers. The abundance of crude oil resources supports competitive pricing, while increasing government initiatives for downstream petrochemical growth are expected to strengthen the region’s market position in the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Process Oil Market Competitive Landscape

Trinidad and Tobago

Trinidad and Tobago is an energy-driven economy with a strong presence in oil, gas, and petrochemical production, aiming to position itself as a regional hub for processing and LNG exports.

-

In February 2023, Trinidad and Tobago invited its energy-rich neighbors, urging them to process their oil and natural gas in the country, aiming to leverage spare capacity for LNG or petrochemical production.

Key Players

-

APAR Industries (PO 160, T 110, RPO 120)

-

Behran Oil Co. (Behran Process Oil 230, Behran Process Oil 380)

-

Cross Oil (Hydroclear Process Oil 200, Hydroclear Process Oil 500)

-

Exxon Mobil Corporation (Prorex 100, Exxsol D 80, Enerpar 10)

-

Gandhar Oil Refinery Limited (Divyol RPO 245, Divyol RPO 180, Divyol Bio RPO 120)

-

H&R Group (Tudalen 65, Circosol 4240, Plaxolene 50)

-

Hindustan Petroleum Corporation Limited (HP RPO 245, HP RPO 160, HP RPO 400)

-

HollyFrontier Refining & Marketing LLC (HollyFrontier) (Petrolatum Process Oil, Sundex 790, Sundex 870)

-

Idemitsu Kosan Co., Ltd. (Daphne Process Oil 150, Daphne Process Oil 200)

-

Indian Oil Corporation Ltd (Servo Rubber Process Oil, Servo Gem Process Oil, Servo Prime Process Oil)

-

Iranol Company (Iranol RPO 110, Iranol RPO 220, Iranol RPO 280)

-

LODHA Petro (Lodhapro 68, Lodhapro 150)

-

Nynas AB (Nytex 810, Nyflex 223, Nypar 220)

-

ORGKHIM Biochemical Holding (TDAE Process Oil, MES Process Oil)

-

ORLEN Unipetrol (Paramo Process Oil 160, Paramo Process Oil 350)

-

Petroliam Nasional Berhad (PETRONAS) (Petronas Process Oil 68, Petronas Process Oil 150, Petronas Process Oil 500)

-

Repsol (Repsol Process Oil 68, Repsol Process Oil 150)

-

Shell plc (Shell Flavex 595, Shell Gravex 925, Shell Flavex 390)

-

TotalEnergies (Rubber Process Oil 255, Cirkan Process Oil 100, Cirkan Process Oil 150)

-

WBF Pte Ltd (WBF Process Oil 100, WBF Process Oil 220)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.00 Billion |

| Market Size by 2032 | USD 5.98 Billion |

| CAGR | CAGR of 2.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Naphthenic, Paraffinic, Non-carcinogenic, Aromatic) •By Function (Extender Oil, Plasticizer, Solvent, Defoamer, Others) •By Technology (Convention Route, Gas to Liquid, Bio-base) •By Application (Rubber Processing, Adhesives & Sealants, Consumer Products, Paints & Coatings, Pharmaceuticals, Polymers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Shell plc, Exxon Mobil Corporation, TotalEnergies, Idemitsu Kosan Co., Ltd., Indian Oil Corporation Ltd, Petroliam Nasional Berhad (PETRONAS), HollyFrontier Refining & Marketing LLC (HollyFrontier), Nynas AB, H&R Group, Repsol and other key players |