Smart Highways Market Size & Overview:

The Smart Highways Market Size was valued at USD 57.10 Billion in 2023 and is expected to reach USD 279.53 Billion by 2032, growing at a CAGR of 19.33% over the forecast period 2024-2032. Advancements in technology are quickly transforming the future of transportation infrastructure, leading to rapid evolution in the smart highways market. The sector is experiencing significant growth due to the rise in popularity of electric vehicles (EVs) and the increased need for more efficient traffic systems. Multiple factors, such as government efforts to cut down on carbon emissions, enhance road safety, and handle growing traffic levels, are fueling the advancement of smart highways. Numerous governments are putting money into smart infrastructure initiatives as a component of their extended city planning approaches. For instance, in 2021, USD 60 million was assigned by the U.S. Department of Transportation (DOT) for smart infrastructure projects, and the Bipartisan Infrastructure Law contains substantial funding for updating roadways.

Get more information on Smart Highways Market - Request Sample Report

Urban areas like Las Vegas and states like California and Florida are adopting intelligent transportation systems to boost traffic efficiency and safety. The use of smart sensors and real-time data management is aiding in decreasing travel times by 20% and lowering accident rates by up to 30%. Testing of self-driving vehicles is being combined with intelligent highway systems, especially on roads such as I-10 in Texas. These technologies help protect the environment by cutting vehicle emissions by as much as 20%. by 2030, smart highways are projected to become a prevalent feature on major U.S. interstates, despite obstacles such as high initial costs and policy standardization. Governments across the Asia Pacific region are proactively investing in smart highway projects to improve transportation efficiency, safety, and sustainability. China has made remarkable advancements in Intelligent Transportation Systems (ITS) utilizing 5G technology, India's Bharatmala Pariyojana incorporates GPS-enabled sensors for real-time traffic control, and Japan's Smart Highway Vision 2030 advocates for autonomous vehicle assistance.

The implementation of intelligent roads is also anticipated to have a vital impact on advancing autonomous driving technology. by 2024, the use of autonomous vehicles (AVs) is advancing in the U.S. but is still in its initial phase. Sales are projected to hit approximately 230,000 by 2034, propelled by innovations from major companies like Waymo, GM's Cruise, and Tesla. Even though there was a decrease in the last few years because of funding constraints and technical obstacles, investments are now increasing once more, backing the continued advancement of AV technologies. Smart highways play a crucial role in providing autonomous vehicles with accurate and immediate data from their surroundings using sensors placed on different infrastructures and embedded in the road. These sensors are capable of identifying the velocity, trajectory, and location of cars, guaranteeing a secure and effective navigation for self-driving vehicles. In the future, the integration of intelligent roads and self-driving cars is expected to significantly decrease the number of traffic accidents and deaths, creating safer streets for all.

Smart Highways Market Dynamics

Drivers

-

Revolutionizing urban mobility through the smart highways market and IoT integration.

The expansion of IoT technologies allows vehicles, infrastructure, and traffic management systems to communicate seamlessly; the aspect has been one of the biggest beneficiaries to propel growth in the smart highways market. High highways with smart sensors can monitor traffic volume, identify the need for emergency assistance, and even collect user data. This data is essential for traffic management centers as it enables them to intervene promptly so that the flow of traffic can be optimized. This could mean sharing real-time traffic data with drivers through mobile apps, letting them know in advance when they're approaching congested areas or accidents. Information like this, provided in real-time, allows a driver to make choices about their route that help lessen congestion and make better roads. 5G promises even more reliable low-latency communication and is therefore likely to soon become a major factor in vehicle-to-infrastructure (V2I) communication as well. Furthermore, the use of smart traffic lights that can change timings as they receive information about current traffic conditions in real-time, is a sure way to optimize traffic flow throughout. This integration is further enhanced by an intelligent transportation system (ITS) that studies traffic patterns and anticipates changes to prevent disruptions.

-

Government investments propel growth in smart highways and intelligent transportation systems.

Smart highways are also a component of the initiative in which government have been pouring more money into recently on account of smart cities, and smarter transportation overall. Intelligent Transportation Systems have become a central focus of the national transportation policies of numerous countries. The Smart Highways market has been in the spotlight over the past few years due to several ongoing governmental projects and systems that are used by agencies for operating, building and maintenance of these highways thereby contributing towards the safety & security. For example, the provision of funds by government agencies for research and development efforts to improve traffic management systems and initiate smart highways technologies. In addition to enhancing the existing infrastructure, these investments create potential for public-private partnerships and spur innovation in Smart Highways Market segment. Further, several governmental schemes can be seen surfaced for boosting the use of environment-friendly modes of transport such as EVs. Since an ever-increasing number of EVs will be on the road, there is a demand for smart highways that integrate charging infrastructure and technologies to manage energy consumption more effectively. Smart highways and EV adoption government incentives go hand in hand.

Restraints

-

The complex regulatory landscape of smart highways, challenges and implications for implementation

Smart Highways Market has a highly fragmented regulatory landscape, with rules and practices that can vary between different categories of vehicle or type of vehicle operation (for example, public transit buses versus commercial traffic). Disparate smart highway initiatives not only generate competition between different local stakeholders: they can also sow confusion and encumber the birth and growth of sophisticated smart highway technologies that benefit from consistency in guidelines and requirements. For example, the legal landscape related to data privacy, cybersecurity and vehicle safety is changing every day. The catch here is the ever-changing scenario which becomes a challenge, specifically for corporations or government bodies searching to investigate on smart highway solutions. Smart Highways require an array of systems and devices to work together so everything can be properly managed. Here they face the issue of integration, for fewer always adhere to a single standard and this is where complications could thwart the wonders of smart highways.

Smart Highways Market Segmentation Outlook

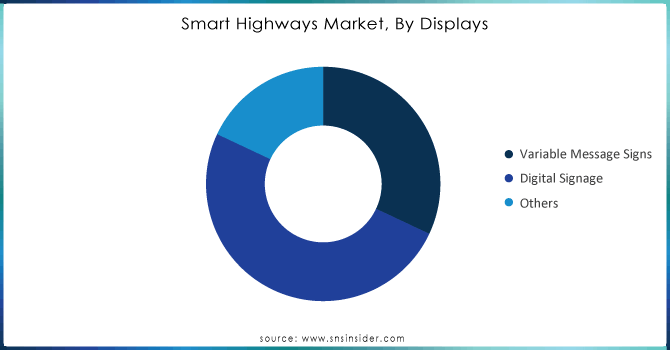

by Displays

Digital signage dominated in 2023 with a 50% market share. Digital signage, in contrast to conventional signs, makes use of electronic screens to communicate different messages, promotions, and data. The growth of this sector is boosted by the increasing popularity of connected vehicles and smart city projects, highlighting the importance of real-time data integration. Samsung and LG Electronics lead the way with cutting-edge digital signage solutions designed specifically for transportation purposes, including interactive kiosks and informative displays along highways.

Variable Message Signs (VMS) are accounted to experience the fastest CAGR during 2024-2032. It plays a vital role in intelligent highway systems by offering drivers up-to-date details on road conditions, traffic flow, accidents, and weather warnings. These electronic screens can be set to modify messages in real-time, improving traffic control and boosting safety. Cubic Corporation and DynaTraffic, top firms, have created advanced VMS solutions that sync with traffic management systems to offer precise and current information, guaranteeing efficient communication with drivers.

Need any customization research on Smart Highways Market - Enquiry Now

by Deployments

The Cloud led the market in 2023 with a 55% market share because of its many benefits such as scalability, affordability, and improved data accessibility. Cloud-based solutions enable centralized data management, facilitating real-time analytics and enhancing decision-making for traffic management and safety systems. Prominent firms like Cisco provide cloud-based systems that combine Internet of Things devices for intelligent traffic control, allowing for live monitoring and adjusting traffic signals accordingly.

The On-Premises is gaining a rapid CAGR during 2024-2032, as it pertains to conventional systems set up and managed inside the actual facilities of a company, like local traffic control centers. Although the on-premise option is commonly viewed as more rigid than cloud services, it offers better management of data security and system functions. Siemens, among other companies, utilizes on-site solutions with cutting-edge sensor technologies and real-time traffic management systems to provide full control over highway operations.

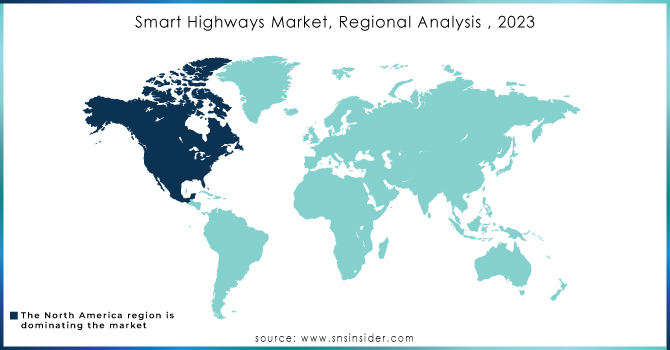

Smart Highways Market Regional Analysis

North America dominated the smart highways market in 2023 with a 45% market share, driven by significant investments in infrastructure modernization and advanced technologies. The presence of leading technology companies, innovative startups, and extensive government initiatives enhances the adoption of smart highway solutions. For instance, the California Department of Transportation has implemented smart traffic signals that optimize traffic flow and reduce congestion. The region's focus on sustainability and improving road safety further solidifies its leadership position, as various states prioritize the integration of renewable energy sources into highway systems and promote electric vehicle infrastructure.

The Asia-Pacific region is accounted to experience a rapid growth rate during 2024-2032 in the Smart Highways Market, fueled by urbanization, population growth, and the increasing demand for intelligent transportation solutions. For example, China’s Smart Highway Project utilizes advanced sensors and data analytics to monitor traffic patterns and enhance road safety. Additionally, initiatives in countries like Singapore focus on implementing integrated transport systems that use real-time data to manage congestion and improve overall traffic flow, positioning APAC as a leader in smart highway innovations.

Smart Highways Companies are:

-

Cisco Systems Inc. (Cisco Connected Roadways, Cisco Industrial Ethernet Switches)

-

Huawei Technologies Co. Ltd. (Huawei Intelligent Traffic Management System, Huawei Smart Traffic Lights)

-

Alcatel-Lucent S.A. (Alcatel-Lucent Omnivista, Alcatel-Lucent Smart Traffic Management)

-

Kapsch TrafficCom AG (Kapsch Tolling Systems, Kapsch Traffic Management Systems)

-

IBM (IBM Intelligent Transportation Systems, IBM Traffic Prediction Tools)

-

Indra Sistemas S.A. (Indra Mova Solutions, Indra Smart Road Monitoring System)

-

Schneider Electric (Schneider EcoStruxure for Transportation, Schneider Smart Traffic Solutions)

-

Siemens (Siemens Sitraffic Concert, Siemens Sitraffic Guide)

-

Xerox Corporation (Xerox Vehicle Passenger Detection, Xerox Mobility Analytics)

-

LG CNS Corporation (LG CNS Smart Traffic Management, LG CNS Smart Tolling System)

-

Fujitsu (Fujitsu SPATIOWL, Fujitsu Intelligent Transport Systems)

-

Thales Group (Thales Smart Road Systems, Thales Highway Toll Collection Solutions)

-

Continental AG (Continental Road Management Solutions, Continental Vehicle-to-Infrastructure Communication)

-

Toshiba Corporation (Toshiba Traffic Management Solutions, Toshiba Mobility Analytics)

-

Sensys Networks (Sensys SNAPS Traffic Sensors, Sensys Networks Adaptive Traffic Control)

-

Econolite (Econolite Advanced Traffic Controllers, Econolite Centracs Mobility Platform)

-

Flir Systems (FLIR Thermal Traffic Cameras, FLIR TrafiOne Smart City Sensor)

-

SWARCO AG (SWARCO Traffic Signal Systems, SWARCO Dynamic Road Markings)

-

Q-Free ASA (Q-Free Advanced Traffic Management, Q-Free Tolling Solutions)

-

TransCore (TransCore RFID Toll Collection, TransCore Advanced Traffic Management Systems)

Recent Development

-

Cavnue's Smart Highway Pilot in Michigan (July 2023): Cavnue, backed by Alphabet, started constructing a 25-mile smart highway between Ann Arbor and Detroit. The road is equipped with sensors, AI, and cameras to monitor traffic conditions and send real-time updates to drivers and transportation authorities. This project aims to improve safety and reduce congestion and is planned to expand to 40 miles.

-

Netherlands' Smart Highway Project (2023): Known for its innovation in smart infrastructure, the Netherlands continues enhancing its Smart Highway initiative, featuring glow-in-the-dark markings. These markings charge during the day and illuminate at night, improving visibility and safety.

-

RoadEO's Smart Infrastructure (2023): RoadEO, a company specializing in traffic management solutions, launched its big data-driven system in 2023. It collects data from sensors and satellites to optimize traffic and road safety on smart highways, offering insights into traffic and road conditions.

-

AI-powered Traffic Systems in Mumbai (2024): India's government introduced AI-powered signal control systems to optimize traffic on key highways in Mumbai, part of a broader investment in AI-based smart traffic solutions. This technology adjusts traffic flow in real time, reducing congestion and improving efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 57.10 Billion |

| Market Size by 2032 | USD 279.53 Billion |

| CAGR | CAGR of 19.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Displays (Variable Message Signs, Digital Signage, and Others) • By Technology (Intelligent Transportation Management System, Communication System, Intelligent Management System, Monitoring System, and Others) • By Deployments (On-Cloud and On-Premises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems Inc., Huawei Technologies Co. Ltd., Alcatel-Lucent S.A., Kapsch TrafficCom AG, IBM, Indra Sistemas S.A., Schneider Electric, Siemens, Xerox Corporation, LG CNS Corporation, Fujitsu, Thales Group, Continental AG, Toshiba Corporation, Sensys Networks, Econolite, Flir Systems, SWARCO AG, Q-Free ASA, TransCore |

| Key Drivers | • Revolutionizing urban mobility through the smart highways market and IoT integration. • Government investments propel growth in smart highways and intelligent transportation systems. |

| RESTRAINTS | • The complex regulatory landscape of smart highways, challenges and implications for implementation |