Asphalt Market Report Scope & Overview:

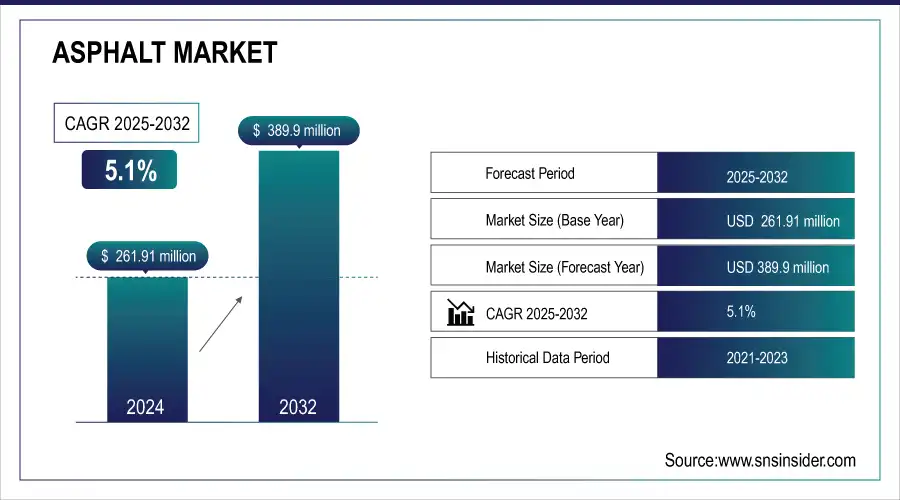

The Asphalt Market Size was valued at USD 261.91 million in 2024. It is expected to grow to USD 389.9 million by 2032 and grow at a CAGR of 5.1% over the forecast period of 2025-2032.

The growth of the asphalt market is driven by the increasing demand for infrastructure development worldwide. The construction of new roads, highways, and airports, coupled with the need for maintenance and repair of existing infrastructure, has fueled the demand for asphalt. Additionally, the rising popularity of asphalt shingles in the roofing industry has further contributed to the market's expansion.

Get E-PDF Sample Report on Asphalt Market - Request Sample Report

Asphalt Market Size and Forecast:

-

Market Size in 2024: USD 261.91 Million

-

Market Size by 2032: USD 370.98 Million

-

CAGR: 5.1% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Asphalt Market Trends:

-

Growing demand for asphalt in road construction and infrastructure projects drives market expansion across both developed and developing regions.

-

Rising adoption of polymer-modified asphalt enhances durability, performance, and resistance to extreme weather conditions in paving applications.

-

Sustainability focus drives increased use of warm-mix asphalt technologies, reducing energy consumption and carbon emissions during production.

-

Recycled asphalt pavement (RAP) utilization gains traction, supporting cost efficiency, circular economy practices, and reduced dependency on virgin raw materials.

-

Urbanization and smart city initiatives fuel investments in advanced asphalt solutions for highways, airports, and urban road networks.

-

Technological innovations, including bio-based binders and additive-enhanced asphalt, expand opportunities for eco-friendly and high-performance pavement materials.

Adopting advanced additives and modifiers in asphalt formulations further drives the growth of the asphalt market. These additives enhance the performance characteristics of asphalt, making it more durable, flexible, and resistant to cracking. Additionally, the use of recycled materials, such as reclaimed asphalt pavement (RAP), is gaining traction as a cost-effective and sustainable alternative to traditional asphalt production.

-

In 2023, Vulcan Materials Company, one of the largest suppliers of infrastructure aggregate and asphalt, extended its production capacity by acquiring U.S. Concrete. The acquisition coincided with the increased federal spending on the roadways. It will allow meeting the growing demand for the product for infrastructure improvement projects all over the United States.

Moreover, the major driving force of the asphalt market is the necessity of road maintenance and rehabilitation. Alongside, North America and Europe account as the major regions of developed infrastructure, and the need for constant maintenance of the aging infrastructure has become the major driver of the market. Many governments of these regions are ready to allocate large budgets for the maintenance and further development of their road networks. There are several examples of such governments for instance, according to the Federal Highway Administration, there should be more than USD 50 million spent annually to maintain and renew the existing highways. In its turn, the U.S. Infrastructure Investment and Jobs Act has allocated USD 110 billion for the maintenance and improvement of roads and bridges, and a considerable part of this budget will be spent on the resurfacing of existing asphalt.

Asphalt Market Drivers:

-

Increasing adoption of asphalt for road construction and maintenance drives the market growth.

The growth in the usage of asphalt in road construction and reparation is explained by the relatively low cost, long-lasting nature, and the opportunities it provides to resist heavy traffic and intense weather conditions. The case is supported by information about the latest developments of the key players. For instance, in 2023 Vulcan Materials enlarged its production of asphalt due to the purchase of U.S. Concrete. It is mentioned that nowadays, the requested volume of infrastructure objects in the U.S. enables such growth of a company. Next, in 2021, CRH Plc enlarged its product line of polymer-modified asphalt in response to the increased demand for materials that are supposed to be used in areas with heavy traffic, such a development could also be regarded as another case. Finally, there is information about the fact that Shell Bitumen 2022 launched a new generation of asphalt called Shell Bitumen CarbonSink. It is explained that this bio-based variant of asphalt may act as a carbon bank and reduce CO2 in both cases noted in the summary.

Asphalt has been gaining popularity in the area of road construction and maintenance. Since it is a multi-use material, asphalt is widely used in the creation of roadways, highways, and other forms of infrastructure. Governments from all over the world have been working on increasing their investment in the development of road infrastructure to boost the country’s economy and improve the transportation of goods and services. For this reason, the need for asphalt is continuously growing. In addition, the spending on road repairs and highway maintenance has been growing on the level of the whole continent, particularly the North. In such a way, the current trend suggests that asphalt plays a significant role in the development of long-standing and effective transportation systems.

-

The rising popularity of asphalt as a sustainable and eco-friendly material drives the market growth.

Eco-friendly materials attract both private and public sectors. The use of asphalt reduces the utilization of new raw materials, as well as the production of waste. Many companies and governments prefer using recycled material for the construction and reconstruction of roads because it is both cheap and appropriate for the environment. Such a sustainable approach considerably affects the demand for asphalt in numerous infrastructure and general construction implementations.

Asphalt Market Restraints:

-

Fluctuating cost of raw materials hampers the market growth.

A major market restraint is the fluctuating cost of raw materials. Crude oil is one of the most important and volatile inputs in the production of asphalt. When crude oil prices rise, the cost of production for asphalt increases as well, leading to higher project expenses for construction companies. Delays in infrastructure builds and renovations or the need for contractors to seek alternative materials limit the growth of the asphalt market. In tandem, governments and corporations become unable to predict and thus budget for the long-term expenses necessitated by the construction and repair of roads.

Asphalt Market Opportunities:

-

Development of advanced asphalt mixtures

Researchers and manufacturers in the asphalt market are increasingly focused on developing innovative additives and advanced technologies to improve asphalt’s performance, strength, and lifespan. These advancements aim to address challenges such as cracking, rutting, and weather resistance, ensuring longer-lasting and safer road surfaces. Modified asphalts, such as polymer-modified and bio-based solutions, enhance flexibility and resilience, particularly under heavy traffic and extreme climate conditions. Beyond traditional road construction, these improvements are expanding asphalt’s applications into new areas, including roofing materials and waterproofing systems, where durability and protection are critical. Such innovations not only enhance infrastructure quality but also contribute to cost savings, environmental sustainability, and broader market opportunities by extending asphalt’s functionality across multiple industries.

Asphalt Market Segmentation Overview:

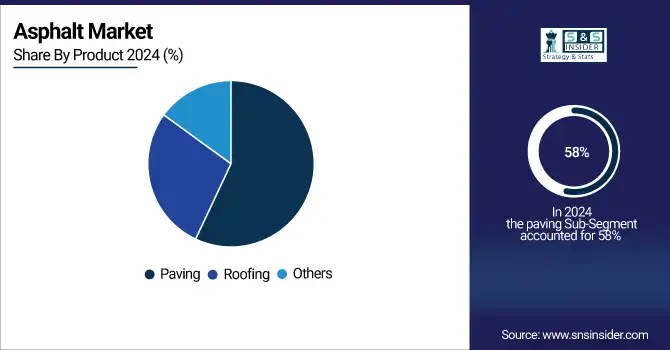

By Product, Paving Segment Leads Asphalt Market with 58% Share in 2024

The paving held the largest market share around 58% in 2024. It is because of its significance in the development and maintenance of infrastructure. Demand for road construction and repair continually increases and drives the sales of asphalt as a material in the paving application. Urbanization and population growth have both led to the need for an increased number of roads for the advancement of various economic activities. Governments spend substantial budgets on infrastructure, and roads and highways are essential components in the modern network of transportation, which has triggered greater demand for asphalt in paving applications. Furthermore, despite being the cheapest road material, in general, asphalt is durable and lasts long. The material is also recyclable helps increase the interest in its utilization. Due to these trends, the main focus of infrastructure activities in many developing territories is on the part of paving, which has enhanced its share in the asphalt market.

By Application, Roadways Segment Dominates Asphalt Market with 43% Revenue Share in 2024

Based on the application, the roadways application segment dominated the asphalt market with the highest revenue share of about 43% in 2024 owing to the expansion of the construction industry. This growth is fueled by rapid urbanization and an increasing population, which creates a demand for roadway applications. The substance plays a crucial role as a binding agent for roadways and highways, ensuring the cohesion and durability of the materials used. Furthermore, the growing connectivity between countries and regions further strengthens the dominance of this segment. Not only does it serve as a binding agent, but it also acts as a waterproofing agent for roadways and other infrastructures. By preventing accidents and protecting residential and non-residential structures from harsh weather conditions, it plays a vital role in ensuring safety and longevity.

Asphalt Market Regional Analysis:

Asia Pacific Dominates Asphalt Market in 2024

Asia Pacific holds an estimated 41% market share in 2024, driven by large-scale infrastructure projects, rapid urbanization, and strong government spending on transportation development. This causes asphalt demand to surge for highways, airports, and urban roads across the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

-

China Leads Asia Pacific’s Asphalt Market

China dominates the Asia Pacific asphalt market due to its massive infrastructure programs, including Belt and Road projects and rapid urban expansion. The government’s continuous investments in highways, airports, and residential development fuel consistent asphalt consumption. China also promotes sustainability by adopting recycled asphalt pavement technologies, improving cost efficiency and environmental performance. With its strong industrial base, robust construction sector, and heavy public funding, China sets the pace for regional asphalt demand and continues to lead growth across the Asia Pacific.

North America is the Fastest-Growing Region in the Asphalt Market in 2024

North America is projected to grow at a CAGR of 5.6% from 2025–2032, driven by rising infrastructure modernization projects and increasing demand for roadway maintenance. This causes accelerated asphalt adoption in road repair, residential construction, and roofing applications.

-

United States Leads North America’s Asphalt Market

The U.S. leads the North American asphalt market due to its large-scale infrastructure repair initiatives, backed by the Infrastructure Investment and Jobs Act. Rising demand for road rehabilitation, highway upgrades, and airport expansion fuels market growth. Additionally, the U.S. housing sector boosts asphalt shingle usage in roofing. Sustainability is another driver, with growing adoption of recycled asphalt materials to lower emissions and costs. Federal funding, coupled with a focus on modern, efficient infrastructure, ensures the U.S. remains the primary contributor to asphalt demand in North America.

Europe Asphalt Market Insights, 2024

Europe is experiencing steady asphalt demand in 2024, driven by EU infrastructure funding, roadway rehabilitation, and sustainability-focused construction practices. Germany’s investment in eco-friendly asphalt solutions and roadway upgrades reduces carbon emissions, causing stronger adoption of sustainable materials across Europe.

-

Germany Leads Europe’s Asphalt Market

Germany dominates the European asphalt market due to its advanced road networks and commitment to sustainable construction. National emphasis on green asphalt technologies aligns with EU decarbonization targets, driving innovation in recycled and low-emission materials. Heavy government investment in transport modernization, combined with strong automotive and logistics sectors, further supports asphalt demand. Germany’s leadership in research, innovation, and infrastructure funding reinforces its position as the regional leader in the European asphalt market.

Middle East & Africa and Latin America Asphalt Market Insights, 2024

The Asphalt Market in these regions is expanding steadily in 2024, supported by large-scale infrastructure projects and rapid urban development. In the Middle East, Saudi Arabia and the UAE lead demand through mega-projects, smart city initiatives, and highway expansion. In Latin America, Brazil and Mexico dominate with significant investments in road construction, airport upgrades, and housing projects. International collaborations and public-private partnerships are accelerating sustainable asphalt adoption. With urbanization and economic growth, both regions continue to increase their contribution to the global asphalt market.

Competitive Landscape for the Asphalt Market:

CEMEX S.A.B. de C.V.

CEMEX is a global building materials company with strong asphalt and paving solutions through CEMEX Asphalt. The company supplies bituminous binders, hot-mix asphalt, and full paving services for highways, airports, and urban infrastructure, combining large-scale production capacity with integrated logistics and project delivery. With a focus on sustainability and recycled asphalt usage, CEMEX supports long-life pavements and circular construction practices for public and private projects. Its role in the asphalt market is crucial, providing end-to-end paving solutions that shorten project timelines and improve pavement performance across regions.

-

In 2024, CEMEX expanded its recycled asphalt pavement (RAP) processing capability to increase sustainable mix availability for major road projects.

Exxon Mobil Corporation

Exxon Mobil is a major supplier of asphalt binders and specialty bitumen products tailored for paving, roofing, and industrial applications. Leveraging extensive refining capabilities, ExxonMobil delivers polymer-modified asphalts and performance-grade binders designed for extreme climates and heavy-traffic corridors. The company supports customers with technical services—mix design assistance, performance testing, and application guidance—helping owners and contractors optimize durability and life-cycle costs. ExxonMobil’s role is pivotal in supplying high-specification binders that enable long-lasting, resilient pavements worldwide.

-

In 2024, ExxonMobil introduced an upgraded polymer-modified binder formulation focused on improved rutting resistance for high-temperature environments.

Royal Dutch Shell

Shell Bitumen is a leading global bitumen supplier providing a broad portfolio of paving asphalts, specialty binders, and emulsions for road construction and maintenance. Shell emphasizes performance enhancements—polymer modification, warm-mix compatibility, and sustainability options—while offering technical support for pavement design and recycling strategies. The company’s integrated supply chain and refinery-backed bitumen production ensure consistent quality and large-volume availability for infrastructure programs. Shell’s role in the asphalt market centers on delivering performance-driven binders that improve pavement life and environmental outcomes.

-

In 2024, Shell launched an initiative to scale warm-mix and low-energy asphalt solutions for lower-carbon pavement production.

Total SA

Total Asphalt (part of TotalEnergies) supplies bitumen products, polymer-modified asphalts, and eco-friendly binders for paving, roofing, and industrial applications. The company focuses on innovation—bio-based additives, modified binders, and recycled mix optimization—to meet evolving performance and sustainability targets. Total supports contractors with mix design, field assistance, and lifecycle assessment tools to extend pavement durability and reduce environmental impact. Its role in the market is to bridge refinery supply strength with R&D-driven binder technologies that address climate resilience and circular construction demands.

-

In 2024, Total expanded its portfolio of bio-modified binders and launched pilot projects using higher RAP contents in highway mixes.

Asphalt Market Key Players:

-

CEMEX S.A.B. de C.V.

-

Exxon Mobil Corporation

-

Royal Dutch Shell

-

Total SA

-

United Refining Company

-

Boral

-

Aggregate Industries Ltd.

-

China Petroleum & Chemical Corporation (Sinopec)

-

Chevron Corporation

-

Marathon Petroleum Corporation

-

LafargeHolcim

-

Oldcastle Materials

-

Granite Construction Incorporated

-

Tarmac

-

CRH plc

-

Bitumina

-

Nynas AB

-

PBA (Petrochemical and Bitumen Association)

-

Colas Group

-

Reynolds Asphalt

| Report Attributes | Details |

| Market Size in 2024 | US$ 261.91 Mn |

| Market Size by 2032 | US$ 370.98 Mn |

| CAGR | CAGR of 5.1% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Roofing, Paving, and Others) • By Type (Cold Mix Asphalt, Warm Mix Asphalt, and Hot Mix Asphalt) • By Application (Roadways, Recreation, Waterproofing, and Others) • By End-user (Residential and Non-Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | CEMEX S.A.B. de C.V., Exxon Mobil Corporation, Royal Dutch Shell, Total SA, United Refining Company, Boral, Aggregate Industries Ltd., China Petroleum & Chemical Corporation, Chevron Corporation, Marathon Petroleum Corporation |