Blind Spot Detection System Market Report Scope & Overview:

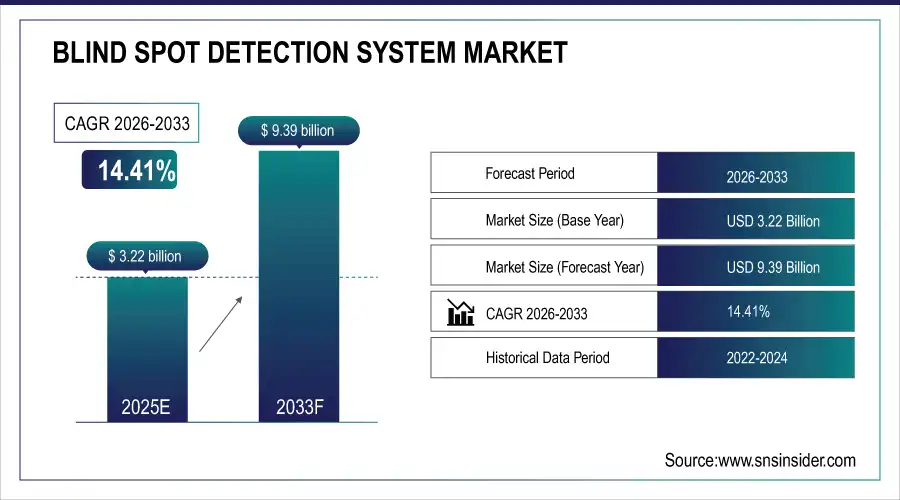

Blind Spot Detection System Market was valued at USD 3.22 billion in 2025E and is expected to reach USD 9.39 billion by 2032, growing at a CAGR of 14.41% from 2026-2033.

To Get more information On Blind Spot Detection System Market - Request Free Sample Report

The Blind Spot Detection System Market is growing due to increasing demand for advanced driver assistance systems (ADAS) and enhanced vehicle safety. Rising vehicle production, especially in passenger cars and commercial vehicles, along with stringent government regulations on road safety, is boosting adoption. Growing consumer awareness about accident prevention, integration of radar, camera, and Lidar technologies, and expansion of electric and connected vehicles are driving market growth. Additionally, investments in automotive R&D and aftermarket safety solutions further support rapid adoption globally.

|

Initiative / Company |

Key Update / Contribution |

Year |

|

NHTSA's NCAP Updates |

Added four new ADAS technologies to NCAP, including Blind Spot Warning (BSW) and Blind Spot Intervention (BSI), improving safety ratings and boosting consumer awareness. |

2024 |

|

ADAS Adoption Projections (GAO) |

Projected that by 2027, 51% of U.S. registered vehicles will be equipped with some form of ADAS technologies, a sharp increase from 28% adoption in 2022. |

2027 |

|

Sheba Microsystems – Sharp-7 |

Introduced the first autofocus automobile camera with an 8MP sensor, reliable across extreme temperatures (-40 to 302°F) and optimized for blind spot monitoring systems. |

2024 |

|

GridMatrix by DOT |

Developed a system that converts DOT-owned sensors into real-time safety monitors, detecting unsafe traffic interactions and strengthening BSD system effectiveness. |

2024 |

Market Size and Forecast

-

Market Size in 2025: USD 3.22 Billion

-

Market Size by 2033: USD 9.39 Billion

-

CAGR: 14.41% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Blind Spot Detection System Market Trends

-

Rising demand for vehicle safety and accident prevention is driving the blind spot detection system market.

-

Growing adoption in passenger cars, commercial vehicles, and electric vehicles is boosting growth.

-

Integration with advanced driver-assistance systems (ADAS), radar, and camera technologies is enhancing detection accuracy.

-

Expansion of regulatory mandates for vehicle safety features is accelerating market adoption.

-

Increasing focus on reducing road accidents and improving driver awareness is shaping market trends.

-

Advancements in sensor fusion, AI algorithms, and real-time monitoring are improving system reliability.

-

Collaborations between automotive OEMs, technology providers, and software developers are fostering innovation and deployment.

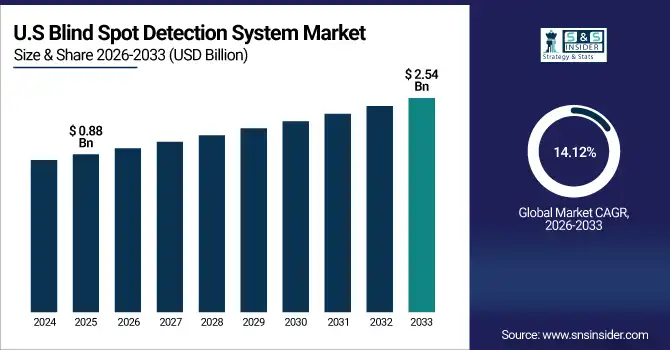

U.S. Blind Spot Detection System Market was valued at USD 0.88 billion in 2025E and is expected to reach USD 2.54 billion by 2032, growing at a CAGR of 14.12% from 2026-2033.

The U.S. Blind Spot Detection System Market is growing due to stringent vehicle safety regulations, increasing adoption of ADAS features, rising consumer awareness, and expanding integration of radar, camera, and Lidar technologies in passenger and commercial vehicles.

Blind Spot Detection System Market Growth Drivers:

-

Technological advancements in sensor systems and integration with autonomous and semi-autonomous driving features accelerating adoption

Advancements in sensor technology, including radar, ultrasonic, Lidar, and camera systems, have significantly improved the accuracy and reliability of blind spot detection systems. These improvements allow vehicles to detect obstacles even under low visibility or high-speed conditions. Integration of BSD with autonomous and semi-autonomous driving systems, such as lane-keeping assist and collision avoidance, further enhances vehicle safety. OEMs are investing in compact, cost-effective, and energy-efficient sensors to promote adoption in mass-market vehicles. Enhanced connectivity, AI-driven algorithms, and real-time data processing make BSD systems smarter, safer, and more attractive to both manufacturers and end-users.

|

Company / Collaboration |

Description |

Key Technology / Feature |

Timeline / Implementation |

|

Mercedes-Benz & Luminar |

Partnership to co-develop and integrate next-generation Halo lidar sensors into Mercedes vehicles |

Compact, efficient Halo LiDAR sensors for autonomous and driver-assistance technologies |

Large-scale production and integration expected by 2026 |

|

Nissan & Wayve |

Agreement to integrate Wayve's AI autonomous driving software into Nissan vehicles |

AI-based system learning from real-world driving, reducing need for costly sensors and 3D maps |

Integration into Nissan ProPILOT by 2027 |

|

Volkswagen & Valeo / Mobileye |

Collaboration to enhance assisted and autonomous driving in high-volume models |

Level 2+ systems with electronic control units, sensors, cameras, radar, and mapping technologies |

Features like hands-free driving, traffic jam assist, hazard detection |

|

Waymo |

Fifth-generation robotaxi equipped with advanced sensor suite |

Five LiDARs, six radar sensors, 29 cameras for high-accuracy environmental perception |

Enhances blind spot detection and overall safety |

|

RoboSense |

Development of RS-IPLS, perception LiDAR system for autonomous driving |

Real-time data processing, "gaze" function, high-resolution color point cloud, AI algorithms |

Designed for mass production at low cost |

Blind Spot Detection System Market Restraints:

-

Technical limitations due to sensor interference, environmental conditions, and integration challenges in complex vehicle systems

Blind spot detection systems face technical challenges related to sensor performance, particularly under adverse weather conditions such as heavy rain, fog, or snow. Radar and Lidar sensors may experience interference from surrounding objects or other vehicles, leading to false alerts or missed detections. Integrating BSD with other ADAS functions in complex vehicle electronics requires sophisticated software and calibration, adding complexity. Variability in vehicle design, mirror placement, and body structure can impact detection accuracy. These technical limitations reduce system reliability, affecting consumer trust and slowing adoption, particularly in regions with diverse driving conditions and extreme weather.

Blind Spot Detection System Market Opportunities:

-

Integration with autonomous and electric vehicles creating new avenues for technological advancement and market expansion

The rise of electric vehicles (EVs) and autonomous driving technologies presents opportunities for integrating blind spot detection as a core safety feature. BSD can complement autonomous systems such as lane centering, automated lane change, and collision avoidance, enhancing overall vehicle intelligence. Growing investments in EV production and connected cars drive demand for advanced safety features, enabling manufacturers to bundle BSD with other smart technologies. Startups and technology providers can innovate lighter, energy-efficient, and AI-driven systems tailored for EVs and self-driving vehicles. This trend expands market potential and positions BSD as an essential component of future mobility solutions.

Blind Spot Detection System Market Segment Highlights

-

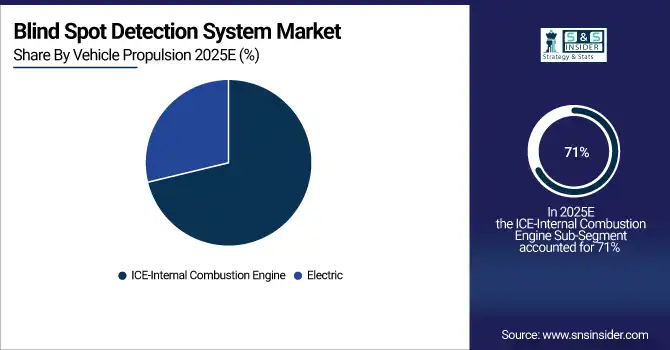

By Vehicle Propulsion, ICE-Internal Combustion Engine dominated with ~71% share in 2025; Electric fastest growing (CAGR).

-

By Technology, Radar Sensor dominated with ~27% share in 2025; Lidar Sensor fastest growing (CAGR).

-

By Sales Channel, OEM dominated with ~86% share in 2025; Aftermarket fastest growing (CAGR).

-

By Vehicle Type, Passenger Cars dominated with ~54% share in 2025; Light Commercial Vehicles fastest growing (CAGR).

Blind Spot Detection System Market Segment Analysis

By Vehicle Propulsion, ICE segment dominated in 2025; Electric segment expected fastest growth 2026–2033 with rising EV adoption and easier sensor integration.

ICE-Internal Combustion Engine segment dominated the Blind Spot Detection System Market in 2025 due to its widespread use in conventional vehicles and well-established integration with ADAS technologies. High production volumes, proven compatibility with existing automotive electronics, and lower implementation costs compared to electric vehicles make ICE the primary segment for BSD adoption globally.

Electric segment is expected to grow fastest from 2026 to 2033 as the adoption of electric vehicles rises. Increasing EV production, integration of advanced safety technologies, and government incentives promoting electrification are driving demand. Compact architecture of EVs allows easier sensor integration, making BSD an attractive feature in new-generation electric and hybrid vehicles worldwide.

By Technology, Radar Sensor dominated in 2025; Lidar Sensor projected fastest growth 2026–2033 due to precision, autonomous vehicle adoption, and declining costs.

Radar Sensor segment dominated the Blind Spot Detection System Market in 2025 due to its long-range detection capabilities, robustness in adverse weather, and high reliability. Its cost-effectiveness, ease of integration with ADAS, and wide adoption by automotive OEMs for safety systems have made radar the preferred sensor technology in conventional and premium vehicles.

Lidar Sensor segment is expected to grow fastest from 2026 to 2033 because of its high precision and accuracy in object detection. Increasing demand for autonomous and semi-autonomous vehicles drives Lidar adoption. Technological advancements, declining costs, and enhanced sensor miniaturization allow integration into new vehicle models, boosting its rapid growth in the BSD market globally.

By Sales Channel, OEM segment led in 2025; Aftermarket segment expected fastest growth 2026–2033 with retrofitting demand and expanding safety awareness.

OEM segment dominated the Blind Spot Detection System Market in 2025 due to the standard installation of BSD in new vehicles by manufacturers. Strong collaborations with sensor and ADAS suppliers, adherence to safety regulations, and high consumer preference for pre-installed safety features support OEM dominance in global BSD deployment.

Aftermarket segment is expected to grow fastest from 2026 to 2033 as vehicle owners increasingly upgrade older cars with advanced safety systems. Rising awareness of road safety, availability of cost-effective retrofit solutions, and expanding distribution networks for sensors and installation services are driving rapid aftermarket adoption of blind spot detection technologies.

By Vehicle Type, Passenger Cars dominated in 2025; Light Commercial Vehicles projected fastest growth 2026–2033 due to fleet safety and regulatory compliance.

Passenger Cars segment dominated the Blind Spot Detection System Market in 2025 due to their large market share, high production volumes, and increased safety feature integration. Consumer demand for enhanced safety in daily commuting vehicles and OEM focus on premium and mid-range cars have resulted in widespread BSD implementation in passenger cars globally.

Light Commercial Vehicles segment is expected to grow fastest from 2026 to 2033 because of rising demand for fleet safety and regulatory compliance. Integration of BSD in delivery vans, pickup trucks, and small transport vehicles reduces accident risks, improves driver confidence, and meets growing commercial transportation safety standards across emerging and developed markets.

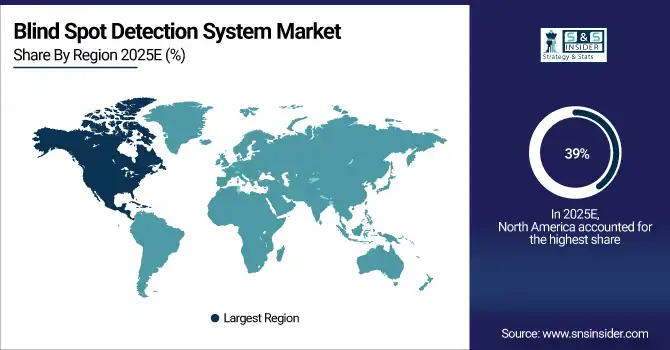

Blind Spot Detection System Market Regional Analysis

North America Blind Spot Detection System Market Insights

North America dominated the Blind Spot Detection System Market in 2025 with the highest revenue share of about 39% due to advanced automotive technology adoption, stringent vehicle safety regulations, and strong consumer awareness regarding road safety. Well-established automotive manufacturing, extensive R&D investments by leading OEMs, and widespread integration of ADAS features in passenger cars and commercial vehicles further strengthen BSD adoption, making North America the leading regional market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Blind Spot Detection System Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 16.56% from 2026 to 2033 due to rapid vehicle production, increasing adoption of advanced safety technologies, and rising consumer awareness. Expanding automotive industry, government initiatives promoting road safety, and growing investments by global OEMs in EVs and connected vehicles are driving demand for blind spot detection systems across countries like China, Japan, India, and South Korea.

Europe Blind Spot Detection System Market Insights

Europe in the Blind Spot Detection System Market is experiencing steady growth due to stringent vehicle safety regulations, high adoption of advanced driver assistance systems (ADAS), and increasing consumer demand for enhanced road safety. Well-established automotive manufacturing, strong presence of leading OEMs, and continuous investments in sensor technologies like radar, Lidar, and cameras further drive market expansion. Growing focus on electric and connected vehicles also contributes to the adoption of BSD systems across the region.

Middle East & Africa and Latin America Blind Spot Detection System Market Insights

Middle East & Africa and Latin America in the Blind Spot Detection System Market are witnessing gradual growth driven by rising vehicle production, increasing road safety awareness, and the adoption of advanced driver assistance systems (ADAS) in new vehicles. Expanding automotive infrastructure, government initiatives promoting vehicle safety, and growing consumer demand for collision prevention technologies are fueling market adoption. Additionally, rising investments by global OEMs and aftermarket players to introduce affordable BSD solutions are accelerating regional market growth.

Blind Spot Detection System Market Competitive Landscape:

Robert Bosch GmbH

Robert Bosch GmbH is a global technology and engineering company, providing innovative solutions in mobility, industrial technology, consumer goods, and energy. Bosch is a leader in automotive safety systems, including sensors, software, and ADAS solutions. By integrating radar, camera, and connectivity technologies, Bosch aims to enhance vehicle automation, improve road safety, and support the evolution toward fully autonomous driving systems.

-

July 29, 2025: Bosch introduced a new radar system-on-chip (SoC) that integrates essential radar components onto a single chip, enhancing object recognition capabilities for ADAS.

Continental AG

Continental AG is a leading automotive supplier specializing in tires, brake systems, electronics, and advanced safety solutions. The company focuses on intelligent vehicle technologies, including radar and sensor systems that support ADAS and autonomous driving. Continental emphasizes innovation and large-scale production to meet the increasing demand for automotive safety systems globally.

-

May 8, 2025: Continental produced 200 million radar sensors, marking a milestone and reinforcing its leadership in automotive safety technology and ADAS demand

Valeo SA

Valeo SA is a French automotive supplier specializing in comfort, driving assistance, and powertrain technologies. Valeo focuses on developing ADAS solutions, integrating sensors, software, and AI to enhance vehicle safety and support autonomous driving. Strategic partnerships and validation programs allow the company to test next-generation systems and accelerate the adoption of Level 2+ ADAS technologies.

-

September 4, 2025: Valeo partnered with Capgemini to test and validate a new integrated ADAS system up to Level 2+, enhancing vehicle safety and supporting autonomous driving technologies.

ZF Friedrichshafen AG

ZF Friedrichshafen AG is a global automotive supplier known for driveline and chassis technologies, safety systems, and mobility solutions. ZF develops ADAS technologies to reduce accidents, improve vehicle handling, and enhance driver assistance. Their solutions include lane-change support, blind spot monitoring, and integrated sensor systems, supporting both driver safety and future autonomous driving developments.

-

June 27, 2024: ZF introduced a system to eliminate blind spots during lane changes, improving driving safety and reducing the risk of accidents.

Magna International Inc.

Magna International Inc. is a global automotive supplier providing vehicle engineering, electronics, and integrated safety solutions. The company focuses on interior and exterior sensing systems, enabling advanced driver assistance, autonomous driving capabilities, and improved occupant safety. Magna invests in innovation to support the evolving automotive landscape and enhance ADAS integration across multiple vehicle platforms.

-

July 29, 2025: Magna unveiled an integrated interior sensing system, advancing vehicle safety innovation and reflecting the growing importance of ADAS in modern vehicles.

Mobileye

Mobileye, an Intel company, specializes in computer vision, driver-assistance systems, and autonomous vehicle technologies. Mobileye develops imaging radar and vision-based ADAS systems, focusing on object detection, lane recognition, and collision avoidance. By streamlining its technology stack, Mobileye emphasizes high-performance, cost-effective solutions for mass-market automotive safety applications.

-

September 9, 2024: Mobileye announced the closure of its lidar development unit, focusing on in-house imaging radar technology for enhanced object detection in ADAS applications.

Aptiv PLC

Aptiv PLC is a global technology company providing electrical architecture, software, and autonomous driving solutions. Aptiv develops ADAS systems, including sensors, control units, and software platforms, to enhance vehicle safety and automation. Strategic portfolio adjustments reflect Aptiv’s evolving approach to autonomous mobility and its focus on scalable ADAS technologies for multiple markets.

-

May 2, 2024: Aptiv reduced its equity interest in Motional, the autonomous driving joint venture, signaling a strategic shift in its ADAS approach.

Key Players

Some of the Blind Spot Detection System Market Companies

-

Robert Bosch GmbH

-

Continental AG

-

Denso Corporation

-

ZF Friedrichshafen AG

-

Valeo SA

-

Magna International Inc.

-

Hella GmbH & Co. KGaA

-

Delphi Technologies PLC

-

Mobileye

-

Autoliv Inc.

-

Aptiv PLC

-

Hyundai Mobis

-

Infineon Technologies AG

-

NXP Semiconductors N.V.

-

Garmin Ltd.

-

Gentex Corporation

-

VBOX Automotive

-

Xiamen Autostar Electronics Co., Ltd.

-

SL Corporation

-

Mando-Hella Electronics Corp.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.22 Billion |

| Market Size by 2033 | USD 9.39 Billion |

| CAGR | CAGR of 14.41% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Ultrasonic Sensor, Lidar Sensor, Radar Sensor, Camera Sensor, Infrared Sensor, Pressure Sensor) • By Vehicle Type (Heavy Commercial Vehicles, Passenger Cars, Light Commercial Vehicles) • By Vehicle Propulsion (ICE-Internal Combustion Engine, Electric) • By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Robert Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Valeo SA, Magna International Inc., Hella GmbH & Co. KGaA, Delphi Technologies PLC, Mobileye, Autoliv Inc., Aptiv PLC, Hyundai Mobis, Infineon Technologies AG, NXP Semiconductors N.V., Garmin Ltd., Gentex Corporation, VBOX Automotive, Xiamen Autostar Electronics Co., Ltd., SL Corporation, Mando-Hella Electronics Corp. |