All-Weather Tire Market Size:

Get More Information on All-Weather Tire Market - Request Sample Report

The All-Weather Tire Market Size was USD 206.2 billion in 2023 and is expected to reach USD 328.20 billion by 2032 and grow at a CAGR of 5.3% by 2024-2032

All-weather tires have become a popular choice for drivers worldwide due to their versatility. Unlike seasonal tires, they can handle a wide range of weather conditions, making them suitable for most regions except those with extreme cold below 7°C. Their primary function goes beyond simple protection for the wheel rim. They provide the crucial grip needed for safe driving on various road surfaces. All-weather tires offer a compelling compromise between summer tires, known for longer tread life, and all-season tires, which excel in both dry and wet conditions. The future of the all-weather tire market looks promising due to several converging factors. Stricter government regulations are mandating clearer tire labelling, allowing consumers to make informed choices about safety features. A growing emphasis on proper vehicle maintenance, including tire care, is driving consumer interest in all-weather tires as a convenient and safe option. The rise of the aftermarket car modification scene, where drivers seek to customize their vehicles with different tires, presents another avenue for market growth.

All-Weather Tire Market Dynamics:

KEY DRIVERS:

-

All-weather tires gain popularity as fuel efficiency concerns drives market growth

All-weather tires could benefit from the growing focus on reducing vehicle emissions. Compared to frequent seasonal tire changes, all-weather tires can potentially improve fuel efficiency. This is because they eliminate the rolling resistance associated with switching between summer and winter tires. With consumers becoming more environmentally conscious, the fuel-saving potential of all-weather tires might become a significant selling point, contributing to increased market adoption.

-

Rising disposable income and a growing automotive sector fuel investment in all-weather tires.

RESTRAINTS:

-

Higher initial cost of all-weather tires may delay the market growth despite long-term benefits

The all-weather tire market might face the problem due to the high upfront costs associated with these tires. Compared to some all-season options, the initial investment for all-weather tires could be higher. This price difference might deter budget-conscious consumers, potentially hindering broader market expansion. However, the long-term benefits of all-weather tires, such as their versatility and potentially longer tread life, need to be factored in to assess the overall value proposition.

OPPORTUNITIES:

-

Increasing adoption in Europe due to stricter winter tire regulations and environmental concerns.

Europe's roads are getting safer and greener thanks to a growing trend: winter tires. Stricter laws are mandating their use in many countries, ensuring drivers have better grip on snow and ice. This reduces accidents and keeps everyone on the road happy. They're also more fuel-efficient in cold weather, which helps reduce emissions and combats climate change.

-

Growing popularity of SUVs and crossover vehicles equipped with larger rim sizes suitable for all-weather tires.

CHALLENGES:

-

Fluctuations in raw material prices, like oil and synthetic rubber, can impact production costs and market stability.

-

Stringent winter tire regulations in some regions might limit the market for all-weather tires.

IMPACT OF RUSSIA-UKRAINE WAR:

The war in Russia-Ukraine disrupts the all-weather tire market through a supply chain ripple effect. The Russia is a producer which contributes up to 20% of the world's synthetic rubber is facing sanctions and logistical hurdles. This could lead to global shortages of 5-10% and price hikes for rubber by 15-25%, impacting production costs for all-weather tires. Additionally, surging oil prices, another crucial raw material, could further inflate production costs by potentially translating to higher consumer prices of 3-8%. Consumer spending might also shift towards essentials due to economic uncertainty, potentially dampening overall demand in some regions by 5-10%. Areas reliant on winter tires due to harsh conditions might see a rise in all-weather tire demand by 10-15% if winter tire supplies are affected by the conflict, offering a more economical alternative.

IMPACT OF THE ECONOMIC SLOWDOWN:

An economic slowdown can disrupt the all-weather tire market in several ways. Consumer spending often face problem during economic downturns, with a potential decline of 5-10% in non-essential purchases like tires. This could decrease the overall demand for all-weather tires, particularly in discretionary replacement markets. The businesses might delay fleet maintenance or prioritize retreading existing tires, leading to a further decrease in demand by 3-8%. Economic hardship might make consumers more budget-conscious, leading to a potential rise in demand for all-weather tires by 2-5% as a more cost-effective alternative to purchasing both summer and winter tires. The impact might vary geographically, with established markets likely experiencing a smaller decline compared to newer markets that might see a steeper drop due to their lower overall demand.

MARKET SEGMENTATION:

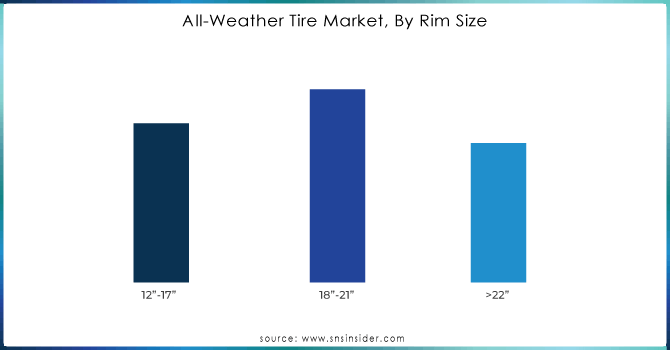

By Rim Size:

By Rim Size is the dominating sub-segment in the All-Weather Tire Market by rim size holding around 35-40% of market share due to the increasing popularity of SUVs and crossover vehicles, which typically come equipped with larger rim sizes. These vehicles often prioritize a balance between performance and aesthetics, making all-weather tires a suitable choice. Additionally, the larger sidewalls of 18"-21" tires offer a smoother ride and can provide some additional protection against potholes and road hazards.

Get a Customized Report as per your Business Requirement - Request For Customized Report

By Sales Channel:

The aftermarket is the dominating sub-segment in the All-Weather Tire Market by sales channel holding around 60-65% of market share. All vehicles come prepared with all-weather tires as standard hardware and consumers might choose to replace their original tires with all-weather alternatives for included comfort and year-round execution. In this way, the aftermarket offers a wider variety of all-weather tire options from distinctive brands and with changing performance characteristics to cater to diverse consumer needs.

By Vehicle Type:

Passenger cars is the dominating sub-segment in the All-Weather Tire Market by vehicle type holding around 55% of market share. This dominance can be attributed to the sheer volume of passenger cars on the road compared to commercial vehicles. The passenger car owners are often more likely to prioritize convenience and year-round performance, making all-weather tires a compelling option.

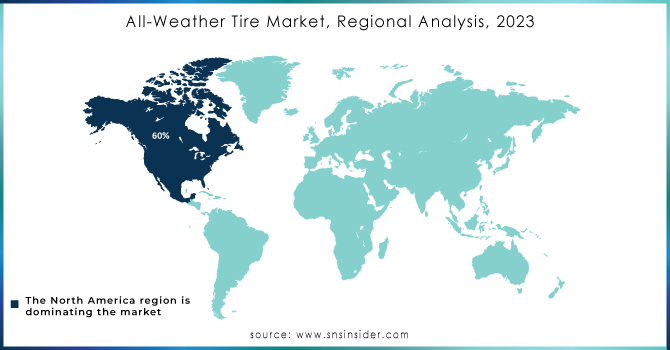

REGIONAL ANALYSIS:

The North America is the dominating region in the all-weather tire market, holding around 60% of market share. This dominance stems from a strong presence of major automakers pre-equipping vehicles with all-weather tires, diverse weather patterns across the region, and a high level of consumer awareness fostered by marketing and educational campaigns. Europe is the second highest region driven by increasingly stringent winter tire regulations that push drivers towards all-weather alternatives for year-round performance. The environmental consciousness and advancements in all-weather tire technology further fuel European market growth.

The Asia Pacific region emerges as the fastest growing market due to its expanding middle class with rising disposable income, leading to increased vehicle ownership and demand for convenient tire solutions. Improving infrastructure and the lack of strict winter tire regulations further solidify the all-weather tire's appeal in this dynamic region.

KEY PLAYERS:

Continental AG (Germany), CEAT Ltd. (India), Bridgestone Corporation (Japan), Pengda Rubber Product Factory (China), Zhejiang PDW Industrial Co., Ltd. (China), Michelin (France), The Goodyear Tyre & Rubber Company (US), Aliner Automotive Equipment Pvt. Ltd. (India), Pirelli & C. S.p.A. (Italy), Sumitomo Corporation (Japan), Yokohama Tire Corporation (Japan), Nokian Tyres plc (Finland), Hankook Tire & Technology Co., Ltd. (South Korea), Toyo Tire Corporation (Japan), Shandong Tang Ren Import and Export Trading Co., Ltd. (China), Hebei Huichao Machinery Parts Co., Ltd. (China), Jiangxi Deyou Technology Co., Ltd. (China), Trading Company (China), Shandong Juling Group (China), Auto Tool Equipment Solution (India), and Qingdao Keter Tyre Co. Ltd are some of the affluent competitors with significant market share in the All-Weather Tire Market.

RECENT DEVELOPMENTS:

-

In January 2024: Ceat introduces Sportrad and Crossrad, a premium line of steel radial motorcycle tires in India. Sportrad caters to high-performance bikes, excelling in speed and cornering, while Crossrad tackles diverse terrains. Both utilize steel-belted radial construction for superior high-speed handling.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 205.71 Billion |

| Market Size by 2032 | US$ 328.20 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Rising consumer awareness about vehicle emissions is likely to promote the use of all-weather tires. • A shift in consumer preference toward fuel-efficient transportation technologies. |

| RESTRAINTS | • The high cost of initial investments is projected to stifle market expansion. • The growth is likely to be hampered by the replacement of all-weather tires with winter tires for intense winter conditions. |