Automotive E Compressor Market Size

Get More Information on Automotive E Compressor Market - Request Sample Report

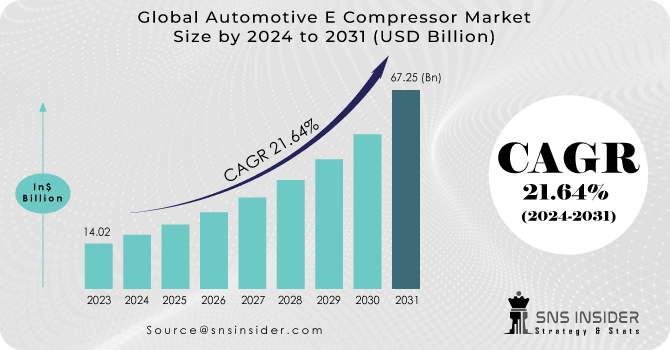

The Automotive E Compressor Market Size was valued at USD 14.02 billion in 2023 and is expected to reach USD 67.25 billion by 2031 and grow at a CAGR of 21.64% over the forecast period 2024-2031.

The automotive E-compressor market is on the brink of a remarkable surge, with projections indicating a YoY growth rate surpassing 24% by 2031. This surge is primarily fueled by the burgeoning electric vehicle (EV) sector. E-compressors, distinct from conventional belt-driven counterparts, operate autonomously using electric motors, aligning perfectly with the electric infrastructure of EVs. Government initiatives, such as China's extension of EV subsidies until 2030 and the US's $7.5 billion investment in EV charging infrastructure, are accelerating EV adoption, thereby driving demand for E-compressors. Moreover, the increasing disposable incomes and growing environmentally conscious populace, particularly in developing countries, are anticipated to significantly elevate the demand for EVs.

This optimistic outlook is attracting substantial investments, exemplified by Denso Corporation's announcement of a $1 billion investment to enhance its E-compressor production capacity. This underscores the mounting confidence in the potential of the E-compressor market and reinforces its pivotal role in the thriving EV revolution.

| Report Attributes | Details |

|---|---|

| Market Segmentation | • by Capacity (Less Than 20 CC, 20-40 CC, 40-60 CC, More Than 60 CC) • by Drivetrain (BEV, HEV, PHEV) • by Vehicle Type (Passenger Vehicles, HCV, LCV, Buses, and Coaches) |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Denso Corporation, Aptiv PLC, MAHLE GmbH, Panasonic Corporation, BorgWarner, Sanden Corporation, Mitsubishi Heavy Industries, Ltd., Robert Bosch GmbH, SCHOTT AG, Hanon Systems, Highly Marelli Holdings Co., Ltd., Toyota Industries Corporation, Valeo S.A., and WABCO |

MARKET DYNAMICS:

KEY DRIVERS:

-

The Market is growing as people become more aware of the importance of choosing the correct oil to safeguard their electric motors

-

The adoption of an electric compressor has been aided by stricter standards for vehicle efficiency and emissions

-

The development of EVs has been aided by technical improvements, which are expected to propel the market

The rise of electric vehicles is driving a simultaneous surge in the automotive E-compressor industry. Unlike conventional compressors powered by engines, E-compressors are electrically operated, making them ideal for EVs. This technological transition offers substantial benefits. E-compressors enable precise regulation of cabin temperature, irrespective of engine activity, ensuring optimal comfort even during electric-only modes. Moreover, their variable speed capabilities enhance efficiency and extend battery range. With the increasing adoption of EVs, the demand for E-compressors is set to soar, reshaping the landscape of in-car climate control.

RESTRAINTS:

-

The market's expansion is hampered by high maintenance costs

-

Due to the lower power of automobile e-compressors compared to conventional compressors, this could stifle expansion

OPPORTUNITIES:

-

As a result of increased spending on e-compressor research and development

-

Manufacturers in the global market benefit from the innovation of new product launches

-

A gain in disposable income, combined with an improvement in living standards, creates an opportunity for market investments

Rising disposable income and a focus on improved living standards are driving a trend towards car ownership, particularly in developing nations. This creates a prime opportunity for the automotive E-compressor market. As consumers seek a comfortable driving experience, the demand for efficient climate control systems will surge. E-compressors, with their ability to deliver superior cooling while reducing emissions and engine strain, are perfectly positioned to benefit from this shift in consumer preferences.

CHALLENGES:

-

Due to a lack of professionals in the vehicle industry

-

Advanced systems are tough for vehicle mechanics to operate, & they also necessitate more heavy-duty electrical wiring

-

Due to growing repair complexity, and total system cost

IMPACT OF RUSSIA-UKRAINE WAR:

The conflict in Ukraine has severely disrupted the fragile supply chain of the automotive E compressor market, a crucial component in air conditioning systems. Prices of neon gas, essential for chip production and largely obtained from Ukraine, have surged by almost 600% since the onset of the conflict. This disruption, combined with sanctions on Russia, a significant aluminum producer (utilized in E compressor housings), is anticipated to result in a 10-15% reduction in global E compressor production in 2023. This could lead to potential delays in car manufacturing for major companies such as Toyota and Volkswagen, which depend on a consistent supply of these components. Consequently, consumers may face higher car prices or extended waiting periods for new vehicles.

IMPACT OF ECONOMIC SLOWDOWN:

Anticipated economic deceleration in 2023 is poised to adversely impact the automotive E compressor market. With consumer expenditure expected to decrease by approximately 5%, the demand for new vehicles, a pivotal factor driving E compressor sales, is likely to diminish. Moreover, the surge in raw material costs experienced in 2023 will exert pressure on production capacities and profit margins of E compressor manufacturers. Consequently, this might result in a temporary halt in market expansion, potentially falling below the previously forecasted 6% growth rate observed in preceding years.

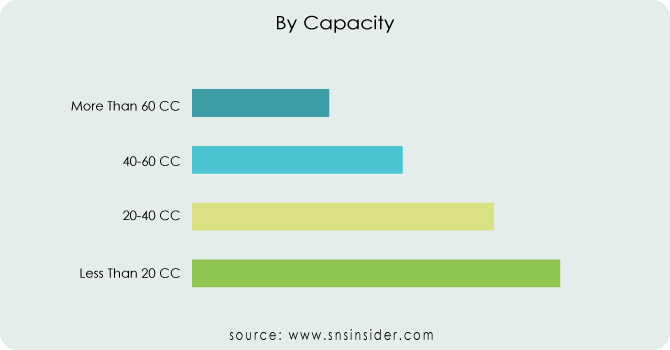

Market, By Capacity:

Based on the capacity segment, the global market has been divided into less than 20 CC, 20-40 CC, 40-60 CC, and more than 60 CC. The 20-40 CC sector is expected to have the greatest CAGR of more than 15%. Due to the deployment of these compressors in smaller cars, the less than 20 CC category accounted for the second-largest share in 2020. Compressors with a cooling capacity of more than 60 CC are necessary thus the more than 60 CC category is predicted to increase moderately.

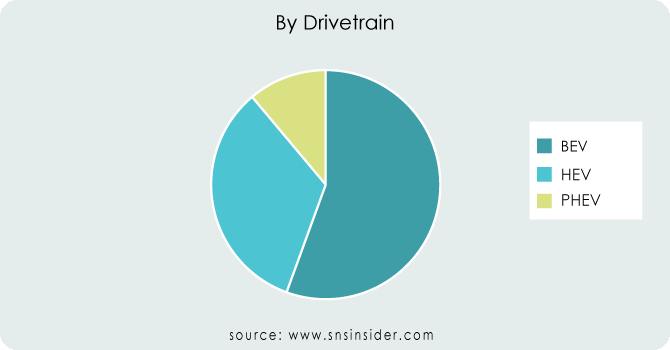

Market, By Drivetrain:

The global market has been divided into BEV, HEV, and PHEV based on the drivetrain segment. Over the projected period, the Battery Electric Vehicle segment is expected to grow at a CAGR of 16.3%. Because hybrid electric vehicles can run on both gasoline and electricity, they accounted for the biggest market share. While the continuing installation of EV charging infrastructure is likely to boost BEV and PHEV adoption.

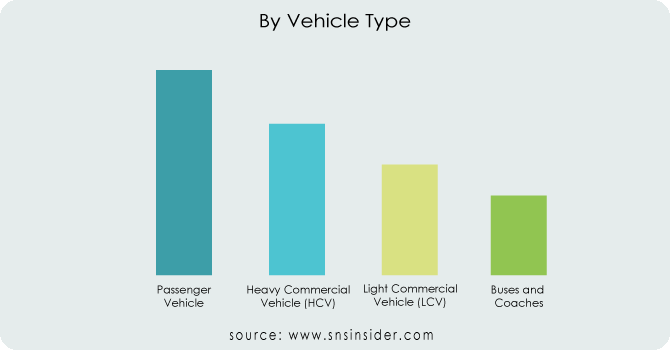

Market, By Vehicle Type:

Based on the vehicle type segment, the global market has been divided into Passenger Vehicles, HCV, LCV, Buses, and Coaches. In 2020, the passenger car segment accounted for more than half of the revenue in the automotive electric compressor market. As part of their attempts to reduce automobile pollution, numerous governments have deployed electric buses for passenger transportation.

Get Customized Report as per your Business Requirement - Request For Customized Report

MARKET SEGMENTATION:

By Capacity:

-

Less Than 20 CC

-

20-40 CC

-

40-60 CC

-

More Than 60 CC

By Drivetrain:

-

BEV

-

HEV

-

PHEV

By Vehicle Type:

-

Passenger Vehicle

-

Heavy Commercial Vehicle (HCV)

-

Light Commercial Vehicle (LCV)

-

Buses and Coaches

REGIONAL ANALYSIS:

Because of China's high rate of EV adoption, the Asia Pacific regional market accounted for a large share of over 55% in 2023. In 2023, China was responsible for more than half of all global electric compressor sales. Over the projection period, the ongoing development of EV charging and transportation infrastructure in developing nations across the Asia Pacific is likely to enhance electric vehicle sales and, as a result, demand for electric compressors. Several important EV manufacturers are based in Asia Pacific countries, such as South Korea and Japan, and are vigorously pursuing various R&D efforts, which bodes well for the Asia Pacific regional market's growth over the forecast period.

Furthermore, because of the growing demand for electric vehicles in various parts of the Asia Pacific area, this region leads the Global Market for Automotive E Compressor growth. Because of its excellent research and development facilities, tier-1 suppliers, and large OEMs, the European region is driving market expansion.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Denso Corporation, Aptiv PLC, MAHLE GmbH, Panasonic Corporation, BorgWarner, Sanden Corporation, Mitsubishi Heavy Industries, Ltd., Robert Bosch GmbH, SCHOTT AG, Hanon Systems, Highly Marelli Holdings Co., Ltd., Toyota Industries Corporation, Valeo S.A., and WABCO are some of the affluent competitors with significant market share in the Automotive E Compressor Market.

RECENT DEVELOPMENTS:

-

Denso Corporation, for instance, has introduced cutting-edge e-compressor solutions aimed at enhancing the efficiency and performance of electric vehicles, thereby contributing to the shift towards sustainable transportation.

-

Continental AG has been focusing on advanced thermal management systems, integrating e-compressors into comprehensive climate control solutions to optimize energy consumption and improve driving comfort.

-

Valeo SA has been leveraging its expertise in electrification to develop compact and lightweight e-compressors, catering to the growing demand for electric and hybrid vehicles worldwide. Meanwhile, Delphi Technologies has been emphasizing on enhancing the durability and reliability of e-compressors through innovative designs and materials, ensuring long-term performance and customer satisfaction.

Aptiv PLC-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 14.02 Billion |

| Market Size by 2031 | US$ 67.25 Billion |

| CAGR | CAGR of 21% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • The Market is growing as people become more aware of the importance of choosing the correct oil to safeguard their electric motors. • The adoption of an electric compressor has been aided by stricter standards for vehicle efficiency and emissions. |

| RESTRAINTS | • The market's expansion is hampered by high maintenance costs. • Due to the lower power of automobile e-compressors compared to conventional compressors, this could stifle expansion. |