Blockchain in Retail Market Report Scope & Overview:

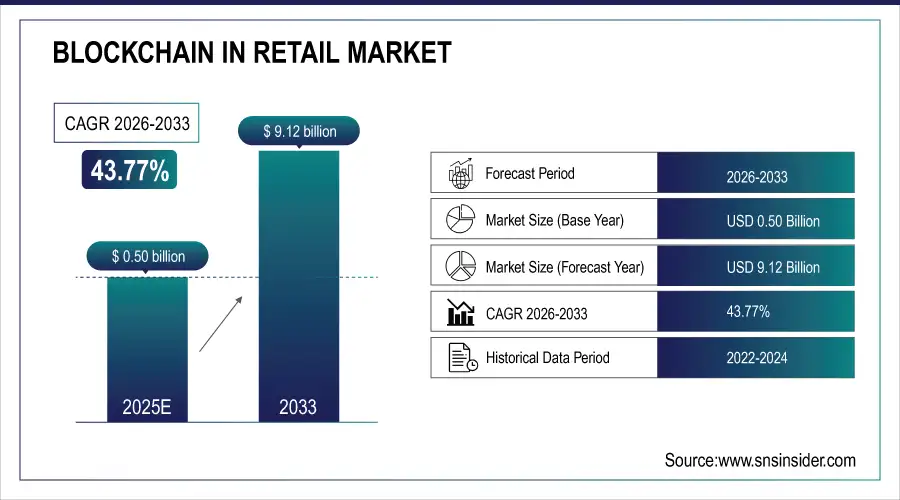

The Blockchain in Retail Market Size was valued at USD 0.50 Billion in 2025E and is expected to reach USD 9.12 Billion by 2033 and grow at a CAGR of 43.77% over the forecast period 2026-2033.

The Blockchain in Retail Market analysis, driven by the market is expanding rapidly as retailers seek greater transparency, traceability, and trust across their supply chains. With growing consumer demand for ethically sourced, authentic, and safe products especially in food, luxury goods, and pharmaceuticals blockchain enables end-to-end visibility from origin to point of sale. This helps reduce fraud, counterfeiting, and quality issues by securely recording product journeys on immutable digital ledgers.

According to study, blockchain-enabled traceability systems reduce counterfeit and fraud incidents by an estimated 30–40%, strengthening brand trust and product authenticity.

Market Size and Forecast:

-

Market Size in 2025: USD 0.50 Billion

-

Market Size by 2033: USD 9.12 Billion

-

CAGR: 43.77% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Blockchain in Retail Market - Request Free Sample Report

Blockchain in Retail Market Trends:

-

Retailers increasingly use blockchain for end-to-end supply chain traceability.

-

Blockchain adoption rising in food and luxury retail to prevent counterfeiting.

-

Integration of blockchain with IoT improves real-time inventory tracking accuracy.

-

Tokenized loyalty programs gaining popularity to enhance customer engagement and retention.

-

Smart contracts streamline supplier agreements and automate retail payment settlements.

-

Emerging markets adopting blockchain alongside rapid growth in e-commerce platforms.

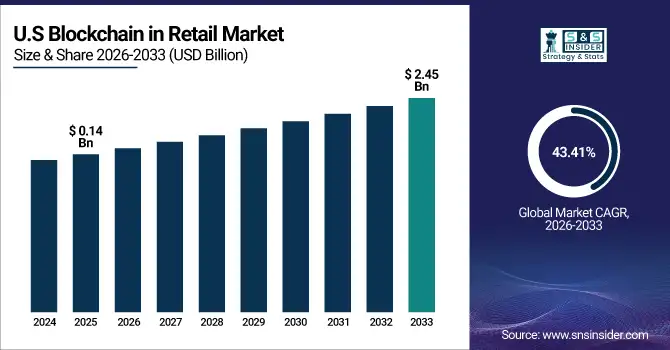

The U.S. Blockchain in Retail Market size was USD 0.14 Billion in 2025E and is expected to reach USD 2.45 Billion by 2033, growing at a CAGR of 43.41% over the forecast period of 2026-2033,

The U.S. blockchain in retail market is expanding rapidly due to advanced digital infrastructure, high e-commerce adoption, and demand for secure payments, supply chain transparency, and loyalty programs. Strong fintech integration and early technology adoption drive sustained market growth.

Blockchain in Retail Market Growth Drivers:

-

Supply chain transparency and anti-counterfeiting needs drive blockchain adoption in retail.

A significant major driver for the blockchain in retail market is the increasing demand for transparency, traceability, and security across retail supply chains. Retailers face challenges such as counterfeit products, inventory mismanagement, supplier fraud, and lack of real-time visibility. Blockchain enables immutable record-keeping, real-time tracking of goods, and end-to-end supply chain transparency, helping retailers verify product authenticity and ensure ethical sourcing. The technology also improves trust between retailers, suppliers, and consumers by providing verifiable product information, which is particularly critical in food, luxury goods, pharmaceuticals, and apparel retail segments.

Ethical sourcing verification enabled by blockchain may impact nearly 25–30% of retail supply chains.

Blockchain in Retail Market Restraints:

-

High implementation costs and integration complexity slow blockchain deployment among retailers.

A challenge lies for the blockchain in retail market is the high cost of implementation and the complexity of integrating blockchain systems with existing retail IT infrastructure. Deploying blockchain solutions requires investment in technology development, skilled personnel, cybersecurity, and system maintenance. Additionally, many retailers rely on legacy systems that are not easily compatible with decentralized blockchain platforms, leading to integration challenges and operational disruptions. Small and mid-sized retailers often face budget constraints and lack technical expertise, which slows blockchain adoption despite its long-term benefits.

Blockchain in Retail Market Opportunities:

-

Digital payments, loyalty programs, and emerging markets unlock blockchain growth opportunities.

A major opportunity lies in the growing use of blockchain for digital payments, smart contracts, customer data management, and loyalty programs, along with market expansion in emerging economies. Blockchain-based payment systems reduce transaction costs, enhance security, and enable faster cross-border transactions. Tokenized loyalty programs improve customer engagement by offering transparent and transferable reward systems. Emerging markets in Asia-Pacific, Latin America, and the Middle East are experiencing rapid digitalization, e-commerce growth, and mobile payment adoption, creating strong demand for blockchain-enabled retail solutions. These trends open significant growth opportunities for blockchain providers and retailers.

Faster cross-border blockchain transactions may reduce retail payment processing time by 30–35%.

Blockchain in Retail Market Segmentation Analysis:

-

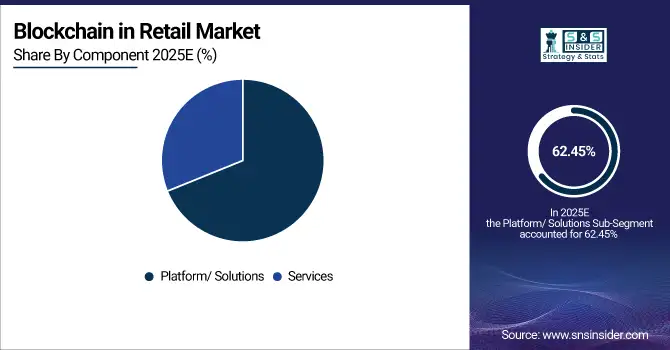

By Component: In 2025, Platform / Solutions led the market with a share of 62.45%, while Services is the fastest-growing segment with a CAGR of 46.10%.

-

By Type: In 2025, Private Blockchain led the market with a share of 41.30%, while Consortium Blockchain is the fastest-growing segment with a CAGR of 45.85%.

-

By Deployment Mode: In 2025, On-Premise led the market with a share of 54.78%, while Cloud-Based is the fastest-growing segment with a CAGR of 47.20%.

-

By Application: In 2025, Supply Chain Management led the market with a share of 36.92%, while Food Safety Management is the fastest-growing segment with a CAGR of 45.23%.

By Component, Platform / Solutions Lead Market and Services Fastest Growth

In 2025, Platform/solutions lead the market, as they provide the foundational architecture for blockchain integration in retail. Retailers adopt these platforms for secure transaction management, loyalty programs, and supply chain transparency. The dominance is supported by demand for end-to-end blockchain infrastructure, enabling seamless implementation of various retail use cases, from payment processing to inventory tracking.

Services are the fastest-growing segment, driven by consulting, integration, and support requirements. As retail businesses increasingly adopt blockchain, demand for professional services to customize platforms, ensure compliance, and maintain operational efficiency is accelerating rapidly.

By Type, Private Blockchain Lead Market and Consortium Blockchain Fastest Growth

In 2025, Private blockchain largest share to the market, favored by retailers who require controlled access, high security, and confidentiality of sensitive business data. Private blockchains are widely adopted for loyalty programs, supply chain operations, and internal transaction validation, making them the primary choice for enterprises seeking restricted network access and governance.

Consortium blockchain is the fastest-growing segment, supported by collaboration between multiple retailers, suppliers, and stakeholders. Consortium networks are expanding rapidly for joint ventures, shared supply chains, and collaborative loyalty programs, enabling interoperability while maintaining privacy and trust among participants.

By Deployment Mode, On-Premise Lead Market and Cloud-Based Fastest Growth

In 2025, On-premise deployment dominated the market, as retailers often prefer to retain full control over blockchain infrastructure and data. On-premise systems are essential for large-scale enterprises managing sensitive transactional or customer data, ensuring compliance with security policies and regulatory requirements.

Cloud-based deployment is the fastest-growing segment, fueled by scalability, lower upfront costs, and faster implementation. Retailers are increasingly adopting cloud blockchain solutions for flexibility, real-time updates, and easy integration with existing ERP, CRM, and supply chain systems.

By Application, Supply Chain Management Lead Market and Food Safety Management Fastest Growth

In 2025, Supply chain management leads the market, driven by the need for transparency, traceability, and efficiency in retail operations. Blockchain enables real-time tracking, fraud reduction, and optimized logistics, making it the primary application across the retail ecosystem.

Food safety management is the fastest-growing application, as regulatory pressure and consumer awareness push retailers to adopt blockchain for traceability, authenticity verification, and quality assurance in food supply chains. Rapid adoption is observed in perishable goods, FMCG, and e-commerce food delivery sectors.

Blockchain in Retail Market Regional Analysis:

North America Blockchain in Retail Market Insights:

The North America dominated the Blockchain in Retail Market in 2025E, with over 38.54% revenue share, due to early adoption of digital technologies, advanced IT infrastructure, and presence of major retail and technology companies. Strong investments in blockchain solutions for supply chain management, payments, and loyalty programs drive market growth. High consumer awareness, supportive regulatory frameworks, and integration with IoT and AI technologies further accelerate adoption. Retailers increasingly leverage blockchain for transparency, fraud prevention, and efficiency, ensuring North America maintains its leading position in the retail blockchain market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Blockchain in Retail Market Insights

The U.S. and Canada lead blockchain adoption in retail due to advanced digital infrastructure, early technology adoption, strong e-commerce growth, and integration of blockchain with payments, loyalty programs, and supply chain management, supporting sustained market growth.

Asia Pacific Blockchain in Retail Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 45.23%, driven by rapid e-commerce growth, increasing smartphone penetration, and rising digital payments adoption. Retailers in China, India, and Southeast Asia implement blockchain for supply chain management, customer data management, and tokenized loyalty programs. Government initiatives promoting digitalization, emerging fintech ecosystems, and growing awareness of blockchain benefits accelerate market expansion. The combination of expanding retail infrastructure, technological adoption, and rising consumer demand positions Asia Pacific as the fastest-growing region.

China and India Blockchain in Retail Market Insights

China and India are rapidly adopting blockchain in retail for supply chain transparency, digital payments, and loyalty programs. Growing e-commerce, government support for blockchain initiatives, and collaborations with fintech companies drive steady market expansion in both countries.

Europe Blockchain in Retail Market Insights

Europe demonstrates steady growth in the blockchain in retail market due to increasing adoption of supply chain transparency, fraud prevention, and digital payment solutions. Retailers focus on customer data security, regulatory compliance, and integration with AI and IoT technologies. Advanced fintech infrastructure, government initiatives supporting blockchain adoption, and collaborative projects between technology providers and retail enterprises enhance market development. Growing use of blockchain for loyalty programs, inventory management, and transaction efficiency further drives market growth across Europe.

Germany and U.K. Blockchain in Retail Market Insights

Germany and the U.K. show steady retail blockchain growth, driven by secure payments, supply chain traceability, and regulatory compliance, with strong collaboration between technology providers and retailers enhancing adoption and innovation.

Latin America (LATAM) and Middle East & Africa (MEA) Blockchain in Retail Market Insights

Latin America and the Middle East & Africa show steady growth in the blockchain in retail market, driven by increasing e-commerce, digital payments, and supply chain modernization. In Latin America, countries like Brazil and Mexico focus on fraud prevention, loyalty programs, and product traceability, supported by government initiatives and fintech partnerships. In the Middle East & Africa, the UAE and Saudi Arabia invest in blockchain-enabled payment systems, smart city programs, and secure transaction management. While challenges such as regulatory hurdles and limited digital literacy exist, increasing infrastructure development, mobile payment adoption, and international collaborations enhance long-term market potential across both regions.

Blockchain in Retail Market Competitive Landscape:

Oracle Corporation offers blockchain solutions for the retail sector to enhance supply chain transparency, secure transactions, and improve traceability of goods. Its Oracle Blockchain Platform enables retailers to track inventory, prevent counterfeiting, and streamline payments using smart contracts. By integrating cloud, AI, and analytics, Oracle supports secure, real-time data sharing among suppliers, distributors, and customers, helping retailers improve operational efficiency, compliance, and customer trust in a highly competitive market.

-

In February 2025, Oracle launched an Oracle Retail Blockchain Module that integrates with Oracle Fusion Cloud, allowing retailers to securely trace products from source to shelf and reduce fraud in gift‑card and return systems.

SAP SE provides blockchain-enabled retail solutions via its SAP Business Technology Platform, allowing seamless tracking of products, payments, and supply chain events. Its services integrate blockchain with ERP, IoT, and analytics to enhance transparency, traceability, and fraud prevention. SAP helps retailers improve efficiency, reduce operational risks, and ensure regulatory compliance. By enabling real-time data exchange across suppliers, logistics, and consumers, SAP drives trust, sustainability, and innovation in the retail blockchain ecosystem.

-

In April 2025, SAP introduced new blockchain‑enabled capabilities within SAP Business Network for Retail, allowing secure multi‑party sharing of product lifecycle data to enhance transparency and optimize omnichannel fulfillment.

Amazon Web Services (AWS) offers blockchain services for retailers through Amazon Managed Blockchain and related tools, enabling secure, scalable networks for supply chain and transaction management. AWS facilitates product provenance tracking, smart contract execution, and real-time data sharing across partners. Its cloud-based blockchain solutions integrate with analytics, IoT, and AI to optimize inventory, improve transparency, and prevent fraud. AWS empowers retailers to enhance operational efficiency, reduce costs, and strengthen consumer trust using decentralized ledger technology.

-

In January 2025, AWS launched Amazon Managed Blockchain Retail Framework, providing pre‑built templates for loyalty tokens, decentralized payment systems, and authenticated product origins for omnichannel retail.

Blockchain in Retail Market Key Players:

Some of the blockchain in retail market Companies

-

IBM Corporation

-

Microsoft Corporation

-

Oracle Corporation

-

SAP SE

-

Amazon Web Services (AWS)

-

Google LLC

-

Alibaba Group

-

Accenture plc

-

Infosys Limited

-

Tata Consultancy Services (TCS)

-

Cognizant Technology Solutions

-

Capgemini SE

-

Wipro Limited

-

Tech Mahindra Limited

-

Deloitte Touche Tohmatsu Limited

-

Ernst & Young (EY)

-

KPMG International

-

PricewaterhouseCoopers (PwC)

-

R3 (R3 Blockchain LLC)

-

Consensys International

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 0.50 Billion |

| Market Size by 2033 | USD 9.12 Billion |

| CAGR | CAGR of 43.77% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Platform/Solutions, Services) •By Type (Public Blockchain, Private Blockchain, Consortium Blockchain) •By Deployment Mode (On-Premise, Cloud-Based) •By Application (Supply Chain Management, Food Safety Management, Customer Data Management, Identity Management, Compliance Management, Billing Transaction Processing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Amazon Web Services (AWS), Google LLC, Alibaba Group, Accenture plc, Infosys Limited, Tata Consultancy Services (TCS), Cognizant Technology Solutions, Capgemini SE, Wipro Limited, Tech Mahindra Limited, Deloitte Touche Tohmatsu Limited, Ernst & Young (EY), KPMG International, PricewaterhouseCoopers (PwC), R3 (R3 Blockchain LLC), and Consensys International. |