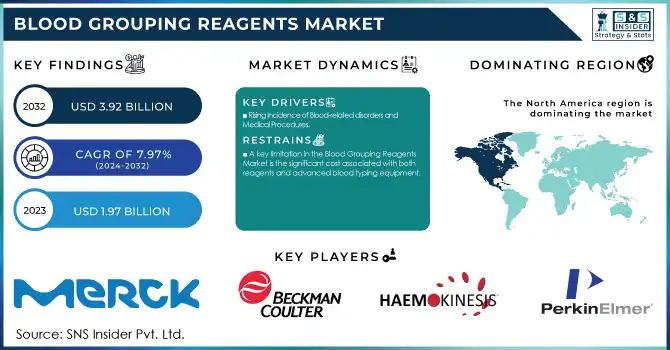

Blood Grouping Reagents Market Report Scope & Overview:

The Blood Grouping Reagents Market size was estimated at USD 1.97 billion in 2023 and is expected to reach USD 3.92 billion by 2032 at a CAGR of 7.97% during the forecast period of 2024-2032. The blood grouping reagents market is gradually expanding due to the increasing need for accurate blood typing, which is expected to be used in several medical applications. Since over 118 million blood donations are made every year worldwide, which emphasizes the necessity of compatibility testing, the World Health Organization states that blood transfusions are important in medical treatments. The reagents that include red blood cells and antisera for blood grouping are critical in ensuring that blood transfusion does not induce undesirable responses. In this case, accurate identification of an individual's blood group requires the use of reagent antisera, such as those produced by Beckman Coulter.

Get more information on Blood Grouping Reagents Market - Request Sample Report

Technological advancement in the field of blood typing systems is changing the market. Automated systems, which provide results faster and more accurately than traditional methods, are being increasingly installed in hospitals and diagnostic laboratories. For instance, the Ortho Vision platform has reduced testing time by a huge margin due to the availability of automated blood typing analyzers, which allows them efficient blood compatibility assessments. The system processes up to 800 samples per hour, which is quite efficient compared to its manual counterparts.

Another driver that is increasing the demand for blood typing reagents is the growing prevalence of chronic conditions. Some of these conditions include chronic anemia, sickle cell disease, and hemophilia. According to the Centers for Disease Control and Prevention, sickle cell disease affects approximately 100,000 Americans and many require regular blood transfusions, which further play a critical role in blood grouping reagents. More recently, organ transplant surgeries wherein the blood group needs to be identified precisely have also been a driving force for the market. In 2024, the United States recorded a record number of organ transplants at more than 48,000 procedures a 3.3% increase from 2023. This is a landmark achievement that reflects the critical importance of accurate blood type identification in ensuring organ compatibility during transplantation.

Another factor that favors growth in the market is an increase in the number of donations of blood globally. In 2024, the American Red Cross called for an emergency blood shortage because its national blood inventory had plummeted by over 25% since July 1. Causes for this include extreme heat which impacts blood drives, seasonal travel, and hurricane season. As it supplies roughly 40% of the country's blood donations, the urgency to conduct intensive blood group testing to ensure donor and recipient safety is paramount. The blood grouping reagents are regulated by various regulatory agencies, such as the FDA and AABB, to ensure very strict quality control standards to make blood testing reliable and safe. Such factors, improving with the advancement of reagent technology, will continue to fuel the market's growth to increase the efficiency and safety of blood transfusion procedures all over the world.

Blood Grouping Reagents Market Dynamics

Drivers

-

The innovations in diagnostic technologies, especially with the development of automated blood typing systems, will drive the Blood Grouping Reagents Market.

These systems increase the accuracy and efficiency with which blood compatibility testing can be done and provide error-free results more quickly. Automated platforms from companies such as Ortho Clinical Diagnostics enable rapid processing of large volumes of blood samples in laboratories and are particularly useful in the high-demand environments of hospitals and blood banks. These systems also ensure better standardization and reliability in blood typing, thus becoming increasingly more sought after in clinical practice. As hospitals and diagnostic centers start adopting more advanced systems, the blood grouping reagents market increases further, thus giving precise and effective solutions for patient care and safety during transfusions.

-

Rising Incidence of Blood-related disorders and Medical Procedures.

The increasing cases of blood disorders including anemia, sickle cell disease, and hemophilia all require repeated transfusions. Due to the presence of a rise in patients with chronic conditions, the need for accurate blood typing reagents occurs to avoid a transfusion reaction. The trend of medical treatments like organ transplants and surgery requires exact matching with blood, resulting in a similar increase in the market. According to the Centers for Disease Control and Prevention, sickle cell disease affects approximately 100,000 Americans, most of whom are on a chronic blood transfusion. The need for ongoing blood grouping reagents in the treatment processes is simply immense.

-

Public awareness campaigns and growing global efforts to ensure the safety of blood donations are helping to drive the Blood Grouping Reagents Market.

Organizations such as the American Red Cross and the World Health Organisation consider regular donation and the safety of blood transfusions of utmost importance. With millions participating in these campaigns, it becomes essential to maintain accurate typing for blood matching to ensure that donor and recipient compatibility is obtained. For example, alone the American Red Cross collects over 13 million blood donations a year, further demonstrating the essential importance of accurately-typed reagents in keeping transfusions safe. Moreover, raising awareness amongst the general populace on the requirement for blood typing as part of health management propels the need for these reagents, making it a constant driver of the growth in the Blood grouping reagents market.

Restraints

-

A key limitation in the Blood Grouping Reagents Market is the significant cost associated with both reagents and advanced blood typing equipment.

With high-quality reagents and automated systems, the primary investment may often be expensive enough to prove inhibitive, especially for smaller or resource-limited facilities and regions. The high cost often becomes a burden for hospitals and labs to embrace the advancement in technology or maintain consistent stocks of such reagents. Additionally, the operations and maintenance of automated systems escalate the cost profile. Hence, even though technological advancements have reduced the time and accuracy used in blood typing, the high costs may be a challenge to inhibit entry into the market for several aspects, like most regions cannot afford the necessary techniques. This makes it the greatest challenge for wide-scale use, and affordable access to trusted blood typing.

Blood Grouping Reagents Market Segmentation Analysis

By Product

The consumables segment held the largest share in the blood grouping reagents market with 56.2% in 2023, primarily due to the high and recurring demand for test kits, reagents, and blood typing sera. Consumables are used in vast numbers in hospitals, diagnostic laboratories, and blood banks for daily blood typing and cross-matching. With increasing cases of chronic diseases, trauma incidents, and surgical procedures being carried out in hospitals worldwide, the demand for reliable and affordable consumables also continues to grow.

The instruments segment is expected to grow the fastest in the blood grouping reagents market during the forecast period. This is primarily due to the increasing adoption of automated blood typing analyzers and high-throughput systems in blood banks, hospitals, and diagnostic laboratories. Automation in blood testing highly improves efficiency, reduces human error, and offers faster and more accurate results, thereby increasing the demand for sophisticated instruments.

By Technique

The PCR-based and microarray techniques segment dominated the blood grouping reagents market in 2023 with a 38.9% share due to its superior accuracy, sensitivity, and ability to identify complex blood group antigens. Polymerase Chain Reaction allows for the detection of rare and weak antigens that conventional serological methods may fail to detect, which makes it extremely valuable in transfusion medicine. Microarray techniques also permit high-throughput and multiplex blood typing, greatly enhancing efficiency in large-scale screening programs. Increased demand for molecular-based blood typing in organ transplantation, prenatal testing, and hematological research further accelerated the growth of this segment.

The fastest growing sector in the blood grouping reagents market is massively parallel sequencing techniques. MPS can generate highly comprehensive genetic profiling of blood group antigens and can test the genes related to blood groups on a simultaneous scale, allowing a better understanding of the variations involved and the compatibility risk. MPS technology is gathering momentum for applications related to personalized transfusion medicine, the identification of rare blood types, and assessing compatibility for transplantation purposes.

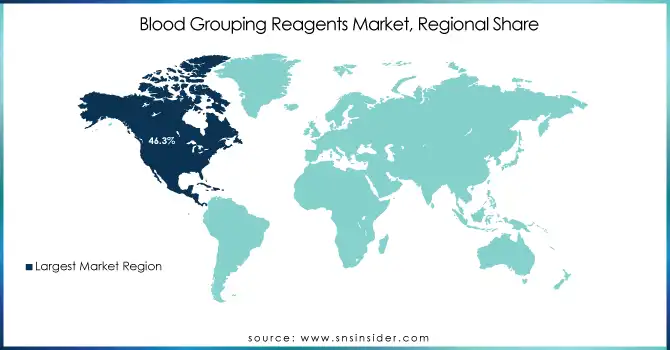

Regional Analysis

The North American blood grouping reagents market accounted for the largest share of 46.3% in 2023, attributed to the presence of a well-established healthcare infrastructure, high blood-donation rate, and strong regulatory support that ensures the safety of blood. The blood grouping reagents market is also driven by the key operating players of the market, continuous developments in technology, and the upsurging automated blood typing instruments. In addition, the rising prevalence of chronic diseases, cancer, and trauma cases in the U.S. and Canada is fueling the demand for blood transfusions and compatibility tests. Additionally, market growth is driven to more aggressively enforce the stringent regulations formulated by regulatory agencies such as FDA, and AABB.

Due to growing healthcare investments, awareness about blood safety, and blood donations the Asia-Pacific is expected to grow at the fastest rate. China, India, and Japan are significant countries in the supply of diagnostics technologies and automation in blood banks due to the increasing prevalence of chronic diseases, road accidents, and surgeries that have fueled the demand for accurate blood typing. Emerging economies, where governments are focused on promoting voluntary blood donation along with increasing healthcare facilities, are also contributing to the growth of the market.

Need any customization research on Blood Grouping Reagents Market - Enquiry Now

Key Players & Their Blood Grouping Reagent Products

-

Merck KGaA – Anti-Human Globulin, Blood Typing Reagents

-

Bio-Rad Laboratories, Inc. – IH-1000, IH-500, IH-Com, IH-Card, IH-Complete, IH-Reader

-

Beckman Coulter, Inc. – PK7400 Automated Microplate System, Microplates for Blood Grouping

-

Haemokinesis Pty Ltd – QWALYS 3 EVO, QWALYS 4, Erytra Blood Grouping Analyzer

-

MTC Med. Produkte GmbH – MTC ABO and RhD Typing Reagents

-

DAY Medical SA – MD-DayGel, DayPlate, DayEry, DayReagent

-

Rapid Labs Ltd – Rapid Labs ABO & RhD Blood Grouping Reagents

-

Ortho Clinical Diagnostics – ORTHO VISION, ORTHO BioVue System, ORTHO Workstation

-

Diagast SAS – E.M. Technology, QWALYS 3, Erytra

-

Atlas Medical – Atlas Blood Grouping Reagents, Atlas Gel Cards

-

Alba Bioscience Limited – ALBAclone, ALBAcheck, ALBAsera

-

PerkinElmer – LABChip GX, DELFIA Blood Grouping Kits

-

Lorne Laboratories Limited – Lorne Blood Grouping Reagents, Lorne ABO & RhD Typing Kits

-

BAG Diagnostics – BAGene ABO Genotyping Kit, BAGene RhD Genotyping Kit

-

Biorex Diagnostics – Biorex ABO & RhD Typing Reagents

-

Cardinal Health – Cardinal Health Blood Bank Reagents

-

Thermo Fisher Scientific Inc. – ProVue, ScanGel, Oxoid Blood Typing Reagents

-

Yuvraj Biobiz Incubator India Pvt – YBIO Blood Typing Reagents

-

Tulip Diagnostics – Tulip ABO & Rh Blood Grouping Reagents

-

Aikang – Aikang Blood Typing Reagents, Aikang Gel Card System

Recent Trends

In Sept 2024, Researchers from NHS Blood and Transplant (Bristol), IBGRL, and the University of Bristol discovered a new blood group system, MAL, solving a 50-year-old mystery. They identified the genetic basis of the previously enigmatic AnWj antigen, enabling better identification and treatment of rare patients lacking this blood group.

In May 2022, the EU enforced the new In-Vitro Diagnostic Regulation (IVDR) to enhance the safety and performance of diagnostic devices. Following this, ALBA Bioscience received Class C Blood Grouping Reagents product group certification under IVDR, ensuring compliance with the updated regulatory standards.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 1.97 Billion |

|

Market Size by 2032 |

USD 3.92 Billion |

|

CAGR |

CAGR of 7.97% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product [Consumables, Instruments, Service And Software] |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Merck KGaA, Bio-Rad Laboratories, Inc., Novacyt Group, Beckman Coulter, Inc., Haemokinesis Pty Ltd, MTC Med. Produkte GmbH, DAY Medical SA, Rapid Labs Ltd, Ortho Clinical Diagnostics, Diagast SAS, Atlas Medical, Alba Bioscience Limited, PerkinElmer, Lorne Laboratories Limited, BAG Diagnostics, Biorex Diagnostics, Cardinal Health, Thermo Fisher Scientific Inc., Yuvraj Biobiz Incubator India Pvt, Tulip Diagnostics, Aikang |

|

Key Drivers |

• The innovations in diagnostic technologies, especially with the development of automated blood typing systems, will drive the Blood Grouping Reagents Market. |

|

Restraints |

• A key limitation in the Blood Grouping Reagents Market is the significant cost associated with both reagents and advanced blood typing equipment. |