Blow-Fill-Seal Technology Market Report Scope & Overview:

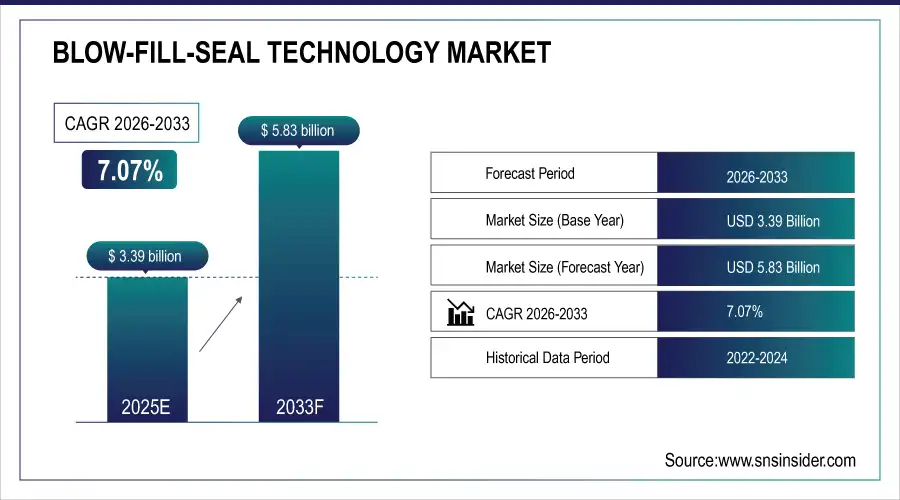

Blow-Fill-Seal Technology Market was valued at USD 3.39 billion in 2025E and is expected to reach USD 5.83 billion by 2033, growing at a CAGR of 7.07% from 2026-2033.

Get More Information on Blow-Fill-Seal Technology Market - Request Sample Report

The Blow-Fill-Seal Technology Market is expanding due to growing demand for sterile, contamination-free packaging in pharmaceuticals, biologics, and vaccines. Rising production of injectable drugs, combined with stringent regulatory requirements for aseptic manufacturing, is driving adoption. The technology offers high-speed filling, reduced human contact, improved safety, and minimized product wastage, making it highly efficient. Increasing applications in personalized medicine, liquid drugs, and industrial automation, along with cost-effectiveness and scalability, further support widespread utilization, fueling substantial global market growth.

SCHOTT Pharma offers advanced aseptic filling solutions, including the iQ Integribag, ensuring sterility and seal integrity through a double-bag system with Tyvek and laminate materials, enhancing safety and reducing contamination risks.

Curida specializes in Blow-Fill-Seal (BFS) and nasal spray technologies, operating six BFS lines with an annual capacity of over 165 million units, producing LDPE ampoules and bottles ranging from 0.15 to 30 ml for sterile pharmaceutical applications.

Market Size and Forecast

-

Market Size in 2025: USD 3.39 Billion

-

Market Size by 2033: USD 5.83 Billion

-

CAGR: 7.07% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Blow-Fill-Seal Technology Market Trends

-

Rising demand for sterile and high-quality pharmaceutical packaging is driving the blow fill seal (BFS) technology market.

-

Growing adoption in injectable drugs, vaccines, and biologics is boosting market growth.

-

Integration with automation and advanced robotics is enhancing production efficiency and reducing contamination risks.

-

Expansion of contract manufacturing, biotech, and pharmaceutical industries is fueling BFS deployment.

-

Focus on regulatory compliance, product safety, and quality assurance is shaping market trends.

-

Advancements in multi-layer containers, customized formats, and high-speed filling systems are improving versatility.

-

Collaborations between technology providers, pharmaceutical companies, and research institutions are accelerating innovation and commercialization.

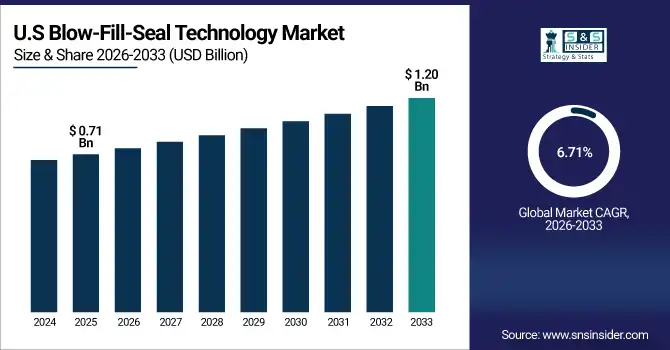

U.S. Blow-Fill-Seal Technology Market was valued at USD 0.71 billion in 2025E and is expected to reach USD 1.20 billion by 2032, growing at a CAGR of 6.71% from 2026-2033.

The U.S. Blow-Fill-Seal Technology Market is growing due to rising demand for sterile pharmaceutical packaging, increased biologics production, stringent regulatory standards, and adoption of automated, high-efficiency filling systems in pharmaceutical and healthcare industries.

Blow-Fill-Seal Technology Market Growth Drivers:

-

Rapid adoption of automated and sterile filling solutions in pharmaceutical manufacturing is driving global Blow-Fill-Seal Technology Market growth significantly

The increasing demand for aseptic and contamination-free packaging in pharmaceuticals is accelerating the adoption of Blow Fill Seal (BFS) technology globally. BFS technology enables high-speed, sterile filling of liquid drugs, vaccines, and injectables with minimal human intervention, ensuring product safety and quality. Rising prevalence of chronic diseases, expansion of biologics and vaccines, and regulatory compliance with stringent sterility standards further boost BFS implementation. Manufacturers are investing in automated systems to improve efficiency, reduce operational costs, and enhance production capacity, driving substantial market growth and widespread adoption across pharmaceutical and biotech industries worldwide.

Blow-Fill-Seal Technology Market Restraints:

-

Limited awareness and regulatory compliance challenges in emerging markets hinder Blow Fill Seal Technology adoption globally

Emerging regions often lack sufficient knowledge about BFS benefits, including sterility, speed, and contamination reduction. Pharmaceutical companies may be hesitant to adopt BFS due to unfamiliarity with operational protocols and validation procedures. Compliance with international standards such as FDA, EMA, and WHO regulations requires extensive documentation, testing, and quality control, creating barriers for market entry. Training personnel and ensuring consistent adherence to regulatory guidelines increases operational complexity. These challenges limit the rapid adoption of BFS systems in developing markets, restraining the technology’s global growth despite rising demand for sterile packaging solutions in pharmaceuticals and biologics.

Blow-Fill-Seal Technology Market Opportunities:

-

Expansion into biologics, vaccines, and personalized medicine packaging presents significant growth opportunities for Blow Fill Seal Technology

The growing demand for biologics, vaccines, and complex injectable drugs is driving BFS technology adoption. BFS systems provide sterile, single-use packaging suitable for sensitive biologics, reducing contamination risks and extending product shelf life. Personalized medicine and emerging therapies require precise, small-batch filling, which BFS can efficiently handle. Investment in R&D, combined with increasing government initiatives supporting vaccine distribution, enhances market prospects. Pharmaceutical and biotech companies are exploring BFS for new product launches, creating avenues for growth in advanced drug delivery, sterile packaging innovation, and global expansion of Blow Fill Seal solutions across healthcare industries.

Blow-Fill-Seal Technology Market Segment Highlights

-

By Product Type, Bottles dominated with ~47% share in 2025; Vials fastest growing (CAGR).

-

By End Use, Pharmaceuticals dominated with ~56% share in 2025; Cosmetics & Personal Care fastest growing (CAGR).

-

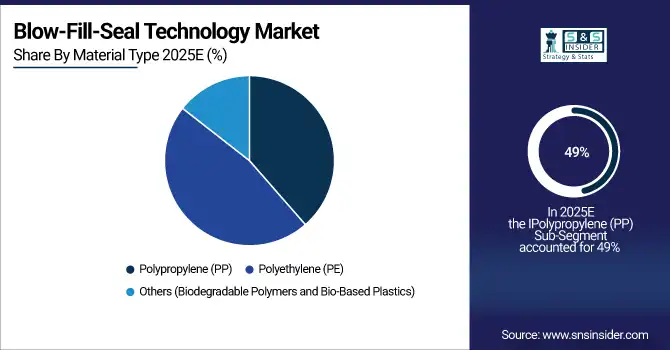

By Material Type, Polypropylene (PP) dominated with ~49% share in 2025; Polypropylene (PP) fastest growing (CAGR).

Blow-Fill-Seal Technology Market Segment Analysis

By Product Type, Bottles dominated in 2025; vials expected fastest growth 2026–2033 due to injectable drugs and vaccine demand.

Bottles segment dominated the Blow-Fill-Seal Technology Market in 2025 due to their widespread usage in liquid pharmaceuticals, ease of production, and compatibility with automated filling systems. Bottles offer durability, precise dosing, and contamination prevention, making them the preferred choice across pharmaceutical, cosmetic, and industrial liquid packaging applications.

Vials segment is expected to grow at the fastest CAGR from 2026-2033 owing to increasing demand for injectable drugs, vaccines, and biologics. Their compact size, sterility, and compatibility with advanced filling technologies make vials ideal for high-precision pharmaceutical applications, driving rapid adoption across hospitals, laboratories, and biopharmaceutical manufacturing globally.

By End Use, Pharmaceuticals led in 2025; cosmetics & personal care projected fastest growth 2026–2033 from hygienic, prefilled packaging needs.

Pharmaceuticals segment dominated the Blow-Fill-Seal Technology Market in 2025 due to the high requirement for sterile liquid medications, vaccines, and parenteral drugs. BFS technology ensures contamination-free filling, precise dosing, and regulatory compliance, making it essential for pharmaceutical manufacturers, thereby securing the largest revenue share in the market.

Cosmetics & Personal Care segment is expected to grow at the fastest CAGR from 2026-2033 due to rising demand for hygienic, prefilled, and travel-friendly liquid packaging solutions. BFS technology offers enhanced product safety, customization, and aesthetic appeal, encouraging adoption in skincare, haircare, and beauty product packaging globally.

By Material Type, Polypropylene (PP) dominated in 2025 and is expected fastest growth 2026–2033 due to chemical resistance and single-use packaging demand.

Polypropylene (PP) segment dominated the Blow-Fill-Seal Technology Market in 2025 due to its excellent chemical resistance, lightweight nature, and cost-effectiveness, making it ideal for sterile liquid packaging. Its high clarity, durability, and compatibility with automated BFS processes ensure safe and efficient filling of pharmaceuticals and personal care liquids. The segment is also expected to grow at the fastest CAGR from 2026-2033, driven by increasing demand for single-use, contamination-free packaging and expanding applications in injectable drugs, vaccines, and cosmetic liquids globally.

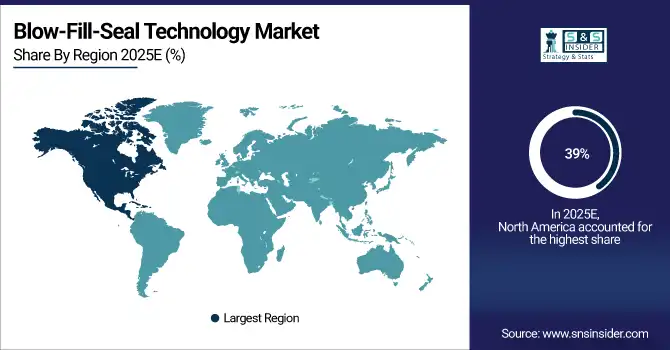

Blow-Fill-Seal Technology Market Regional Analysis

North America Blow-Fill-Seal Technology Market Insights

North America dominated the Blow-Fill-Seal Technology Market in 2025 with significant revenue share of 39%, due to advanced pharmaceutical manufacturing infrastructure, rising biologics and vaccine production, and stringent regulatory standards. The region’s focus on sterile, high-quality packaging solutions, coupled with growing adoption of automation and high-efficiency filling systems, supports market growth. Increasing demand from healthcare, biotechnology, and life sciences sectors further strengthens regional dominance and revenue generation in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Blow-Fill-Seal Technology Market Insights

Asia Pacific held the second-largest share in the Blow-Fill-Seal Technology Market in 2025 due to rapid industrialization, expanding pharmaceutical and biotechnology sectors, and increasing vaccine and biologics production. High adoption of automated filling systems, growing demand for sterile packaging, and supportive government initiatives for healthcare infrastructure further drive regional market growth and revenue generation.

Europe Blow-Fill-Seal Technology Market Insights

Europe accounted for a significant share in the Blow-Fill-Seal Technology Market in 2025 due to advanced pharmaceutical and biotechnology industries, strict regulatory compliance, and emphasis on sterile, high-quality packaging. Growing vaccine production, biologics manufacturing, and adoption of automated, efficient filling systems drive demand. Supportive government initiatives, increasing healthcare infrastructure, and focus on patient safety further boost the region’s market growth and revenue potential.

Middle East & Africa and Latin America Blow-Fill-Seal Technology Market Insights

Middle East & Africa and Latin America are witnessing steady growth in the Blow-Fill-Seal Technology Market due to expanding pharmaceutical manufacturing, increasing vaccine production, and rising demand for sterile packaging solutions. Growing healthcare infrastructure, government initiatives supporting local pharmaceutical industries, and adoption of automated, efficient filling systems drive market expansion. Awareness of high-quality, contamination-free packaging further contributes to the regions’ market growth and revenue potential in 2025 and beyond.

Blow-Fill-Seal Technology Market Competitive Landscape:

Rommelag Kunststoff-Maschinen Vertriebsgesellschaft mbH

Rommelag Kunststoff-Maschinen is a leading manufacturer of high-precision Blow-Fill-Seal (BFS) machines, serving pharmaceutical, biotechnology, and vaccine industries. The company focuses on innovative solutions to ensure sterility, product integrity, and operational efficiency. Rommelag emphasizes advanced technology in automated filling, packaging, and container handling, aiming to protect sensitive products during manufacturing. Their systems are designed to meet strict regulatory standards while optimizing throughput and reducing contamination risks.

-

2024: Rommelag's coolBFS technology protects products like vaccines from elevated heat levels of conventional BFS processes by cooling freshly formed containers before and after filling.

Catalent, Inc.

Catalent, Inc. is a global provider of advanced delivery technologies and development solutions for pharmaceuticals, biologics, and consumer health products. The company offers integrated manufacturing platforms, including Blow-Fill-Seal (BFS) technology, to enhance efficiency, safety, and sterility in drug packaging. Catalent emphasizes innovation in drug delivery and sterile manufacturing, helping clients accelerate time-to-market while maintaining rigorous quality standards. Their solutions support single-dose formats, liquid products, and sterile containers in highly regulated industries.

-

2024: Catalent's Blow-Fill-Seal (BFS) technology offers a fully integrated solution for the production of sterile, single-dose containers, enhancing efficiency and reducing contamination risks.

Unipharma LLC

Unipharma LLC specializes in Blow-Fill-Seal (BFS) technology for pharmaceutical manufacturing, focusing on the cost-effective production of sterile, single-dose products. The company leverages automation and high-precision filling systems to minimize contamination risks while maximizing operational efficiency. Unipharma serves a range of pharmaceutical applications, including injectables, oral liquids, and vaccines, adhering to strict regulatory standards. Their solutions provide scalable, reliable, and efficient packaging options for global healthcare providers.

-

2024: Unipharma LLC specializes in Blow-Fill-Seal (BFS) technology for sterile, single-dose pharmaceutical products, offering a cost-effective and efficient packaging solution.

Weiler Engineering, Inc.

Weiler Engineering, Inc. manufactures Blow/Fill/Seal (BFS) machines for liquid pharmaceutical and nutraceutical products. The company focuses on flexible, automated solutions for packaging oral supplements, vitamins, and liquid medicines. Weiler offers custom single-use containers in various shapes and materials, with features such as twist-off, snap-off, and re-closable tops. Their technology ensures product safety, sterility, and operational efficiency while meeting strict quality and regulatory standards for global pharmaceutical manufacturing.

-

2024: Weiler Engineering's Blow/Fill/Seal machines efficiently package liquid oral supplements, offering custom single-use containers with twist-off, snap-off, and re-closable options.

Asept Pak, Inc.

Asept Pak, Inc. provides advanced Blow-Fill-Seal (BFS) solutions for sterile pharmaceutical packaging. The company focuses on automating single-dose production, reducing contamination risks, and enhancing manufacturing efficiency. Asept Pak serves a variety of pharmaceutical applications, including injectables, vaccines, and liquid medications. Their BFS systems are engineered for high precision, reliability, and compliance with strict regulatory standards, helping manufacturers scale production while ensuring product safety and operational excellence.

-

2024: Asept Pak, Inc. provides Blow-Fill-Seal (BFS) technology solutions for sterile, single-dose pharmaceutical products, focusing on automation and efficiency.

Biocorp Production

Biocorp Production is a specialized manufacturer of Blow-Fill-Seal (BFS) technology for sterile pharmaceutical packaging. The company offers automated systems for single-dose production, emphasizing cost-effective, high-throughput solutions. Biocorp supports manufacturers in producing vaccines, injectables, and liquid medications with stringent sterility requirements. Their BFS platforms are designed to enhance production efficiency, reduce contamination risks, and comply with global regulatory standards, making them a trusted partner in the pharmaceutical industry.

-

2024: Biocorp Production specializes in Blow-Fill-Seal (BFS) technology for sterile, single-dose pharmaceutical products, offering a cost-effective and efficient packaging solution.

Key Players

Some of the Blow-Fill-Seal Technology Market Companies

-

Amanta Healthcare Ltd.

-

Unither Pharmaceuticals

-

Rommelag Kunststoff-Maschinen Vertriebsgesellschaft mbH

-

Catalent, Inc.

-

Curida AS

-

Unipharma LLC

-

Weiler Engineering, Inc.

-

Schott AG

-

West Pharmaceutical Services

-

Biocorp Production

-

Stevanato Group

-

SMC Ltd.

-

Groninger & Co. GmbH

-

Ismeca Semiconductor

-

Pharmapack Co. Ltd.

-

Automatic Liquid Packaging Solutions LLC

-

Asept Pak, Inc.

-

NuPharm

-

BioConnection

- Plastikon

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.39 Billion |

| Market Size by 2033 | USD 5.83 Billion |

| CAGR | CAGR of 7.07% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type(Bottles, Vials, Ampoules) • By Material Type(Polyethylene (PE), Polypropylene (PP), Others) • By End Use(Pharmaceuticals, Food & Beverage, Cosmetics & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amanta Healthcare Ltd., Unither Pharmaceuticals, Rommelag Kunststoff-Maschinen Vertriebsgesellschaft mbH, Catalent, Inc., Curida AS, Unipharma LLC, Weiler Engineering, Inc., Schott AG, West Pharmaceutical Services, Biocorp Production, Stevanato Group, SMC Ltd., Groninger & Co. GmbH, Ismeca Semiconductor, Pharmapack Co. Ltd., Automatic Liquid Packaging Solutions LLC, Asept Pak, Inc., NuPharm, BioConnection, Plastikon |