Water Soluble Packaging Market Report Scope & Overview:

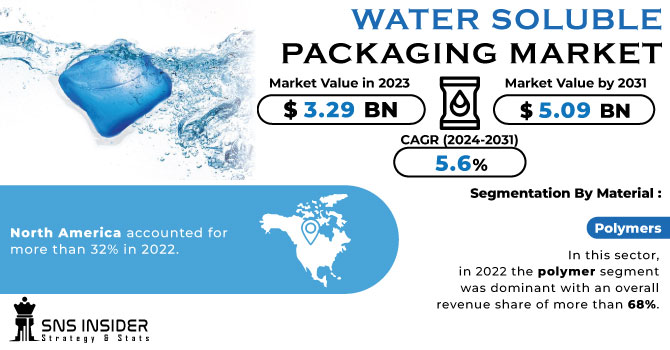

The Water Soluble Packaging Market size was USD 3.29 billion in 2023 and is expected to Reach USD 5.09 billion by 2031 and grow at a CAGR of 5.6 % over the forecast period of 2024-2031.

The packaging has been designed to dissolve in water, which means it is an environmentally viable alternative to traditional packaging materials like plastics, glass and metal. Rising concerns about the environment, as well as a shift in consumer demand for sustainable packaging solutions, are contributing to the growth of the water soluble packaging market.

Get More Information on Water Soluble Packaging Market - Request Sample Report

The growth of the water soluble packaging market has also been positively influenced by stringent government legislation on a plastic ban. As an example, by 2042 a goal of zero preventable plastic waste is set in the draft EU regulation issued by the United Kingdom Government. The initiative by the government has led to an increase in demand for sustainability packaging solutions, e.g. water soluble packaging.

MARKET DYNAMICS

KEY DRIVERS:

-

To minimize the carbon footprint, adoption of sustainable packaging to give boost to the market growth

Green packaging has become more widespread in most countries due to increasing concerns about the environment. The market's growth is also driven by an increase in transport and energy costs. Moreover, market growth has been fueled by negative consumer impressions of conventional packaging as well as pressure from the government to shift towards ecofriendly materials. In order to reduce their carbon footprints, a number of brands have recently implemented water soluble solutions.

-

Due to their beneficial properties, growing consumption from a number of end users.

RESTRAIN:

-

Lack of compliance with regulatory requirements and standardization

Regulations or standards on water soluble packaging may be different from region to region and country. In order to guarantee that safety, environment and performance standards are respected, manufacturers need to work in a variety of regulatory environments.

OPPORTUNITY:

-

Market growth is being boosted by a stringent government regulations and policies

A positive environment for growth of the water soluble packaging market is provided by government regulations that aim to reduce plastics waste and promote sustainability in packaging solutions. Increased adoption can be stimulated by incentives and policies that encourage the use of sustainability packaging.

CHALLENGES:

-

Technical restrictions on some products

Some types of products, in particular those which are based on oil or have specific chemical properties, may not be suitable for water soluble packaging. As a result, its potential applications are limited.

IMPACT OF RUSSIAN UKRAINE WAR:

As the price of oil has risen to its highest level in 14 years, as gasoline prices hit $4 a gallon or more, producers should be afraid that resin prices will also rise. Russia's increasingly aggressive war with Ukraine is creating volatility throughout the industry. Europe, where water soluble packaging is the main market, was hit hard by the war and has been experiencing a general slowdown. This led to a decline in demand for water soluble packaging in the region. Due to high energy prices it has caused disruptions in the production. Since the outbreak of the war, wood pulp prices have risen by more than 50% and are a crucial raw material for water soluble packaging. This is resulting in higher costs for the production of water soluble packaging.

IMPACT OF ONGOING RECESSION:

If the recession persists into 2023, it could cut worldwide demand for water soluble packaging by up to 1%. The strongest impact of the recession is being felt by advanced economies. The largest user of water soluble packaging is the developed economies. As a result of the downturn, consumer spending in advanced countries is falling and this results in reduced demand for water soluble packaging. In 2023, demand for water soluble packaging in the food and beverages sector is expected to decrease by 1%. This can be attributed to the fact that consumers have reduced their expenditure on food and drinks in the course of the recession. It is expected that water soluble packaging demand in the pharmaceutical sector will decrease by 0.5%. These are mainly because consumers have been delaying or avoiding healthcare procedures in times of recession.

KEY MARKET SEGMENTS

By Material

-

Surfactants

-

Polymers

-

Fibers

Water soluble packaging is broken down according to materials into polymers, surfactants and fibres. In this sector, in 2022 the polymer segment was dominant with an overall revenue share of more than 68%. Because of its powerful film formation properties and very good solubility in water, polyvinyl alcohol has been popular as a packaging material made from water soluble materials.

The fibre segment is projected to grow significantly with a compounded annual growth rate of 5% over the forecast period. Natural fibre materials are obtained from plant resources, including wood pulp and synthetic fibre is made with grains of corn or wheat which they use in the production of water soluble fibres for packing solutions

By Product Type

-

Bags

-

Pouches

-

Pods & Capsules

Based on products, the water soluble packaging market is subdivided into bags, pouches and Pods & capsules. The bag category held the largest market share of 45.68% in 2022 and is anticipated to retain its attractiveness over the forecast period. It is due to its widespread application in the healthcare packaging sector, notably with regard to contaminated laundry bags. For both producers and consumers, the convenience of using water soluble bags makes them an attractive option.

By contrast, it is estimated that the pod and capsule product segment will increase at a compound annual growth rate of 4.8% over the forecast period.

By Solubility Type

-

Hot Water Soluble

-

Cold Water Soluble

In 2022, demand for hot water solubility accounted for a higher market share of more than 60%. The elimination of the need for measuring, handling and disposal of standard packaging materials is facilitated by its ability to be dissolved rapidly and easy in hot water temperatures up to 80 C. This is a major driver of the demand in this segment.

By Design

-

Plate

-

Tubular

By End Use

-

Industrial

-

Residential

Due to the wide usage of water soluble packaging in industrial segment accounted for a market share of almost 72% by 2022.

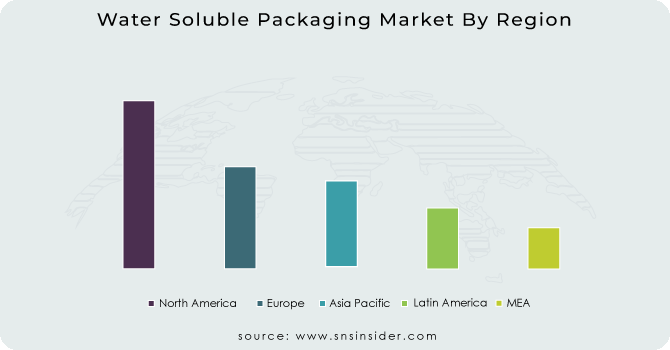

REGIONAL ANALYSIS

In the water soluble packaging market, North America accounted for more than 32% in 2022. This is due to growing demand from a number of regional end user industries, like household products and food & beverages, for these packaging solutions. In addition, demand for these packaging solutions is also driven by strict government rules and the growing awareness among consumers of the negative environmental impact of traditional packaging materials.

With a revenue share of more than 65 % in 2022, the US market is one of the largest contributors to the North American region. This is due to a growing demand from the household sector for cleaning capsules and capsules, in particular for washing machines and dishwashers. The market in this country is driven by the convenience & ease of use of such products without harmful chemicals which pose a risk to skin contact.

Due to growing demand from the region for sustainable packaging solutions, Asia Pacific is expected to grow at an accelerated pace of compound annual growth until 2030 on the water soluble packaging market. In view of the strong demand from detergents and personal care products, countries like China, India, South Korea as well as Japan are major contributors to market growth. In addition, the growth of the regional market is driven by the ban on plastic packaging in various countries.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Water Soluble Packaging market are Mondi Group, Mitsubishi Chemical Corporation, Aquapak Polymers Ltd, Cortec Corporation, Soluble Technology Limited, Green Master Packaging, Soltec Development, Solupak, Kuraray, AICELLO CORPORATION and other players.

Mitsubishi Chemical Corporation-Company Financial Analysis

RECENT DEVELOPMENT

-

Aquapak entered into a partnership with Industrial Physics, a global product, material and packaging testing company, in July 2022. This cooperation is expected to play an important role in the development of a range of sustainable water soluble Hydropol packaging products by AquaPak.

-

Mondi, a global sustainable packaging and paper company, has launched a new water soluble paper packaging solution called SolmixBag for use in the global construction industry.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.29 Bn |

| Market Size by 2031 | US$ 5.09 Bn |

| CAGR | CAGR of 5.6 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Surfactants, Polymers, Fibers) • by Product Type (Bags, Pouches, Pods & Capsules) • by Solubility Type (Hot Water Soluble, Cold Water Soluble) • by Design (Plate, Tubular) • by End Use (Industrial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Mondi Group, Mitsubishi Chemical Corporation, Aquapak Polymers Ltd, Cortec Corporation, Soluble Technology Limited, Green Master Packaging, Soltec Development, Solupak, Kuraray, AICELLO CORPORATION |

| Key Drivers | • To minimize the carbon footprint, adoption of sustainable packaging to give boost to the market growth • Due to their beneficial properties, growing consumption from a number of end users. |

| Key Restraints | • Lack of compliance with regulatory requirements and standardization |