Blowing Agent Market Report Scope & Overview:

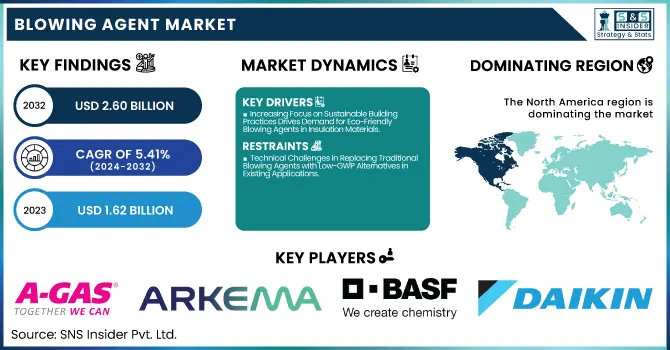

The Blowing Agent Market Size was valued at USD 1.62 Billion in 2023 and is expected to reach USD 2.60 Billion by 2032, growing at a CAGR of 5.41% over the forecast period of 2024-2032.

To Get more information on Blowing Agent Market - Request Free Sample Report

The blowing agents market is undergoing rapid change driven by environmental pressure, economic transformation, and industry innovation. Our study reveals the cost profile and price trends affected by raw material volatility and energy costs. It follows trends in production capacity, reporting expansion by major manufacturers to meet increasing global demand. The economic contribution of the market to world GDP is increasing, particularly through construction and automobile applications. Sustainability is catching on with the growing focus on recycling and trends towards reuse favoring a circular economy model. At the same time, climatic change in the world is creating demand for environmentally friendly, low-carbon alternatives. The trends, unraveled in this report in detailed analysis, reflect a strategic look into the prospect of the market for blowing agents and its transforming dynamics.

The US Blowing Agent Market Size was valued at USD 358.72 Million in 2023 with a market share of around 68% and growing at a significant CAGR over the forecast period of 2024-2032.

The U.S. Blowing Agent industry is witnessing strong growth, fueled by various exciting drivers. The growth in the construction industry, especially in energy-efficient structures, is growing demand for materials used in insulation that incorporate blowing agents. For example, Arkema has made investments to boost production capacity in hydrofluoroolefin-based blowing agents in Calvert City, Kentucky, to address this growing demand. Besides, the move by the auto industry towards the use of lightweight material in order to enhance fuel efficiency is further driving the application of blowing agents in production. Environmental policies are also at the center of it all; the policies by the U.S. Environmental Protection Agency are stimulating low global warming potential alternatives adoption. All these are combined to drive the market's growth, placing the United States at the forefront of the global blowing agent market.

Market Dynamics

Drivers

-

Increasing Focus on Sustainable Building Practices Drives Demand for Eco-Friendly Blowing Agents in Insulation Materials

With the increased focus on sustainability in the construction sector, demand for energy-efficient products is on the rise. Low global warming potential blowing agents are being more and more integrated into insulation products. Green buildings are a key driver of demand, particularly in the United States, where building regulations are becoming increasingly stringent with respect to energy efficiency. Producers of insulation products are shifting to environmentally friendly blowing agents that meet changing environmental standards, helping to curb the carbon footprint of building developments. For example, the movement towards zero-VOC and low-GWP blowing agents is becoming the industry norm. The U.S. Environmental Protection Agency regulatory system supports this change, pushing the market toward alternatives with comparable or even superior performance than that of traditional blowing agents. The change is likely to accelerate the market for sustainable blowing agents, making construction and building sectors major drivers for market growth.

Restraints

-

Technical Challenges in Replacing Traditional Blowing Agents with Low-GWP Alternatives in Existing Applications

Although momentum is building toward the phase-out of low-global-warming-potential blowing agents, the technical complexity of substituting conventional agents with environmentally friendly alternatives persists. Several industries, including automotive and insulation, are dependent on certain attributes of conventional blowing agents, including stability, efficiency, and economy. Substitution with low-GWP agents provides a need for wide-ranging modifications to systems, manufacturing processes, and product recipes. For example, the reduced thermal conductivity of some low-GWP alternatives can affect foams' insulation performance, so manufacturers have to reformulate to ensure product quality. Likewise, some alternatives lack the consistency or ease of handling of traditional agents, resulting in possible inefficiencies in operations. These technical barriers delay the transition to low-impact agents, and manufacturers spend time and money adjusting. Consequently, although there is a significant drive for more environmentally friendly solutions, overcoming these engineering challenges is paramount to a successful market transition.

Opportunities

-

Increased Consumer Demand for Environmentally Conscious Products Drives Blowing Agent Market Innovation

Consumer demand for green products is pushing innovation in the blowing agent industry. As consumers become increasingly environmentally aware, their demand for sustainable, low-impact products is increasing. Packaging, automotive, and construction industries are responding to this demand by adding environmentally friendly blowing agents to their products. In the building industry, the growing demand for green building certification, including LEED (Leadership in Energy and Environmental Design), is also fueling this trend. Packaging companies are looking at lightweight and recyclable materials with low-impact blowing agents as well. This move toward sustainability is leading manufacturers to invest more in research and development to make new, innovative products that meet consumer values. Consequently, business entities that are able to satisfy these consumers with innovative, environmentally friendly solutions will be set for impressive growth in the years ahead.

Challenge

-

Stricter Environmental Regulations Require High Investment in Research and Development for Compliance

Stricter environmental controls, especially aimed at eliminating high-global-warming-potential compounds, are a double-edged sword for the blowing agent industry. While these controls spur innovation in sustainable solutions, they encourage substantial research-and-development expenditures to achieve compliance. Firms have to spend money on new technology, product formulation, and testing to make sure their blowing agents are in line with changing regulations. For example, the phasing out of ozone-depleting substances in international treaties like the Montreal Protocol compels producers to make a shift towards safer substitutes. This is an expensive and time-consuming process that acts as a challenge for smaller firms with less financial muscle. Therefore, producers have to weigh the cost of compliance against increasing demand for environmentally friendly substitutes, presenting a knotty challenge for industry players to deal with.

Segmental Analysis

By Product Form

Chemical Blowing Agents dominated the blowing agent market in 2023 with a market share of 51.8%. This dominance can be attributed to their high versatility, consistent performance, and compatibility with a wide range of polymer systems such as polyurethane and polystyrene foams. Chemical blowing agents, which include substances like azodicarbonamide and sodium bicarbonate, are widely adopted in automotive, construction, and electronics applications due to their effective cellular structure creation and thermal insulation properties. Their popularity is reinforced by regulatory support for advanced materials that meet energy efficiency standards. For example, the U.S. Environmental Protection Agency promotes the phase-down of high global warming potential materials while encouraging the use of non-ozone-depleting chemical blowing agents in rigid foam insulation. Additionally, manufacturers are investing in non-toxic and eco-friendly variants, strengthening the segment's long-term dominance in global applications.

By Type

Chemical Blowing Agents dominated the blowing agent industry in 2023 with 51.8% market share. Their wide versatility, dependable performance, and suitability for all types of polymer systems like polyurethane and polystyrene foams have led to their prevalence. Chemical blowing agents, such as azodicarbonamide and sodium bicarbonate, are extensively used in automotive, construction, and electronics applications because of their efficient cellular structure formation and thermal insulation characteristics. Their use is further supported by regulatory encouragement of advanced materials that are energy-efficient. For instance, the U.S. Environmental Protection Agency encourages phase-down of high global warming potential products and use of non-ozone-depleting chemical blowing agents in rigid foam insulation. Manufacturers are also spending on non-toxic and environmentally friendly variants, securing the segment's long-term supremacy in worldwide applications.

By Foam Type

Polyurethane Foam (PU) dominated the blowing agent market in 2023 with a market share of 45.3%. This dominance is driven by its broad use in insulation for residential and commercial buildings, appliances, and automotive interiors due to its excellent thermal insulation and energy efficiency characteristics. The U.S. Department of Energy promotes building envelope upgrades, which significantly include PU foam-based insulation materials. Furthermore, federal tax incentives under programs like the Energy Efficient Home Credit encourage the use of high-performance materials like polyurethane foam. The growing demand for thermal-efficient housing and lightweight vehicle components has also elevated PU foam's application scope. Industry leaders such as Covestro, BASF, and Dow have continued to develop advanced PU formulations with eco-friendly blowing agents, boosting its market footprint. The foam’s versatility, compatibility with chemical and physical blowing agents, and regulatory alignment for energy conservation solidify its top position in the market.

By Application

Building and Construction dominated and accounted for a market share of 33.8% in the blowing agent industry in 2023. Its hold is because the demand for sustainable and energy-efficient construction techniques has been increasing. Blowing agents play an indispensable role in making insulation materials such as polyurethane foam, which finds application in roofs, walls, and HVAC. Both the U.S. Green Building Council's LEED certification and the Department of Energy's Weatherization Assistance Program encourage high-performance insulation, thus expanding blowing agent usage. Moreover, governments across the globe are enacting more stringent building codes emphasizing thermal efficiency, so the application of high-performance insulation products is on the rise. United States, China, and India construction activity, particularly in urban residential housing and commercial real estate, remains driving the growth of foam-based insulation solutions. The industry's need for renewable materials that save energy in the long term underpins its steady demand for blowing agents, solidifying its leadership in market share.

Regional Analysis

North America dominated the Blowing Agent Market in 2023, accounting for a market share of approximately 32.5%. This dominance is primarily fueled by stringent environmental policies and a strong focus on energy-efficient building solutions. The U.S. Environmental Protection Agency (EPA) has led multiple initiatives under the Significant New Alternatives Policy (SNAP) program to phase out ozone-depleting substances, encouraging a transition to low-GWP blowing agents. Additionally, North America has a well-established insulation and packaging industry that extensively uses polyurethane and polystyrene foams, further increasing demand. The region is also seeing a construction boom, particularly in commercial real estate and smart residential buildings, necessitating advanced insulation solutions made using eco-friendly blowing agents. Government incentives, such as the U.S. Department of Energy's Weatherization Assistance Program (WAP), are driving demand for insulating materials in residential buildings. Country-wise, the United States is the major contributor, with Canada also showing strong adoption due to similar environmental regulations and building codes. Leading companies such as Honeywell, Huntsman Corporation, and Chemours have substantial operational bases in the region and have actively transitioned their product lines to environmentally compliant blowing agents, reinforcing North America’s leadership position.

On the other hand, Asia Pacific emerged as the fastest-growing market in the Blowing Agent Market, which is expected to experience a strong CAGR over the forecast period of 2024 to 2032. The high growth is attributed to an increase in industrialization, urbanization, and infrastructure development in emerging economies like China, India, and Southeast Asian nations. The growing automotive and construction industries in these nations are driving demand for insulating materials using blowing agents significantly. Favorable government policies encouraging energy-efficient manufacturing processes and buildings are also driving market growth. For example, China's national building energy efficiency standard has been tightened under its 14th Five-Year Plan, promoting the application of rigid insulation foams. In the same vein, India's Energy Conservation Building Code (ECBC) is also driving better thermal insulation in new construction. Additionally, the high-speed development of appliance manufacturing in Vietnam and Thailand is driving up the use of foam-based insulation products. China leads the regional market with its enormous manufacturing base and government-driven climate programs, while India is becoming a significant player based on its policy-driven demand and infrastructure development programs. Together, the region's vibrant economic activities and changing regulatory landscape are paving the way for robust growth in the blowing agent market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

A-Gas International Limited: (HFC-134a, Hydrocarbons)

-

Arkema: (Forane 134a, Forane 152a, Forane 125)

-

BASF SE: (Enovate 3000, Enovate 2000, HFC-245fa)

-

Changshu 3F Zhonghao New Chemical Materials Co. Ltd.: (HFC-245fa, HFC-365mfc)

-

Daikin Industries, Ltd.: (HFC-32, HFO-1234ze, HFC-143a)

-

Evonik Industries AG: (Dymel, Dyno-Blow)

-

ExxonMobil Corporation: (HFC-134a, HFC-143a, HFC-125)

-

Form Supplies Inc. (FSI): (Cyclopentane, Pentane, CO2)

-

Harp International Ltd.: (Cyclopentane, n-Pentane)

-

HCS Group GmbH: (Hydrocarbons, CO2)

-

Honeywell International Inc.: (Solstice LBA, Solstice PF, Solstice N)

-

Huntsman International LLC: (Hydrocarbon-based blowing agents, HFC-134a)

-

Ineos: (HFC-134a, HFC-152a)

-

Lanxess: (Hydrocarbon Blowing Agents, Vinnolit)

-

Linde PLC: (CO2, Nitrogen)

-

Nouryon: (Hydrogen Peroxide-based blowing agents)

-

Sinochem Holdings Corporation Ltd.: (HCFC-141b, HFC-134a)

-

Solvay: (HFC-245fa, HFO-1234ze, Solstice LBA)

-

The Chemours Company: (Opteon 1234ze, Freon 134a)

-

Zeon Corporation: (Zepol 110, Zepol 210)

Recent Developments

-

April 2024: Solvay inaugurated a new Alve-One production unit in Rosignano, Italy, to enhance supply of eco-friendly chemical blowing agents. Alve-One, a safer alternative to azodicarbonamide, supports industries like automotive and construction. Recognized by ChemSec and the Solar Impulse Foundation, the initiative reflects Solvay’s commitment to sustainable and low-emission foam solutions.

-

February 2024: BASF introduced a new HFO-blown polyisocyanurate (PIR) insulation system in Japan, in collaboration with TATUMI Industrial Co., Ltd. The innovation offers superior thermal performance and non-flammability, meeting local building codes. Designed for applications like refrigeration and data centers, the system improves energy efficiency and reduces environmental impact in construction.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.62 Billion |

| Market Size by 2032 | USD 2.60 Billion |

| CAGR | CAGR of 5.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Form (Physical Blowing Agents, Chemical Blowing Agents) •By Type (Hydrochlorofluorocarbons (HCFCs), Hydrofluorocarbons (HFCs), Hydrocarbons (HCs), Hydrofluoroolefin (HFO), Others) •By Foam Type (Polyurathane Foam (PU), Polystyrene Foam (PS), Phenolic Foam, Polyolefin Foam, Others) •By Application (Building and Construction, Automotive, Bedding and Furniture, Appliances, Packaging, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Solvay, Arkema, ExxonMobil Corporation, Linde PLC, Daikin Industries, Ltd., The Chemours Company, BASF SE, Sinochem Holdings Corporation Ltd., Huntsman International LLC and other key players |