Needle Coke Market Report Scope & Overview:

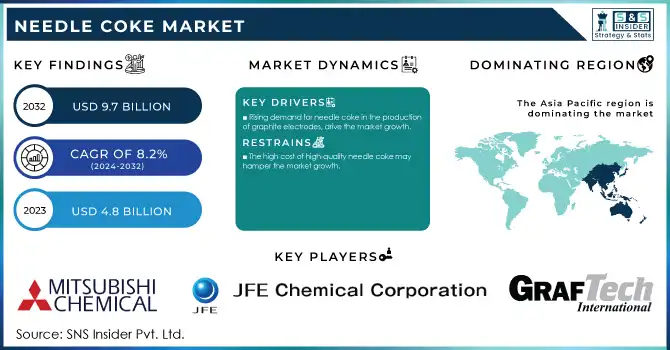

The Needle Coke Market size was valued at USD 4.8 Billion in 2023. It is expected to grow to USD 9.7 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

Growing electric vehicle (EV) production is one of the key factors driving the growth of the needle coke market. Needle coke is an essential input for graphite anodes used in lithium-ion batteries, the mainstay of powering EVs. With electric car numbers booming around the world right now, especially in large markets like China and Europe, the need for premium needle coke should continue to rise substantially in the coming years. Government support providing subsidies and carbon emissions standards for EVs has played a role in courting this domestic EV production growth, which is now also being backed by increasing consumer acceptance of cleaner mobility solutions. To help prolong battery life and increase energy density, battery makers are on the hunt for better, longer-lasting, and high-performance anode materials. As a result, this report anticipates rising demand for high-quality needle coke, which is required to fulfill the stringent quality standards of high-performing anodes, in line with the ongoing sustainable energy transition and electric mobility growth.

To get more information on Needle Coke Market - Request Free Sample Report

In Europe, the European Automobile Manufacturers' Association (ACEA) reported that electric vehicles accounted for 22% of all new car sales in the EU in 2023, continuing to rise as the European Union's Green Deal and emission reduction targets push for a transition to electric mobility.

Increased utilization of renewable energy also solar and wind power boosts the need for energy storage systems which in turn will increase the growth of energy storage devices and thereby drive the demand for high-performance batteries. Such renewable energy sources are intermittent, they are producing electricity only when the sun shines or the wind blows, and are therefore requiring effective and reliable energy storage systems with enough load balance to secure a level of stable power generation. Li-ion batteries are the dominant technology for good reason, offering the world-leading properties like energy density, long cycle life, and efficiency, but we need affordable and high-quality needle coke for graphite anodes.

For example, the European Union and China with its ambitious renewable sources targets of 40% of energy based on replicas of energy from renewables by 2030 and 20% by 2025, respectively. Together with global trends pushing towards decarbonization and green energy solutions, these initiatives further highlight the energy storage need in mitigating the variation of renewable energy output.

Needle Coke Market Dynamics

Drivers

-

Rising demand for needle coke in the production of graphite electrodes, drive the market growth.

Needle coke is a vital raw material component when generating graphite electrodes further along the line and thus, is an important factor driving market growth. Needle coke is used as the key raw material to produce high-quality graphite electrodes required in the electric arc furnace (EAF) process for the production of steel. With the global steel industry currently transforming towards more sustainable and energy-efficient steel production methods through the use of electric arc furnaces (EAFs), the demand for graphite electrodes has increased. Electric Arc Furnaces (EAFs), which melt down scrap steel using high-temperature electrical arcs, consume high-quality electrodes made from needle coke for optimal performance and durability. The EAF steelmaking trend, especially in China (the largest steel producer worldwide), Europe, and North America is causing rising needle coke demand. Additionally, with industries demanding greener and more sustainable steel solutions, the importance of needle coke in terms of high-performance electrodes for these advanced technologies is expected to power the growth of the needle coke market as a whole.

The U.S. Geological Survey (USGS) reports that the demand for needle coke, particularly for graphite electrodes, has been steadily rising as electric arc furnaces continue to gain popularity in the steel industry. The increased focus on EAF steel production, combined with rising steel demand in emerging markets, has led to a greater need for high-quality needle coke to manufacture graphite electrodes.

Restraint

-

The high cost of high-quality needle coke may hamper the market growth.

High-quality needle coke costs too much and acts as a major restraint for the growth of the needle coke market. Needle coke, which is used in highly critical applications such as graphite electrodes for electric arc furnaces and anodes for lithium-ion batteries, requires very high-purity petroleum pitch or coal tar pitch raw materials. This type of material is more complicated and energy-intensive to create, and it requires specialized equipment, enhancing production costs. Moreover, adequate feedstock availability is another constraint, besides global crude oil price fluctuations adding to the costs. Consequently, the elevated raw material cost translates into a higher production cost in industries utilizing needle coke for steel production and in electric vehicle batteries.

Needle Coke Market Segmentation Analysis

By Grade

The super-premium grade held the largest market share around 54% in 2023. This is due to its higher quality and importance in high-performance applications (graphite electrodes for electric arc furnaces (EAF) for the production of steel and lithium-ion batteries for electric vehicles). Featuring high thermal stability, low electrical resistance, and low levels of impurities, super-premium needle coke possesses unique structural properties, which are needed for precision and demanding applications. Graphite electrodes made from super-premium needle coke used in the steel industry improve energy efficiency in the electric arc furnace process, part of a critical transformation in steelmaking towards global practices that are more sustainable and energy-efficient.

By Application

Electrode held the largest market share around 48% in 2023. It is because of the key function of needle coke in the manufacturing of graphite electrodes, which are then utilized in electric arc furnaces (EAF), which are used in steel making. Needle coke-based graphite electrodes are in critical demand for carrying out electricity in the electric arc furnace (EAF) process, which is a more energy and environmentally friendly approach for steelmaking than traditional blast furnace technologies. With more of the world steel sector moving from BF to EAF technology-based brig there is a need for a continued supply of high-quality graphite electrodes as the market sweeps the globe in search of lower carbon energy-dense cemented carbon. These electrodes require a material with high thermal conductivity, low electrical resistance, and the capacity to withstand high temperatures; needle coke’s unique properties make it the best choice for the electrodes.

Regional Analysis

Asia Pacific held the largest market share around 54% in 2023. Industrialization taking place in various countries with the increased demand for electric vehicles in the region. Needle coke, so essential for global EAF steel production, is influenced by latent need in China, the world's largest steel producer. Electric Arc Furnace (EAF) technology, which consumes high-quality needle coke, is favored for being more energy-efficient and emitting less carbon than the conventional steelmaking approach. The rapid transition to electric mobility in the Asia Pacific, notably in China, Japan, and South Korea, has also driven up the demand for lithium-ion batteries, thus increasing the requirement for high-performance needle coke for battery anodes. It is also a significant market in terms of key manufacturers and consumers that further support its region's market dominance of the needle coke market. Additionally, various Asia Pacific governments are promoting cleaner and sustainable industry transitions that favor the consumption of needle coke in both the steel and battery production processes.

Key Players in Needle Coke Market

-

GrafTech International (Ultra-Pure Needle Coke, High-Quality Needle Coke)

-

JFE Chemical Corporation (Needle Coke for Graphite Electrodes, High-Performance Needle Coke)

-

Mitsubishi Chemical Corporation (Super-Premium Needle Coke, Needle Coke for Steelmaking)

-

Indian Oil Corporation Limited (IOCL Needle Coke, Petroleum Needle Coke)

-

Shaanxi Coal and Chemical Industry (Needle Coke, Petroleum Needle Coke)

-

Asbury Carbons (Needle Coke, Synthetic Needle Coke)

-

Koch Industries (Needle Coke, Petroleum Needle Coke)

-

Sinosteel Corporation (Needle Coke for Lithium Batteries, Ultra-High-Quality Needle Coke)

-

China National Petroleum Corporation (CNPC) (Needle Coke, High-Purity Needle Coke)

-

Phillips 66 (Petroleum Needle Coke, Ultra-High Performance Needle Coke)

-

Fushun Jinly Petrochemical (Needle Coke, Petroleum Needle Coke)

-

Shanxi Hongte Chemical (Needle Coke for Lithium-ion Batteries, Petroleum Needle Coke)

-

LG Chem (Needle Coke, High-Performance Needle Coke)

-

Dongjiang Chemical (Needle Coke, Carbon Needle Coke)

-

Mitsui Chemicals (High-Quality Needle Coke, Graphite Electrode Needle Coke)

-

Hunan Jinli New Materials (Petroleum Needle Coke, High-Performance Needle Coke)

-

C-Chem Co. Ltd. (Needle Coke for Steel Production, Ultra-Pure Needle Coke)

-

Pechiney (Alcan) (Needle Coke, Petroleum-Based Needle Coke)

-

ConocoPhillips (Needle Coke, Synthetic Needle Coke)

-

SGL Carbon (Needle Coke for Electrode Production, Graphite Needle Coke)

Recent Development:

-

In 2023, Showa Denko, a leading producer of needle coke, has made significant investments in expanding its production capacity for super-premium needle coke. The company announced the construction of a new needle coke manufacturing plant in South Korea to meet the growing demand from the steel and battery industries.

-

In 2023, HEG Limited, one of the major players in the graphite electrode industry, expanded its production capacity in Madhya Pradesh, India.

-

In 2022, C-Chem, a major player in the production of high-quality needle coke, expanded its production capabilities by upgrading its facilities in Japan. The company focused on increasing the output of premium-grade needle coke specifically for use in graphite electrodes for steelmaking.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$4.8 Billion |

| Market Size by 2032 | US$9.7 Billion |

| CAGR | CAGR of8.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Super-Premium, Premium-Grade, Intermediate Grade) • By Application (Electrode, Silicon Metals & Ferroalloys, Carbon Black, Rubber Compounds, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GrafTech International, JFE Chemical Corporation, Mitsubishi Chemical Corporation, Indian Oil Corporation Limited (IOCL), Shaanxi Coal and Chemical Industry, Asbury Carbons, Koch Industries, Sinosteel Corporation, China National Petroleum Corporation (CNPC), Phillips 66, Fushun Jinly Petrochemical, Shanxi Hongte Chemical, LG Chem, Dongjiang Chemical, Mitsui Chemicals, Hunan Jinli New Materials, C-Chem Co. Ltd., Pechiney (Alcan), ConocoPhillips, SGL Carbon. |

| Key Drivers | • Rising demand for needle coke in the production of graphite electrodes, drive the market growth. |

| RESTRAINTS | •The high cost of high-quality needle coke may hamper the market growth. |