Helium Market Report Scope & Overview:

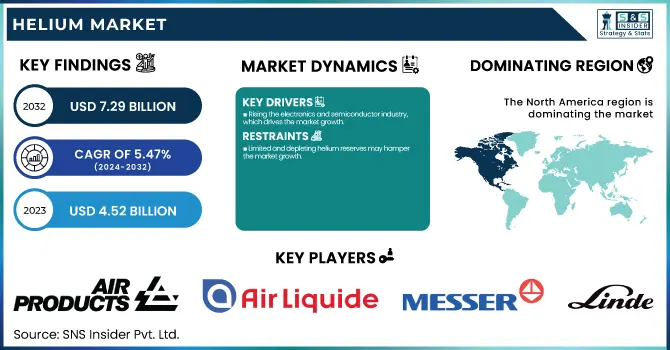

The Helium Market size was USD 4.52 Billion in 2023 and is expected to reach USD 7.29 Billion by 2032 and grow at a CAGR of 5.47% over the forecast period of 2024-2032. This report provides in-depth statistical insights and trends in the helium market, covering production capacity and utilization by country and source, along with pricing trends and supply constraints in 2023. It examines export and import volumes by region and application, as well as regulatory policies and strategic reserves across key markets. Additionally, the report analyzes helium consumption across major end-use industries, including healthcare, electronics, and aerospace. Sustainability initiatives, such as helium recycling efforts and advancements in extraction technologies, are also highlighted to assess future market dynamics.

To Get more information on Helium Market - Request Free Sample Report

Helium Market Dynamics

Drivers

-

Rising the electronics and semiconductor industry, which drives the market growth.

Helium is also used in a large number of manufacturing processes in the growing electronics and semiconductor industry, which is one of the primary drivers of the helium market. The simplicity of He makes its application in semiconductor fabrication very essential as it provides an inert and controlled environment which is critical to maintain cleanliness and precision in chip making. Helium is also critical to the manufacturing process of semiconductors, helping maintain extreme temperatures in advanced manufacturing processes like extreme ultraviolet (EUV) lithography. The growing application of high-performance semiconductors in consumer electronics, data centers, and automotive electronics is also catching the attention of helium consumers and fuelling the demand for semiconductor helium. In addition, the growth of semiconductor plants, especially in the U.S., China, South Korea, and Taiwan, can support helium demand as it is an essential element to maintain progress in technical processes in the electronics field.

Restraint

-

Limited and depleting helium reserves may hamper the market growth.

Helium is a non-renewable resource, it is mainly produced as a by-product from the production of natural gas, and limited and depleting reserves of helium represent another major challenge to market growth. Helium is a unique gas in a sense that we cannot artificially synthesize it in large amounts, hence its availability is entirely dependent on nature. Supply vulnerability: Helium reserves are highly localized (largely in the U.S., Qatar, and, Russia). With depleting existing reserves and increasingly difficult and expensive sources of new helium, there is a risk of supply shortages becoming more common, having a price-raising and destabilizing effect on the market. In addition, the possible scarcity of helium constrains growth in related industries calling for its use including healthcare, electronics, and aerospace, and makes governments, industry, and technology leaders pursue alternative sources and recycling technologies to support sufficient demand for this market.

Opportunity

-

The increasing use of helium in cryogenics and MRI machines creates an opportunity in the market.

The higher use of helium in cryogenics & MRI machines is a major factor driving the growth of the helium market. As it turns out, helium is critical for cooling the superconducting magnets in MRI (Magnetic Resonance Imaging) machines. It has a very low boiling point (-269°C), making it able to sustain the ultra-low temperatures needed. As many researchers and hospitals are investing in MRI tech due to the greater demand for advanced medical imaging and diagnostics, this is resulting in greater helium consumption. Similarly, the applications of helium in cryogenics in scientific research, space explorations, and quantum computing will keep fuelling the market. Recent developments in cryogenic technology, along with the rapid growth of healthcare infrastructure around the globe, have driven up the demand for helium continuously.

Challenges

-

Logistical constraints in storage and transportation may create a challenge for the market.

Helium has a very low boiling point, so its storage is very difficult. Keeping it in a liquid state necessitates specialist cryogenic vessels and high-tech infrastructure, driving up its supply chain costs. Moreover, helium is a finite resource, and both transportation and leakage render it unrecoverable. The number of helium processing and distribution plants across the globe is limited, meaning that even if a user has the required hardware installed, plant population can create logistical bottlenecks, particularly for regions dependent on imports. Stricter regulatory requirements associated with transporting and storage of cryogenic gases, as well as supply disruptions related to transportation including delays in shipping, can further trim their market growth.

Helium Market Segment Analysis

By Phase

Gas held the largest market share, around 68% in 2023. It is utilized in major end-use industries including healthcare, electronics, aerospace, and welding. Helium gas is also used for keeping ultra-low temperatures like cryogenic magnetic resonance imaging machine and many other such applications. In addition, helium gas is critical to the electronics and semiconductor industry where it is used in cooling and carrier gas in manufacturing processes. Helium gas is also used in the welding and metal fabrication sector to provide an inert ambient condition that hinders oxidation during high-precision welding activities. Additionally, it's being used in aerospace & and industrial processes for leak detection and pressurized systems further solidifies its position.

By Application

Cryogenics held the largest market share around 28% in 2023. The prime focus is on ultra-low temperature applications, which are vital in the healthcare, aerospace & research industries. Helium is needed for MRI machines where it is used to cool superconducting magnets so they can function. Also, it is used in particle accelerators, space, quantum computing, etc. where extreme cooling aria required for maximum domination. It further cements its market dominance due to the rising need for cryogenic helium during liquefied natural gas (LNG) production and superconducting applications. Its growth is propelling the use of helium as it is promising to remain at the forefront of cryogenics with improvements in space and medical imaging.

By End Use Industry

Medical & Healthcare held the largest market share around 38% in 2023. It is widely used in MRI machines, respiratory therapies, and cryogenic medical applications. Helium serves an integral part in the operating of the magnetic resonance imaging (MRI) systems; helium cools the superconducting magnets to keep the superconducting magnets working, enabling high-precision imaging for accurate diagnostics. Helium is also used for respiratory therapy for patients with lung pathology because helium-oxygen mixtures are less viscous than air. Helium in Healthcare has garnered significant adoption due to the increasing demand for advanced medical diagnostics and the rising incidence of respiratory diseases. Also, since helium is utilized for the cryogenic preservation of biological samples and organ transplants, it gives helium a firm foothold in the business.

Helium Market Regional Outlook

North America held the largest market share, around 35% in 2023. It is due to the presence of a strong industrial base specifically in the U.S., which is responsible for relatively high demand for helium in the region. Located in the same region, the United States has historically been the major supplier of helium worldwide and used to host some of the largest reserves of helium. Especially for MRI machines, the growth in the need from the medical industry has quickly propelled growth up for the market. In addition to the above, a growing semiconductor and electronics industry relying on helium for cooling and leak detection only enhances demand. North America has retained its leading position in the market owing to the presence of key market players, well-established supply chains, and continual investments in helium extraction and storage technologies as well. In addition, government policies for domestic helium production and strategic reserves guarantee a steady supply to further cement the regional dominance over the market.

Asia Pacific contributes to a substantial portion of helium consumption on account of rapid industrialization, increasing electronics industry, and widening healthcare needs. Significant growth in semiconductor manufacturing has been observed in China, Japan, South Korea, and India, with helium used for cooling processes and leak detection. Moreover, the increasing utilization of MRI machines across the healthcare industry, driven by enhancing medical infrastructure, has been creating a positive outlook for helium consumption. Even more, the region has a growing aerospace and defense sector in need of helium for rocket propulsion and welding. In addition, the Helium shortage is encouraging government initiatives and partnerships to hold a constant supply of helium in the market, and the development of Gas extraction technologies might show a high presence for the Asia Pacific region in the helium market over the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Air Products and Chemicals, Inc. (Helium Dewar, Helium Gas Cylinder)

-

Linde Plc (Balloon Gas, Helium Purity Plus)

-

Air Liquide (ALPHAGAZ Helium, HELIAL)

-

Messer Group (Messer Helium Balloon Gas, Ultra High Purity Helium)

-

Taiyo Nippon Sanso (Helium Gas Cylinder, Helium Liquid Dewar)

-

MESA Specialty Gases & Equipment (Research Grade Helium, Semiconductor Helium)

-

Matheson Tri-Gas Inc. (Matheson Helium, Ultra-High Purity Helium)

-

Iwatani Corporation (Liquid Helium, Helium Gas for Cryogenics)

-

Gazprom PJSC (Gazprom Helium, Industrial Helium)

-

Gulf Cryo S.A.L. (Helium Grade 5.0, Helium Gas Mixtures)

-

IACX Energy (High Purity Helium, Processed Helium Gas)

-

Weil Group Resources, LLC (Weil Liquid Helium, Industrial Grade Helium)

-

ExxonMobil (ExxonMobil Helium, Research Grade Helium)

-

Praxair Technology, Inc. (Praxair Helium, Helium for Electronics)

-

Airgas, Inc. (Airgas Balloon Helium, Medical Helium)

-

Gazprom Helium Service (Cryogenic Helium, High-Purity Helium)

-

Buzwair Industrial Gases (Liquid Helium, Helium Cylinder Gas)

-

Coregas Pty Ltd (Coregas High-Purity Helium, Coregas Balloon Gas)

-

Linde Engineering (Linde Helium Cryogenics, Helium Purification Systems)

-

Global Gases Group (Global Gases Liquid Helium, Helium Specialty Gas)

Recent Development:

-

In November 2024, Reliance's U.S. subsidiary acquired a 21% stake in Wavetech Helium for USD 12 million. This strategic move aims to strengthen Reliance’s position in the low-carbon energy sector by securing a stable helium supply. The investment aligns with the company’s focus on sustainable energy solutions and industrial gas expansion.

-

In May 2023, First Helium entered into a long-term supply agreement with a leading global industrial gas company. The contract is expected to generate up to USD 100 million in revenue over five years, depending on production levels at the Worsley facility.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.52 Billion |

| Market Size by 2032 | USD 7.29 Billion |

| CAGR | CAGR of5.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Phase (Gas, Liquid) •By Application Breathing Mixes, Cryogenics, Leak Detection, Pressurizing & Purging, Welding, Controlled Atmosphere, and Others. •By End Use Industry (Aerospace & Defense, Medical & Healthcare, Electronics & Electrical, Nuclear Power, Metal Fabrication, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Air Products and Chemicals, Inc., Linde Plc, Air Liquide, Messer Group, Taiyo Nippon Sanso, MESA Specialty Gases & Equipment, Matheson Tri-Gas Inc., Iwatani Corporation, Gazprom PJSC, Gulf Cryo S.A.L., IACX Energy, Weil Group Resources, LLC, ExxonMobil, Praxair Technology, Inc., Airgas, Inc., Gazprom Helium Service, Buzwair Industrial Gases, Coregas Pty Ltd, Linde Engineering, Global Gases Group. |