Board-to-Board Connectors Market Size & Trends:

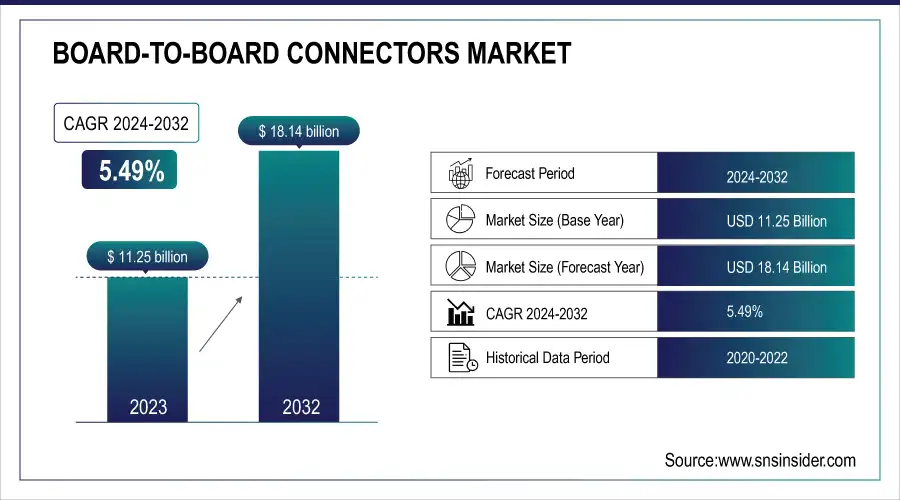

The Board-to-Board Connectors Market was valued at USD 11.25 billion in 2023 and is expected to reach USD 18.14 billion by 2032, growing at a CAGR of 5.49% over the forecast period 2024-2032. There is a strong momentum in the market for board-to-board connectors, which is creating a wave in the factory scope utilization level indicating improved demand and production efficiency over the past few years. The requirement for compact and high-speed connectors is being further increased due to the integration of artificial intelligence and high-performance computing systems.

To Get more information on Board-to-Board Connectors Market - Request Free Sample Report

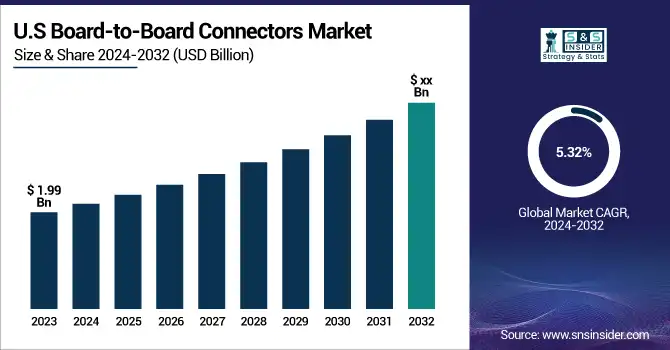

In addition, the increasing need for ESG & sustainability is also encouraging manufacturers to go to recyclable materials & RoHS-compliant designs. Board level orientation is moving toward vertical where it is ideal for modular and high element density electronic applications across industries. The U.S. Board-to-Board Connectors Market was being driven by advancements in consumer electronics and telecommunication. The growing use of mobile devices, like smartphones and wearables, has required compact-sized connectors with sub 1 mm pitch. Moreover, the trend toward electric and hybrid vehicles in the automotive sector further increased the need for connectors that can be highly reliable in sophisticated electronic systems. To meet these ever-changing industry requirements, manufacturers speed up their improvement in signal integrity and high-speed data transmission capabilities.

The U.S. Board-to-Board Connectors Market is estimated to be USD 1.99 Billion in 2023 and is projected to grow at a CAGR of 5.32%. Growing demand for compact high-speed electronic components in sectors like consumer electronics, automotive electronic systems, and telecom is trending in the U.S. Board to Board Connectors Market. The ASP of connectors for miniaturized devices continues to shrink as new generations of devices, such as electric vehicles, 5G infrastructure, and other applications require improved signal integrity, durability, and high-density interconnect solutions.

Board-to-Board (BTB) Connectors Market Dynamics

Key Drivers:

-

Rising Demand for Compact High-Speed Connectors Driven by Consumer Electronics EVs and 5G Expansion

The Board-to-Board Connectors market is driven by the fast growth of consumer electronics, along with the transitional shift towards device miniaturization. As demand for smartphones, wearables, and tablets-megadard devices continue to consolidate more and more functionality into smaller and smaller packages, the need for ultra-fine pitch, space-efficient connectors that operate at optimal speeds is also bringing manufacturers to integrate this type of technology. In addition, the transition of the automotive industry toward electric vehicles (EV) and the introduction of advanced electronic control units (ECUs) also boost the need for high-density, high-performance board-to-board connectors. Increasing demand for 5Gtechnology along with growing data center infrastructure is also driving the growth for high-speed connectors to provide better signal integrity and performance.

Restrain:

-

Design Complexity and Integration Challenges Limit Growth of Board-to-Board Connectors in Modern Electronics

The complexity in connector design and integration is acting as a major restraint to the growth of Board-to-Board Connectors market, especially in high-density electronic systems. A need for denser, better-performing, more signal- and mechanically-stable, durable devices makes reducing package size challenging. Miniaturization in other places presents its own set of problems such as cross-talk, heat dissipation, and electromagnetic interference (EMI) that need more advanced engineering fixes. It can also lead to more time-consuming development cycles, and compatibility issues, since certain applications may require customized connectors, and these connectors may not easily integrate particularly with legacy systems or other industry standards.

Opportunity:

-

Emerging Markets Drive Connector Demand with Industrial Automation Healthcare and IoT Accelerating Regional Growth

Asia Pacific and Latin America are among the emerging markets with a huge potential as manufacturing hubs expand in this region, coupled with an increasing investment in industrial automation. Moreover, the growing adoption of portable and connected medical devices in the healthcare sector opens up more opportunities for reliable and precise connectors. Developments in connector construction, for instance, better durability, EMI shielding, and low-profile forms supply a clear advantage for manufacturers with limited applications. With the increasing adoption of Industry 4.0 and IoT, high-speed, short-latency communication across board-to-board connectors is needed in industrial and smart system applications.

Challenges:

-

Connector Reliability Faces Challenges in Harsh Environments with Demand Rising from AI EV and 5G Advancements

There are issues surrounding reliability and performance in extreme environments that the market as a whole is also dealing with. Connectors utilized in industrial, automotive, and aerospace domains are often subjected to harsh environmental conditions including high temperatures, high vibrations, moisture, and dirt environment. Scalability can also be a challenge for such high-performance materials, as maintaining performance in demanding environments takes high-quality materials and significant amounts of testing. It further needs constant innovation and re-work from the manufacturers as industries like 5G, AI, and Electric Vehicles are experiencing an extraordinary evolution. Continuing to evolve with these advancements while providing premium quality and compliance with global regulations is a constant struggle for the board-to-board connectors ecosystem players.

BTB Connectors Market Segment Analysis

By Type

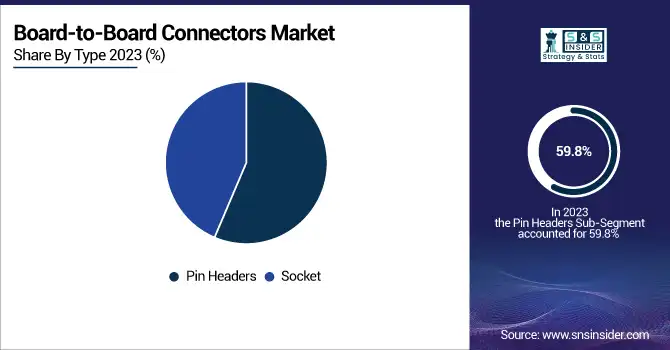

Pin Headers occupied the leading position in the board-to-board connectors market with a market share of 59.8% in 2023, which is mainly due to use of the consumer electronics, industrial automation, and automotive. Their minimal construction along with cost and ease of integration into printed circuit boards makes them the go-to for many, standard and custom electronic assemblies. Moreover, they are available in different configurations and pitch sizes, which makes them more suitable for small and high-density circuits.

Fastest-growing type of sockets from 2024 to 2032, Sockets, which is estimated to have the highest CAGR in the global market due to the demand for modularity, upgradability, and repairability of electronics. The ability to have non-permanent connections using sockets is important for applications involving frequent replacement of components or testing, common in development boards, diagnostic systems, or telecom infrastructure. Whether connected to the computer as single devices, the demand for socket connectors has steadily increased, driven by the gradual evolution of electronics into ever more flexible and serviceable designs.

By Component

The broad market for connectors board-to-board was dominated by 1mm to 2mm pitch size connectors with a 2023 share of 48.7%. This is because typically they are well-balanced with a good compromise between compactness and mechanical stability. These connectors find application in automotive electronics, industrial automation telecommunications-based medium-density interconnections sectors. Their capability to support both high-speed and power applications has made them an acceptable choice for a wide variety of PCB layouts.

Over 2mm are anticipated to witness the highest CAGR over the forecast period from 2024 to 2032. This is mostly due to their broader application in tougher industrial and power-hungry use cases that need durable mechanical properties and an ability to carry higher thermionic currents. The heavy machinery, energy systems, and transportation sectors are a few among the others that widely depend on these connectors to facilitate long-term durability and performance in a challenging environment.

By End User

The Consumer Electronics segment accounted for the largest revenue share of 31.5% in 2023 in the board-to-board connectors market as compact electronic devices, which are extensively utilized including smartphones, tablets, laptops, and wearables among others. Because of this, high-density, low-profile connectors capable of high-speed data transmission and designs that require a miniature footprint have rapidly accelerated the development and adoption of board-to-board connectors in this segment. The development of precision interconnect solutions also remains a top priority for manufacturers who are striving to improve device performance, longevity, and looks.

During the period between 2024-2032, Automotive is projected to hold the highest CAGR because of the progression in electric vehicle (EV) development and production, self-driving technology, and in-vehicle infotainment system. Demand continues to grow due to increasing demand for dependable, high-performance connections that can meet the extreme environmental and electrical requirements of seamless communication between various electronic control units (ECUs). With the rise of electronic and connected vehicles, board-to-board connectors also are emerging as essential elements in modern automotive design.

Board to Board Connectors Market Regional Outlook

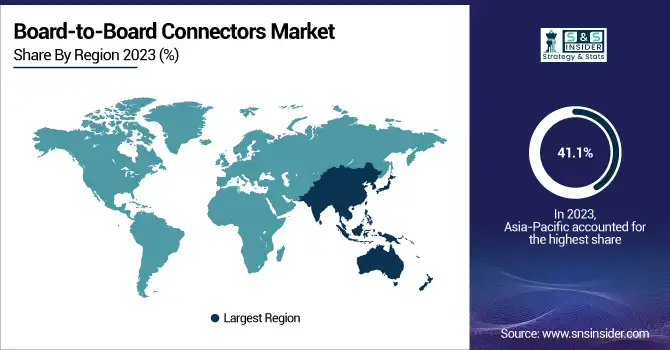

Asia Pacific accounted for the largest share of 41.1% in 2023 and is foreseen to execute the highest CAGR from 2024 to 2032 in the board-to-board connectors market. This regional strength is attributed predominantly to the booming electronics manufacturing industry, especially in countries such as China, Japan, South Korea, and Taiwan. This is where the top global firms like Samsung, Sony, Foxconn, and BYD in consumer electronics, semiconductors, and automobiles contribute to density-driven demand for low-profile high-performance connectors. As the world's largest electronics manufacturing base, mass production of smartphones, tablets, and computers made China the largest end-use of board-to-board connectors, consuming these connectors at high volume. With the continued integration of high-speed connectors into next-gen devices and electric vehicles (EVs), South Korea and Japan are key innovators in advanced consumer electronics and automotive technologies. Also, India is a faster-growing market and it is attracting a lot of investments from electronics manufacturing as it did ("Make in India"). Due to its well-developed infrastructure, availability of skilled labor, and a strong supply chain ecosystem, the region continues to be a strategic hotspot for connector manufacturers projecting to expand operations and meet the growing demand across diverse end-use verticals.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players Listed in the Board-to-Board Connectors Market are

-

TE Connectivity (Fine Pitch Board-to-Board Connector)

-

Amphenol Corporation (BergStak® 0.8mm Connector)

-

Hirose Electric Co., Ltd. (FX10 Series Connector)

-

Molex, LLC (SlimStack Board-to-Board Connector)

-

Samtec (Edge Rate® Connector)

-

JAE Electronics (MXM Connector Series)

-

3M (High-Speed Board-to-Board Connector)

-

ERNI Electronics (MicroSpeed Connector)

-

Fujitsu Components (FCN Series Connector)

-

Yamaichi Electronics (HF301 Board-to-Board Connector)

-

Kyocera Corporation (6311 Series Connector)

-

AVX Corporation (BTB Series Connector)

-

HARTING Technology Group (har-flex® Connector)

-

Smiths Interconnect (HPH Series Connector)

-

CUI Devices (Interconnect B2B Series).

Recent Trends

-

In December 2024, Hirose Electric launched the FH79 Series, a 0.3mm pitch FPC connector designed for automotive applications, offering high heat resistance and compact design for advanced systems like LiDAR.

-

In December 2024, Yamaichi Electronics launched the CN214 Series interface connector, compatible with 1.6 Tbps Ethernet for next-gen optical communication modules.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.25 Billion |

| Market Size by 2032 | USD 18.14 Billion |

| CAGR | CAGR of 5.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Pin Headers, Socket) • By Component (Less than 1mm, 1mm to 2mm, Greater than 2mm) • By End User (Consumer Electronics, Industrial Automation, Telecommunication, Automotive, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | TE Connectivity, Amphenol Corporation, Hirose Electric Co., Ltd., Molex, LLC, Samtec, JAE Electronics, 3M, ERNI Electronics, Fujitsu Components, Yamaichi Electronics, Kyocera Corporation, AVX Corporation, HARTING Technology Group, Smiths Interconnect, CUI Devices. |