Printed Circuit Board Market Size & Growth:

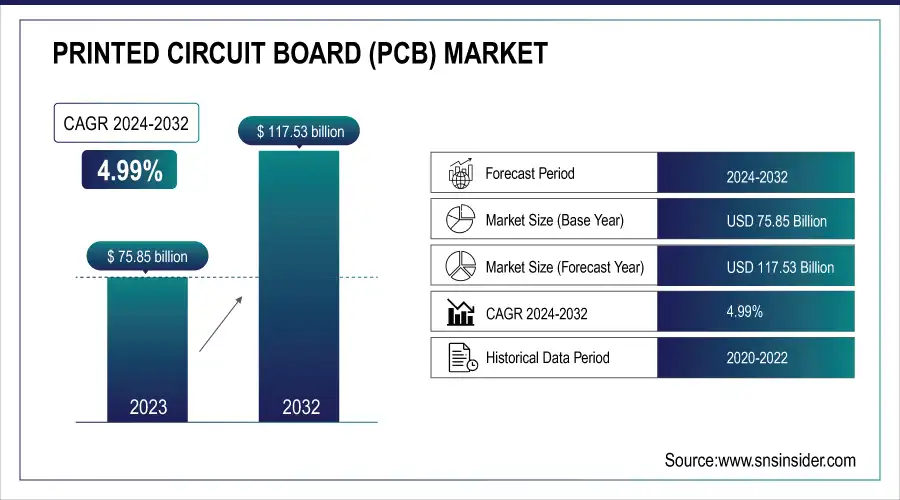

The Printed Circuit Board (PCB) Market was valued at 75.85 Billion in 2023 and is projected to reach USD 117.53 Billion by 2032, growing at a CAGR of 4.99 % from 2024 to 2032.

Key market drivers include the rapid adoption of advanced technologies such as high-density interconnect (HDI) and flexible PCBs, which support miniaturized and high-performance electronics. Environmental impact metrics are also shaping design and manufacturing standards, encouraging the use of RoHS-compliant and low-carbon materials.

To Get more information on Printed Circuit Board (PCB) Market - Request Free Sample Report

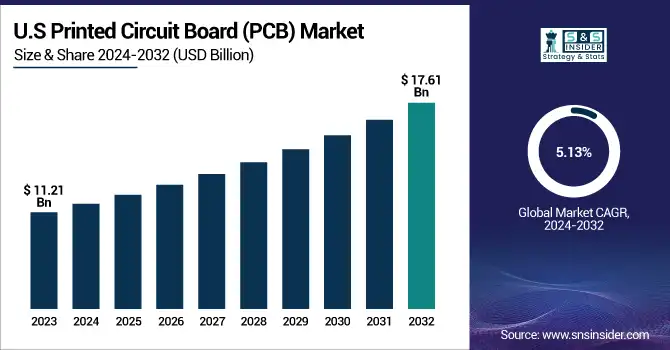

In the U.S., the market was valued at USD 11.21 billion in 2023 and is expected to reach USD 17.61 billion by 2032, with a slightly higher CAGR of 5.13%. Technological adoption curves reflect the increasing penetration of AI-enabled manufacturing systems and automated optical inspection tools. Additionally, factory automation and smart manufacturing trends are reducing defect rates and improving yield. In parallel, tighter inventory levels and fluctuating lead times underscore the need for resilient, agile supply chains in the PCB ecosystem.

Printed Circuit Board (PCB) Market Dynamics:

Drivers:

-

Technology and sustainability are transforming the PCB industry through innovations, EV growth, miniaturization, and eco-friendly practices.

The Printed Circuit Board (PCB) industry is at the heart of technological transformation, driven by emerging trends in 5G, IoT, and AI. With IoT devices expected to double from 12.4 billion in 2023 to 25.2 billion by 2027, demand for advanced PCB designs is rising across applications. Simultaneously, environmental sustainability is reshaping manufacturing practices through the use of recyclable and biodegradable materials. Asia-Pacific continues to dominate PCB production, led by China, while nations like India are investing in reshoring, such as Kaynes Solutions’ USD 100 million PCB plant announced in August 2023. The miniaturization of devices is fueling demand for HDI and flexible PCBs, particularly in automotive and consumer electronics. EV adoption growing from 206,000 units in 2013 to over 10.5 million in 2022 is accelerating PCB usage in vehicles. Together, these forces position PCBs as essential components in advancing global innovation, efficiency, and environmental responsibility within the broader electronics ecosystem.

Restraints:

-

Impact of Precision, Costs, and Yield on Advanced PCB Manufacturing

The complexity of manufacturing advanced PCBs such as HDI (High-Density Interconnect) and flexible PCBs significantly impacts production processes. They are very precise and specific PCBs which demand more extended production cycle, that leads to higher labor costs and increased purity. HDI and flexible PCBs has thin trace, micro and multilayer, for which the process is relatively more delicate than the regular PCB. This means that manufacturers struggle to maintain quality control and manage production costs, which is especially the case during scaling-up production for mass-market applications. Additionally, these complexities amplify material waste and defects that inherently lower yield. Advanced PCB unit yields range from 85% to 95%, with HDI boards on the low end of that for many finer layers and advanced manufacturing techniques. As a result, it can increase overall production costs for manufacturers, which potentially could reduce profitability.

Opportunities:

-

Sustainability in PCB manufacturing focuses on using recyclable materials, eco-friendly processes, and reducing waste.

The growing emphasis on sustainability in manufacturing presents significant opportunities for the PCB industry. Increasingly, technologies that minimize environmental impact, such as recyclable and biodegradable materials in PCB production, are in demand. Environmental Concerns: Manufacturers are seeking out environmentally friendly options, like eco-friendly laminates and lead-free solder, to comply with regulations and appeal to environmentally conscious consumers. Moreover, optimizing the production processes in a way that waste is eliminated, less energy is used, and the carbon footprint is minimized is gradually becoming a necessity for companies which want to comply with the global sustainability goals. Such initiatives not only mitigate the ecological consequences of PCB manufacturing but also improve the image of companies that embrace more environmentally friendly practices. With eco-awareness on the rise, embracing eco-friendly PCB production is a good differentiator for businesses in a green-minded marketplace.

Challenges:

-

Protecting Intellectual Property in PCB Manufacturing to safeguard innovations from theft and counterfeiting risks.

The increasing use of advanced and proprietary PCB technologies has heightened concerns over intellectual property (IP) theft, especially in regions with weaker IP protection laws. As PCB designs become more complex, involving innovative materials, processes, and high-performance capabilities, protecting these intellectual assets becomes critical for manufacturers. Without proper IP safeguards, companies risk losing their competitive edge, as counterfeit products can be produced using stolen designs. Additionally, the globalization of PCB production, which is partly done in nations with lax IP enforcement, further exposes sensitive systems. Patents, encryption, and other means of infrastructure IP protection will need investments are essential to reduce risks and enable manufacturers to thrive and flourish in the long term.

PCB Industry Segmentation Analysis:

By Product Type

The Rigid Board segment dominated the PCB market, accounting for approximately 40% of the total revenue in 2023. This trend is led by a significant application of rigid PCBs in consumer electronics, automotive, telecommunications, and industrial applications, which poses stability and durability requirements. With their reliable performance in different types of electronic devices and systems, these boards hold a great market share. Meanwhile, the strong demand for rigid boards, particularly in sectors such as smartphones, computers, and automotive electronics, supports the growth of rigid boards in the worldwide PCB marketplace. While the manufacturing solutions of rigid boards are increasingly becoming more complex and miniaturized to produce electronic components required by the industry, the rigid board segment continues to play a significant role in addressing these technological requirements.

The High-Density Interconnect (HDI) Board segment is the fastest growing in the PCB market from 2024 to 2032. The driving force behind this growth is the rising demand for compact, high-performance electronic devices across a variety of industries, including consumer electronics, automotive, telecommunications, and medical technology. Furthermore, HDI boards ensure higher performance, component density, and compactness, vital aspects that support the manufacturing of advanced applications including smart phones, entertainment, and electric vehicles (EVs). They provide improved signal integrity, greater power savings, and greater efficiency, making them a popular choice for manufacturers. Moreover, the increasing penetration of 5G, IoT, and AI technologies is propelling the need for HDI boards, thereby driving their adoption across sectors and geographies.

By Application

The Consumer Electronics segment dominated the PCB market, accounting for around 38% of the total revenue in 2023. This significant share is attributed to the widespread use of PCBs in various consumer electronic devices, including smartphones, laptops, tablets, televisions, gaming consoles, and home appliances. As consumer electronics continue to evolve with more advanced features, such as high-resolution displays, smart functionalities, and wireless connectivity, the demand for sophisticated and reliable PCBs increases. Additionally, the continuous growth of wearable technology and smart home devices has further bolstered the consumer electronics segment. The ongoing trend of miniaturization, combined with the increasing integration of Internet of Things (IoT) technologies, is expected to drive continued demand for high-performance PCBs in consumer electronics, ensuring the segment's market dominance in the years ahead.

The Automotive segment is the fastest-growing in the PCB market from 2024 to 2032, driven by greater integration of advanced electronic systems into vehicles. With advancements in automotive technology, the need for printed circuit boards in sectors such as electric vehicles (EVs), autonomous driving, and advanced driver-assistance systems (ADAS) is also on the increase. The shift to EVs, which require more PCBs than conventional vehicles thanks to their richer electronic content, is a meaningful driver of growth. Also, high-reliability and high-performance PCBs are indispensable for the growing adoption of ADAS technologies such as collision avoidance, lane-keeping assist and adaptive cruise control. The automotive industry's ongoing trend towards smarter, more connected vehicles further accelerates the need for robust, high-density PCBs, making it a key segment for future market expansion.

Printed Circuit Board Market Regional Outlook:

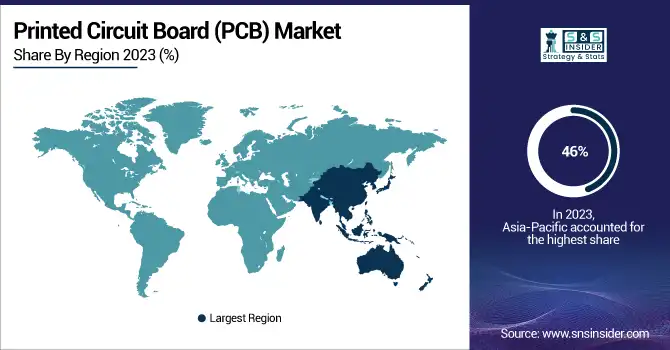

The Asia-Pacific region dominated the PCB market in 2023, accounting for approximately 46% of the total revenue. This dominance can be attributed to the strong manufacturing capabilities of the region, particularly in China, Japan, South Korea, and Taiwan, which are leading producers of PCBs. Most of the top PCB manufacturers in Asia-Pacific region serve diverse industries such as automotive, consumer electronics, telecommunications, and industrial. It is the main PCB production center because of a well-established supply chain, cost benefits, and rapid technological developments in the region. The Asia-Pacific PCB market continues to balloon, driven by deflating IoT, 5G, and electric vehicle demand for electronics in the region. Asia-Pacific's competitive advantage in manufacturing and technology will continue to drive its leading share of the global PCB market.

North America is the fastest-growing region in the PCB market from 2024 to 2032. This growth is driven by the increasing demand for advanced PCBs in various industries, including automotive, telecommunications, medical devices, and consumer electronics. The region's strong focus on innovation and technology adoption, particularly in areas like 5G, electric vehicles (EVs), and the Internet of Things (IoT), fuels the need for high-performance and reliable PCBs. Additionally, North America is seeing a rise in reshoring efforts and strategic investments in domestic PCB manufacturing, aimed at strengthening supply chain resilience and reducing dependency on overseas production. These factors, combined with robust research and development in PCB technologies, are driving North America's rapid growth in the global PCB market, making it a key region for future development.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players Listed in Printed Circuit Board Market along with their products:

-

Zhen Ding Technology (China) - HDI Boards, Rigid PCBs, Flexible PCBs, Multilayer PCBs, Automotive PCBs

-

Unimicron Technology (China) - HDI Boards, Rigid PCBs, Flexible PCBs, High-Frequency PCBs

-

DSBJ (China) - Rigid PCBs, Multilayer PCBs, Flex PCBs

-

Nippon Mektron (Japan) - HDI Boards, Flexible PCBs, Multilayer PCBs, Automotive PCBs

-

Compeq (China) - Rigid PCBs, Multilayer PCBs, HDI Boards

-

Tripod Technology (Taiwan) - HDI Boards, Multilayer PCBs, Rigid PCBs, Flexible PCBs

-

TTM Technologies (U.S.) - Rigid PCBs, Flexible PCBs, HDI Boards, Multilayer PCBs, High-Frequency PCBs

-

SCC (China) - Rigid PCBs, HDI Boards, Flexible PCBs

-

Ibiden (Japan) - HDI Boards, Rigid PCBs, Multilayer PCBs, Automotive PCBs

-

Hannstar Board (China) - Rigid PCBs, Multilayer PCBs, High-Density PCBs

-

AT&S (Austria) - HDI Boards, Rigid PCBs, Flexible PCBs, Automotive PCBs

-

Rhyming Technology (China) - Flexible PCBs, Rigid PCBs, Automotive PCBs

-

Sanmina Corporation (U.S.) - Rigid PCBs, Flexible PCBs, Multilayer PCBs, High-Frequency PCBs, Automotive PCBs

-

Wurth Elektronik Group (Germany) - Rigid PCBs, Flexible PCBs, HDI Boards

-

Becker & Muller Schaltungsdruck GmbH (Germany) - Rigid PCBs, Flexible PCBs

-

Advanced Circuits Inc. (U.S.) - Rigid PCBs, HDI Boards, Flex Circuits, Multilayer PCBs

-

Sumitomo Corporation (Japan) - Rigid PCBs, Automotive PCBs, Flexible PCBs

-

Murrietta Circuits (U.S.) - Rigid PCBs, Flexible PCBs, HDI Boards

List of Suppliers who Provide Raw Material and Component in Printed Circuit Board Market:

-

Rogers Corporation (U.S.)

-

Isola Group (U.S.)

-

Panasonic Corporation (Japan)

-

Hitachi Chemical (Japan)

-

Kester (U.S.)

-

Alpha Assembly Solutions (U.S.)

-

Senju Metal Industry (Japan)

-

DuPont (U.S.)

-

Taiyo Yuden (Japan)

-

Mitsui Mining & Smelting Co. (Japan)

-

Mek (Japan)

-

KUKA Robotics (Germany)

-

Texas Instruments (U.S.)

-

NXP Semiconductors (Netherlands)

-

STMicroelectronics (Switzerland)

-

MacDermid Alpha Electronics Solutions (U.S.)

-

Atotech (Germany)

Recent Development:

-

July 30, 2024, Sumitomo Electric Industries (SEI) is investing an additional USD 27.4 million in Hanoi to expand its flexible circuit board manufacturing capacity. This will include two projects at the Thang Long Industrial Park, increasing total investment in these facilities to USD 265.2 million.

-

24 Nov, 2024, Murrietta Circuits has added the Excellon Cobra Hybrid Laser System, enhancing precision in drilling microvias for complex HDI designs, improving quality, and supporting more intricate PCB production with dual-laser technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 75.85 Billion |

| Market Size by 2032 | USD 117.53 Billion |

| CAGR | CAGR of 4.99 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Rigid Board (Single Layer Board, Double Layer Board, Others (Multilayer)), HDI Board, Flexible Board, Others) • By Application(Automotive, Consumer Electronics, Telecommunication, Healthcare, Energy & Power, Others (Military, Utilities)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zhen Ding Technology (China), Unimicron Technology (China), DSBJ (China), Nippon Mektron (Japan), Compeq (China), Tripod Technology (Taiwan), TTM Technologies (U.S.), SCC (China), Ibiden (Japan), Hannstar Board (China), AT&S (Austria), Rhyming Technology (China), Sanmina Corporation (U.S.), Wurth Elektronik Group (Germany), Becker & Muller Schaltungsdruck GmbH (Germany), Advanced Circuits Inc. (U.S.), Sumitomo Corporation (Japan), Murrietta Circuits (U.S.). |