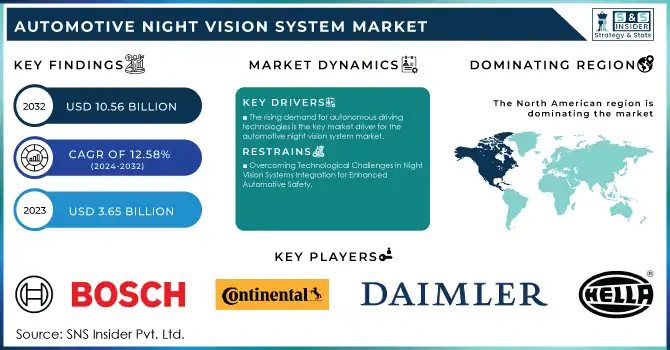

AUTOMOTIVE NIGHT VISION SYSTEM MARKET SIZE:

To get more information on Automotive Night Vision System Market - Request Free Sample Report

The Automotive Night Vision System Market Size was valued at USD 3.65 Billion in 2023 and is expected to reach USD 10.56 Billion by 2032 and grow at a CAGR of 12.58% over the forecast period 2024-2032.

The automotive night vision system market is growing due to the development of technology and the rise in patron demand for advanced security features. Night vision technology is also helping as vehicle manufacturers continue to improve driver assistance systems for low-light conditions. The use of infrared cameras and several other sensors reveals hazards before the regular headlights show them, giving drivers a better view of the road ahead to see pedestrians, animals, and obstacles on or near the roadway. Such an additional layer of protection is especially attractive to those consumers who consider safety at the top of their list when it comes to vehicle choices.

-

In 2023, more than 20% of premium and luxury models from brands such as BMW, Audi, and Cadillac offer night vision systems, indicating increasing penetration in the upper portions of the vehicle market. The new systems, which include thermal cameras produce about 90% detection accuracy on pedestrians and animals as far away as 300 meters well beyond the standard headlight range of about 120 meters.

Moreover, increasing knowledge of road safety regulations and the installation of tough safety standards across different markets is further propelling the growth of automotive night vision system market. By making models with elements like night vision integrated into them, automakers stick to the letter of upmarket safety features regulations as well, which are always changing. In addition, the increasing popularity of luxury and high-performance automobiles with advanced technology is also providing an upward push to the market. With consumers looking for not just performance but something that comes built with more safety as well as convenience, the take-up of night vision systems looks set to remain on an upward trend.

-

In 2023, 90% of new high-end vehicle models in Europe and North America were compliant with the safety regulations incentivizing night vision or advanced driver assistance technologies. According to a 2024 survey, 72% of consumers buying luxury cars were open to paying a premium for advanced safety tech such as night vision.

MARKET DYNAMICS

KEY DRIVERS:

-

The rising demand for autonomous driving technologies is the key market driver for the automotive night vision system market.

The automotive industry is rapidly pivoting to autonomous vehicles and that trend requires advanced sensing technologies. Night vision systems increase the ability to recognize natural surroundings in any type of lighting environment.

In 2023, around 25% of new autonomous vehicle prototypes included night vision for improved low-light detection. Global automotive firms invested over USD 50 billion in autonomous R&D, focusing on advanced sensing techs like night vision and thermal cameras.

Additionally, 35% of autonomous fleets from companies like Tesla and Waymo tested night vision systems to enhance low-visibility performance. This heightened awareness of the surroundings is crucial for safe navigation, especially when light conditions are poor and traditional lighting may be insufficient. As manufacturers spend billions on R&D to create fully self-driving cars, (integrating night vision systems) is a critical part of the tools that will need to be developed.

-

Rising consumer safety and accident prevention is another major factor propelling the market growth.

Traffic accidents have been an alarming situation worldwide, and manufacturers are trying to introduce new safety features that can lower the chances of a collision. Night vision systems aid this goal by giving drivers improved visibility so they can make better decisions in life-or-death situations. The result of this safety-conscious trend has been strategic manufacturing measures resulting in the general availability of advanced technologies that have made night vision systems an increasingly popular consumer commodity. In addition, with vehicle safety ratings and consumer awareness of these technologies developing year after year, the pressure for automakers to include night vision on their cars has increased. As a result, this tendency not merely propels the expansion of the night vision system market but also promotes a larger movement toward safer driving spaces in general.

-

In 2023, more than 1.3 million people were killed on the road, according to a WHO report many of them in low-visibility conditions proving that industry have much room for improvement when it comes to night-time safety.

-

According to a 2023 survey 68% of drivers sought advanced safety features in vehicles a 15% increase from the previous year. US insurers have been giving as much as 10% discounts on cars with night vision systems since 2024 when nighttime accident claims fell by 20%.

RESTRAIN:

-

Overcoming Technological Challenges in Night Vision Systems Integration for Enhanced Automotive Safety

The factor that is expected to restrain the growth of the automotive night vision system market over the forecast period is technological limitations related to sensor technologies. Though night vision systems have improved, obstacles remain in creating sensors able to detect and classify objects properly in a wide range of environmental conditions like fog rain, or glare from headlights. Communicating seamlessly between the different components, such as night vision cameras, displays or other driver assistance systems is challenging. There is a lot of time and effort that manufacturers need to put in for effective integration. This considerably delays product development and deployment. An example is BMW, which has been developing and refining its night vision systems so they better integrate with the other advanced driver assistance systems, how well functional integration takes place remains one of the challenges faced.

KEY MARKET SEGMENTS

BY TECHNOLOGY

The Far Infrared technology segment dominated the Automotive Night Vision System Market with a 64% share in 2023 owing to its high-quality ability for thermal imaging and object detection. Whenever it has low-light conditions, the FIR sensors work perfectly as they detect heat signatures from a being, vehicle, or obstacle. This helps drivers to see beyond their headlamp beams, great for safety during night driving. FIR systems have established application reliability and sound functionality, which are primarily responsible for the share of automotive manufacturers adopting FIR technology.

Near Infrared technology is expected to grow at the fastest CAGR from 2024 to 2032. The NIR systems allow for imaging at very high resolution and capture of clear visuals free from ambient reflection interferences. This technology is progressively combined with advanced driver assistance systems and cars, as it improves situational awareness and supplies information to make decisions. Amid warping consumer demand toward safety and automation, NIR tech will be a wave that automakers increasingly surf. In addition, this demand for NIR sensor technology will be supported by its growing consumer preference and continuous technological development in NIR sensors.

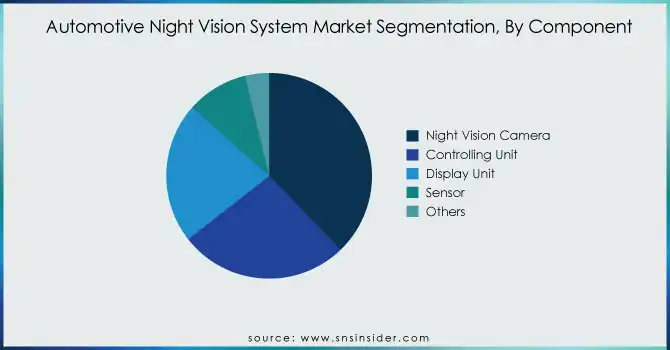

BY COMPONENT

The Night Vision Camera segment held the largest market share of 37% in 2023 due to its crucial advantages in improving driver safety and visibility under low-light conditions. Night vision cameras both thermal and infrared-based allow the driver to be able to see further than their stock headlights would normally allow. Night’s 3D detection of pedestrians, animals, and other obstacles has proven their effectiveness in making them an essential feature in modern vehicles. With increasing consumer awareness regarding such safety technologies, manufacturers are incorporating night vision cameras in their vehicle designs, thus contributing to a substantial market share.

The Display Unit segment will witness the fastest growth at a CAGR from 2024 to 2032 due to display technology advancement and increasing focus towards intuitive human-machine interface. At the same time, as night vision systems become more integrated with other vehicle technologies (e.g., advanced driver assistance systems [ADAS]), high-quality display units will also be required. Modern displays allow you to see more information immediately available, which makes the experience better with clearer visuals and interaction of night vision in an optimal way. In addition, increasing penetration of connected vehicles and implementation of the display via infotainment systems will further increase demand for high-end display units, which is expected to be a main growth driver over the next few years.

BY VEHICLE

The Passenger Vehicles segment dominated with a 73% market share in 2023 because of the steady consumer emphasis on safety & comfort for personal modes of transportation. As passenger vehicles workforces with advanced safety features to protect drivers and passengers alike, such as night vision systems arbitrate appealing options for consumers. The segment that contributed significantly to market share is due to the rising awareness regarding road safety; manufacturers are including night vision into their offerings as a solution for the high demand for visibility and accident prevention.

The Commercial Vehicles segment is estimated to record the fastest growth during the period from 2024 to 2032. This growth is triggered by the safety demand in commercial transport, which typically represents large vehicles driven in rugged environments and at night. Night vision systems improve the visibility for truck and bus drivers along with other commercial vehicle operators thereby minimizing accidents due to less lighting conditions. Furthermore, the increasing regulatory pressure and the need for more effective safety features in commercial transportation are encouraging fleet operators to adopt novel technologies including night vision systems. Since these vehicles are extensively utilized for long-distance travel the commercial sector will continue to be the most significant growth area in this market due to demand for systems enhancing visibility and reducing fatigue.

REGIONAL ANALYSIS

North America led the Automotive Night Vision System Market share accounting for a market share of 31% in 2023, owing to the technologically advanced automotive industry and high safety regulation standards. General Motors, Ford, and Tesla, which have manufacturing operations in the region, are leaders in-vehicle technologies. Night vision systems that improve driver awareness during nighttime driving are included with Cadillac's Super Cruise feature. Additionally, persistent consumer demand for safety has been combined with rising sales of luxury vehicles provided with advanced driver assistance systems (ADAS), hence further complementing the growth of the market in this region.

Asia Pacific region will witness the fastest CAGR during the years 2024-2032 owing to rapid urbanization coupled with high disposable incomes and a developing automotive market. China, India, and other countries are producing and selling so-called motor vehicles akin to hotcakes propelled by a larger middle class and an increased awareness of safety features. Take the night vision for example, we see Chinese manufacturers, NIO and Xpeng embedding this technology into their EVs to beat global brands on the same view of high-end. As night vision systems help improve a driver's vehicle safety and performance, they are increasingly becoming an integral part of autonomous driving technologies being adopted in the Asia Pacific region. These two factors along with the growing demand for safer vehicles across the globe will propel the market growth in the Asia Pacific region during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Automotive Night Vision System Market are:

-

Bosch (Night Vision Camera, Driver Assistance System)

-

Continental AG (Night Vision System, Sensor Technology)

-

Daimler AG (Thermal Imaging System, Driver Assistance)

-

Ford Motor Company (Night Vision Assistance, Advanced Driver Assistance System)

-

General Motors (GM) (Night Vision System, Safety Technologies)

-

Valeo (Thermal Imaging Camera, Night Vision Sensor)

-

Aisin Seiki Co., Ltd. (Night Vision System, Advanced Lighting Solutions)

-

Delphi Technologies (Night Vision Systems, Automotive Sensor Solutions)

-

Hella (Night Vision System, Radar Sensors)

-

Magna International (Thermal Imaging System, Active Safety Systems)

-

Nissan Motor Corporation (Night Vision Assistance, Advanced Safety Features)

-

Toyota Motor Corporation (Night Vision System, Driver Assistance Technologies)

-

Autoliv (Night Vision System, Advanced Safety Solutions)

-

ZF Friedrichshafen AG (Night Vision System, Driver Assistance Technology)

-

Infineon Technologies (Automotive Sensors, Vision Processing Solutions)

-

Carmudi (Thermal Night Vision Systems, Driver Monitoring Systems)

-

Samsung Electronics (Automotive Cameras, Night Vision Technology)

-

Visteon Corporation (Night Vision System, Vehicle Cockpit Electronics)

-

Pioneer Corporation (Night Vision Display, Automotive Camera Systems)

-

Stoneridge, Inc. (Night Vision Assistance, Advanced Driver Systems)

Some of the Raw Material Suppliers for Automotive Night Vision System Companies:

-

3M

-

DuPont

-

BASF

-

Honeywell

-

SABIC

-

Covestro

-

Eastman Chemical Company

-

Huntsman Corporation

-

Teijin Limited

-

Toray Industries

RECENT TRENDS

-

In September 2024, Veoneer is set to launch the world's first thermal camera designed specifically for Level 4 autonomous vehicles. This groundbreaking technology will utilize multiple high-resolution thermal cameras to improve safety in the mobility-as-a-service sector, marking a significant advancement in autonomous driving systems.

-

In October 2024, Israeli startup AdaSky is developing an infrared camera to improve night vision for self-driving cars, enhancing navigation in challenging conditions.

-

In January 2024, InfiRay showcased its Auto AI Night Vision System, the InfiRay NV2, at CES 2024. The NV2 features an infrared thermal imaging unit that captures clear images in total darkness and effectively identifies glare, reflections, and haze in harsh conditions like rain and dust, enhancing night driving safety.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.65 Billion |

| Market Size by 2032 | USD 10.56 Billion |

| CAGR | CAGR of 12.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Far Infrared (FIR), Near Infrared (NIR)) • By Component (Night Vision Camera, Controlling Unit, Display Unit, Sensor, Others) • By Vehicle (Passenger Vehicles, Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch, Continental AG, Daimler AG, Ford Motor Company, General Motors (GM), Valeo, Aisin Seiki Co., Ltd., Delphi Technologies, Hella, Magna International, Nissan Motor Corporation, Toyota Motor Corporation, Autoliv, ZF Friedrichshafen AG, Infineon Technologies, Carmudi, Samsung Electronics, Visteon Corporation, Pioneer Corporation, Stoneridge, Inc |

| Key Drivers | • Driving the Future Night Vision Systems Revolutionizing Safety in Autonomous Vehicle Technology • Enhancing Road Safety Night Vision Systems Driving Consumer Demand and Reducing Traffic Accidents |

| Restraints | • Overcoming Technological Challenges in Night Vision Systems Integration for Enhanced Automotive Safety |