Automotive ambient lighting market Report Scope & Overview:

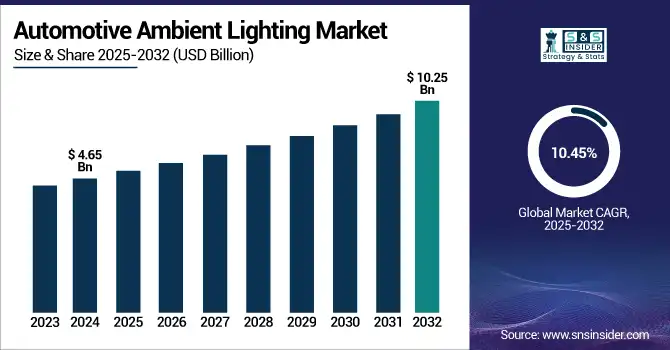

The Automotive ambient lighting market Size was valued at USD 4.65 Billion in 2024 and is expected to reach USD 10.25 Billion by 2032 and grow at a CAGR of 10.45% over the forecast period 2025-2032.

To Get more information on Automotive ambient lighting market - Request Free Sample Report

The Automotive Ambient Lighting Market growth is driven by rising consumer demand for enhanced in-vehicle experience, safety, and personalization. This market includes interior lighting solutions integrated into dashboards, footwells, doors, and center consoles, offering aesthetic appeal and functional visibility. Increasing adoption in mid-range and luxury vehicles, along with advancements in LED and OLED technologies, is reshaping vehicle interiors. Automotive ambient lighting market share is expanding as automakers leverage lighting to reflect brand identity and improve cabin ambiance. Automotive ambient lighting market analysis highlights a surge in integration with connected vehicle systems, enabling adaptive lighting features that enhance driver comfort and safety.

“For Instance in December 2024 - ams OSRAM showcased advanced automotive ambient lighting innovations at CES 2025, highlighting dynamic color control, personalization features, and integration with autonomous driving systems to enhance in-cabin user experience.”

The U.S. Automotive ambient lighting market size was valued at USD 0.95 Billion in 2024 and is expected to reach USD 1.91 Billion by 2032, growing at a CAGR of 11.13% over the forecast period of 2025-2032.

The U.S. automotive ambient lighting market is growing due to increasing demand for premium vehicles and enhanced in-cabin experiences. Automakers are integrating customizable LED lighting systems to improve aesthetics, comfort, and safety. Advancements in smart lighting technologies and rising consumer preferences for personalized interiors are further driving market growth.

Market Dynamics

Drivers:

- Rising Preference for Enhanced In-Cabin Aesthetics and Comfort Drives the Automotive Ambient Lighting Market Growth

Automotive manufacturers are increasingly incorporating ambient lighting features to elevate the in-cabin user experience. Ambient lighting enhances vehicle interiors, making them more appealing and luxurious. It also improves night-time visibility and comfort, thereby contributing to driver and passenger well-being. Consumers, especially in premium and mid-range segments, are showing a clear preference for cars with aesthetic lighting options that offer both mood enhancement and visual appeal. This shift in buyer expectations has prompted Automotive Ambient Lighting Companies to innovate with dynamic color schemes, brightness customization, and integration with infotainment systems, which collectively boost the Automotive Ambient Lighting Market Trends.

- Increasing Integration of Smart Lighting Technologies Accelerates Adoption Across Connected and Autonomous Vehicles

With the rapid evolution of connected and autonomous vehicles, smart ambient lighting systems are becoming standard features. These systems adapt lighting levels and colors based on real-time driving conditions, driver emotions, and voice commands, significantly enhancing user interaction. Smart lighting also contributes to safety by subtly guiding driver attention and alerting passengers. As vehicle intelligence increases, automakers are leveraging IoT and AI-driven lighting controls to meet consumer expectations for personalization and safety. These innovations are central to Automotive Ambient Lighting Market Analysis, positioning lighting as both a design and functional element in future mobility.

Restraints:

- High Cost of Advanced Ambient Lighting Systems Limits Adoption in Budget and Entry-Level Vehicles

Despite growing demand, the cost of implementing advanced ambient lighting systems remains a key challenge, especially for budget car manufacturers. Premium components, design integration, and control systems increase vehicle production costs, making it difficult to incorporate these features into lower-end models. As a result, ambient lighting remains primarily confined to luxury and high-end segments. This cost barrier affects the overall penetration of ambient lighting across the broader automotive spectrum, slowing down mass-market adoption and impacting the long-term expansion of the Automotive Ambient Lighting Industry.

Segmentation Analysis

By Component

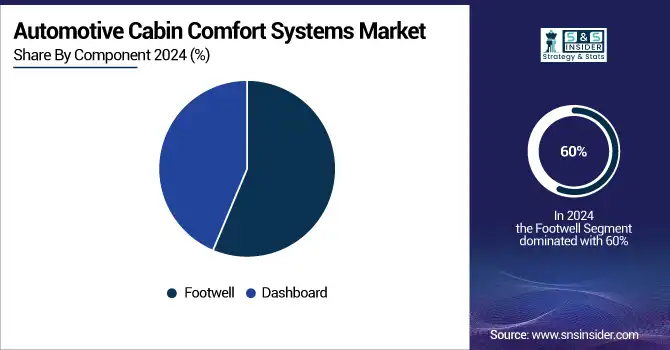

The footwell segment dominated the automotive ambient lighting market with the highest revenue share of about 60% in 2024 due to its widespread integration across both mid-range and premium vehicle models. Footwell lighting enhances both safety and aesthetics by illuminating the lower cabin area, improving visibility during entry and exit. Its relatively low cost and ease of installation have led to broad OEM adoption, making it a standard feature in many passenger vehicles, which significantly contributes to its strong market dominance.

The dashboard segment is expected to grow at the significant CAGR of about 11.04% from 2025 to 2032 owing to rising consumer demand for personalized and interactive cabin experiences. As vehicles become more digitally integrated, dashboard lighting is being paired with infotainment systems, driver alerts, and ambient mood settings. Automakers are focusing on smart lighting features that synchronize with driving modes and climate controls, making dashboard lighting a central element in enhancing user interface and in-cabin engagement.

By Application

The interior segment dominated the automotive ambient lighting market with the highest revenue share in 2024 due to its direct impact on passenger comfort, luxury, and safety. Interior lighting, especially in the dashboard, door panels, and footwell, enhances the driving experience and supports night-time visibility. OEMs are increasingly including customizable interior ambient lighting features, particularly in mid-range and high-end vehicles, to differentiate their models and align with consumer expectations for refined, tech-enhanced in-cabin environments, making this segment the most profitable.

The exterior segment is expected to grow at the robust CAGR from 2025 to 2032 as automakers adopt innovative lighting solutions for branding, safety, and aesthetic appeal. Exterior ambient lighting, such as illuminated logos, door handles, and welcome lighting, is becoming more prevalent in luxury and electric vehicles. This trend is driven by the demand for premium vehicle personalization and enhanced brand identity. Regulatory support for visibility and pedestrian safety also contributes to the rapid adoption of exterior lighting technologies.

By Car Segments

The D segment dominated the automotive ambient lighting market with the highest revenue share in 2024, largely due to its position as a popular choice for premium mid-size sedans and SUVs. Vehicles in this segment often include advanced comfort and aesthetic features, such as ambient lighting, as standard or optional upgrades. As more automakers equip D-segment vehicles with customizable lighting to enhance in-cabin experience and compete in the premium category, the segment continues to lead in ambient lighting adoption.

The F segment is expected to grow at the fastest CAGR from 2025 to 2032 owing to rising demand for ultra-luxury vehicles and increased investment in high-end in-cabin features. F-segment vehicles, including executive sedans and luxury limousines, are early adopters of cutting-edge lighting technologies. As consumers in this segment prioritize exclusivity, comfort, and personalization, automakers are integrating dynamic ambient lighting systems with AI and voice controls, propelling strong growth in ambient lighting applications within this vehicle category.

By Vehicle Type

Battery Electric Vehicles (BEVs) dominated the automotive ambient lighting market with a lucrative revenue share in 2024, driven by the segment’s strong focus on futuristic and tech-rich interiors. BEVs often feature minimalistic yet highly digital cabin layouts where ambient lighting plays a key role in enhancing the user interface, highlighting touchpoints, and reflecting charging or driving modes. Leading EV manufacturers use advanced lighting as a signature design element, contributing to the higher integration rate and revenue share of ambient lighting in BEVs.

Fuel Cell Electric Vehicles (FCEVs) are expected to grow at the significant CAGR of 5% from 2025 to 2032 due to increasing R&D investment and expanding interest in zero-emission technologies. As FCEVs enter the premium and commercial market segments, automakers are equipping them with advanced features, including ambient lighting, to attract environmentally conscious luxury buyers. Additionally, governments' support for hydrogen fuel infrastructure encourages innovation in FCEV designs, which often include cutting-edge lighting systems for interior ambience and user feedback.

By Sales Channel

The OEM segment dominated the automotive ambient lighting market with the highest revenue share in 2024 as ambient lighting features are increasingly being offered as standard or factory-installed upgrades in new vehicles. OEMs are integrating ambient lighting into vehicle design to enhance user comfort, brand identity, and in-cabin aesthetics. With growing competition in vehicle personalization and customer experience, automakers are equipping even mid-range vehicles with basic ambient lighting systems, making OEMs the leading contributors to market revenues.

The aftermarket segment is expected to grow at the significant CAGR from 2025 to 2032 due to increasing consumer interest in vehicle customization post-purchase. As awareness of ambient lighting’s aesthetic and functional benefits rises, many car owners are turning to aftermarket solutions to upgrade their interiors. Advancements in plug-and-play LED kits and wireless control options have made ambient lighting upgrades more accessible and affordable. This shift in consumer behavior is driving strong growth in aftermarket ambient lighting installations.

Regional Analysis

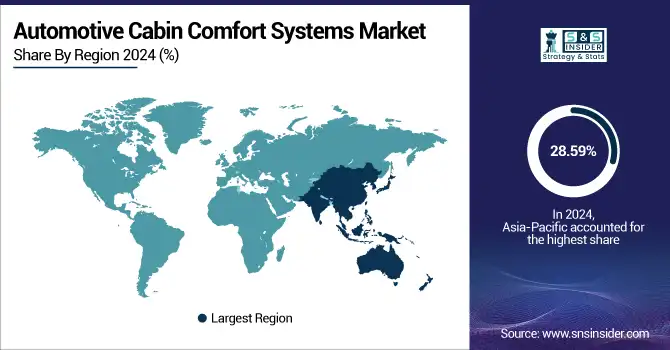

Asia-Pacific dominated the automotive ambient lighting market with the highest revenue share of about 28.59% in 2024 due to the presence of major automotive manufacturers, rising vehicle production, and increasing consumer demand for advanced in-cabin features. Countries like China, Japan, and South Korea are leading in integrating ambient lighting technologies across mid-range and premium vehicles. Growing urbanization, rising disposable income, and a strong preference for comfort and aesthetics are driving the adoption of ambient lighting, making Asia-Pacific the leading regional market.

“In May 2025- Valeo strengthens its position in China’s automotive market by advancing intelligent lighting systems, including ambient lighting, to support electrification, safety, and premium in-cabin experiences across next-generation vehicles.”

North America is projected to grow at a steady CAGR of about 11.30% from 2025 to 2032, driven by increasing demand for connected and luxury vehicles featuring smart ambient lighting systems. Automakers in the U.S. and Canada are focusing on enhancing the user experience through personalized cabin environments. The growing popularity of electric vehicles, coupled with rising consumer expectations for tech-integrated interiors and safety enhancements, is accelerating the adoption of ambient lighting solutions across the region’s automotive landscape.

Europe's automotive ambient lighting market is thriving due to strong demand for premium vehicles and safety-enhancing features. Germany dominates the region, driven by luxury OEMs like BMW and Mercedes-Benz. Recent innovations include adaptive ambient lighting synchronized with driving modes, enhancing both aesthetics and functionality across high-end electric and connected vehicles.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major players operating in the market are: HELLA, Valeo S.A., ams OSRAM, Grupo Antolin, Koito Manufacturing Co., Ltd., Signify, Stanley Electric Co., Ltd., Continental AG, ZKW Group GmbH, Flex-N-Gate

Recent Developments

- April 2025 - Valeo and Appotronics have announced a strategic partnership to develop next-generation front lighting systems, integrating advanced laser technologies to enhance road safety and automotive ambient lighting innovations.

- April 2024 - ams OSRAM and DOMINANT Opto Technologies have partnered to develop smart automotive ambient lighting solutions, enhancing in-vehicle experiences with dynamic color control and advanced human-centric lighting features.

| Report Attributes | Details |

| Market Size in 2024 | USD 4.65 Billion |

| Market Size by 2032 | USD 10.25 Billion |

| CAGR | CAGR of 10.45% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Application (Interior, Exterior) By Component (Dashboard, Footwell, Doors, Center Console, Others) By Car Segments (C, D, E, F) By Vehicle Type (Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-in Hybrid Electric Vehicle (PHEV)) By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | HELLA, Valeo S.A., ams OSRAM, Grupo Antolin, Koito Manufacturing Co., Ltd., Signify, Stanley Electric Co., Ltd., Continental AG, ZKW Group GmbH, Flex-N-Gate |