Body Composition Analyzers Market Size & Trends:

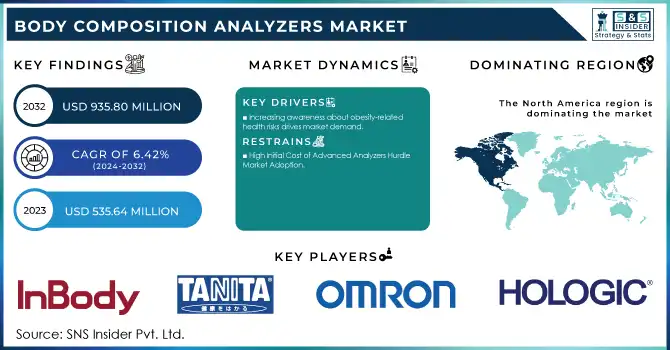

The Body Composition Analyzers Market Size was valued at USD 535.64 Million in 2023 and is expected to reach USD 935.80 Million by 2032 and grow at a CAGR of 6.42% over the forecast period 2024-2032.

To get more information on Body Composition Analyzers Market - Request Free Sample Report

The Body Composition Analyzers Market is witnessing rapid growth, driven by technological advancements and heightened health consciousness. These devices have gained traction for their ability to provide accurate insights into body fat, muscle mass, bone density, and hydration levels, aiding in preventive healthcare, sports performance enhancement, and chronic disease management. With innovations like non-invasive bioelectrical impedance analysis (BIA) and dual-energy X-ray absorptiometry (DXA), along with IoT integration and mobile compatibility, devices such as the InBody 970 and Tanita MC-780MA now offer real-time data tracking and personalized health insights. Rising obesity rates—affecting over a billion people globally, according to 2024 estimates—highlight the growing need for effective monitoring tools. Developed and developing nations alike, such as the U.S., India, and Brazil, are experiencing a surge in obesity-related health concerns.

The healthcare industry's shift toward preventive care is further accelerating the adoption of body composition analyzers in medical institutions for monitoring patients at risk of obesity, cardiovascular diseases, and diabetes. The incorporation of AI and machine learning is poised to transform the market, enabling more accurate and tailored health data interpretation, solidifying the significance of body composition analyzers in modern healthcare.

Body Composition Analyzers Market Dynamics

Key Drivers:

-

Increasing awareness about obesity-related health risks drives market demand.

The increasing obesity rate around the world and rising awareness about the associated health risks have significantly driven demand for body composition analyzers. Between 1975 and 2022, obesity rates nearly tripled among women (6.6% to 18.5%) and quadrupled in men (3% to 14.0%). This corresponds to about 504 million women and 374 million men living with obesity in 2022. To these numbers are added 159 million children aged 5-19 years, which brings the total number of people living with obesity to over one billion in 2022. Overweight and obesity are projected to continue to rise unless concerted and evidence-based action is undertaken – the time for action is now. This condition is highly linked to an increased susceptibility of developing chronic diseases such as diabetes, cardiovascular diseases, and a myriad of cancers. The more aware the people get about these risks, they are drifting more toward preventive health management, in which body composition analyzers become crucial.

-

Increasing digital health tracking trends drive more adoption in the market.

The growing digital health trends include wearable devices and health-tracking applications driving growth in the body composition analyzers market. IoT-enabled devices have become a must for users who want to monitor their body metrics since it enables syncing data with the smartphone or cloud storage.

Body composition analyzers offering connectivity via Bluetooth and Wi-Fi will appeal to consumers who are more tech-savvy and fitness enthusiasts seeking a way to incorporate their body composition data into a comprehensive digital health ecosystem. There is a strong trend seen here, especially in the world of fitness, for in-depth body composition analysis supporting goal setting, following one's fitness progress over time, and custom-made workouts. As the demand for the connected health devices increases, so does the use of devices from body composition analyzers manufacturers, which align the devices with health applications for further growth in the market.

Restrain:

-

High Initial Cost of Advanced Analyzers Hurdle Market Adoption.

As high initial cost associated with the advanced devices is a critical concern that has restricted the higher use of the body composition analyzers. Most of the advanced body composition analyzers, especially those applied in clinical and professional fitness settings, cost from a few hundred to thousands of dollars. These prices are primarily justified by the complexity of technologies involved, such as DXA (dual-energy X-ray absorptiometry) or multi-frequency BIA (bioelectrical impedance analysis). The cost is especially overwhelming for small clinics, independent fitness centers, and individual consumers, thus preventing wider availability and penetration.

The expenses regarding maintenance and calibration are generally added to ensure that the accuracy of measurement is not compromised; thus, it would increase the total cost of ownership even further. For users based in low-and middle-income regions, where obesity, among other lifestyle-related health concerns, is on the increase, the affordability of body composition analyzers remains a question. This may be a major cost hurdle; the cost can be mitigated by government subsidies or insurance reimbursement for the monitoring device. So far, though, this has been a limiting factor for broader acceptance of the devices in the market.

Body Composition Analyzers Market Segmentation Overview

By Modality

Portable Body Composition Analyzers dominated with the market share of 62% in the year 2023. Reasons for popularity include flexibility and compact design, making it easy to fit into any fitness center, wellness clinic, or personal user that finds this type of monitoring convenient when in use. In addition, a great increase in consumer preference for health monitoring from home has led to increased demand for the portable models, which have become more and more compatible with the digital health applications for instant tracking.

Stationary or Bench-Top Body Composition Analyzers are likely to grow at the fastest pace with an estimated CAGR of 6.80% in the forecast period 2024-2032. These larger and more complex machines are more found in clinical and research settings, where accuracy is paramount. Thus, these are the best suited for in-depth analysis of body composition. With increasing demand for more precise and accurate assessment, benchtop analyzers are expected to have growing penetration in institutional and specialty healthcare markets.

By Distribution Channel

Offline/Retail channels accounted for 68% of the market share in 2023. These are attributed to the various consumer preferences of consulting or demonstrating the products and making purchases, hence, acquiring post-purchase support provided to the consumers beyond what they can receive at specialty medical equipment outlets and wellness centers; hence, this has attained relatively high consumer confidence and satisfaction levels.

E-commerce channels will grow with the fastest cagr at 7.20% from 2024 to 2032. Increased internet penetration, along with convenience and competitive pricing, is contributing to an increase in growth in the e-commerce channel. Therefore, it is being adopted more by individual users and by healthcare providers, which have been looking for cost-effective solutions. The e-commerce segment is growing at a rapid rate due to the shift of users from traditional shopping that involves price comparison, a read-through of reviews in the convenience of home delivery services, as has become preferred post-COVID-19.

Body Composition Analyzers Market Regional Analysis

The North America region commanded the highest market share in 2023, driven primarily by a well-established healthcare infrastructure, high awareness of preventive health, and significant consumer demand for fitness and wellness solutions. The region is further supported by significant market players and robust regulatory support for health monitoring solutions.

The fastest growth rate is likely to be seen in the Asia Pacific region, as per this study, estimated at a CAGR of 7.27% between 2024 and 2032. The upsurge in lifestyle disorders, growing middle-class populations, and health awareness are fuelling the demand for body composition analyzers among various countries such as China, Japan, and India.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Body Composition Analyzers Market are

-

InBody (InBody 270, InBody 970)

-

Tanita (BC-545N, MC-780MA)

-

Omron Healthcare (HBF-516B, BF511)

-

Hologic (Discovery DXA System, Horizon DXA System)

-

Bodystat (QuadScan 4000, Bodystat 1500)

-

Seca (mBCA 515, Seca 525)

-

GE Healthcare (Lunar iDXA, Prodigy Advance)

-

COSMED (BOD POD, Pea Pod)

-

RJL Systems (Quantum X, BIA 101 Anniversary)

-

Beurer (BF1000, BF105)

-

BioSpace (InBody S10, InBody 120)

-

AccuFitness (MyoTape, Accu-Measure Body Fat Caliper)

-

MuscleSound (Mbody, Metabolic Analysis)

-

Maltron International (BF-906, Maltron 920)

-

Withings (Body Cardio, Body+)

-

Garmin (Index S2, Index Smart Scale)

-

Xiaomi (Mi Body Composition Scale 2, Smart Scale)

-

Fitbit (Aria Air, Aria 2)

-

Renpho (Smart Scale ES-CS20M, Bluetooth Body Fat Scale)

-

Styku (Styku S100, Styku S200)

Major Suppliers (Components, Technologies)

-

TE Connectivity (sensors, connectors)

-

Texas Instruments (microcontrollers, sensors)

-

Analog Devices (signal processing components, sensors)

-

Murata Manufacturing (capacitors, sensors)

-

Samsung Electro-Mechanics (capacitors, components)

-

Vishay Intertechnology (resistors, capacitors)

-

LEMO (connectors, cables)

-

Maxim Integrated (analog ICs, sensors)

-

Honeywell (sensors, switches)

-

Omron Components (connectors, relays)

-

Amphenol (connectors, cables)

-

STMicroelectronics (microcontrollers, sensors)

-

Microchip Technology (microcontrollers, analog ICs)

-

Broadcom (optocouplers, sensors)

-

Bosch Sensortec (sensors, microcontrollers)

-

TDK Corporation (capacitors, sensors)

-

Kyocera Corporation (ceramics, capacitors)

-

Epson Electronics (quartz devices, semiconductors)

-

Panasonic Industry (batteries, sensors)

-

Molex (connectors, cable assemblies)

Major Clients

-

Mayo Clinic

-

Kaiser Permanente

-

Cleveland Clinic

-

Life Time Fitness

-

Planet Fitness

-

Equinox

-

Gold's Gym

-

U.S. Department of Defense

-

National Institutes of Health (NIH)

-

American Heart Association

-

Johns Hopkins Medicine

-

World Health Organization (WHO)

-

University of California, Los Angeles (UCLA Health)

-

National Health Service (NHS), UK

-

Tokyo Medical University

-

UnitedHealth Group

-

YMCA

-

Singapore General Hospital

-

Cleveland Clinic Abu Dhabi

-

MedStar Health

Recent Trends

-

February 2024: Amazfit has announced its new accessory, which in India will be available by the name Amazfit Body Composition Analyzer Mat that will be working along with the Amazfit Balance. The mat does an entire body composition analysis. The Amazfit Balance was launched back in December 2023.

-

January 2024: The U.S. Marine Corps, having established service-wide body composition standards to measure readiness in its Marines decades ago, recently looked to refine its current method of body composition assessment by using the InBody 770, one of InBody's professional body composition analyzers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 535.64 Million |

| Market Size by 2032 | US$ 935.80 Million |

| CAGR | CAGR of 6.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Bio-impedance Analyzer (Multi-frequency Bio-impedance Analyzers, Single-frequency Bio-impedance Analyzers, Dual-frequency Bio-impedance Analyzers), Skinfold Calipers, Hydrostatic Weighing Equipment, Air Displacement Plethysmography, Dual Energy X-ray Absorptiometry, and Other Products), • By Compartment Model Type (Two-Compartment Model, Three-Compartment Model, and Multi-Compartment Models) • By Modality (Portable Body Composition Analyzers, Stationary/Benchtop Body Composition Analyzers) • By Usage Type (Professional-Grade Body Composition Analyzers (Hospitals, Academic and Research Centers), Consumer-Grade Body Composition Analyzers (Fitness Clubs and Wellness Centers, Others)) • By Application (Segmental Body Measurement, Whole-body Measurement) • By Distribution Channel (E-commerce, Offline/Retail Stores) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | InBody, Tanita, Omron Healthcare, Hologic, Bodystat, Seca, GE Healthcare, COSMED, RJL Systems, Beurer, BioSpace, AccuFitness, MuscleSound, Maltron International, Withings, Garmin, Xiaomi, Fitbit, Renpho, Styku |

| Key Drivers | • Increasing awareness about obesity-related health risks drives market demand. • Increasing digital health tracking trends drive more adoption in the market. |

| Restraints | • High Initial Cost of Advanced Analyzers Hurdle Market Adoption. |