Bowie-Dick Test Pack Market Report Scope And Overview:

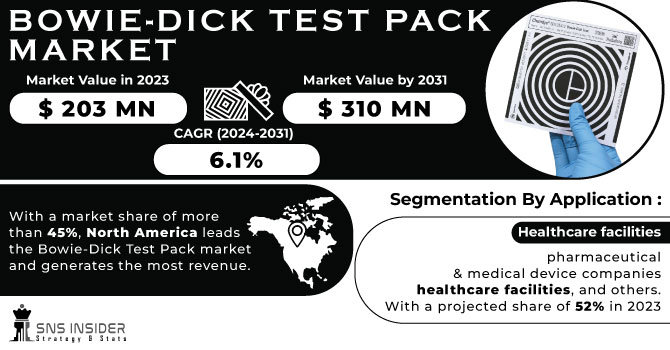

The Bowie-Dick Test Pack Market size is projected to grow from USD 203 million in 2023 to USD 310 million by 2031, at a CAGR of 6.1% during the forecast period 2023-2031.

One test used to assess the sterilization effectiveness of a particular sterilization cycle is the Bowie Dick Test Pack. The growing number of pharmaceutical and medical device companies, the increased focus on sterilisation in the healthcare industry, and the growing demand for more advanced, high-value products are the main drivers of the bowie-dick test pack market expansion.

Get More Information on Bowie-Dick Test Pack Market - Request Sample Report

Furthermore, during the projected periods, the global market growth is anticipated to be further propelled by the surge in demand for sterilisation monitoring products, which are intended to manage hospital-acquired infections (HAIs) that arise during hospital stays or invasive surgeries. Furthermore, the Bowie-Dick test pack market is growing as a result of significant technological advancements, the expansion of healthcare manufacturing facilities, and the growing market presence of major companies. Global market growth is anticipated to be further stimulated by the major players' increasing competition to introduce advanced products throughout the forecast period.

According to the National Healthcare Safety Network's 2023 report, 20% of hospital-acquired infections (HAIs) are sexually transmitted infections (SSIs). This means that Bowie-Dick test products have more potential to reduce contamination in hospitals and clinics.

Sterilisation equipment is becoming more and more necessary due to rising global healthcare costs and healthcare facilities' ongoing expansion. In order to satisfy the growing market demand, producers of Bowie-Dick test packs have the chance to expand their production capacity and streamline their distribution systems thanks to this growth trend. By using this tactic, they guarantee that their products will be easily available to healthcare facilities, both new and old.

The major factor which is anticipated to play a key role in driving the demand for Bowie dick pack test market globally, that the healthcare facilities are required by the FDA's Quality System Regulations to periodically test and supervise the sterilisation of equipment using Bowie-Dick test packs. This indicates adherence to accepted guidelines, improving patient safety and lowering the possibility of infections brought on by inadequately sanitised medical equipment.

MARKET DYNAMICS

DRIVERS

-

Growing understanding of the value of quality control

The growing understanding of the value of quality control in the healthcare sector is one of the main motivators. Ensuring that medical facilities meet the highest standards and that patients receive the best care possible requires quality control.

The rising need for healthcare types is another major factor propelling the Bowie Dick Test Pack market. It is anticipated that the need for healthcare types will rise as the population ages and grows. Lastly, the growing globalization of the healthcare sector is driving the Bowie Dick Test Pack market. It is anticipated that the demand for quality control goods and types will rise as the healthcare sector grows more international.

-

Innovations in Bowie-Dick test pack design

Bowie-Dick test packs are now more effective and user-friendly due to improvements in sensitivity, reliability, and material and feature selection.

RESTRAINT

-

Limited Awareness and Education

Healthcare professionals and other stakeholders are still not well-informed about the significance of Bowie Dick test packs, despite the importance of sterilization validation. This factor may partially impede market expansion.

OPPORTUNITY

-

Growing emphasis on sterilization in healthcare facilities

The growing emphasis on sterilization in healthcare facilities has led to a notable growth in the Bowie-Dick Test Pack market in recent years. According to market data, Bowie-Dick Test Packs are becoming more and more popular throughout the world. The increase in surgical procedures, growing public awareness of infection control, and strict sterilization regulations are some of the factors contributing to this growth. The Bowie-Dick Test Pack market is expected to continue growing in the future, which is a positive outlook. To remain competitive, market participants should, nevertheless, keep a close eye on developments in application and alterations to regulations.

CHALLENGES

-

High cost of test packs

Dick Bowie Test packs can be pricey, especially when weighed against alternative techniques for sterilization monitoring. Their adoption may be hampered by their cost, particularly in settings with limited resources or in smaller healthcare facilities.

IMPACT OF RUSSIAN UKRAINE WAR

The extent to which this trend continues to be driven by the nature of the conflict and the capacity of the military medical systems in Romania and Russia to treat injured soldiers will determine how much demand there is for trauma Types during times of war.

India is the world's third-largest pharmaceutical exporter to Ukraine. The war has caused disruptions in international trade, leading to increased costs for manufacturing and transportation, inflation, and problems with trade payments.

IMPACT OF ECONOMIC DOWNTURNS

In general, during an economic downturn, overall investment levels tend to be lower. Nevertheless, cyclical trends do not appear to have an impact on the healthcare industry. For instance, in spite of the difficult macroeconomic market conditions, we are currently witnessing a persistent interest in the healthcare industry and assets.

Government Initiative

The Indian government has announced favorable policies to attract foreign direct investment (FDI) and has implemented extensive structural and ongoing reforms to bolster the healthcare sector.

Aatmanirbhar Bharat Abhiyaan packages include various short- and long-term health system measures, such as Production-Linked Incentive (PLI) schemes aimed at increasing domestic pharmaceutical and medical device manufacturing. India is also aiming to become a center for spiritual and wellness travel because it has a lot to offer in the areas of yoga and Ayurveda.

KEY MARKET SEGMENTATION

By Application

-

Pharmaceutical and medical device companies

-

Healthcare facilities

-

Others

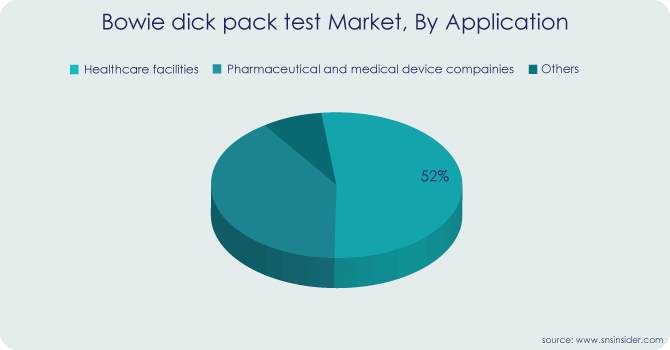

The Bowie-Dick Test Pack Market is divided into three categories based on application: pharmaceutical & medical device companies, healthcare facilities, and others. With a projected share of 52% in 2023, the Healthcare Facilities segment holds the largest share.

Following the safety guidelines set forth for hospitals and clinics, healthcare facilities in developed countries place a high priority on providing high-quality treatments and services that are safe, effective, and free of infections. Throughout the anticipated period, this commitment fuels the segment's growth. The growing number of hospitals throughout the world is another factor driving up demand for this product.

The second-largest market segment for bowie-dick test packs is anticipated to be made up of pharmaceutical and medical device companies. This growth is attributed to a number of important factors, one of which is the widespread use of Bowie-Dick test packs. The U.S. FDA's recommended guidelines, which require pharmaceutical manufacturers to use Bowie-Dick test packs before loading products, are the reason for the increased utilisation.

Need any customization research on Bowie-Dick Test Pack Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS

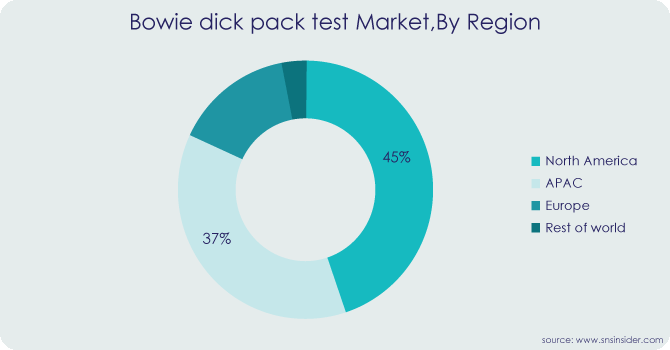

With a market share of more than 45%, North America leads the Bowie-Dick Test Pack market and generates the most revenue. Numerous factors, such as strict regulations, state-of-the-art healthcare facilities, technological breakthroughs, competitive dynamics, public awareness campaigns, and government support, heavily impact the market in North America. Bowie-Dick Test Packs are required to confirm the efficacy of sterilization procedures in this region, particularly in the United States and Canada, where stringent healthcare regulations are enforced. Furthermore, the region's well-established healthcare infrastructure generates a sizable demand for effective sterilization solutions, resulting in a competitive market environment.

With a share of more than 37%, Europe is the second-largest market in the Bowie-Dick Test Pack Market. The rising demand for superior healthcare Types and efficient sterilization procedures is driving the European market for Bowie-Dick Test Packs. As a result of the increased competition between suppliers and manufacturers brought about by this growing demand, advanced test pack technologies that cater to the various needs of healthcare facilities have been developed.

Numerous countries in the Asia-Pacific area are witnessing noteworthy advancements in their healthcare systems. This progress includes the opening of new clinics, hospitals, and other healthcare facilities, which has increased the need for effective sterilization techniques that use Bowie-Dick Test Packs.

KEY PLAYERS

Some of the major key players of Bowie Dick Pack Test Market are 3M, Steris, Medline Industries Inc., EDM3 HealthLink, Getinge Assure, Konkore Packaging, Mesa Labs, Crosstex Airview, Thermal Compliances, and other players.

Medline Industries Inc-Company Financial Analysis

RECENT DEVELOPMENTS

-

November 2021, Verrix LLC, a medical device company that creates cutting-edge technologies to shield patients from infections linked to healthcare, was acquired by Getinge. The company's global market entry into the hospital sterility monitoring system was aided by this strategic acquisition.

-

September 2021, Excelsior Scientific, a producer of chemical and biological indicators, partnered with Miclev AB. With this acquisition, Miclev AB expanded the range of sterilisation indicators in its product line.

-

3M announced in January 2023 the introduction of a new line of environmentally friendly Bowie-Dick Test Packs.

-

In order to create new standards for Bowie-Dick test packs, 3M and the Association for the Advancement of Medical Instrumentation (AAMI) collaborated in February 2023.

-

In July 2023, Medline introduced a new range of reasonably priced Bowie-Dick Test Packs aimed at consumers on a tight budget.

| Report Attributes | Details |

| Market Size in 2023 | US$ 203 Million |

| Market Size by 2031 | US$ 310 Million |

| CAGR | CAGR of 6.1% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Pharmaceutical And Medical Device Companies, Healthcare Facilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Steris, Medline Industries Inc., EDM3 HealthLink, Getinge Assure, Konkore Packaging, Mesa Labs, Crosstex Airview, Thermal Compliances |

| Key Drivers | • Growing understanding of the value of quality control • Innovations in Bowie-Dick test pack design |

| Market Opportunities | • Growing emphasis on sterilization in healthcare facilities |