Immunoprotein Diagnostic Testing Market Size Analysis

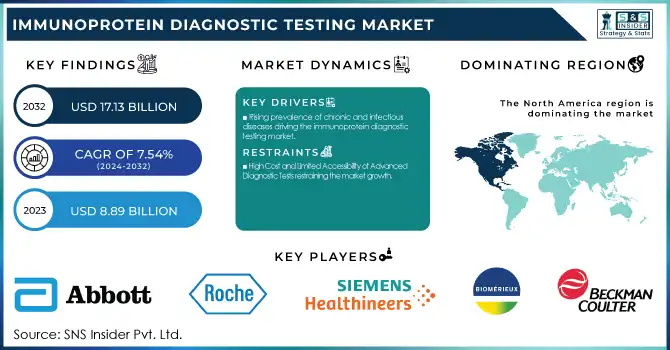

The Immunoprotein Diagnostic Testing Market was valued at USD 8.89 billion in 2023 and is expected to reach USD 17.13 billion by 2032, growing at a CAGR of 7.54% from 2024-2032.

The Immunoprotein Diagnostic Testing Market report provides statistical analysis by reviewing the incidence and prevalence of immunological diseases and associated conditions (2023), pointing to the increasing disease burden that requires sophisticated diagnostics. It also reviews diagnostic test use trends by geography, presenting a comparison of testing uptake in major markets. The report provides test volume trends, providing a long-term outlook on market growth. In addition to this, it explores healthcare expenditures on immunoprotein diagnostics by geography, which is further bifurcated into government, commercial, private, and out-of-pocket spending. It analyzes point-of-care (POC) and laboratory-based immunoprotein test adoption trends, highlighting the transition to decentralized, rapid diagnostics.

To Get more information on Immunoprotein Diagnostic Testing Market - Request Free Sample Report

Immunoprotein Diagnostic Testing Market Dynamics

Drivers

-

Rising prevalence of chronic and infectious diseases driving the immunoprotein diagnostic testing market.

Immunoproteins like complement system proteins, C-reactive proteins (CRP), and immunoglobulins are involved in identifying diseases such as cancer, infections, and autoimmune diseases. Non-communicable diseases (NCDs) are responsible for 74% of deaths globally, as per the World Health Organization (WHO), and include cardiovascular diseases, cancer, and diabetes as the top-most causes. Also, the rise in the prevalence of infectious conditions such as tuberculosis, HIV, and respiratory infections has created the need for speedy and effective immunoprotein-based diagnostic tests. Advances in immunoassay technologies, including high-sensitivity CRP and multiplex immunoassays, have enhanced early disease detection, driving market growth. Growing healthcare spending and the adoption of AI-based diagnostics also drive the market forward.

-

Technological advancements in immunoassay platforms enhanced the accuracy, speed, and reliability of immunoprotein diagnostic testing.

The ongoing development of immunoassay technologies has dramatically improved the accuracy, speed, and consistency of immunoprotein diagnostic testing. Advances in chemiluminescence immunoassay (CLIA), enzyme-linked immunosorbent assay (ELISA), and multiplex immunoassay systems have contributed to improved disease detection capacity. For example, the availability of fully automated immunoassay analyzers has enhanced workflow efficiency in hospitals and diagnostic laboratories. Firms such as Roche Diagnostics and Siemens Healthineers are targeting high-throughput immunoassay platforms that allow for faster processing of tests and shorter turnaround times. Further, the use of biosensors and microfluidic devices has streamlined point-of-care immunoprotein diagnostics, especially for life-threatening diseases such as sepsis and cancer. Such developments, combined with AI-assisted diagnostic interpretation, are accelerating the use of immunoprotein diagnostic testing in various healthcare environments.

Restraint

-

High Cost and Limited Accessibility of Advanced Diagnostic Tests restraining the market growth.

One of the key constraints in the immunoprotein diagnostic testing market is the high price of cutting-edge immunoassay technologies and restricted access, especially in low- and middle-income nations (LMICs). Advanced diagnostic platforms, including chemiluminescence immunoassays (CLIA) and multiplex immunoassays, need advanced equipment, skilled staff, and significant infrastructure, resulting in higher operational costs. Also, the expensive nature of reagents and consumables boosts the overall testing costs, thereby making such diagnostics more unaffordable for resource-poor healthcare systems. As reported by the WHO, close to half of the world's population has no access to basic healthcare services, reflecting the imbalance in diagnostic accessibility. Also, reimbursement difficulties in some areas inhibit the extensive use of immunoprotein tests, thus curbing market expansion. Overcoming cost-related barriers and increasing point-of-care immunoassay solutions would help to address this challenge.

Opportunities

-

The increasing demand for rapid and accessible diagnostic solutions presents a significant opportunity for the Immunoprotein Diagnostic Testing Market.

Growing demand for fast and convenient diagnostic tools represents a big opportunity for the Immunoprotein Diagnostic Testing Market, especially via growth in point-of-care (POC) testing. POC immunoassays provide rapid detection of biomarkers like C-reactive protein (CRP), immunoglobulins, and haptoglobin, allowing early disease diagnosis and prompt intervention. Emerging microfluidic and biosensor technology has made portable diagnostic devices more accurate and cost-effective, hence sustainable for decentralized healthcare. The global POC diagnostics market is anticipated to grow significantly, as per recent research, driven by the increasing demand for rapid test results. In addition, the rising incidence of infectious and chronic diseases, as well as government programs to improve diagnostic availability in rural and underserved communities, is further propelling investments in POC immunoprotein testing solutions.

Challenges

-

One of the primary challenges in the Immunoprotein Diagnostic Testing Market is the complexity of regulatory approvals and the lack of standardization across different diagnostic platforms.

One of the major issues in the Immunoprotein Diagnostic Testing Market is the complexity of regulatory approvals and the absence of standardization across various diagnostic platforms. Immunoassay-based diagnostic tests have to comply with strict regulatory environments established by organizations like the FDA, EMA, and ISO, resulting in extensive approval periods and expensive compliance. Also, differences in assay methods and biomarker threshold values among different manufacturers generate inconsistencies in test outcomes, impairing clinical decision-making. A research article in the Journal of Clinical Laboratory Analysis underscores the necessity for harmonization in immunoprotein assays to enhance reproducibility and reliability. Additionally, changing regulatory policies for upcoming technologies such as multiplex immunoassays and companion diagnostics need to constantly adapt through manufacturers, creating a constant challenge for market players to balance compliance with innovation.

Immunoprotein Diagnostic Testing Market Segmentation Analysis

By Testing

The immunoglobulin diagnostic tests segment dominated the Immunoprotein Diagnostic Testing Market with a 28.15% market share in 2023 because of its extensive use in the diagnosis of immune system disorders, infections, and autoimmune diseases. Immunoglobulin (Ig) tests, such as IgA, IgG, and IgM tests, play a significant role in the identification of immune deficiencies, multiple myeloma, and chronic inflammatory diseases. The increasing incidence of autoimmune diseases, including rheumatoid arthritis and lupus, has increased demand for these tests substantially. Also, the growing application of immunoglobulin tests for the monitoring of the effectiveness of immunotherapies in cancer therapy further consolidated the dominance of the segment. As diagnostic technologies improve, including high-sensitivity immunoassays and laboratory automation, immunoglobulin tests have become a common diagnostic tool for disease diagnosis, resulting in their large market share in 2023.

The C-reactive protein (CRP) diagnostic tests market is forecast to expand at the fastest growth rate in the forecast period based on its important role in diagnosing inflammation, cardiovascular conditions, and infections. CRP tests are extensively applied as biomarkers for sepsis, bacterial infections, and inflammatory conditions like arthritis and thus are extremely valuable in clinical diagnosis. The rising prevalence of cardiovascular diseases, which are still the global cause of death, has increased the need for CRP testing for risk stratification and early intervention. Moreover, the increased demand for point-of-care CRP testing, combined with the technical progress in high-sensitivity CRP (hs-CRP) assays, has further increased its application in general healthcare screening. Growing recognition of chronic disease prevention and management of preventive healthcare is also anticipated to support the exponential expansion of the CRP diagnostic tests market further.

By Application

The infectious disease testing segment dominated the market with a 24.62% market share in 2023 because of the heavy burden of infectious diseases like HIV, hepatitis, tuberculosis, and COVID-19 around the world. Immunoprotein diagnostic tests are important for detecting pathogen-specific antibodies, antigens, and inflammatory markers for early and correct disease diagnosis. The extensive adoption of immunoassays, such as enzyme-linked immunosorbent assays (ELISA) and chemiluminescence immunoassays (CLIA), has consolidated the infectious disease testing market. Furthermore, the emergence of antimicrobial resistance and the growing need for point-of-care, rapid diagnostic products have also spurred adoption. Large-scale infectious disease screening programs implemented by governments and healthcare organizations globally have also supported consistent demand for immunoprotein-based diagnostics in this segment.

The Oncology Testing segment is expected to see the fastest growth in the immunoprotein diagnostic testing market with 8.78% CAGR over the forecast period, spurred by the growing global cancer incidence and biomarker-based diagnostics innovation. Immunoprotein tests play a pivotal role in identifying cancer-associated biomarkers, including tumor-associated antigens and immunoglobulins, which provide for early diagnosis and personalized therapeutic strategies. The growing use of immunotherapy and targeted cancer therapies has driven the need for very specific immunodiagnostic tests to track responses to treatment. Further, developments in multiplex immunoassays and next-generation immunoassay platforms have improved the sensitivity and specificity of cancer diagnostics. As precision medicine picks up pace, demand for immunoprotein-based oncology testing will increase, buoyed by rising investments in cancer research and greater focus on early cancer detection programs.

By Technology

The Enzyme-Based Immunoassay segment dominated the Immunoprotein Diagnostic Testing Market with a 25.34% market share in 2023 because of its excellent sensitivity, specificity, and versatility in use for diagnosing different diseases. Enzyme-linked immunosorbent assays (ELISA) and enzyme immunoassays (EIA) are some of the most prevalent immunoprotein diagnostic methods for the detection of antibodies, antigens, and other biomarkers in infectious disease, oncology, autoimmune disease, and cardiovascular disease. These tests offer quick, affordable, and accurate results, which have made them the choice of clinical labs and point-of-care environments. Moreover, advancements in technology, including automated ELISA systems and multiplex immunoassays, have enhanced test efficiency, throughput, and precision. The growing need for early disease detection, combined with government and healthcare organizations' efforts to boost diagnostic capacity, has further increased the use of enzyme-based immunoassays, cementing their market dominance.

By End Use

The hospitals and clinics segment dominated the immunoprotein diagnostic testing market with 43.16% market share in 2023 as they possess extensive infrastructure, availability of cutting-edge diagnostic instruments, and capability to manage high patient flow. Hospitals are referral centers for basic health care and diagnose and manage infectious diseases, autoimmune diseases, and cancer, which all involve immunoprotein diagnostic testing. Moreover, hospitals incorporate high-throughput immunoassay analyzer laboratories, making the test process faster and more accurate. The availability of expert healthcare providers, payment policies, and government initiatives in favor of timely disease detection also support the leadership of hospitals. The rising incidence of chronic illnesses and growing hospitalization for life-threatening ailments like sepsis, cardiovascular illness, and autoimmune diseases have also fueled the need for immunoprotein testing, cementing the segment's dominance in the market.

The diagnostic Laboratories segment is anticipated to register the fastest growth in the forecast period with the highest CAGR, led by the growing outsourcing of diagnostic testing, the increasing need for specialty testing, and the improvement in lab automation. With the rising preference for high accuracy and high-volume diagnostic testing, reference and standalone labs are now investing in advanced immunoassay technology, including chemiluminescence and multiplex immunoassays, to enhance test efficiency and turnaround time. Furthermore, the growth of point-of-care (POC) and home testing is contributing to more sample processing at diagnostic laboratories. Government programs to increase laboratory networks, particularly in developing economies, are also driving growth. Additionally, collaborations between pharmaceutical companies and diagnostic labs for biomarker-based drug development are fueling demand for specialty immunoprotein diagnostic testing, making diagnostic laboratories the fastest-growing segment in the forecast period.

By Distribution Channel

The Retail Sales segment of the immunoprotein diagnostic testing market dominated with around 55% market share in 2023 on account of increasing demand for over-the-counter (OTC) diagnostic kits, home testing solutions, and ease of availability of immunoprotein diagnostic products in pharmacies and through e-commerce sites. Consumers are in search of easier and faster diagnostic solutions and therefore are more and more using self-testing kits. In addition, the development of digital health and telemedicine services has promoted direct-to-consumer testing, wherein patients buy diagnostic kits online and undergo test analysis remotely. The development of pharmaceutical retail chains, along with positive regulatory clearances for at-home immunoassays, has also supported the leadership of the retail sales segment. Furthermore, promotional prices and discounts by retail channels have contributed to making diagnostic products affordable for a larger population.

Immunoprotein Diagnostic Testing Market Regional Insights

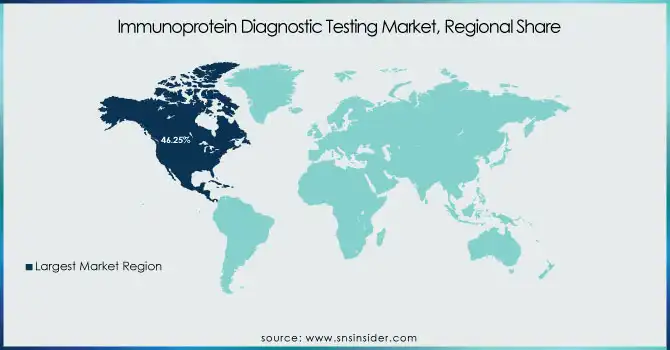

North America dominated the immunoprotein diagnostic testing market with a 46.25% market share in 2023 due to its robust healthcare infrastructure, superior adoption of innovative diagnostic solutions, and predominant presence of industry giants like Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers. The region is aided by the prevalence of chronic and infectious diseases like cancer, autoimmune disorders, and cardiovascular diseases, with a high rate of occurrence of these conditions triggering the need for immunoprotein-based diagnostic testing. Chronic diseases are responsible for 7 in 10 deaths in the United States, as per the CDC, making early and precise diagnostics all the more necessary. Supportive reimbursement policies, heavy R&D expenditure, and approving authorities for new immunoassay-based diagnostic products are some of the added factors that ensure North America remains the leading region in this market.

Asia Pacific is the fastest-growing region in the immunoprotein diagnostic testing market with 8.70% CAGR throughout the forecast period, because of the rising incidence of infectious diseases, growth in the expenditure on healthcare, and enhanced diagnostic facilities. China, India, and Japan are all experiencing a high demand for immunoprotein-based diagnostic tests as a result of an increasing geriatric population and increased awareness of early disease diagnosis. The area also receives government-initiated programs to increase the accessibility of healthcare, like India's Ayushman Bharat program and China's Healthy China 2030 initiative. Furthermore, the growth of local diagnostic firms and partnerships with international firms to launch cost-saving immunoassays are driving market growth. The growth in the adoption of point-of-care testing and automation in diagnostics is also speeding up the market growth in the Asia Pacific region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Immunoprotein Diagnostic Testing Market

-

Abbott Laboratories (ARCHITECT Immunoassay System, i-STAT Immunoassay Cartridge)

-

Roche Diagnostics (Elecsys Immunoassay Analyzer, Cobas e 411 Analyzer)

-

Siemens Healthineers (ADVIA Centaur Immunoassay System, Atellica IM Analyzer)

-

Beckman Coulter (Access Immunoassay System, DxI 9000 Analyzer)

-

bioMérieux (VIDAS Immunoassay System, BIOFIRE FilmArray System)

-

Thermo Fisher Scientific (ImmunoCAP Specific IgE Test, Qubit Protein Assay)

-

Bio-Rad Laboratories (Liquichek Immunology Controls, Bio-Plex Multiplex Immunoassay System)

-

Ortho Clinical Diagnostics (VITROS Immunodiagnostic System, VITROS Anti-HCV Assay)

-

Randox Laboratories (Evidence Investigator, Acusera Immunoassay Controls)

-

Becton, Dickinson and Company (BD Veritor Plus System, BD Multitest 6-Color TBNK Reagent)

-

DiaSorin S.p.A. (LIAISON XL Analyzer, LIAISON QuantiFERON-TB Gold Plus)

-

Agilent Technologies (Bioanalyzer Protein Kit, SureScan Microarray Scanner)

-

PerkinElmer Inc. (EnVision Multilabel Plate Reader, AlphaLISA Immunoassay Kit)

-

Quidel Corporation (Sofia 2 Fluorescent Immunoassay Analyzer, Triage MeterPro)

-

Zeus Scientific (ZEUS ELISA Test Kits, ZEUS dIFine Immunofluorescence System)

-

Merck KGaA (MilliporeSigma) (MILLIPLEX Multiplex Assay, SMCxPRO Immunoassay System)

-

F. Hoffmann-La Roche Ltd. (Cobas Immunoassay Analyzer, Elecsys Anti-SARS-CoV-2 Assay)

-

Trinity Biotech (Uni-Gold HIV Rapid Test, Captia ELISA Test Kits)

-

Theradiag (Lisa-Tracker Immunoassay Kit, FIDIS Multiplex Immunoassay)

-

Zymo Research (Quick-DNA/RNA Protein Kit, ELISA-Based Immunoassay Kits)

Suppliers (These suppliers play a crucial role in providing essential raw materials and components for immunoprotein diagnostic testing products.)

-

Thermo Fisher Scientific

-

Merck KGaA (MilliporeSigma)

-

Bio-Techne Corporation

-

Abcam plc

-

PerkinElmer Inc.

-

Boster Biological Technology

-

R&D Systems (Bio-Techne)

-

RayBiotech, Inc.

-

Antigenix America, Inc.

-

Jackson ImmunoResearch Laboratories, Inc.

Recent Development in the Immunoprotein Diagnostic Testing Market

-

January 2025 – Roche has obtained U.S. Food and Drug Administration (FDA) approval for a label extension of the PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody. The extension allows for the detection of patients with HR-positive, HER2-ultralow metastatic breast cancer, who can now be considered for treatment with ENHERTU, a HER2-targeting antibody-drug conjugate (ADC) created by Daiichi Sankyo and AstraZeneca.

-

July 25, 2024 – BD (Becton, Dickinson, and Company), a medical technology leader, today signed a worldwide partnership with Quest Diagnostics to create, produce, and market flow cytometry-based companion diagnostics (CDx). The partnership will facilitate precision medicine by assisting clinicians in the selection of optimal treatments for cancer and other diseases.

-

January 2023 – Beckman Coulter Diagnostics, a premier clinical diagnostics leader, has entered into a co-development and commercialization partnership with MeMed, a host-response technology innovator, for the MeMed BV® test. Developed for application on the Access Family of Immunoassay Analyzers, this test allows for differentiation between bacterial and viral infections, enhancing diagnostic efficacy and patient care.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.89 billion |

| Market Size by 2032 | US$ 17.13 billion |

| CAGR | CAGR of 7.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Testing (Complement System Proteins Diagnostic Tests, Free Light Chain Diagnostic Tests, Haptoglobin Diagnostic Tests, Immunoglobulin Diagnostic Tests, Prealbumin Diagnostic Tests, C-Reactive Protein (CRP) Diagnostic Tests) • By Application (Infectious Disease Testing, Oncology Testing, Endocrine Testing, Toxicology Testing, Allergy Testing) • By Technology (Radioimmunoassay, Enzyme-Based Immunoassay, Chemiluminescence Assay, Immunofluorescence Assay, Immunoturbidity Assay, Immunoprotein Electrophoresis) • By End Use (Hospitals and Clinics, Diagnostic Laboratories, Others) • By Distribution Channel (Direct Tender, Retail Sales) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Beckman Coulter, bioMérieux, Thermo Fisher Scientific, Bio-Rad Laboratories, Ortho Clinical Diagnostics, Randox Laboratories, Becton, Dickinson and Company, DiaSorin S.p.A., Agilent Technologies, PerkinElmer Inc., Quidel Corporation, Zeus Scientific, Merck KGaA (MilliporeSigma), F. Hoffmann-La Roche Ltd., Trinity Biotech, Theradiag, Zymo Research, and other players. |