Cancer Biopsy Market Size & Overview:

Get more information on Cancer Biopsy Market - Request Sample Report

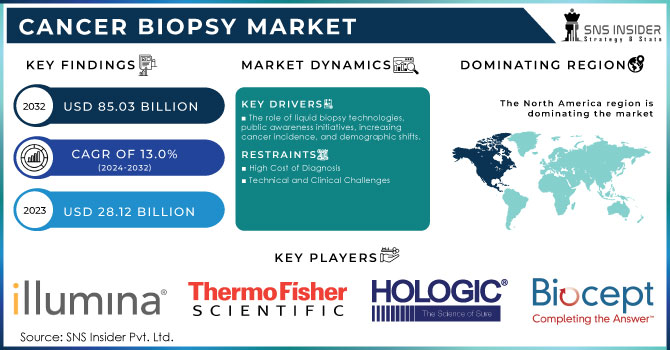

The Cancer Biopsy Market Size was valued at USD 28.12 billion in 2023 and is expected to reach USD 85.03 billion by 2032 and grow at a CAGR of 13.0% over the forecast period 2024-2032.

The cancer biopsy market is growing at a significant rate, mainly due to the rising incidence of cancer, which calls for innovative diagnostic solutions that will, in turn, allow for early detection and efficient treatment of patients. Recently, according to the 2022 update from the National Cancer Institute (NCI), the U.S. alone documented nearly 20 million new cancer cases, with nearly 9.7 million cancer-related deaths worldwide. The worrying trend calls for more advanced diagnostic techniques, especially liquid biopsy. Some of these technologies associated with liquid biopsy are gaining popularity because they are cost-effective and due to the minimally invasive nature in which the cancer may be detected. Liquid biopsy evaluates the heterogeneity of the tumor as well as gene profiling and, thus, is crucial in diagnosing many forms of cancers, including prostate, breast, non-small-cell lung, colorectal, and ovarian cancers.

Detection of cancer in its early stage greatly improves patients' chances of survival. Studies have shown that early-stage detection stages are likely to multiply the patient's chances of survival by 5-10 times compared to the survival chances of late-stage diagnosis patients. Other various organizations, including the CDC and WHO, initiate campaigns encouraging patients to embrace awareness of screening against cancer, particularly cervical cancer. Some of the most important campaigns are the U.S. The FDA Oncology Center of Excellence's National Black Family Cancer Awareness campaign seeks to enlighten underserved populations about clinical trials and the importance of early detection.

Despite these growth potentials in the market, there are big challenges to be met, and these relate particularly to the high cost of diagnostic tests, burdening the patients, especially in developing countries and mostly with no cover. However, this landscape is changing as medical tourism in countries such as India and Malaysia offers more affordable diagnostic solutions.

Additionally, the moderate level of mergers and acquisitions activity is reflected in the overall volume of acquisitions that companies engage in to expand product lines and raise technological capabilities. The trend underlines that change will continue in the landscape of biopsy; an increase in the adoption rate by healthcare providers of advanced biopsy solutions for enhanced outcomes for cancer detection and treatment. Overall, growth in the cancer biopsy market will be strong, with a sustained drive from the technology and increasing awareness regarding the critical importance of early diagnosis.

Cancer Biopsy Market Dynamics

Drivers

-

The role of liquid biopsy technologies, public awareness initiatives, increasing cancer incidence, and demographic shifts.

The market for cancer biopsy will be on a high growth trajectory mainly due to the advent of liquid biopsy technologies and growing public awareness about cancer. Liquid biopsies are a boon in the diagnosis of cancer without being invasive, as they help in the analysis of circulating tumor DNA (cfDNA) in the blood. For example, Labcorp's newly launched blood test from June of 2023 detects cancer-related biomarkers, and by doing so, patients will be exposed to the best available treatment quickly. Through this innovation, the detection of cancer cases becomes more efficient and forms part of personalized plans regarding treatment.

In addition, awareness campaigns by governments and health institutions increase public knowledge about cancer. Programs such as the National Cancer Control Program offered by the World Health Organization intend to reduce cancer mortality and enhance the quality of life in its patients so that patients are empowered with proactive care for their health.

The increasing incidence of cancer across the world also offers great opportunities for all market stakeholders. According to American Cancer Society Projections, in 2023, over 1.9 million new cancer cases were found in the U.S. Furthermore, the aging population is likely to fuel demand in the market because elderly patients often require sophisticated assessments for cancer treatment. With the size of the population aged 60 plus doubling by 2050, the demand for effective cancer biopsy solutions will keep increasing.

Restraints

-

High Cost of Diagnosis

-

Technical and Clinical Challenges

Cancer Biopsy Market - Key Segmentation

by Product

Kits and consumables held the dominant share of 61.8% in 2023. The increasing adoption and use of these kits for effective screening and diagnostic solutions have topped the market. Technological advancements in biopsy methods also help support growth in the market. The advent of advanced biopsy needles, specialized collection containers, as well as advanced tissue preservation solutions, which enhance the efficiency and accuracy of biopsy procedures, is boosting demand.

The instrument is expected to have the highest CAGR of 9.3% during the forecast period. This segment is expected to grow further as development in technology advances along with the rising necessity of precise diagnostic tools. At this juncture, the increase in the incidence of cancer begins to show on the foremost scale, and with this increase, requirements for intricate biopsy tools to detect and analyze the tumors also increase. This is further going to improve due to advancements in biopsy technology, which include automated tissue processors, advanced imaging systems, and precision-guided biopsy needles.

by Type

Tissue biopsy accounted for the largest market share in 2023 at 61.7%. This trend can be because of increasing cases of cancer and improved biopsy technologies. The trend toward personalized medicine, which requires highly accurate molecular and genetic characterization of tumors, has significantly increased the demand for advanced tissue biopsy techniques. Besides, minimally invasive biopsy techniques have begun to improve patient experiences through less discomfort and faster recovery periods. The increasing healthcare infrastructure and rising awareness regarding the importance of early detection also add to the rising demand for tissue biopsies.

Liquid biopsy, on the other hand, is expected to hold the highest compound annual growth rate of 9.0% during the forecast period. Liquid biopsy is a new test technology for the diagnosis of tumor-associated genetic alterations and also has been applied to characterize tumors, guiding treatment tailoring in precision oncology. For instance, at the beginning of 2023, the FDA authorized Guardant Health liquid biopsy assay, Guardant360 CDx, as a companion diagnostic to identify mutant ESR1-breast cancer. The emergence of new developments and innovations in the market, which make it possible to introduce liquid biopsy, are furthering the evolution of the market. The advantages being provided by liquid biopsy technologies make Next-Generation Sequencing or massively parallel sequencing ever more not only a key technology but increasingly find applications in diverse diseases afflicting humans. The consequent increased identification of molecular alterations in various cancer types justifies the integration of NGS into clinical settings because it is a cost-effective, especially time-efficient, way to detect cancer.

by Application

In the year 2023, the breast cancer segment held a market share of 15.7%. The developing research and developments in advanced screening tools are expected to increase this segment considerably soon. A new breast cancer screening test utilizing MMP-1 and miR-21 urinary exosomal levels of expression is presented in a September 2019 article published in Scientific Reports. This test has been demonstrated to successfully identify 95% of cancers at a pre-metastatic stage. In addition, the researchers concluded that both markers are highly specific and sensitive, well-suited for screening. Apart from that, the high penetration of new product launches in the market is also expected to propel the market growth during the forecast period; for instance, in February 2023, NGeneBio announced the launch of an NGS-based breast cancer diagnostic test in Thailand.

The kidney cancer segment is expected to foresee the highest CAGR at a rate of 10.3% over the forecast period. This increase is expected to be higher with further studies carried out by esteemed academic and research centers. A new study published by the University of Michigan Rogel Cancer Center, in April 2020, aimed at identifying biomarkers in kidney cancer. Scientists relied on next-generation RNA sequencing to determine the gene expression profile of ChRCC and evaluated the expression of three newly discovered biomarkers to diagnose. Besides, research scientists from Ghent University have collaborated with the researchers at the University of Turku, in addition to developing the method for biomarker discovery in urological cancers further adding growth potential to this segment.

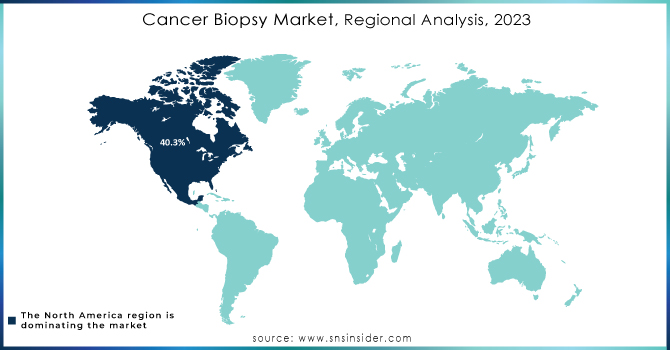

Cancer Biopsy Market Regional Analysis

North America was the market leader in 2023, accounting for a 40.3% share of the cancer biopsy market. This is primarily attributed to the region's dominant medical infrastructure and higher health expenditure, resulting in the widespread use of diagnostic technologies. Other than this, several launches and funding are likely to propel further growth in the market. For example, biotechnology company Freenome reported in February 2024 that it had raised USD 254 million in fresh and existing funds in a bid to advance its single-cancer and tailored Multicancer Early Detection (MCED) tests.

In 2023, the European market for cancer biopsy held a major share of the market due to an increase in approval levels, competitive dynamics across companies, government initiatives, and enhanced reimbursement scenarios. In the UK, commercial partnerships between the government and key players are driving the market in respect of routine use of cancer biopsies. Established and new product manufacturers are expected to boost the growth of the market in France by following continuous organic as well as inorganic growth strategies.

Ongoing healthcare reforms are expected to fuel the Asia Pacific cancer biopsy market at the highest compound annual growth rate during the forecast period. Other factors driving this market include growth in population, improvement of health infrastructure, and entry of new market players. This geographic region has a massive population base and high incidence of cancer; for instance, Global Cancer Statistics state that approximately 10.5 million new cancer cases in Asia were recorded in 2022.

Need Any Customization Research On Cancer Biopsy Market - Inquiry Now

Key Players

-

QIAGEN

-

Illumina, Inc.

-

Hologic, Inc.

-

Biocept, Inc.

-

BD (Becton, Dickinson, and Company)

-

Thermo Fisher Scientific, Inc.

-

Genesystems, Inc. (Genesys Biolabs)

-

Danaher

-

F. Hoffmann-La Roche Ltd.

-

Lucence Health Inc.

-

GRAIL, Inc.

-

Natera, Inc.

-

Personalis Inc.

-

Guardant Health Inc.

-

Oncimmune

-

Epigenomics AG

-

HelioHealth (Laboratory for Advanced Medicine)

-

Freenome Holdings, Inc.

-

Biodesix (Integrated Diagnostics)

-

Chronix Biomedical, Inc.

-

Personal Genome Diagnostics Inc. and others.

Recent Developments

-

In August 2024, Illumina, Inc. gained approval for its TruSight Oncology (TSO) test, an in vitro diagnostic (IVD) tool designed to rapidly match cancer patients with appropriate targeted therapies using biomarker testing and companion diagnostics.

-

In June 2024, Guardant Health, Inc. released an updated version of its Guardant360 TissueNext test that detects 498 genes in tissue. This allows oncologists to better determine and target more suitable treatment therapies for patients with advanced cancer.

-

In May 2024, VESICA HEALTH, INC. announced the availability of the first of their laboratory-developed tests, AssureMDX, marking a new stage in diagnosing bladder cancer and having claimed it would therefore improve earlier detection and treatment available for patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 28.12 Billion |

| Market Size by 2032 | USD 85.03 Billion |

| CAGR | CAGR of 13.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instrument, Kits and Consumables, Services) • By Type (Tissue Biopsies, Liquid Biopsies, Others) • By Application (Breast Cancer, Colorectal Cancer, Cervical Cancers, Lung Cancers, Prostate Cancers, Skin Cancers, Blood Cancers, Kidney Cancers, Liver Cancers, Pancreatic Cancers, Ovarian Cancers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | QIAGEN, Illumina, Inc., ANGLE plc, Hologic, Inc., Biocept, Inc., BD (Becton, Dickinson, and Company), Myriad Genetics, Inc., Thermo Fisher Scientific, Inc., Genesystems, Inc. (Genesys Biolabs), Danaher, Hoffmann-La Roche Ltd., Lucence Health Inc., GRAIL, Inc., Natera, Inc., Personalis Inc., Guardant Health Inc., Exact Sciences Corporation, Oncimmune, Epigenomics AG, HelioHealth (Laboratory for Advanced Medicine), Freenome Holdings, Inc., Biodesix (Integrated Diagnostics), Chronix Biomedical, Inc., Personal Genome Diagnostics Inc. and Others |

| Key Drivers | • The role of liquid biopsy technologies, public awareness initiatives, increasing cancer incidence, and demographic shifts |

| Restraints | • High Cost of Diagnosis • Technical and Clinical Challenges |