Personalized Retail Nutrition And Wellness Market Size:

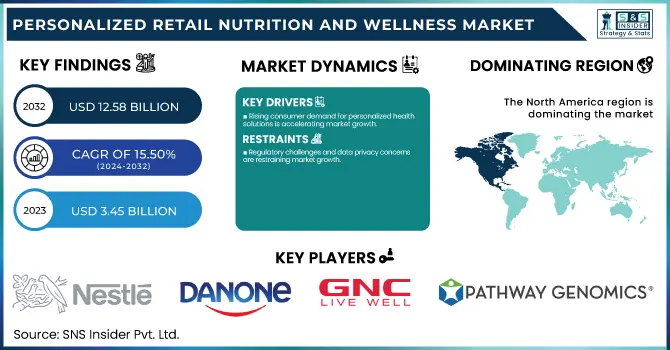

The Personalized Retail Nutrition and Wellness Market size was estimated at USD 3.45 billion in 2023 and is projected to reach USD 12.58 billion by 2032, growing at a CAGR of 15.50% from 2024 to 2032.

To Get more information on Personalized Retail Nutrition and Wellness Market - Request Free Sample Report

Our Personalized Retail Nutrition and Wellness Market report offers insights about market expansion analysis. It features consumer adoption and usage patterns, the rising demand for DNA-based diets, meal planning using AI, and personalized supplement subscriptions. The report also features purchase and subscription patterns by region, comparing consumers in terms of behavior. Besides, we offer market penetration of digital platforms to monitor the increase in AI-based nutrition apps and telehealth diet consultations. Additionally, consumer spending analysis by region (2023), categorized as government, commercial, private, and out-of-pocket, gives a complete fiscal overview of personalized nutrition investment.

Personalized Retail Nutrition And Wellness Market Dynamics

Drivers

-

Rising consumer demand for personalized health solutions is accelerating market growth.

Consumers are gravitating toward tailored nutrition and well-being products and services more than ever as the demand for personalized health benefits rises. In its 2023 consumer survey, the International Food Information Council (IFIC) reported that 63% of consumers say they're interested in food based on their particular health needs. Besides this, digital healthcare innovations have improved personalized nutrition so that companies like Nourish raised USD 35 million in Series A funding (March 2024) to grow their telenutrition platform. Demand for DNA-inspired nutrition plans, AI-based meal suggestions, and metabolic health monitoring is increasing, with platforms such as Viome and Habit providing precision-based diet solutions. With technology becoming part of nutrition, wearables, mobile apps, and AI-driven diet-planning software going mainstream, allowing real-time analysis of data and hyper-personalized health advice, the market is being pushed forward.

-

Increasing integration of AI and digital platforms in nutrition, propelling the market to grow.

The increasing influence of artificial intelligence (AI) and digital platforms in the personalized retail nutrition market is revolutionizing the way people get dietary and wellness advice. Artificial intelligence platforms such as Nutrino Health and Foodsmart use big data analysis to develop customized meal plans based on one's food preferences, metabolic status, and health objectives. In January 2024, Verdify raised USD 2.49 million to further build its AI-powered nutrition platform, which personalizes food choices based on health status and sustainability. In addition, 75% of nutrition firms are investing in AI for real-time diet tracking and recommendation systems, enabling consumers to base their nutrition decisions on data. Smartphone app uptake, telehealth dietitian sessions, and food tracking based on blockchain technology are also boosting the efficiency and accuracy of customized nutrition, driving the market growth.

Restraint

-

Regulatory challenges and data privacy concerns are restraining market growth.

The personalized retail nutrition and wellness market is challenged by regulatory compliance and data privacy. Since personalized nutrition is based on genetic testing, AI-based meal planning, and health monitoring apps, strict regulations cover data collection, storage, and use. Adherence to models such as GDPR in Europe and HIPAA in the U.S. is mandatory, but these laws are complicated to navigate for businesses operating across geographies. Furthermore, worries regarding consumer data security may act as an impediment to adoption, as PwC discovered in its 2023 survey that 56% of consumers are concerned about the way firms manage their health data. Recent health-tech platform cybersecurity breaches have only raised concerns further, and transparency, along with secure data management, is thus important. Businesses need to focus on strong encryption, user permission policy, and rules compliance to move past this inhibiting factor and establish trust among consumers.

Opportunities

-

Expansion of insurance coverage for personalized nutrition, creating opportunity in the market.

The growing incorporation of personalized nutrition services into medical insurance policies is a substantial market opportunity. With increasing awareness of preventive care, insurers are becoming increasingly aware of the cost savings that come from disease management through nutrition. For example, Nourish raised USD 35 million in Series A funding (March 2024) to grow its telenutrition platform, which provides access to insured registered dietitians (RDs) for patients. This transformation is reducing the cost and accessibility of personalized nutritional guidance, especially for diabetic, obese, and cardiovascular disease patients who live with chronic illnesses. Moreover, corporate wellness initiatives are also adopting AI-based meal planning as well as genetic testing-based nutrition plans, adding to the demand. As more employers and insurers subsidize individualized nutrition solutions, industry players can leverage such an opportunity and collaborate with healthcare providers and insurers, widening their customer base as well as revenue streams.

Challenges

-

High cost and limited accessibility of personalized nutrition solutions challenge the market to grow.

Though the demand is increasing, the expense of individualized nutrition services and products still poses a primary challenge. DNA-based at-home testing kits, AI-powered meal plans, and precision supplements tend to be priced at a premium, which discourages middle- and low-income customers from purchasing them. For instance, advanced genetic nutrition tests may range from USD 100 to USD 300 per kit, whereas subscription-based personalized meal plans typically involve recurring charges, which are an added cost. Moreover, access to experienced nutritionists and dietitians remains limited in most areas, particularly in emerging markets where digital health infrastructure is not well established. Firms need to concentrate on expanding operations, minimizing costs through technology, and creating more accessible pricing structures to successfully address this challenge and expand market coverage among price-sensitive customers.

Personalized Retail Nutrition And Wellness Market Segmentation Analysis

By Type

The Repeat Recommendation segment dominated the personalized retail nutrition and wellness market in 2023 because of its systematic approach, balancing constancy with personalization. The segment relies on repeated checks and incremental updates based on user choice, health reports, and life alterations. People opt for repeat recommendations because they offer continuous advice without bombarding consumers with multiple changes, thus making personalized nutrition more efficient and practical. Most of the subscription-based platforms, including Persona Nutrition and Viome, use repeat recommendations to provide personalized supplement regimens and diet plans. Moreover, the combination of AI and machine learning provides updates to recommendations in an automated manner, improving user compliance. The dominance of the segment is also driven by the growing demand for long-term wellness solutions, especially for individuals living with chronic conditions like obesity, diabetes, and cardiovascular diseases.

By End User

The Hospitals & Clinics segment dominated the personalized retail nutrition and wellness market with around 64.13% market share in 2023, owing to the increased adoption of personalized nutrition in clinical practice for the prevention and treatment of diseases. Healthcare professionals more and more employ personalized dietary management to manage chronic diseases like diabetes, cardiovascular disorders, and gastrointestinal diseases. Credibility and medical expertise also come with hospitals and clinics, which is why they are the go-to sources for evidence-based nutrition advice. In addition, research and development in nutrigenomics and microbiome analysis made precision nutrition become mainstream in the clinical environment, boosting patient satisfaction. Growing interoperability between medical practitioners and online nutrition platforms and coverage of dietitian consultations under insurance plans strengthened the stronghold of this segment and provided access to customized nutritional therapy at large scales.

Regional Insights

North America dominated the market with a 42.28% market share in 2023 due to the strong presence of key market players, high consumer awareness, and well-developed healthcare infrastructure in the personalized retail nutrition and wellness market. The region enjoys a high adoption rate for precision nutrition solutions with the support of sophisticated research in nutrigenomics and digital health. Firms like Nestlé Health Science, Persona Nutrition, and Viome lead the way in personalized nutrition with AI-powered suggestions and DNA-informed meal plans. Furthermore, increasing anxiety about lifestyle diseases, combined with increasing disposable income, has driven demand for personalized dietary supplements and wellness programs. The availability of leading insurance companies offering coverage for nutrition consultations and the growth of telehealth services further cement North America's leadership in this space.

Asia Pacific is poised to become the fastest-growing region with 16.69% CAGR throughout the forecast period in the personalized retail nutrition and wellness market as a result of heightened health awareness, accelerating urbanization, and rising middle-class consumer bases with higher expenditure capacity. Nations such as China, India, and Japan are experiencing a high demand for customized nutrition offerings in response to increased cases of obesity, diabetes, and other metabolic diseases. The growth of digital health platforms and online shopping has made it easier for people to have access to tailored dietary supplements and wellness programs. Moreover, preventive healthcare and nutrition awareness campaigns from the government, as well as technological innovations in genetic testing and AI-based nutrition platforms, are driving market growth. The move toward personalized dietary solutions in the region, as well as the growing emphasis on traditional and functional foods, is further driving the growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

Nestlé S.A. (Nestlé Health Science, Persona Nutrition)

-

Danone S.A. (Nutricia, Danone Manifesto Ventures)

-

Verdify (Swapmeals, Nutrition Profile Platform)

-

GNC Holdings, Inc. (GNC Mega Men, GNC Probiotic Solutions)

-

The Vitamin Shoppe (Vthrive The Vitamin Shoppe, BodyTech)

-

Pathway Genomics (Pathway Fit, SkinFit)

-

Habit Food Personalized, LLC (Habit Personalized Nutrition Plans, Habit Meal Kits)

-

Nutrino Health Ltd. (FoodPrint Reports, Nutrino App)

-

Prenetics Ltd. (CircleDNA, DNAfit)

-

LifeSeasons, Inc. (Metabolism, Digestivi-T)

-

Cargill, Incorporated (Truvia, Regenasure)

-

Nature's Bounty Co. (Nature's Bounty Fish Oil, Nature's Bounty Probiotics)

-

Bayer AG (One A Day, Berocca)

-

PlateJoy (PlateJoy Personalized Meal Plans, PlateJoy Diabetes Prevention)

-

Better Therapeutics, Inc. (BT-001, Nutritional Cognitive Behavioral Therapy)

-

Viome (Gut Intelligence Test, Precision Supplements)

-

Noom, Inc. (Noom Weight, Noom Mood)

-

Savor Health (Ina Personalized Nutrition Platform, Savor Health Meal Delivery)

-

Foodsmart, Inc. (Foodsmart App, Telenutrition Services)

-

Novogenia GmbH (Personalized Supplements, Genetic Testing Services)

Suppliers (These suppliers play pivotal roles in the personalized nutrition and wellness market by offering essential ingredients, manufacturing capabilities, and innovative solutions to meet the growing demand for customized health products.)

-

Glanbia Nutritionals

-

Fermentis Life Sciences

-

Guires Food Research Lab

-

GreenDropShip.com

-

Positive Promotions

-

IFF (International Flavors & Fragrances)

-

Herbalife Nutrition

-

Zydus Wellness

-

Smart Fit Nutri

-

Sakara Life

Recent Development

-

In January 2024, Verdify, which is an alumnus company of StartLife, raised USD 2.49 million to further cultivate its personalized nutrition innovations for advancing human and planetary health. New and current investors participated in the funding round, including Koppert Cress, De Smaakmaker, Oost NL (Founding Partner to StartLife), and Goeie Grutten Impact Fund.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.45 billion |

| Market Size by 2032 | US$ 12.58 billion |

| CAGR | CAGR of 15.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fixed Recommendation, Repeat Recommendation, Continuous Recommendation, Personalized Testing) • By End User (Hospitals & Clinics, Wellness and Fitness Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nestlé S.A., Danone S.A., Verdify, GNC Holdings, Inc., The Vitamin Shoppe, Pathway Genomics, Habit Food Personalized, LLC, Nutrino Health Ltd., Prenetics Ltd., LifeSeasons, Inc., Cargill, Incorporated, Nature's Bounty Co., Bayer AG, PlateJoy, Better Therapeutics, Inc., Viome, Noom, Inc., Savor Health, Foodsmart, Inc., Novogenia GmbH, and other players. |