Broadcast Equipment Market Size:

Broadcast Equipment Market was valued at USD 5.30 billion in 2023 and is expected to reach USD 9.15 billion by 2032, growing at a CAGR of 6.29% from 2024-2032.This report includes insights into the market's adoption trends, investment and funding, usage patterns, consumer behavior, and the influence of regulations. Key drivers include technological upgrades and growing demands for high-quality broadcasting solutions. A much-needed adaptation in innovation has resulted from this trend, including the evolution of automation and digital broadcasting, as well as the regulatory frameworks determining trends in industry growth and consumer preferences. All these factors contribute to a great deal of expansion in the sector.

Get more information on Broadcast Equipment Market - Request Sample Report

Market Dynamics

Drivers

-

Technological Advancements in Broadcast Equipment: IP-Based Solutions, Virtual Studios, and Cloud Technology Driving Industry Evolution

The broadcast technologies will be shaped anew by innovations that include IP-based broadcasting, virtual studios, and cloud-based solutions. As broadcast organizations push their demand for flawless, high-definition content delivery to the maximum potential, advanced equipment capable of facilitating these new forms of broadcast has become inevitable for broadcasters. While IP-based broadcasting offers flexibility in workflow and better scalability, the virtual studios permit immersive production in a cost-effective environment. Cloud-based solutions help facilitate remote production and storage, reduce infrastructure costs, and enhance efficiency. This advancement leads not only to operational efficiency but also increases the quality and diversity of content produced and distributed, making broadcasters invest in new equipment to stay ahead in the ever-changing media landscape.

Restraints

-

Challenges in Adopting Advanced Broadcast Technologies Integration Complexity and Training Needs Hindering Quick Transition to Modern Systems

New broadcasting technologies, such as IP-based systems and cloud solutions, are major challenges for broadcasters. It is time-consuming and resource-intensive to integrate these high-tech systems into the existing infrastructure. In some cases, they have to re-engineer their operations and workflows, which can be expensive and even more disrupting. It also requires more training for the staff to handle and work with these new systems, which adds on to the cost and effort altogether. The intricateness might be the reason for the delay in execution for smaller broadcasters that would not have the technical knowhow or the finances to affect such a change. Consequently, the use of modern broadcasting technologies can create a significant entry barrier for various organizations that hope to remain viable in a market that is always changing.

Opportunities

-

Rising Demand for High-Quality Content from Streaming Platforms Driving Need for Advanced Broadcast Equipment Solutions.

With the increase in demand for high-quality content production and delivery due to rapid growth in digital streaming platforms, the streaming services need advanced broadcasting technologies to deliver seamless, professional-grade experiences for their audiences. This is prompting broadcasters to invest in cutting-edge equipment that can support ultra-high-definition formats like 4K and 8K, along with innovations in live streaming and on-demand content. The pressure to deliver high-quality, same-time content across all devices and platforms combined further increases the need for broadcasting solutions. As this shift to streaming continues, it will continue to have a considerable impact on generating increased demand for advanced broadcast equipment for long-term growth in this industry.

Challenges

-

Supply Chain Disruptions, Including Semiconductor Shortages, Causing Delays and Increased Costs in Broadcast Equipment Production.

Global supply chain issues, particularly semiconductor shortages, are causing a huge delay in the production of broadcast equipment. This has led to extended lead times, reduced availability of critical components, and increased production costs for equipment manufacturers. With broadcasters and other media companies looking to a seamless stream of ever more sophisticated technologies to meet swelling content demands, interruptions in this supply chain tend to slow progress toward upgrading and expanding infrastructure, thereby delaying upgrades or expansions for broadcasters. At the same time, these production delays increase their costs, compelling broadcasters to shave even tighter budget lines and creating the potential that they may simply be unable to afford new technology. Since supply chain stability is still a challenge, the broadcast equipment market may face ongoing constraints in its growth potential.

Segment Analysis

By Technology

The digital segment dominated the broadcast equipment market in 2023, capturing around 79% of the revenue share due to the increasing demand for high-definition, IP-based broadcasting solutions, which offer greater flexibility, scalability, and efficiency. The analog segment is expected to grow at the fastest CAGR of around 7.84% from 2024-2032 due to the existence of legacy infrastructure and continued use in some regions and industries. As a result, the cost-effective upgrades and replacements of analog systems are needed in specific markets.

By Application

The television segment held the highest market share in broadcast equipment in 2023, with a share of around 75%, because of increasing demands for high-definition video content including 4K and 8K broadcasts. The radio segment is expected to grow at the fastest CAGR of about 7.63% from 2024-2032, as the rise of digital and internet radio platforms, coupled with advancements in audio technology and broadcasting tools, enhances content delivery and audience engagement across various regions.

By Equipment

The dish antennas segment led the broadcast equipment market in 2023, capturing about 31% of the revenue share as they are commonly used for satellite communications, allowing for the efficient reception of signals for broadcast content in both rural and urban locations. The video servers segment, however is expected to lead in the industry with the highest CAGR at about 9.65% during the given period of 2024-2032 mainly due to rising demand for superior quality video storage, streaming and content management as on-demand as well as live video content rise.

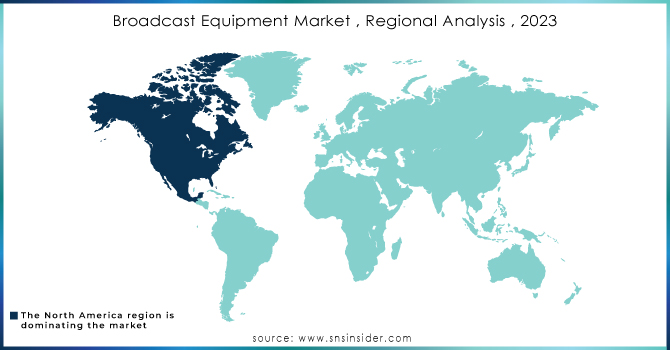

Regional Analysis

In the year 2023, Asia Pacific dominated the broadcast equipment market, holding around 38% of the revenue share. The reason behind this domination is mainly due to the expanded media and entertainment industry in the region, powered by an increased consumers' demand for high-definition and digital content. The speed by which advanced broadcast technologies are being adopted, coupled with increased investment in infrastructure, makes Asia Pacific one of the most significant centers of broadcast equipment manufacturing and distribution.

North America is projected to increase at the quickest rate of around 7.88% during 2024-2032. The increasing demand for next-generation equipment across digital and cloud-based broadcast solutions is promoting the development of the region, which leads in technological innovation. Going forward, with massive investments being made by major media companies and broadcasters to upgrade their equipment to the next generation, North America is expected to have tremendous market growth in the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Cisco Systems Inc. (Cisco Digital Media Player, Cisco Video Streaming Solution)

-

Ericsson (Ericsson Media Solutions, Ericsson Video Processing Solutions)

-

CommScope (CommScope Edge Solution, CommScope Antenna Systems)

-

Evertz Microsystems Ltd (Evertz IP Routing, Evertz Control Systems)

-

Harmonic Inc. (Harmonic MediaServer, Harmonic Electra Video Encoding)

-

EVS Broadcast Equipment (EVS XT4K, EVS Media Infrastructure)

-

Grass Valley (Grass Valley K-Frame, Grass Valley LDX Camera)

-

Wellav Technologies Ltd. (Wellav IP Video Encoder, Wellav Satellite Modulator)

-

Eletec Broadcast Telecom S.A.R.L (Eletec Broadcast Transmitters, Eletec Antennas)

-

Clyde Broadcast (Clyde Broadcast Production Switchers, Clyde Broadcast Studio Equipment)

-

ACORDE Technologies Inc. (ACORDE IPTV Solutions, ACORDE Encoder)

-

AvL Technologies Inc. (AvL Satellite Antennas, AvL Earth Stations)

-

Datum Systems (Datum IP Media Converter, Datum Video Encoders)

-

ETL Systems Ltd. (ETL RF Distribution Equipment, ETL Satellite Systems)

-

GBS online (GBS Broadcast Management Software, GBS Digital Signage Solutions)

-

Invacom Group (Invacom Satellite Dish, Invacom LNBs)

-

Hangzhou Dibsys Technologies Co., Ltd. (Dibsys Video Processors, Dibsys Audio Equipment)

-

NEC Corporation (NEC Video Wall Display, NEC Digital Signage Solutions)

-

OMB Broadcast (OMB Video Servers, OMB Broadcast Routers)

-

Rohde & Schwarz India Pvt Ltd (Rohde & Schwarz Broadcast Transmitters, Rohde & Schwarz Signal Generators)

-

Shanghai Teng Guang Broadcasting Equipment Co., Ltd. (Teng Guang Broadcast Equipment, Teng Guang Video Encoders)

-

TVC Communications (TVC RF Equipment, TVC Video Encoders)

Recent Developments:

-

In 2024, Cisco’s IP Fabric for Media technology helped NBC Sports deliver cutting-edge broadcast coverage of the Paris 2024 Olympic and Paralympic Games, enhancing 4K and 8K content delivery with mobile camera flexibility and distributed production.

-

In 2024, CommScope introduced the Flex Max FM321e-LE 1 GHz line extender amplifier, which provides high-output capacity for extending existing broadband systems or building new networks with minimal disruption

| Report Attributes | Details |

| Market Size in 2023 | USD 5.30 Billion |

| Market Size by 2032 | USD 9.15 Billion |

| CAGR | CAGR of 6.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Analog, Digital) • By Equipment (Dish Antennas, Switches, Video Servers, Encoders, Transmitters & Repeaters, Others) • By Application (Television, Radio) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems Inc., Ericsson, CommScope, Evertz Microsystems Ltd, Harmonic Inc., EVS Broadcast Equipment, Grass Valley, Wellav Technologies Ltd., Eletec Broadcast Telecom S.A.R.L, Clyde Broadcast, ACORDE Technologies Inc., AvL Technologies Inc., Datum Systems, ETL Systems Ltd., GBS online, Invacom Group, Hangzhou Dibsys Technologies Co., Ltd., NEC Corporation, OMB Broadcast, Rohde & Schwarz India Pvt Ltd, Shanghai Teng Guang Broadcasting Equipment Co., Ltd., TVC Communications. |