Ground Penetrating Radar Market Report Scope & Overview:

Get PDF Sample Copy of Ground Penetrating Radar Market - Request Sample Report

Ground Penetrating Radar Market size was valued at USD 338.5 million in 2023 and is expected to grow to USD 654.5 million by 2032 and grow at a CAGR of 7.6% over the forecast period of 2024-2032.

GPR (Ground Penetrating Radar) is a geophysical equipment that records underground structures without the need for excavation. GPR is a non-destructive technique in which a high-tech radar generates electromagnetic pulses at numerous frequencies (up to 1000MHz). Underground structures reflect such frequencies. The transmitted pulse recedes due to the quick change in velocity when applied to several materials. Increase rental procurement of GPR systems to drive the industry.

GPR can also detect leaks in pipelines and voids, as well as provide precise depth information for these problems. Furthermore, GPR technology aids in the reduction or elimination of potential damage to buried utilities such as water, gas, utility lines, and communications lines throughout the drilling and drilling process. Damage to these cables might cause delays, higher repair or maintenance expenses, and service disruptions. GPR systems are an excellent option for inspecting concrete. They can be used to find rebar, conduits, post-tension cables, and voids, among other things. GPR systems are an excellent option for inspecting concrete.

KEY DRIVERS:

-

Increased Preference for GPR Over Traditional Drilling Techniques

-

GPR equipment in utility safety and damage protection is in high demand.

GPR is known as the subterranean utility locator because it can detect both metallic and non-metallic utilities. Water and wastewater transit pipes, gas pipes, water boxes, conduits, polythene, and even fiber-optic cables are examples of underground services that are difficult or impossible to identify using traditional methods. GPR may also detect leaks in pipes and voids and provide precise depth information on these defects. Furthermore, ground penetrating radar industry equipment assists in minimizing or preventing potential damage to buried utilities, such as water, gas, electric utility lines, and communication lines, during the excavation and digging processes; any damage to these lines may result in delays, an increase in repair or maintenance costs, or a loss of productivity.

RESTRAIN:

-

Security Concerns

-

Lack of expertise

-

High-cost Associates

OPPORTUNITY:

-

Rising infrastructure development

-

Growing demand in military appliances

Ground penetrating radar is a utility finder capable of locating both metallic and non-metallic utilities. Water and sewage transport pipes, gas pipes, water boxes, conduits, polyethylene, and even fibre optic cables are examples of underground services that are otherwise difficult or impossible to discover. They can detect rebar, conduits, post-tension cables, and voids in real time, as well as measure concrete slab thickness. Their compact design allows for quick inspection of concrete in limited locations or from above, while a tough plastic shell and wheels provide long-lasting performance.

CHALLENGES:

-

Availability in alternative options

-

Lack knowledge and abilities to operate GPR equipment

Worries about the safety and security of subterranean utilities are projected to boost the market. Furthermore, government support for GPR implementation is propelling industry expansion. The increased need for real-time GPR services connected with aged infrastructure development represents a future market opportunity. However, there is a dearth of competence and abilities in operating GPR instruments.

IMPACT OF RUSSIAN UKRAINE WAR

As the Russian-Ukrainian conflict unfolds, the world is being influenced by a new wave of rising defense spending. These battles, however, may have a higher influence than the military expenditure. It can also help to modify procurement priorities. For example, the successful deployment of modern Russian electronic warfare equipment in Syria has driven communications solution research and development, as well as the deployment of (potentially imperfect) communications solutions that work in GPS situations.

The Russian-Ukraine war has also altered the balance of defense procurement, and the defense industry must prepare for this shift. Several countries, like India and China, are prioritizing defense spending in the radar industry in order to construct the necessary infrastructural facilities to combat the country's expanding threats. This element may have a minor impact on market growth. However, military spending in developed and developing countries such as the United States, the United Kingdom, India, and China is expected to rise in 2022. According to the Stockholm International Peace Research Institute (SIPRI), worldwide military spending climbed by 2.8% in 2022, reaching USD 1,991 million.

IMPACT OF ONGOING RECESSION

Measurements of streambed scour and deposition at bridge locations are critical for understanding the scour process; thus, better building approaches and scour countermeasures can be devised to limit scour consequences. Maximum scour on a bridge typically occurs near the peak of a flood, when measurements are difficult to obtain. Scour holes are frequently plugged immediately after the peak flow and during the flow recession. If the scour hole has been filled, data acquired after the flood using standard methods (sounding weight) may be unable to determine the maximum scour depth. Ground-penetrating-radar (GPR) data collected before and after the flood may be able to detect existing or infilled scour holes caused by the flood. GPR techniques can be used as an alternative.

MARKET SEGMENTATION

By Offering

-

Equipment

-

Services

By Type

-

Handheld Systems

-

Cart-based Systems

-

Vehicle-mounted Systems

By Application

-

Utility Detection

-

Concrete Investigation

-

Transportation Infrastructure

-

Archaeology

-

Geology & Environment

-

Law Enforcement & Military

-

Others

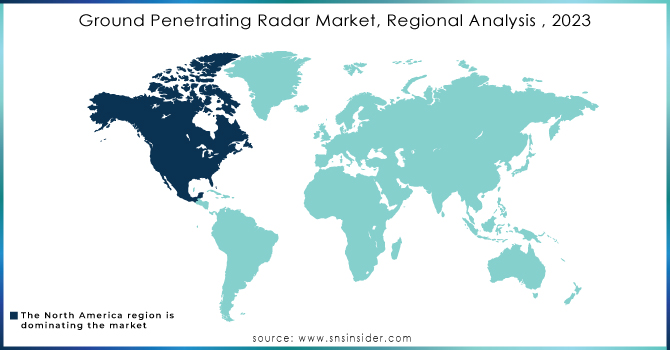

REGIONAL ANALYSIS

North America dominates the ground penetrating radar market and will maintain its dominance over the forecast period because of the increased emphasis on the deployment of modern technologies. However, Asia-Pacific will have the highest CAGR within this time span. This is due to increased military, utility detection, and transportation infrastructure deployment. North America dominated the market in 2023, with a market value of USD 130.9 million. This increase is attributed to the United States' strong defense spending and the acquisition of modern military radar. Programs and initiatives like 3D Radar and aerial missile defense radar are intended to propel market expansion.

In the base year, Europe had the second-largest ground penetrating radar market share. The increase is related to the increasing use of GPR in geology and the environment, utility detection, concrete examination, and other applications. Furthermore, the presence of important players such as Chemring Group, Geoscanners, Pipehawk plc, and others drives market expansion in the region.

The Asia Pacific market is one of the most important emerging regions in the aviation sector. This expansion is ascribed to the expansion of road infrastructure and subway building to tackle pollution and travel time issues by offering affordable and safe transportation. Furthermore, an increase in the automobile industry and military spending in Japan is expected to enhance regional market growth.

Get Customised Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some of key players Ground Penetrating Radar Market of are Chemring Group plc, Radiodetection, Hilti, Sensors and Software Inc., Guideline Geo, Geophysical Survey Systems Inc., ids georadar, Penetradar Corp. Leica Geosystems AG, Utsi Electronics Ltd., and other players are listed in a final report.

RECENT DEVELOPMENT

-

In May 2022, IDS GeoRadar s.r., a subsidiary of Hexagon AB, unveiled AiMaps, their newest product for utility experts, which provides intelligent cloud-processing of GPR data to deliver the right information to find subsurface utilities faster.

-

Sensors & Software Inc. announced the availability of SPIDAR SDK, a software development kit, in January 2022. It is intended for people who want to use GPRs on their own platforms and operate them with their own data collecting and data processing software.

-

Guideline Geo will launch the MALA Easy Locator Core for utility locating in September 2021. This is meant to be capable of conquering the most difficult terrains.

Ground Penetrating Radar Market Report Scope: Report Attributes Details Market Size in 2023

USD 338.5 Mn

Market Size by 2032

USD 654.5 Mn

CAGR

CAGR of 7.6% From 2024 to 2032

Base Year

2023

Forecast Period

2023-2032

Historical Data

2020-2022

Report Scope & Coverage

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook

Key Segments

By Offering (Equipment, Services), By Type (Handheld Systems, Cart-based Systems, Vehicle-mounted Systems), By Application (Utility Detection, Concrete Investigation, Transportation Infrastructure, Archaeology, Geology & Environment, Law Enforcement & Military, Others)

Regional Analysis/Coverage

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America)

Company Profiles

Chemring Group plc, Radiodetection, Hilti, Sensors and Software Inc., Guideline Geo, Geophysical Survey Systems Inc., ids georadar, Penetradar Corp. Leica Geosystems AG, Utsi Electronics Ltd.

Key Drivers

• Increased Preference for GPR Over Traditional Drilling Techniques

• GPR equipment in utility safety and damage protection is in high demand.Market Restraints

• Security Concerns

• Lack of expertise

• High-cost Associates