Running Gear Market Size & Trends:

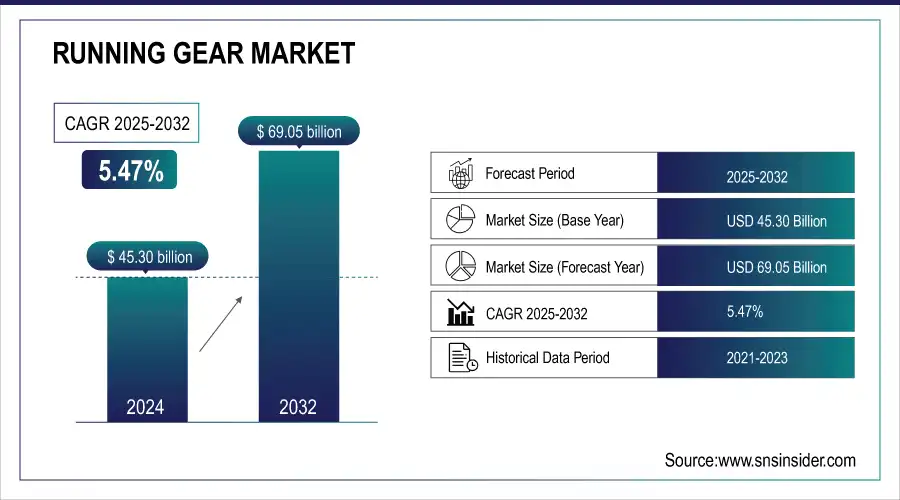

The Running Gear Market size was valued at USD 45.30 billion in 2024 and is expected to reach USD 69.05 billion by 2032, growing at a CAGR of 5.47% over the forecast period of 2025-2032. Running Gear Market trends are shifting toward smart wearables, sustainable materials, and gender-inclusive designs. E-commerce and personalized products are accelerating demand. Growing awareness of health and fitness has driven people to participate more and more in marathons and running events abroad, which in turn is contributing to the growth of the global running gear market. Market growth is also aided by the increased demand for smart wearables and high-tech running shoes. Also, the sustainability of consumers for fashionable, utility aimed & performance-oriented apparel is propelling the innovations. Demand is further supported through e-commerce growth, influencers driven marketing and a more fitness based social media environment. Growing number of people migrating to urban areas coupled with government initiatives of promoting active lifestyles are also supporting steady growth of the market globally.

To Get more information on Running Gear Market - Request Free Sample Report

In 2024, approximately 534 million wearable devices were shipped globally, including 499 million smartwatches/wristbands

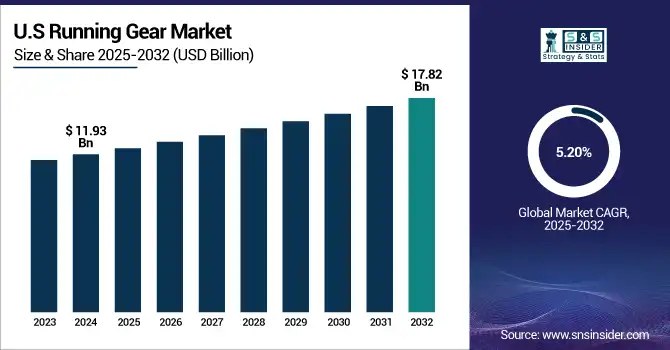

The U.S. Running Gear Market size was valued at USD 11.93 billion in 2024 and is expected to reach USD 17.82 billion by 2032, growing at a CAGR of 5.20% over the forecast period of 2025-2032. The U.S. Running Gear Market is growing due to rising health consciousness, increased marathon participation, smart wearable adoption, e-commerce expansion, and consumer demand for sustainable, performance-driven athletic apparel and footwear.

Running Gear Market Drivers:

-

Health Awareness and Fitness Culture Drive Global Demand for Innovative and Stylish Running Gear Products

The global running gear market growth is primarily driven by increasing health awareness and a growing culture of fitness across all age groups. Rising participation in marathons, daily running routines, and fitness events is fueling demand for high-performance footwear, apparel, and accessories. Technological advancements in smart wearables, such as fitness trackers and GPS-enabled devices, are enhancing user engagement and tracking capabilities. In addition, the rising popularity of athleisure and functional fashion further boosts demand for stylish yet performance-oriented products.

The 2024 New York City Marathon shattered previous records with 55,646 finishers, highlighting surging interest in long-distance running especially among younger adults

Running Gear Market Restraints:

-

Product Saturation and Counterfeit Goods Pose Major Challenges for Global Running Gear Market Expansion

One of the key restraints in the global running gear market is product saturation in mature markets, where consumers already own multiple items like running shoes or fitness trackers. This leads to slower replacement cycles and reduced urgency for frequent purchases. Additionally, counterfeit products and unregulated sellers online can dilute brand reputation and consumer trust, especially in price-sensitive regions.

Running Gear Market Opportunities:

-

Ecommerce Growth and Personalization Create New Opportunities for Running Gear Brands in Emerging Global Markets

Expanding e-commerce platforms and direct-to-consumer sales models provide significant growth potential, especially in emerging markets. There's a strong opportunity for brands to invest in sustainable materials, personalized gear, and inclusive designs catering to diverse consumer segments. Strategic influencer marketing and digital fitness platforms also present lucrative channels for brand visibility and consumer engagement.

Influencer-led campaigns boosted engagement by 13% among Gen Z consumers in 2023–2024, and micro‑influencers (10k–100k followers) were found to deliver ~30% higher ROI and ~3.9% engagement rates, compared to larger creators

Running Gear Market Challenges:

-

Balancing Innovation Performance Sustainability and Style Presents Ongoing Challenges for Running Gear Manufacturers Worldwide

Maintaining innovation while balancing performance, sustainability, and aesthetics remains a significant challenge for manufacturers. Ensuring durability, comfort, and eco-friendliness in materials without compromising performance requires ongoing R&D. Moreover, shifting consumer trends such as the preference for multifunctional gear or merging fitness with fashion demands brands stay agile and responsive to evolving expectations, posing a challenge for consistent product development and inventory planning.

Running Gear Market Segmentation Outlook:

By Product Type

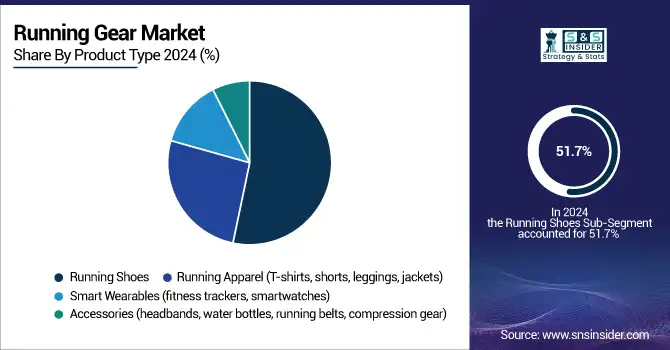

In 2024, running shoes dominated the global running gear market with a substantial 51.7% market share, driven by high demand across recreational and professional user segments. Innovations in cushioning, motion control, lightweight materials, and injury-prevention technologies have made running shoes the core product in the industry. The rise in fitness-conscious consumers, coupled with a strong retail and e-commerce presence of major brands, continues to support this leadership position.

During 2025 to 2032, smart wearables are expected to record the fastest CAGR, propelled by growing adoption of fitness tracking, GPS, and biometric monitoring features. Wearables that integrate seamlessly with fitness apps and running ecosystems offer enhanced user experiences, encouraging tech-savvy and health-focused consumers to upgrade and adopt connected gear.

By Consumer Group

In 2024, the men’s segment dominated the global running gear market share with a 40.4%, attributed to higher participation rates in marathons, fitness routines, and performance-focused sports. Brands have traditionally targeted male consumers with extensive product lines in running shoes, apparel, and smart accessories, supporting strong sales volumes. The availability of technologically advanced and style-oriented gear tailored to male preferences has further reinforced this dominance.

During 2025 and 2032, the women’s segment is projected to grow at the fastest CAGR, driven by increasing female participation in organized runs, wellness programs, and fitness challenges. Rising awareness around women-specific product needs such as fit, comfort, and performance has led to targeted innovations and marketing. Empowering fitness campaigns and inclusive brand strategies are fueling sustained growth in this category.

By Distribution Channel

Online distribution dominated the global running gear market with a 38.4% share in 2024, and it is expected to grow at the fastest CAGR from 2025 to 2032. This growth is driven by the convenience of home shopping, access to a wide product range, and frequent online-exclusive launches. Additionally, the integration of virtual try-ons, AI-driven recommendations, and personalized marketing enhances the digital shopping experience, making online platforms the preferred choice for tech-savvy and fitness-conscious consumers globally.

By End User/Usage

In 2024, recreational runners and joggers dominated the global running gear market with a 36.3% share, driven by the widespread adoption of running as a daily fitness activity. This segment includes individuals of all ages engaging in low- to moderate-intensity running for wellness, stress relief, and general health. The accessibility of running, requiring minimal equipment and infrastructure, has made it a popular choice, further supported by the availability of diverse and affordable running gear.

During 2025 to 2032, fitness enthusiasts are projected to grow at the fastest CAGR, as more consumers integrate running into multi-disciplinary training routines like HIIT, gym workouts, and cross-training. The demand for versatile, tech-integrated, and performance-driven products is rising among this segment. Brands are responding with advanced wearables and multifunctional apparel tailored to their dynamic needs.

Running Gear Market Regional Analysis:

North America dominated the global running gear market with a 35.2% share in 2024, driven by a well-established fitness culture, high disposable income, and strong brand presence. Advanced retail infrastructure, growing adoption of smart wearables, and increasing participation in marathons and wellness programs continue to support demand. Consumers in this region show strong interest in performance, style, and innovation, leading to steady product upgrades and premium gear purchases through both online and offline channels.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S led the North American running gear market in 2024, fueled by high fitness participation, strong e-commerce penetration, and dominant sportswear brands catering to performance and lifestyle needs.

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2032 in the global running gear market, driven by rising urbanization, increasing health awareness, and expanding middle-class populations. Rapid digitalization, growth in e-commerce, and the influence of fitness-focused social media trends are fueling product demand. Additionally, international sports events, government wellness initiatives, and the popularity of athleisure are encouraging more consumers across the region to invest in smart, performance-oriented running gear.

China dominated the Asia Pacific running gear market in 2024, supported by its large population, rapid urban fitness adoption, growing e-commerce platforms, and rising interest in both local and international marathon events.

Europe represents a mature and health-conscious market in the global running gear industry, driven by widespread participation in marathons, trail running, and wellness-focused lifestyles. Consumers in the region value quality, sustainability, and performance in their running gear, supporting demand for eco-friendly and premium products. Well-established sports infrastructure, government-backed fitness initiatives, and a growing preference for athleisure have strengthened the market. Countries like Germany, the UK, and France lead in consumption, with both online and offline retail channels contributing to sales growth.

Latin America and the Middle East & Africa are emerging markets in the global running gear industry, showing steady growth due to rising fitness awareness and youth-driven sports culture. Urbanization, increased access to online retail, and government efforts promoting healthy lifestyles are driving demand. While Latin America benefits from a growing middle class and interest in local running events, the Middle East & Africa are witnessing demand for branded, performance-oriented gear amid expanding fitness infrastructure and wellness programs.

Key Running Gear Companies are:

The Major Players in Running Gear Market are Nike, Adidas, Puma, ASICS, Under Armour, New Balance, Skechers, Brooks, Mizuno, Columbia, Reebok, HOKA, Decathlon, Salomon, Saucony, Lululemon, The North Face, Garmin, Polar, and Fitbit.

Recent Developments:

-

In April 2024, Nike debuted a sculpted Air Zoom unit in the Pegasus Premium, integrating ZoomX and ReactX foam to boost energy return and smooth performance in road running shoes.

-

In April 2024, Adidas TERREX introduced the trail-focused Agravic Speed Ultra, designed with Lightstrike PRO foam, Energy Rods, and rocker geometry—paired with a mentorship program to support trail runners via the Adidas Strava platform.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 45.30 Billion |

| Market Size by 2032 | USD 69.05 Billion |

| CAGR | CAGR of 5.47% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Running Shoes, Running Apparel (T-shirts, shorts, leggings, jackets), Smart Wearables (fitness trackers, smartwatches), Accessories (headbands, water bottles, running belts, compression gear)) • By Consumer Group (Men, Women, Kids / Youth, and Unisex) • By Distribution Channel (Online (Brand websites, E-commerce platforms), Offline (Specialty Sports Stores, Department Stores, Hypermarkets/Supermarkets), Direct-to-Consumer (DTC) Stores, and Third-party Retailers) • By End User / Usage (Professional Athletes, Recreational Runners / Joggers, Fitness Enthusiasts, and Marathon Participants / Race Day Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Nike, Adidas, Puma, ASICS, Under Armour, New Balance, Skechers, Brooks, Mizuno, Columbia, Reebok, HOKA, Decathlon, Salomon, Saucony, Lululemon, The North Face, Garmin, Polar, and Fitbit. |