Smart Home Security Market Size & Trends:

The Smart Home Security Market Size was valued at USD 72.42 billion in 2023 and is expected to reach USD 169.63 billion by 2032, growing at a CAGR of 9.96% over the forecast period 2024-2032.

Consumer habits for advanced technologies, such as video surveillance, motion detection, and remote monitoring, shape preferences in the Smart Home Security market. This enables security and natural user experiences with mobile apps and voice integrations.

To get more information on Smart Home Security Market - Request Free Sample Report

Another area of focus both in the market and among consumers is the reduction of security incidents, with smart systems deterring crimes in real time via alerts and video footage. These systems, which need to be dependable, ensure customer retention through high performance. In addition, the high adoption rate is an increasing trend as homeowners and businesses are looking for strong, smart solutions to protect their properties.

Smart Home Security Market Dynamics

Key Drivers:

-

Rising Demand for Smart Security Solutions Driven by Smart Homes IoT Integration and Mobile Monitoring

The major drivers are the growing adoption of smart homes and connected devices, as consumers desire more convenience, energy efficiency, and safety. Increasing security apprehensions, home burglaries, and property destruction are some factors expected to drive intelligent video surveillance systems and intruder alarms. Apart from this, the fast-paced evolution and adoption of Internet of Things (IoT) technologies and the seamless interconnection of multiple smart home devices are further expected to strengthen the market growth. Another factor responsible for the boost in demand for smart security solutions is the increasing dependence on smartphones and mobile applications for monitoring and control.

Restrain:

-

Overcoming Installation Challenges and Consumer Education to Boost Adoption of Smart Home Security Solutions

The complexity of installation and integration of the smart security system is another restraint. Although these solutions are convenient, installation, especially more advanced smart home security systems, can be difficult for many consumers, especially in residential settings. For a portion of consumers, the requirement for professional installation prevents mass adoption by limiting the pool of available purchasers in the marketplace. Market growth in certain regions is also hindered further due to a lack of knowledge and understanding regarding the advantages of smart home security systems. Consumer education and better product usability are some ways to deal with these challenges, which in turn umps consumer faith in this technology.

Opportunity:

-

AI Cloud Integration and Smart Cities Drive Growth and Innovation in Commercial and Residential Security

As businesses and homeowners remain focused on safety, the commercial and residential sectors are an excellent growth opportunity. In addition, AI and machine learning technologies are already making their way into security systems (for instance, through facial recognition and anomaly detection), an emerging quality that should only lead to more innovations and products in the future. In addition, cloud-based security services have been growing and the management of security systems remotely is now much easier, which in turn is expected to drive the market by driving further adoption of security services. Further development, expansion, and transformation opportunities await market players due to the strong global emphasis on smart cities and digital transformation.

Challenges:

-

Data Privacy and Cybersecurity Challenges Hindering Widespread Adoption of Smart Home Security Solutions

A major challenge is the issue of data privacy and cyber-security. Smart home devices generate tons of personal data unauthorized access, data breaches, and leakage of sensitive information are other possible risks. Increasingly aware of these security vulnerabilities, consumers can also be reluctant to adopt intelligent security solutions. There are no standard security protocols enforced on different devices making it easier to hack or cyberattack these systems as well.

Smart Home Security Market Segmentation Outlook

By Type

In 2023, the market was dominated by intelligent Video Surveillance, attracting 44.7% of the market share as expected due to its lucrative functionalities in monitoring and the security sector. These systems utilize AI and ML to provide features like facial recognition, motion detection, and anomaly detection, thereby providing a very high degree of security. While crimes and security threats are becoming ever more sophisticated, businesses and homeowners are more inclined towards video surveillance solutions that deliver proactive and real-time responses.

Access Control Systems are projected to experience the highest compound annual growth rate (CAGR) from 2024 to 2032, attributed to their rising relevance in managing secure entry and exit points, especially in commercial and industrial environments. These systems help restrict access of unauthorized people to specified parameters, which is important in cases of offices, factories, and government buildings. The increasing adoption of touchless and biometric authentication systems along with the growing emphasis on workplace & personal security is driving the accelerative growth of access control solutions & demand is on the rise.

By Protocols

In 2023, the Hybrid segment held the largest market share at 43.2%, since the hybrid device can integrate wired as well as wireless components, making it a flexible and reliable solution. Hybrid solutions gain from the solidity and stability of wired connections while also leveraging the scalability and ease of installation of wireless components. Such versatility allows hybrid solutions to be used in a wide variety of commercial and residential applications where it is necessary to combine different technologies to meet specific security requirements. Hybrid systems provide the perfect solution to situations that may struggle with fully wireless solutions, such as near metal objects, signal interference, or when long-range solutions are required.

Wireless Protocols are expected to grow with the fastest compound annual growth rate (CAGR) from 2024 to 2032, due to the increasing trend towards connectivity and the escalating adoption of smart home devices. Various wireless communication protocols like Zigbee, Z-Wave, and Wi-Fi facilitate that the security devices can be installed and maintained easily because the physical wiring will not be necessary, which makes the installation process cheaper and faster. As the number of households and businesses adopting IoT and smart home technologies continues to grow, wireless systems offer seamless integration with other smart technologies in the space to expand the user experience.

By Application

In 2023, the Commercial segment accounted for 47.8% of the market share in the report due to the growing attention toward security in any business environment. Commercial properties, including offices, retail, warehouses, and industrial, are subject to greater risk of theft, vandalism, and other unauthorized access. Resulting in a high demand for state-of-the-art and high-end security systems such as intelligent video surveillance and access control systems. Moreover, companies are boosting their spending on consolidated security systems as they not only increase protection but also offer remote supervision and automation among various other boasts and features.

The Residential segment will continue to have the fastest compound annual growth rate (CAGR) from 2024 to 2032, due to increasing smart home technology adoption. With the rise in the number of break-ins and other safety concerns, homeowners want to have better security and protect themselves and their property. Residential security systems have ended up being more inexpensive and available, as numerous devices– from video doorbells to clever cameras to motion detectors– are easy to set up and run smart devices.

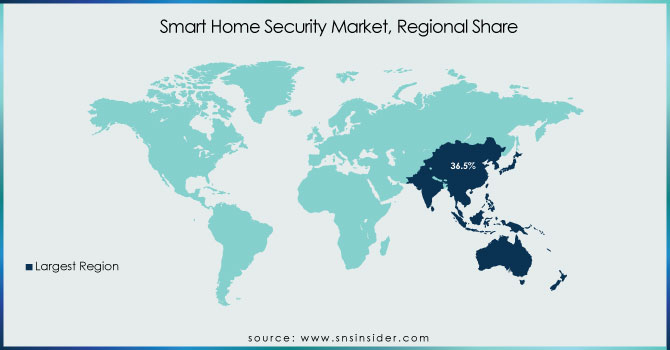

Smart Home Security Market Regional Analysis

Asia Pacific contributed 36.5% market share in 2023 and is forecasted to witness the fastest compound annual growth rate (CAGR) between 2024 to 2032. The rapid pace of urbanization and the rising middle-class population, along with growing concerns associated with security, are driving the adoption of advanced security solutions, which in turn is driving the region's dominance even further. This demand will also be supported by the development of smart cities and infrastructural growth in countries such as China, India, Japan, and South Korea, thereby increasing the need for intelligent security systems. The immense growth in the segment of smart home security solutions is also witnessed by India, where thousands of homeowners are turning to IoT-connected security systems to protect their properties, especially in urban cities like Bengaluru, and Mumbai. For this end-user segment, we find that advanced security solutions are deep-rooted and already embedded in homes and corporate areas in countries like Japan, where organizations such as Panasonic and Sharp are popular.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Smart Home Security Market are:

-

ADT Inc. (ADT Command, ADT Pulse)

-

Vivint, Inc. (Vivint Smart Home, Vivint Outdoor Camera)

-

Ring (Ring Video Doorbell, Ring Alarm)

-

SimpliSafe (SimpliSafe Home Security System, SimpliCam)

-

Arlo Technologies (Arlo Ultra 2, Arlo Pro 4)

-

Google Nest (Nest Secure, Nest Cam IQ)

-

Frontpoint (Frontpoint Security System, Frontpoint Outdoor Camera)

-

Abode (Abode Iota, Abode Security Kit)

-

Eufy Security (EufyCam 2, Eufy Security Doorbell)

-

Honeywell Home (Lyric T6 Pro, Total Connect 2.0)

-

RingCentral (Ring Protect, Ring Video Doorbell Pro)

-

Lorex (Lorex 4K Security Camera, Lorex Smart Home)

-

Kwikset (Kwikset Kevo Smart Lock, Kwikset Halo Smart Lock)

-

Canary (Canary Pro, Canary Flex)

-

RoboGuard (RoboGuard Smart Camera, RoboGuard Smart Alarm)

Recent Trends

-

In March 2024, Vivint Smart Home introduced AI-powered Vehicle Detection, enhancing security with real-time alerts and video recordings when vehicles enter or exit designated areas.

-

In August 2024, Ring launched its new Battery Video Doorbell, offering a 150-degree field of view for head-to-toe HD video and easy installation with a redesigned push-pin mount.

-

In October 2024, SimpliSafe launched Active Guard Outdoor Protection, combining AI with live monitoring to prevent crime before it happens. The service features the upgraded Outdoor Security Camera Series 2, which includes real-time audio interaction and a 90dB siren for proactive security.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 72.42 Billion |

| Market Size by 2032 | USD 169.63 Billion |

| CAGR | CAGR of 9.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Smart Intruder Alarms, Intelligent Video Surveillance, Access Control Systems, Others) • By Protocols (Wireless Protocols, Wired Protocols, Hybrid) • By Application (Commercial, Residential, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ADT Inc., Vivint, Inc., Ring, SimpliSafe, Arlo Technologies, Google Nest, Frontpoint, Abode, Eufy Security, Honeywell Home, RingCentral, Lorex, Kwikset, Canary, RoboGuard. |