Bromine Market Report Scope & Overview:

The Bromine Market size was valued at USD 3.7 billion in 2023 and is expected to reach USD 5.4 billion by 2032 and grow at a CAGR of 4.2% over the forecast period 2024-2032. The bromine market is experiencing growth driven by increasing demand for flame retardants in the construction and automotive sectors, alongside rising usage of bromine-based biocides in water treatment applications. Expansion is further fueled by the growing consumption of bromine in pharmaceuticals for sedatives and analgesics production. Bromine's incorporation into agrochemical formulations enhances its effectiveness in controlling pests and weeds, contributing to improved agricultural yields and crop quality which further drives the growth of the market. For instance, in 2023, ICL Group expanded its bromine operations by increasing production capacities for flame retardants and water treatment biocides to meet the rising global demand, particularly in the construction and automotive sectors.

Bromine Market Size and Forecast

-

Market Size in 2023: USD 3.7 Billion

-

Market Size by 2032: USD 5.4 Billion

-

CAGR: 4.2% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2023

Get More Information on Bromine Market - Request Sample Report

Bromine Market Trends

-

Rising demand from the flame retardants segment is driving bromine consumption, accounting for over 40% of global bromine usage, particularly in electronics and construction materials.

-

Expansion of the oil & gas drilling industry is boosting bromine-based clear brine fluids demand, with the segment contributing nearly 25–30% of total market revenue.

-

Growing adoption in water treatment applications is supporting steady growth, as industrial water treatment demand is increasing at a CAGR of over 5% globally.

-

Increasing use in energy storage systems, particularly zinc-bromine batteries, is gaining traction, with grid-scale battery installations projected to grow at over 20% annually.

-

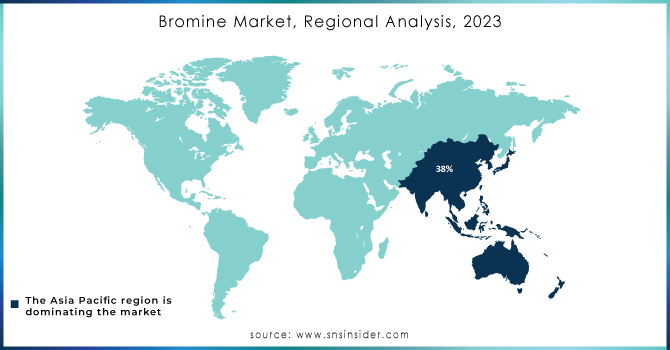

Asia-Pacific dominates bromine production and consumption, accounting for more than 50% of global market share, driven by strong chemical and electronics manufacturing activity.

Additionally, Lanxess introduced new bromine-based agrochemical formulations in 2023, enhancing pest control efficiency in agriculture. According to the U.S. Department of Agriculture (USDA), bromine-based agrochemicals have contributed to a 12% improvement in crop yields in major agricultural regions.

Technological advancements in bromine-based products and processes contribute to market expansion. Additionally, regulatory support for bromine applications, coupled with efforts toward environmental sustainability, bolsters market growth.

According to the orders, the use of bromine in water treatment chemicals was estimated to increase by 8% between 2020 and 2023. Technological advancements and the demand for more sustainable options are further supported by major world organizations. For example, the EU Circular Economy Action Plan required an increase in the use of sustainable materials and solutions in such industries as construction and electronics; the use of bromine-based solutions is also increasing in these industries.

Market Dynamics

Drivers

-

Increasing the usage of bromine compounds to cut down emissions of mercury.

Increasing the utilization of bromine compounds presents a viable strategy for curbing mercury emissions across multiple sectors. Leveraging bromine's unique chemical properties, it can effectively capture mercury, offering practical solutions in waste management and energy production. Bromine compounds, whether in brominated activated carbon or scrubbing processes, excel in trapping mercury emissions, thus preventing their release into the environment. This approach holds promise in significantly mitigating the detrimental impacts of mercury on human health and ecosystems by harnessing bromine's binding capabilities. However, its implementation warrants careful consideration of potential challenges and adverse effects that may arise.

In 2023, Calgon Carbon Corporation, a leading player in air and water treatment technologies, launched an advanced brominated activated carbon product specifically designed for mercury capture in industrial flue gas systems. This product is engineered to enhance the efficiency of mercury removal and meet stringent emission regulations.

Alternatively, in 2022, Honeywell International presented a bromine-based mercury control technology, which reportedly had some implementations in coal-fired power plants in the USA. The technology uses some varieties of bromine chemicals to improve the performance of the existing mercury control units, thus increasing the rates of efficiency of mercury capture.

Restrain

-

Environmental concerns regarding the use of bromine compounds, particularly their potential impact on ecosystems and human health.

Environmental concerns surrounding bromine compounds arise from their persistence and ability to accumulate in ecosystems, posing risks to biodiversity and ecosystem stability. Moreover, bromine's potential adverse effects on human health, including respiratory and skin irritation, add to regulatory scrutiny and public concern. These factors act as significant restraints for the bromine market, necessitating stringent regulations and sustainable practices to address environmental and health risks effectively. Moreover, the production and disposal of bromine-based chemicals can result in the release of hazardous by-products, which may contribute to soil and water contamination. In response to these issues, regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are enforcing stricter guidelines on the use and disposal of bromine compounds to mitigate their environmental footprint.

Market segmentation

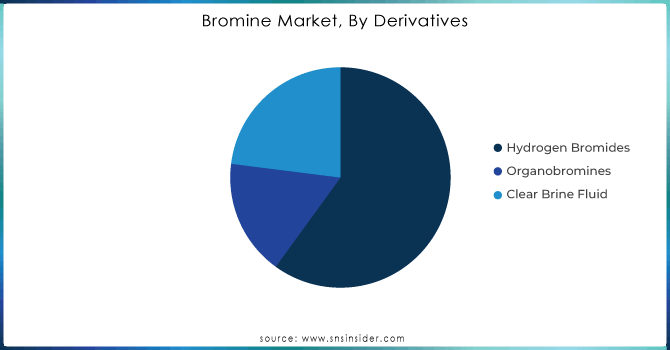

By Derivatives

By derivative segment, Organobromines held the highest revenue share of more than 45% in 2023 due to their unparalleled effectiveness as flame retardants, particularly in critical industries such as construction and electronics. Additionally, their widespread application in pharmaceuticals and agrochemicals further bolstered their market dominance. The unique combination of flame-retardant properties and versatility across diverse sectors solidified organobromines as the preferred choice, driving their highest revenue share in the bromine derivative market.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Flame Retardants dominated the application segment of the bromine market with the highest revenue share of more than 32% in 2023 due to their critical role in enhancing fire safety across various industries. Their widespread adoption in construction materials, electronics, and automotive components underscores their indispensability in preventing and minimizing fire hazards. Additionally, stringent fire safety regulations and increasing awareness regarding the importance of flame retardants further propelled their dominance in the bromine market.

By End-User

Electrical & Electronics held the largest market share in the bromine market. This dominance is driven by the extensive use of bromine-based flame retardants in electronic devices and components, which are subject to stringent fire safety regulations. The rapid growth of consumer electronics, including smartphones, laptops, and home appliances, has significantly increased the demand for brominated flame retardants to enhance fire safety and meet regulatory standards.

Regional Analysis

Asia Pacific held the largest revenue share of more than 38% in 2023 in the Bromine Market. driven by the region's burgeoning industrialization and robust demand across diverse sectors. China and India, as key players, witnessed significant growth in bromine utilization, particularly in the construction, electronics, pharmaceutical, and automotive industries. Additionally, favorable government policies and investments in infrastructure further propelled the demand for bromine-based products, cementing Asia Pacific's dominance in the market.

North America is expected to grow at the highest CAGR during the forecast period of 2024-2031. This is attributed to factors such as the increasing adoption of bromine compounds in pharmaceuticals, electronics, and flame retardants applications. Moreover, stringent regulatory standards promoting safety and sustainability further stimulate market growth, positioning North America as a key driver in the bromine market's expansion.

Key Players:

Some of the Key Plyers are LANXESS AG, TETRA Technologies, Inc., ICL Group Ltd., TATA Chemicals Ltd., Albemarle Corporation, Solaris Chemtech Industries Ltd., Hindustan Salts Ltd., Tosoh Corporation, Honeywell International Inc., Satyesh Brinechem Pvt. Ltd., and other players.

Recent Development:

-

In February 2023, TETRA Technologies, Inc. published an S-K 1300 Section 19 Report on its Investor Relations website. This report contains crucial financial information regarding the development of TETRA's Arkansas bromine assets, based on engineering, cost, and revenue assumptions completed up to the present.

-

In January 2023, ICL introduced an innovative product designed to handle Bromine spill incidents. Known as BromoQuel®, this product provides a safe and immediate response to bromine vapor and liquid spills. BromoQuel® represents ICL's groundbreaking bromine neutralization system.

-

In August 2022, Albemarle Corporation, a prominent player in the global specialty chemicals industry, announced a strategic realignment of its Bromine and Lithium global business units (GBU). This restructuring aims to better address customer needs and cultivate the talent necessary to thrive in a competitive global market. This decision follows the recent announcement of the company's plan to reorganize Catalyst under a new, wholly-owned subsidiary.

-

In June 2020, Tosoh Corp. unveiled plans to enhance its production capacity for bromine at its Nanyo Complex in Shunan City, Yamaguchi Prefecture. This expansion is intended to support the production of bromine for various applications, including flame retardants, fungicides, medicines, and agrochemicals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.7 Billion |

| Market Size by 2032 | US$ 5.4 Billion |

| CAGR | CAGR of 4.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Derivatives (Hydrogen Bromides, Organobromines, and Clear Brine Fluid)

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LANXESS AG, TETRA Technologies, Inc., ICL Group Ltd., TATA Chemicals Ltd., Albemarle Corporation, Solaris Chemtech Industries Ltd., Hindustan Salts Ltd., Tosoh Corporation, Honeywell International Inc., Satyesh Brinechem Pvt. Ltd. |

| KEY DRIVERS | • Increasing demand for flame retardants in construction and automotive industries, where bromine compounds are extensively used. • Increasing the usage of bromine compounds to cut down emissions of mercury |

| Restraints | • Fluctuations in raw material prices, affecting the cost of bromine production and market competitiveness • Environmental concerns regarding the use of bromine compounds, particularly their potential impact on ecosystems and human health. |