Lubricating Oil Additives Market Report Scope & Overview:

Get More Information on Lubricating Oil Additives Market - Request Sample Report

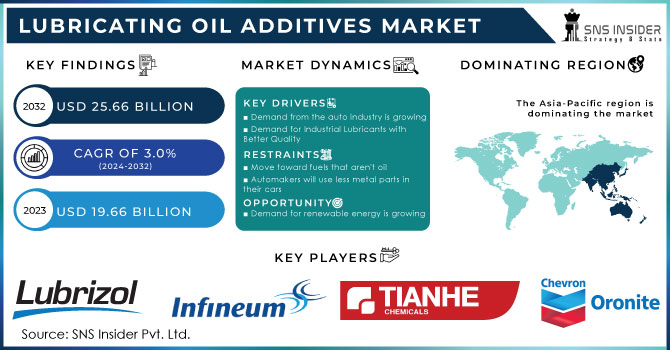

The Lubricating Oil Additives Market Size was valued at USD 19.66 billion in 2023 and is estimated to reach USD 25.66 billion by 2032 and grow at a CAGR of 3.0% over the forecast period 2024-2032.

The lubricating oil additives market is growing in industrial sector, especially in manufacturing and machinery. The growing demand of lubricants is attributed to the need of more sophisticated means of production as well as growth of the industrial production, which is becoming more complex and massive in scale.

For instance, In March 2024, Chevron Oronite launched a new line of advanced lubricating oil additives designed to enhance engine performance and fuel efficiency. This new product line incorporates innovative friction modifier technologies and anti-wear agents aimed at improving the longevity and reliability of engines used in both industrial and automotive applications.

The demand for high-performance lubricants has been increasing because the automotive and industrial sectors need products capable of operating in harsh conditions, improving engine efficiency, and aiding in emission reduction. For example, the European Union adopted stricter limits for CO2 emissions in 2022, and this action substantially increased the need for lubricants that help reduce fuel consumption and the carbon footprint.

Similarly, the Environmental Protection Agency updated its regulation of the Clean Air Act, which also forced multiple manufacturers to seek advanced lubricants. Overall, the demand for such lubricating materials has allowed key market players to introduce new additives with improved properties.

In 2023, BASF introduced a new range of high-performance lubricating oil additives under its LUBRIZOL brand, designed to enhance fuel efficiency and reduce emissions. These additives are tailored for modern engines that operate under high stress and temperatures, offering improved thermal stability and oxidation resistance.

Moreover, governments worldwide are implementing strict regulations to reduce carbon emissions and improve fuel efficiency. This is pushing manufacturers to develop additives that enhance lubricant performance while meeting environmental standards.

Market Dynamics:

Drivers

- Demand from the automotive industry is growing driving the market growth.

The rapid expansion of the automotive sector is boosting the demand for lubricating oil additives. The most significant driver of this trend is that automobile manufacturers have no choice but to respond to the ongoing transition from traditional to more efficient and environmentally friendly means of transportation. Engrossed in fighting air pollution, virtually every government has tightened emissions standards, forcing automakers to develop engines that are more powerful and, at the same time, greener. Unsurprisingly, most of the most prominent lubricating oil additive manufacturers grew their supply by creating innovative products that cater to modern engines.

For instance, in 2023, for example, Lubrizol launched a series of additives specifically designed for low-viscosity engine oils, which help improve fuel economy and reduce greenhouse gas emissions.

Moreover, the U.S. Department of Energy believes that this means of transportation is particularly promising. It estimates that the adoption of energy-efficient vehicles and fuels will grow at an average rate of 10% per year through 2030. Naturally, this trend is becoming increasingly important for lubricating oil additives. The automotive sector, therefore, emerges as one of the foremost drivers of the lubricating oil additives market. At the same time, it means that further innovation will be crucial to enable automakers to comply with increasingly tightening standards without losing their capacity to propel the vehicles they manufacture.

Restrain

- Competition from alternative technologies may hamper the market growth.

Synthetic lubricants, known for their superior performance, longer service intervals, and better environmental profiles, require fewer additives compared to conventional mineral-based oils. As industries and consumers increasingly opt for synthetic lubricants, driven by their enhanced thermal stability, better protection against wear and tear, and overall cost-effectiveness in the long run, the demand for traditional lubricating oil additives is expected to decline. This shift not only reduces the market share for conventional additives but also pressures manufacturers to innovate and develop more advanced formulations to remain competitive. Consequently, the growing preference for alternative lubrication technologies is becoming a key restraining factor, potentially hampering the overall market growth for lubricating oil additives.

Market Segmentation:

By Type

The viscosity index held the largest market share 24.92%, by revenue, in 2023. Viscosity index improvers are polymeric additives, which are added to offset the effect of raised temperature in lubricant on its viscosity. The additives find applications in multi-grade engine oils, hydraulic fluids, gear oils, automatic transmission fluids, greases, and power steering fluids. On the other hand, dispersant is widely used to protect against sludge, varnish, and other deposits on the surface. Dispersants are mostly used in heavy-duty engine oils and gasoline engines, making up about 70 to 80 percent of their entire use in engine protection. Additionally, dispersants are utilized in gear lubricants, automatic transmission fluids, natural gas engine oils, and aircraft piston engine oils. Additionally, the additives are used in high-temperature, medium-speed supercharged engines.

By Application

The engine oil segment held the largest market share around 28.56% in 2023. The leading application segment in the lubricating oil additives market is engine oil. Internal combustion engines are still the most common type of engines and are widely used in the automotive and industrial sectors. Engine oil is vital to the performance and longevity of internal combustion engines. Engine oil additives are used to improve the performance of engine oils. They provide various advantages, such as enhanced viscosity, wear protection, corrosion resistance, and engine cleanliness. Moreover, engine oil additives continue to be in high demand because of the large number of vehicles in operation worldwide and the increasingly stringent regulations to improve fuel efficiency and minimize emissions.

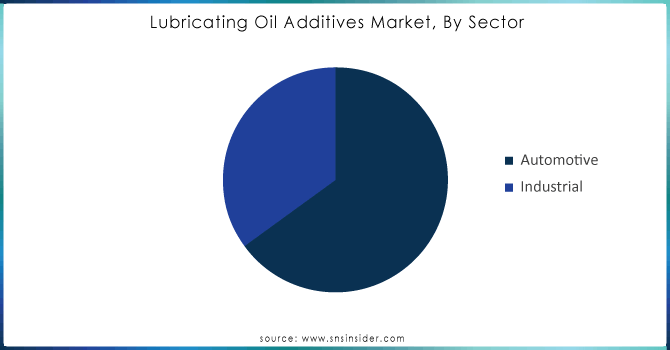

By Sector

The automotive lubricants segment held the largest market share around 63.56% in 2023. This is because consumers prefer high-performance operational efficient engine fuel. Lubricant additives are commonly used in automobile fuel systems such as both gasoline & diesel engines including dispersants, viscosity index improvers, antioxidants, and friction modifiers. These additives support the use because they have excellent stability intended for oxidation which is estimated from the low-rate volatility, solvency improved together with oxidative stability. In addition, they are used to maintain cleanliness in an engine and improve fuel economy and performance at particular temperatures. Currently, it is recommended for diesel fuels additives to compensate for both conventional abilities and high-pressure injection and thus prolongs the life of the lubricants itself.

Get Customized Report as per your Business Requirement - Request For Customized Report

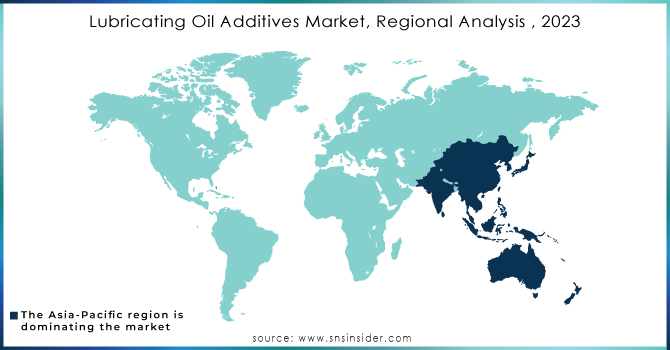

Regional Analysis:

The Asia Pacific lubricant additives market held a substantial share of 36.03% by volume in 2023. This is associated with a large amount of skilled labor at low costs, as well as the availability of land and resources. Change in the production landscape from mature economies of the U.S. and Germany has shifted to emerging economies of the Asia Pacific, especially in China, India, Thailand, Vietnam, and Indonesia is expected to positively impact the market growth of lubricant additives over the forecast period.

China's lubricant additives market is expected to grow over the forecast period. China has very rich sources of petrochemical reserves and has high amounts of highly skilled labor that is easily accessible to any firm. China is the world’s highest population density region thus creating high demand for housing facilities and the growth of the residential construction sector, which will influence building machinery & equipment such as excavators, bulldozers, and others, which will positively impact the lubricants consumption.

Key Players:

Lubrizol Corporation, Tianhe Chemicals, Infineum International Limited, Chevron Oronite Company LLC, Lanxess, Evonik Industries AG, BRB International BV, Croda International PLC, BASF SE, Afton Chemical, Krystal Lubetech Private Limited and other players.

Recent Development:

- In 2023: Chevron Oronite announced the expansion of its additive production capacity in Singapore to meet the growing demand for advanced lubricating oil additives in the Asia-Pacific region.

- In 2022: Afton Chemical Corporation introduced a new line of dispersant and detergent additives designed for improved engine cleanliness and performance. The company focused on enhancing its product portfolio to meet the evolving needs of modern engines, particularly in the automotive sector, where emissions regulations are becoming more stringent.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 19.66 Billion |

| Market Size by 2032 | US$ 25.66 Billion |

| CAGR | CAGR of 3.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Viscosity Index Improvers, Dispersants, Detergent, Anti-oxidants, Anti-wear Agent, Rust & Corrosion Inhibitors, Friction Modifiers, Extreme Pressure Additives, Pour Point Depressants, Others) • By Application (Engine Oil, Hydraulic Fluid, Gear Oil, Metal Working Fluids, Transmission Fluid, Grease, Compressor Oil, Others) • By Sector (Automotive, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Lubrizol Corporation, Tianhe Chemicals, Infineum International Limited, Chevron Oronite Company LLC, Lanxess, Evonik Industries AG, BRB International BV, Croda International PLC, BASF SE, Afton Chemical, Krystal Lubetech Private Limited and other players. |

| DRIVERS | • Demand from the automobile industry is growing driving the market growth. • Demand for Industrial Lubricants with Better Quality |

| Restraints | • Competition from alternative technology may hamper the market growth |