Nano Fertilizer Market Report Scope and Overview:

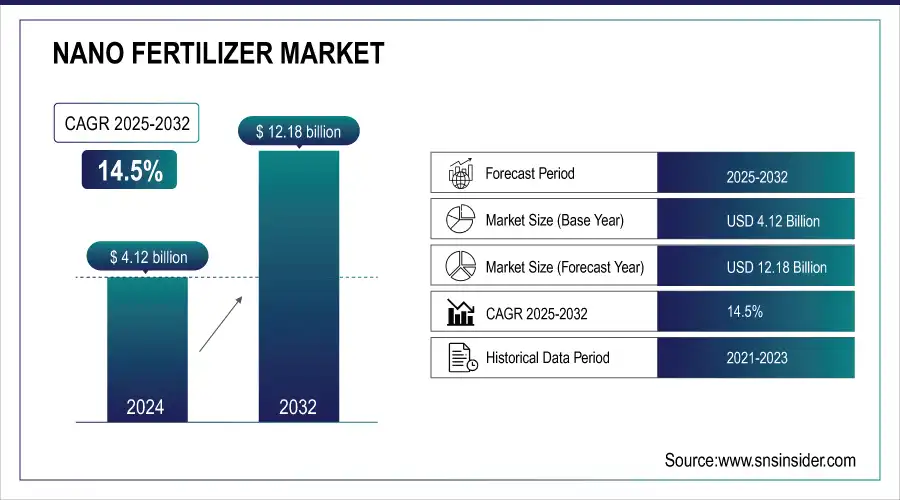

The Nano Fertilizer Market Size was valued at USD 4.12 billion in 2024, and is expected to reach USD 12.18 billion by 2032, and grow at a CAGR of 14.5% over the forecast period 2025-2032.

Get more information on Nano Fertilizer Market - Request Sample Report

Increasing demand for sustainable agriculture and the need for higher crop yield are presently driving the growth of the nano fertilizer market. Nano fertilizers can offer more efficient nutrient use, less environmental pollution, and improved plant growth as compared to conventional fertilizers. For example, conventional K fertilizers increase corn yields by around 16.7%, while K-based nano fertilizers could increase yields between 9.5% to 24.5% depending on the applied dose. On average, nano fertilizers have been found to increase crop yields ranging from 10% up to 30%. If calculated in monetary terms, this could correspond to additional income worth USD 133.2 per hectare for corn, USD 66.0 for wheat, and USD 86.4 for soybeans. This data underscores the economic and agricultural benefits of utilizing nano fertilizers, especially in a scenario where global demand for food is expected to increase.

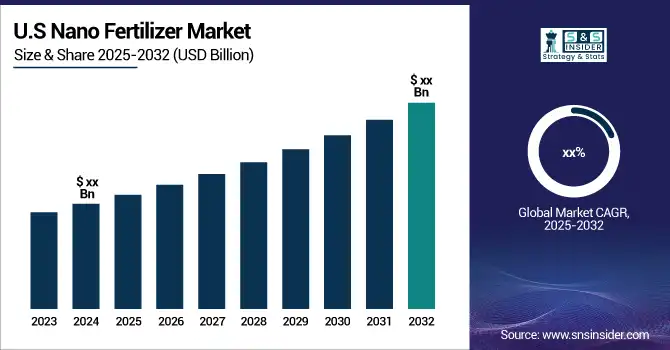

Nano Fertilizer Market Size and Forecast:

-

Market Size in 2024: USD 4.12 Billion

-

Market Size by 2032: USD 12.18 Billion

-

CAGR: 14.5% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Nano Fertilizer Market Highlights:

-

Enhanced crop efficiency and sustainability with nano fertilizers improving nutrient efficiency, reducing waste, minimizing environmental damage, and boosting crop yields and produce quality to support global food demand

-

Government initiatives and adoption in India including replacing 2.5 million tonnes of conventional urea with nano urea and establishing multiple nano fertilizer plants, reflecting strategic support for agricultural efficiency and sustainability

-

R&D and technological advancements such as nano-encapsulated and biopolymer-coated fertilizers that enhance nutrient delivery, reduce leaching, and improve crop yield with minimal environmental impact

-

Rising demand for sustainable agriculture driving adoption of nano fertilizers, supported by collaborations like NFL-India and ICAR for nano urea development

-

High production costs due to sophisticated processes and expensive raw materials, limiting affordability for small-scale farmers and potentially slowing adoption

-

Reduced nutrient loss through precise nutrient release, preserving soil fertility, lowering costs, and promoting sustainable farming practices globally

Moreover, nano-fertilizers assure that crops work with a better nutrient efficiency, hence being more effective and reducing waste in the process, minimizing damage to nature. Such precision enhances crop health and productivity while reducing the risk of nutrient leakage into the soil or water bodies, thereby preserving the environment. As a result, farmers who are using nano fertilizers will have much more yields and quality of produce to result in higher revenue. This is potentially able to meet the global food demand. The incorporation of nano fertilizers into cultivation can be in the trend due to the increasing need for sustainable usage in agriculture that balances between productivity and environmental stewardship.

The recent developments in the nano fertilizer market refer to huge adoptions by the government itself of those innovative solutions, especially in India. India is going to replace 2.5 million tonnes of conventional urea with nano urea in FY24, showing a huge shift towards nano fertilizers. The government has also set up six nano urea plants and four nano diammonium phosphate plants. Further, initiatives such as IFFCO's promotion of nano-fertilizers through 200 model nano-village clusters indicate an emphasis on educating the farmer on the benefits of nano-fertilizers. These moves reinforce the strategic importance of nano-fertilizers in gaining improvement towards agricultural efficiency and sustainability.

Furthermore, nano-fertilizers come into focus with their place in the national policies and budgets for the future of any agricultural strategy. Fertilizers such as nano DAP and other post-hat technologies play a significant role in the India budget of 2024 in order to encourage their application, based on the values of nano fertilizers in reducing dependence on traditional, efficient resource use. The global population is increasing steadily with the direness of agricultural solutions that are innovative. Nano-fertilizers are a step in the direction necessary for this, as they offer a sustainable manner of enhancing food production while friendly to the environment. Therefore, the nano fertilizers market is bound to grow in the future, especially due to tecnolodgical advances in agriculture, government support, and the dire neccessity to feed the increasing world population.

Nano Fertilizer Market Drivers:

-

Increasing demand for sustainable agriculture

Increased focus on sustainable agriculture is a major reason for growth in the nano fertilizer market, wherein farmers and firms from the agriculture sector want higher crop productivity without affecting the environment. Nano fertilizers provide nutrition at a nanoscale level, enabling efficient and effective delivery to plants, avoiding excessive application of fertilizers that may lead to soil and water contamination. Events illustrating the adaptation of sustainable farming practices can be drawn from various initiatives and partnerships whose aim is to foster eco-friendly agricultural solutions. For instance, in March 2024, NFL-India's National Fertilizers Limited-and the Indian Council of Agricultural Research entered into an agreement for the development and dissemination of nano urea, a nano fertilizer that enhances nitrogen use efficiency hence reducing the need for conventional urea. Also, in May 2023, the Brazilian agricultural company Verde Agritech introduced its line of nano fertilizers, which are planned for increasing nutrient intake and improving the soil to meet the national objectives of ensuring a low-carbon economy from its agricultural production. Examples of this sort draw attention to the rising demand for sustainable agricultural inputs, hence driving the development of nano fertilizer markets as one of the crucial solutions toward meeting global food security challenges with sustainability in environmental health.

-

Advancements in nanotechnology

The advances in nanotechnology, over the years, have constituted one of the strong drivers in the growth of the nano fertilizer market, enabling an improvement in the production of nutrient products while reducing environmental impacts. The technological advancement has enabled the manufacturing of fertilizers from nanoscale particles, which increases the efficiency of nutrient usage and minimizes loss due to leaching or volatilization. For example, in January 2024, BASF, one of the leading chemical manufacturers in the world, introduced a new family of nano-encapsulated fertilizers designed to release their nutrients slowly, enabling the improvement of crop yield with reduced application frequency. In August 2023, Corteva Agriscience presented a nano-based fertilizer coated with a biopolymer, which aids in enhancing the availability of nutrients to plants, with minimal degradation of the soil and contamination of water. These advancements in nanotechnology not only optimize fertilizer use but also help meet international goals for sustainable agriculture. In February 2024, a collaborative project between Syngenta and the leading nanotechnology research institute in Switzerland developed nano-sized zinc fertilizer that provides the essential micronutrient to crops in more controlled and efficient ways, thus improving health and robustness in plants. These developments underline how nanotechnology inventions remain crucial in transforming agriculture inputs and, consequently, the adoption of nano-fertilizers to meet the rising demand for sustainable and effective farming solutions.

Nano Fertilizer Market Restraints:

-

High production costs associated with the nano-fertilizers

The high expenses linked to producing nano fertilizers are a major obstacle in the market, as the sophisticated technology needed to make them often requires costly materials and complicated procedures. These expenses can reduce the affordability of nano fertilizers for small-scale farmers, restricting their widespread use. In September 2023, Mosaic Co., an American company, announced that the increased production expenses of their newly created nano-phosphorus fertilizer, attributed to the necessity of specific tools and strict quality standards, led to a higher cost compared to traditional fertilizers. Likewise, Yara International, a top fertilizer producer worldwide, stated in November 2023 that the costs associated with procuring high-purity nano-scale ingredients for their new nano-nitrogen product had notably raised production expenses, creating a hurdle for competitive pricing. These instances demonstrate how the economic obstacles related to manufacturing nano fertilizers can impede market expansion, particularly in regions that are sensitive to prices.

Nano Fertilizer Market Opportunities:

-

Nano fertilizers offer the advantage of reduced nutrient loss

Nano fertilizers provide the benefit of decreased nutrient waste, offering a promising opportunity in agriculture by improving nutrient utilization and reducing environmental harm. These fertilizers, by utilizing nanoscale particles, guarantee a more precise and regulated nutrient release, minimizing the chances of leaching and runoff. In July 2023, IFFCO, an Indian company, introduced a new nano nitrogen fertilizer that showed a 20% decrease in nutrient loss in contrast to traditional fertilizers. This new fertilizer assists farmers in preserving soil fertility and reducing expenses. In a similar fashion, Nutrien Ltd., a large Canadian fertilizer company, launched a new nano potassium product in October 2023. This product was found to greatly reduce nutrient runoff in test fields, leading to more sustainable farming practices by lowering the necessary amount of fertilizer for successful crop development. These advancements highlight the possible impact of nano fertilizers on improving agricultural yield and addressing ecological issues linked to conventional fertilizer usage.

Nano Fertilizer Market Segment Analysis:

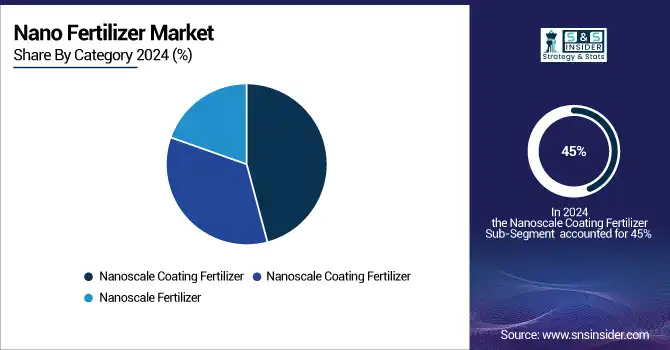

By Category

The Nanoscale Coating Fertilizer segment was the dominated in the nano fertilizer market in 2024, holding a significant market share of approximately 45%. This section is able to achieve dominance because it is efficient in delivering nutrients by regulating the release rates, which reduces nutrient loss and improves crop absorption. In May 2023, Syngenta launched a new nanoscale coating fertilizer for growing rice in Southeast Asia, leading to a 20% higher yield than traditional fertilizers. The increasing use of nanoscale coating fertilizers in areas such as India and China, where agriculture is intense, shows their effectiveness in enhancing nutrient distribution and decreasing environmental harm, leading to a substantial market presence.

By Raw Material

The Nitrogen-based segment dominated in the nano fertilizer market in 2024, capturing around 50% of the market share. The reason for this dominance is the important function of nitrogen in the growth of plants and its extensive use in different crops. In July 2023, Yara International introduced a new nano nitrogen fertilizer that greatly increased corn production in Brazil, with yields rising by as much as 25% compared to conventional nitrogen fertilizers. The predominant use of nitrogen in nano fertilizers, due to its ability to boost plant growth and increase crop yields, has made it the top segment in the market.

By Mode of Application

The Spray or Foliar application sector controlled over half of the nano fertilizer market in 2024, holding approximately 55% market share. The main reason for the popularity of this particular segment is its effectiveness in providing nutrients directly to plant leaves, leading to quick absorption and improved plant development. In March 2023, Nutri-Tech, an Israeli company, launched a foliar nano fertilizer that resulted in a 30% yield increase for tomato crops in Spain compared to conventional soil-applied fertilizers. The nano fertilizer market has been dominated by foliar application due to its efficiency in delivering nutrients quickly and enhancing crop performance.

By Crop Type

In 2024, the Fruits & Vegetables dominated the nano fertilizer market, holding around 60% of the market share. The reason for this predominance is the valuable nature and intensive farming methods linked to these crops, which greatly profit from the improved nutrient delivery offered by nano fertilizers. In August 2023, IFFCO, an Indian company, stated that its nano fertilizer solutions resulted in a 25% higher yield for tomatoes and peppers compared to conventional fertilizers. The use of nano fertilizers in the production of high-quality, high-yield fruits and vegetables has surged due to increased demand, leading to its position as the top and fastest growing sector in the market.

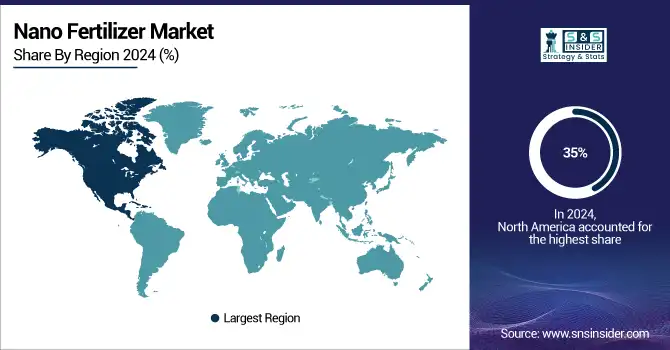

Nano Fertilizer Market Regional Analysis:

North America Nano Fertilizer Market Trends:

In 2024, North America dominated and accounted for the largest market share of approximately 35% in the Nano Fertilizer Market. North America's strong research and development (R&D) infrastructure is a major factor in its success in the Nano Fertilizer Market. Moreover, the robust agricultural industry in North America has been instrumental in increasing the need for nano fertilizers. As reported by the USDA, the agriculture, food, and related sectors contributed about USD 1.264 trillion to the US GDP in 2021, representing 5.4% of the total. From the total amount, American farms alone made USD164.7 billion, accounting for about 0.7 percent of the entire U.S. GDP. Additionally, the area consists of modern agricultural techniques and numerous industrialized farms. These farms have acknowledged the benefits of nano fertilizers for increasing crop yields and boosting agricultural productivity. Therefore, they have quickly embraced these new fertilizers, thus boosting market expansion. Additionally, the market's growth has been significantly influenced by North America's positive regulatory environment. Stringent regulations have been put in place in the area to guarantee the safety and effectiveness of nanofertilizers. This has built trust among farmers and consumers, resulting in a rise in acceptance and demand for these products.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia-Pacific Nano Fertilizer Market Trends:

In 2024, the Asia-Pacific region emerged with the highest CAGR in the Nano Fertilizer Market during the forecast period. The Asia-Pacific region has a large agricultural sector and a population largely dependent on farming for a good part of their livelihood. As a result, there has been increasing demand for sustainable and innovative agricultural practices that can promote crop productivity and ensure food security. Nano fertilizers have emerged as a suitable solution for this demand as they are endowed with unique properties and play a significant role in facilitating absorption of nutrients, and subsequent growth of crops. In addition, the region is rapidly urbanizing and industrializing leading to increasing pollution and environmental degradation. This makes it necessary for the region to adopt eco-friendly and efficient agricultural practices that can reduce the adverse effects on soil and water resources. The use of Nano fertilizers is highly relevant in addressing these concerns considering the fact that they possess targeted delivery systems which promote the well-being of the soil and have minimal environmental effects. In India, the Union Minister for Chemicals and Fertilizers has been at the forefront of making the country grow its indigenous industries through Prime Minister, Shri. Narendra Modi’s Atma Nirbhar Bharat vision, as a result all fertilizer companies are in the process of being changed to having gas-based technology. It has been noted that the production of organic and Nano fertilizers has been encouraged by the government, which are at least 25-30 % less the cost and give a yield increase of 18 to 35% while ensuring soil health. Narayana Gowda, the Union Minister, said that as much as 12,000 farmers and agriculture universities in India have been given free distribution of Nano Fertilizers resulting in good remarks being made.

Europe Nano Fertilizer Market Trends:

In 2024, Europe held a significant share of the Nano Fertilizer Market, driven by its strong focus on sustainable agriculture and stringent environmental regulations. The region’s advanced farming technologies, precision agriculture adoption, and government incentives for eco-friendly fertilizers have encouraged the use of nano fertilizers. Countries like Germany, France, and the Netherlands are investing in R&D to develop innovative nanofertilizer formulations that increase nutrient efficiency and reduce environmental impact. European farmers are increasingly adopting these products to enhance crop yields, maintain soil health, and comply with strict agricultural sustainability standards, which supports market growth across the region.

Latin America Nano Fertilizer Market Trends:

In 2024, Latin America emerged as a rapidly growing market for nano fertilizers due to its large agricultural sector and favorable climatic conditions for crop cultivation. Countries such as Brazil, Argentina, and Mexico are witnessing increased demand for sustainable fertilizers to improve crop productivity and reduce nutrient losses. The adoption of nano fertilizers is supported by government programs promoting modern agricultural practices and the need to ensure food security for a growing population. Additionally, rising awareness among farmers about the benefits of targeted nutrient delivery and soil health preservation is contributing to the market expansion in this region.

Middle East & Africa Nano Fertilizer Market Trends:

In 2024, the Middle East & Africa (MEA) region is experiencing steady growth in the nano fertilizer market, primarily driven by the need to optimize limited agricultural resources and improve crop yields in arid and semi-arid areas. The region’s focus on food security, government initiatives for modern agriculture, and investments in R&D for innovative fertilizer solutions have increased adoption rates. Nano fertilizers help address challenges such as water scarcity, soil salinity, and nutrient deficiencies, making them increasingly relevant for MEA farmers. Rising awareness of eco-friendly farming practices and the efficiency of nanotechnology-based fertilizers is expected to continue supporting market growth in the region.

Nano Fertilizer Market Key Players:

-

Indian Farmers Fertiliser Cooperative Limited (IFFCO)

-

EuroChem Group AG

-

Aqua-Yield Operations LLC

-

Lazuriton Nano Biotechnology Co., Ltd.

-

AG CHEMI Group, s.r.o.

-

Geolife Group

-

JU Agri Sciences Pvt. Ltd.

-

Shan Maw Myae Trading Co., Ltd.

-

Tropical Agrosystem India (P) Ltd.

-

Nano Solutions

-

Indogulf BioAg LLC

-

Nanotech-Agri

-

Ray Nano Science & Research Center

-

Kanak Biotech

-

Coromandel International Ltd.

-

Nutrien Ltd.

-

BASF SE

-

Yara International ASA

-

Haifa Chemicals Ltd.

-

The Mosaic Company

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.12 Billion |

| Market Size by 2032 | USD 12.18 Billion |

| CAGR | CAGR of 14.5% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Category (Nanoscale Fertilizer, Nanoscale Additive Fertilizer, Nanoscale Coating Fertilizer) •By Raw Material (Nitrogen, Carbon, Zinc, Silver, Aluminium, Others) •By Mode of Application (Spray or Foliar, Soaking Method, Soil) •By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Indian Farmers Fertiliser Cooperative Limited (IFFCO), EuroChem Group AG, Aqua-Yield Operations LLC, Lazuriton Nano Biotechnology Co., Ltd., AG CHEMI Group, s.r.o., Geolife Group, JU Agri Sciences Pvt. Ltd., Shan Maw Myae Trading Co., Ltd., Tropical Agrosystem India (P) Ltd., Nano Solutions, Indogulf BioAg LLC, Nanotech-Agri, Ray Nano Science & Research Center, Kanak Biotech, Coromandel International Ltd., Nutrien Ltd., BASF SE, Yara International ASA, Haifa Chemicals Ltd., The Mosaic Company |