Building Integrated Photovoltaics (BIPV) Market Size:

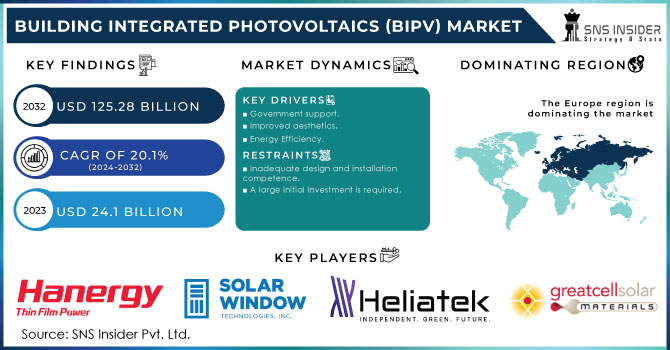

The Building Integrated Photovoltaics (BIPV) Market Size was valued at USD 24.1 billion in 2023 and is expected to reach USD 125.28 billion by 2032 with a growing CAGR of 20.1% over the forecast period 2024-2032.

Building photovoltaics are photovoltaic materials that are utilized as alternatives to traditional building materials. They are employed in construction components such as roofs, skylights, and facades. Building-integrated photovoltaics is another name for solar panels that are integrated into the building industry. Thin-film solar panels, flexible thin-film solar panels, thin-film or crystalline-based solar panels, and semi-transparent solar panels are among the several kinds available. BIPV is one of the fastest growing areas of the worldwide solar PV market.

Get More Information on Building Integrated Photovoltaics (BIPV) Market - Request Sample Report

MARKET DYNAMICS

KEY DRIVERS:

-

Government support.

-

Improved aesthetics.

-

Energy Efficiency.

RESTRAINTS:

-

Inadequate design and installation competence.

-

A large initial investment is required.

OPPORTUNITIES:

-

Collaboration with the construction industry.

-

The creation of heat by BIPV modules.

-

Cell technology of the next generation.

IMPACT OF COVID-19:

The market for building integrated photovoltaics is predicted to drop in 2020, owing mostly to the impact of COVID-19. Several major economies' governments have imposed lockdowns to prevent the spread of COVID-19. Manufacturing activity have been severely hampered as a result of the shutdown. Because the vast majority of PV modules are made in China, the manufacturing and supply chain have suffered significantly. The Chinese industrial capacity had been severely impacted by the lockdown, since all major ship container firms had also halted operating out of Chinese ports and shipping commodities from China to other nations. As a result, supply chain interruptions occurred in March and April 2020. Furthermore, other nations' lockdowns disrupted supply chains and created labor shortages in the PV industry. Due to travel limitations, businesses were unable to get the necessary workforce for their operations. Though the industry is projected to be affected in 2020.

Based on Technology, the building integrated photovoltaics market is segmented into Thin Film, Crystalline Silicon and Others. Because of its excellent resilience to adverse weather conditions and high strength, the crystalline silicon segment accounted for a significant part of the building integrated photovoltaics market. The worldwide market is predicted to be driven largely by falling crystalline silicon cell prices, which will cut installation costs throughout the forecast period.

Based on Application, the building integrated photovoltaics market is segmented into Roof, Wall, Glass, Façade and Others. Due to the availability of a greater panel installation area for BIPV, the roof segment accounted for a significant part of the building integrated photovoltaics market. Residential roof installations are predicted to expand in demand in countries such as the United States, the United Kingdom, Germany, and France. Furthermore, the increased deployment of energy storage systems is likely to support demand for off-grid solar PV systems during the projection period.

Based on End Use, the building integrated photovoltaics market is segmented into Commercial, Residential and Industrial. Due to increased awareness of zero-emission green infrastructure, the commercial category accounted for a significant building integrated photovoltaics market share. BIPV installations boost the aesthetic appeal of business premises while saving significant amounts of power, promoting product adoption across the commercial market.

REGIONAL ANALYSIS:

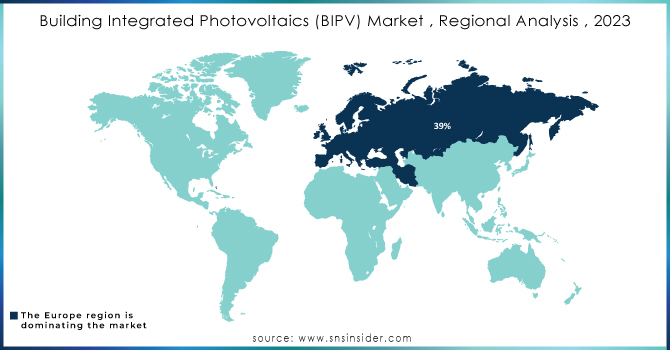

Europe led the worldwide market in 2023, accounting for about 39 percent of sales. A favorable outlook for renewable energy, along with consumer awareness in European nations, is expected to boost the BIPV market throughout the projected period. Germany and Italy are prioritizing the use of solar energy, which is projected to translate into increased usage of BIPV, encouraging industry growth throughout the projection period. The increasing use of aesthetically appealing solar energy-harnessing systems is expected to drive demand for building-integrated photovoltaics in the North American area. Furthermore, the region's high disposable incomes, particularly in the United States and Canada, as well as advancements in BIPV solar panel production methods, are expected to contribute to greater demand for the product over the next seven years. The product's demand is expected to continue high in economies such as China and Japan due to increased government initiatives to adopt these solutions. Consumers in the region have a strong demand for renewable energy sources in order to lessen the environmental effects of nonrenewable energy sources.

Do You Need any Customization Research on Building Integrated Photovoltaics (BIPV) Market - Enquire Now

KEY PLAYERS

The Major players in the building integrated photovoltaics market are SolarWindow, Hanergy Mobile Energy Holding Group, Heliatek, Greatcell, Ertex Solartechnik, AGC, The Solaria, Carmanah Technologies, Tesla and BELECTRIC.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 24.1 Billion |

| Market Size by 2032 | US$ 125.28 Billion |

| CAGR | CAGR of 20.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Thin Film, Crystalline Silicon, Others) • By Application (Roof, Wall, Glass, Façade, Others) • By End Use (Commercial, Residential, Industrial) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SolarWindow, Hanergy Mobile Energy Holding Group, Heliatek, Greatcell, ertex solartechnik, AGC, The Solaria, Carmanah Technologies, Tesla and BELECTRIC. |

| Key Drivers | • Government support. • Improved aesthetics. • Energy Efficiency. |

| Restraints | • Inadequate design and installation competence. • A large initial investment is required. |