Biofuels Market Report Scope & Overview:

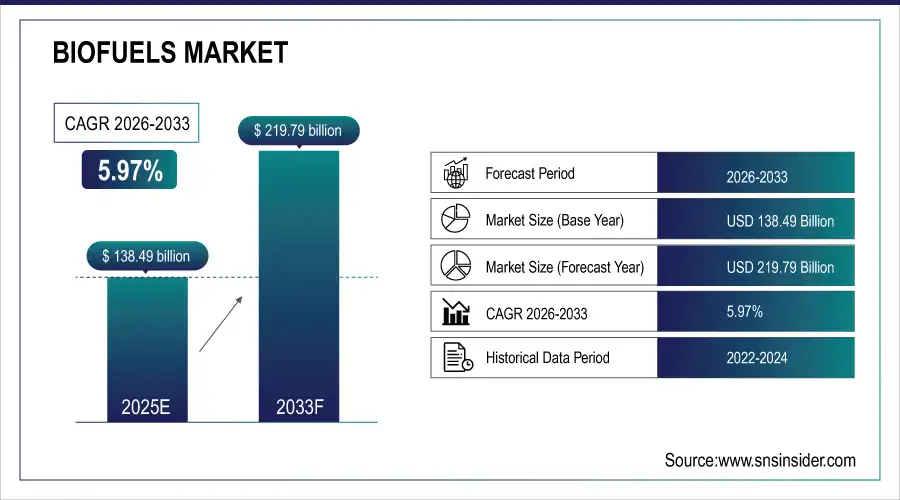

The Biofuels Market Size was valued at USD 138.49 Billion in 2025E and is projected to reach USD 219.79 Billion by 2033, growing at a CAGR of 5.97% during the forecast period 2026–2033.

The Biofuels Market analysis provides an in-depth study of production trends and feedstock adoption to understand market growth. It categorizes the market based on product, feedstock, application, end user, and distribution channel. Growing need for renewable energy and sustainable fuels supports market growth.

Ethanol and biodiesel production reached 85 billion liters in 2025, driven by rising renewable energy demand.

Market Size and Forecast:

-

Market Size in 2025: USD 138.49 Billion

-

Market Size by 2033: USD 219.79 Billion

-

CAGR: 5.97% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Biofuels Market - Request Free Sample Report

Biofuels Market Trends:

-

The increasing interest in reduction of the carbon footprint globally and climate policies is inducing growth of ethanol, biodiesel, and advanced biofuels applicable to transportation and industrial sectors.

-

Novel feedstock sources, including agricultural residues and algae-based feedstocks, are increasing technology sustainability and lowering costs of production.

-

Mix of mandates and renewable energy targets are pushing governments and corporations to use more biofuels in transport, aviation.

-

Technological innovation in bio-refining and energy-efficient production continues to enhance yield, quality and scale for producers.

-

The increasing awareness of consumers regarding the environmental footprint is driving for cleaner fuels, generating markets opportunities for green logistics and industrial applications running on biofuels.

U.S. Biofuels Market Insights:

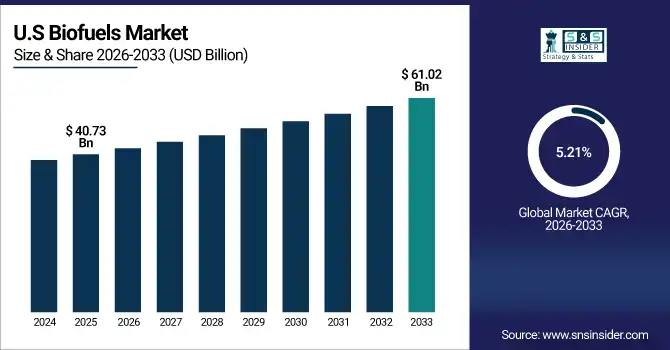

The U.S. Biofuels Market is projected to grow from USD 40.73 Billion in 2025E to USD 61.02 Billion by 2033 at a CAGR of 5.21%. Led by ethanol, biodiesel, increases buoyed by automotive mixtures and industrial use, renewable mandates and investments in cleaner sustainable fuel technologies.

Biofuels Market Growth Drivers:

-

Government renewable mandates and carbon reduction policies are accelerating demand for cleaner, sustainable biofuels.

Demand for cleaner, sustainable fuels is increasing, contributing to Biofuels Market growth, driven by renewable mandates and carbon-reduction policies. Biofuel output was about 142 billion liters in 2025 with increasing use of ethanol and biodiesel for transport and industry. Countries such as Brazil, India and Indonesia are ramping up blending of ethanol in fuels and promoting biodiesel made from vegetable oils and agricultural residues. These projects increase production, consumption and technology development for advanced biofuels.

Expanding ethanol and biodiesel mandates contributed to annual consumption of 95 billion liters in 2025, driven by automotive and industrial fuel blending.

Biofuels Market Restraints:

-

High production costs and feedstock supply limitations are restricting large-scale adoption of sustainable biofuels.

High production cost and availability of feedstock are some of the factors inhibiting the Biofuels Market growth. In 2025, the demand for ethanol and biodiesel could not be fully met as raw material was lacking by 60% and 55%, respectively. Small producers have difficulty competing with integrated plants and their economies of scale, and inconsistent government policy, volatile vegetable oil prices and land limitations. Despite growing interest in sustainable fuels, however, cost pressures and feedstock constraints have limited more widespread implementation.

Biofuels Market Opportunities:

-

Rising adoption of advanced biofuels and waste-to-energy technologies presents profitable opportunities for sustainable fuel innovations.

Increasing demand for advanced biofuels and waste-to-energy to propel market growth. In 2025, the world produced 35 billion liters of advanced biofuels, adding up to a forecasted production level beyond 70 billion liters by 2033. Industries and companies in the transportation sectors are searching for cleaner, sustainable fuel alternatives. Advanced feedstocks such as algae and ag residue, together with better production technologies are making it more efficient, sustainable and profitable for new and existing biofuel producers.

Advanced biofuels and waste-to-energy solutions accounted for 25% of new biofuel production in 2025, driven by industrial adoption and cleaner fuel mandates.

Biofuels Market Segmentation Analysis:

-

By Product Type, Ethanol held the largest market share of 61.42% in 2025, while Advanced Biofuels are expected to grow at the fastest CAGR of 12.48%.

-

By Feedstock, Corn dominated with a 40.75% share in 2025, while Vegetable Oils are projected to expand at the fastest CAGR of 6.28%.

-

By Application, Transportation accounted for the highest market share of 79.63% in 2025, and Aviation is projected to record the fastest CAGR of 7.43%.

-

By End User, Automotive segment held the largest share of 54.86% in 2025, while Aviation users are expected to grow at the fastest CAGR of 7.57%.

-

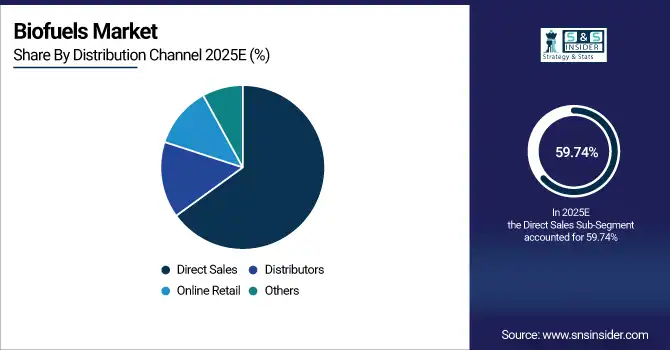

By Distribution Channel, Direct Sales dominated with a 59.74% share in 2025, while Online Retail is projected to record the fastest CAGR of 7.21%.

By Product Type, Ethanol Dominates While Biodiesel Expands Rapidly:

Ethanol sector dominated the Product Type segment with more than 87.5 billion liters produced in 2025 owing to its extensive usage in automotive fuels, government blending mandates and mature production infrastructure across Americas and Asia. It has the lead in both volume and revenue underpinned by its mature corn and sugarcane derived production. Biodiesel sector is the fastest growing Product Type segment, which will be worth 28.3 billion liters in 2025 due to growing demand for cleaner diesel alternatives, rising demand from transport and industrial applications and government incentives promoting sustainable fuels.

By Feedstock, Corn Dominates While Vegetable Oils Expand Rapidly:

Corn sector dominated the Feedstock segment with 57.3 billion liters in 2025 driven by high output, subsidies, and ready availability in the U.S., other parts of Asia. It’s being effective and low costing has made it the method of choice for ethanol production. The Vegetable Oils sector is the fastest-growing Feedstock segment which is used for inking agents up to 21.5 billion liters by 2025. Meat, feed and policy are driving expansion through renewable energy mandates, growing biodiesel output in addition to greater demand from the European and Southeast Asia transport sectors.

By Application, Transportation Dominates While Air Transport Expands Rapidly:

Transportation sector dominated the Application segment with 113 billion liters, as a result of road transport demand, blending mandates and fleet conversions across developing and developed markets. It still is the biggest volume and dollar contributor. Air Transport sector is the fastest growing Application segment. It will produce around 7.8 billion liters in 2025, supported by sustainable aviation fuel initiatives and airline commitments to cut carbon emissions and by incentives legislations in North America and Europe making it a leading market for future growth.

By End User, Automotive Dominates While Aviation Expands Rapidly:

Automotive sector dominates the End User segment at 76.2 billion liters of biofuels on account of increasing penetration ethanol blended gasoline and biodiesel in both light and heavy-duty vehicles in major markets. It has an unchallenged lead in volume and revenue based on the infrastructure and supply chains it previously built. The Aviation sector is the fastest growing End-User segment, at 7.8 billion litres, with airline investment in advanced biofuels, mandatory targets and increasing awareness of climate change providing incentives to grow.

By Distribution Channel, Direct Sales Dominates While Online Retail Expands Rapidly:

Direct Sales sector dominated Distribution Channel segment in 2025, which provided 82.7 billion liters directly to industrial, energy and transportation by way of long-term contracts, integrated refineries or B2B arrangements. This guarantees high-quantity, secure allocation in all major markets. The Online Retail sector is the fastest growing Distribution Channel segment which delivers 14.5 billion liters by 2025 as digital marketplaces and e-commerce platforms for small-scale industrial buyers and logistics providers develop and facilitate much needed flexibility, transparency, and direct access to emerging markets or niche segments.

Biofuels Market Regional Analysis:

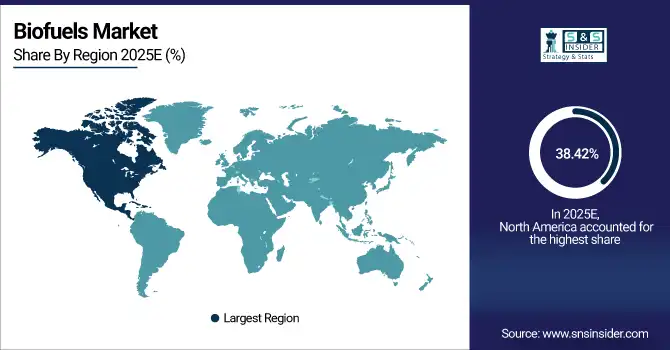

North America Biofuels Market Insights:

The North America Biofuels Market dominated accounting for 38.42% market share and is followed by Europe Automotive fuel blending, industrial use and government renewable requirements were the main drivers of demand. High production and distribution became feasible due to strong infrastructure, mature supply chains and policies. Market growth in the US and Canada remains strong due to growing use of cleaner fuels, fleet conversions and investments in sustainable fuel solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Biofuels Market Insights:

In 2025, the U.S. produced 53.2 billion liters of ethanol and 22.5 billion liters of biodiesel, including 45 billion liters from automotive fuel in and 30.7 billion liters for industrial purposes. Augmentation is stimulated by blending targets, conversion of the fleet, renewable policies and increasing application in both transport and energy.

Asia-Pacific Biofuels Market Insights:

Asia-Pacific is the fastest-growing region in the Biofuels Market with a CAGR of 7.01%, driven by rising energy demand, government blending mandates, and investments in sustainable fuel infrastructure. China generated 28.4 billion liters of ethanol and 12.1 billion liters of biodiesel, and India produced 14.5 billion liters of ethanol in 2025. Expansions are driven by the adoption of transportation/industrial/aviation in emerging markets.

-

China Biofuels Market Insights:

In 2025, China manufactured more than 28.4 billion liters of ethanol and 12.1 billion liters of biodiesel, using 25 billion and 15.5 billion liters for transportation system and industrial/energy sector, respectively. Demand growth is fueled by government requirements, increasing energy demands, fleet conversions and sustainable fuel investment policies throughout the country.

Europe Biofuels Market Insights:

Europe Biofuels Market in 2025 producing 18.7 billion liters of ethanol and 15.3 billion liters of biodiesel. Germany was the leader with 7.2 billion liters; France followed with 5.4 billion and Italy at 4.1 billion liters. Transportation consumed most and industrial use was also higher. Expanding demand is supported by renewable mandates, sustainable fuel policies and in many cases increasing biodiesel and ethanol penetration within key sectors.

-

Germany Biofuels Market Insights:

In 2025, Germany's biofuel production was at 7.2 billion liters with usage being 4.5 billion liters in transport and 2.7 billion liters for industry. Ethanol dominated the market. Government backed blending requirements, fleet conversions and renewables polices are spurring expansion in automotive, industrial and energy applications.

Latin America Biofuels Market Insights:

Latin America, of which Brazil generated over 51%, Argentina more than 32% and Colombia the remaining 15%. Some 6 billion liters were consumed in transportation and 3.8 billion liters for industry. Government blending requirements, renewability of the source material, and the potential for transportation fuel use to address greenhouse gas emissions are all motivation in market growth in automotive, industrial, and energy sectors.

Middle East and Africa Biofuels Market Insights:

The Middle East and Africa generated more than 3.20 billion liters of biofuels by 2025, where UAE accounted for 1.20 billion liters and South Africa around 0.90 billion liters. Roughly 2 billion liters went toward transportation and 1.2 billion liters to industry. Market growth is being driven by renewable fuel policies and increasing use of ethanol and biodiesel.

Biofuels Market Competitive Landscape:

Gevo Inc., US-based biofuel dominated with more than 50 billion liters of ethanol and biodiesel in 2025. Its management is led by integrated renewable fuel production, sustainable aviation fuel initiatives, and development of a novel carbon recycling technology. Gevo develops innovative solutions that change the way natural resources are transformed into energy and products by creating a renewable fuel system that powers cars, trucks, and planes with high‐performance solutions for a low‐carbon world.

-

In March 2025, Gevo advanced its Net-Zero 1 project in South Dakota, aiming to produce 60 million gallons of sustainable aviation fuel (SAF) annually using 100% U.S.-sourced feedstocks. This development strengthens Gevo’s leadership in renewable fuels and supports growing adoption of cleaner energy solutions.

LanzaTech is a world leader in converting industrial emissions to sustainable fuels, producing nearly 9 billion litres of biofuels by 2025. This cutting-edge gas-to-fuel technology, its sustainable practices and its partnerships make it a major player in the biofuels industry. The business is committed to lowering carbon levels and circular fuel production that support consistent market presence and growth.

-

In September 2025, LanzaTech, in collaboration with Mibelle Group and Fraunhofer IGB, scaled up its dual fermentation technology. This innovation converts waste CO₂ gases into alcohol, which can be further transformed into biofuels, including SAF.

Valero Energy Corporation leads the biofuels sector with over 6 billion liters of ethanol and renewable diesel in 2025. Its distributed production network, technological know-how and supply capability facilitate high volume consumption of transportation and industrial fuels. Valero's focus on production of sustainable fuels views it well positioned to lead in the world biofuels market.

-

In October 2025, Valero’s joint venture, Diamond Green Diesel, partnered with Southwest Airlines to supply sustainable aviation fuel (SAF) to Chicago Midway International Airport. Under this agreement, Southwest will purchase a minimum of 3.6 million gallons of SAF, with options to increase supply.

Biofuels Market Key Players:

Some of the Biofuels Market Companies are:

-

Gevo

-

LanzaTech

-

Valero Energy Corporation

-

Neste

-

Renewable Energy Group, Inc.

-

Archer Daniels Midland Company (ADM)

-

BP PLC

-

Shell PLC

-

Wilmar International Ltd.

-

Cargill Incorporated

-

Diamond Green Diesel

-

Petrobras

-

Raízen

-

Green Plains Inc.

-

Bunge North America, Inc.

-

Air Liquide

-

Scandinavian Biogas Fuels International AB

-

Abengoa

-

Praj Industries

-

LanzaJet

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 138.49 Billion |

| Market Size by 2033 | USD 219.79 Billion |

| CAGR | CAGR of 5.97% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Ethanol, Biodiesel, Biogas, Bio-Butanol, Others) • By Feedstock (Corn, Sugarcane, Vegetable Oils, Animal Fats, Agricultural Residues, Others) • By Application (Transportation, Power Generation, Aviation, Industrial, Others) • By End User (Automotive, Aviation, Marine, Power & Utilities, Industrial) • By Distribution Channel (Direct Sales, Distributors, Online Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Gevo, LanzaTech, Valero Energy Corporation, Neste, Renewable Energy Group, Inc., Archer Daniels Midland Company (ADM), BP PLC, Shell PLC, Wilmar International Ltd., Cargill Incorporated, Diamond Green Diesel (Valero & Darling JV), Petrobras, Raízen, Green Plains Inc., Bunge North America, Inc., Air Liquide, Scandinavian Biogas Fuels International AB, Abengoa, Praj Industries, LanzaJet |