Bulletproof Glass Market Report Scope & Overview:

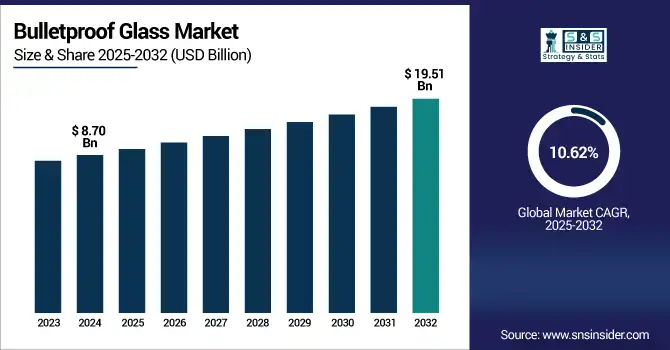

The bulletproof glass market size was valued at USD 8.70 billion in 2024 and is expected to reach USD 19.51 billion by 2032, growing at a CAGR of 10.62% over the forecast period of 2025-2032.

To Get more information on Bulletproof Glass Market - Request Free Sample Report

Bulletproof glass market analysis indicates that a global spending boom across defense and homeland security is expected to drive market growth during the forecast period. With the rise of internal and external threats and geopolitical tensions, governments around the world are dramatically increasing their defense budgets to protect in military, law enforcement, and critical infrastructure. One of the key applications of bulletproof glass is the protection of personnel, vehicles, and facilities against ballistic threats. Whether it is to protect armored vehicles, security checkpoints, embassies, and command centers, or for other applications, the demand for advanced protective glazing solutions is skyrocketing. The trend is particularly strong in the United States, China, and Middle Eastern countries as security concerns increase and are in response expressed with a commitment to investing in ballistic-resistant material for the long term, which drive the bulletproof glass market growth.

In January 2023, Guardian Glass purchased Miami-based Vortex Glass, increasing its U.S.-based fabrication capacity and positioning Guardian Glass to meet the increasing demand for commercial and residential security glazing.

Market Dynamics:

Drivers

-

Rising Demand for Armored Vehicles Across Civil and Commercial Sectors Drives the Market Growth

Rising demand for bulletproof glass in armored vehicles due to increasing need for secure transport among military forces, government officials, diplomats, and high-net worth individuals and drive the growth of the bulletproof glass market over the forecast timeline. Moreover, commercial sectors such as cash-in-transit, policing, and VIP transport are also increasing their armored vehicle fleets to address growing safety concerns. But due to improvements in lightweight and high-performance bullet-resistant materials, the automakers are no longer compromising on the security glass market which is aesthetics or performance, while integrating bulletproof glass in the cars. The trend is especially vibrant in crime-ridden or geopolitically unstable areas.

In 2023, several U.S.-based armored vehicle manufacturers reported increased contracts with federal agencies and private security firms, signaling a strong surge in the deployment of bullet-resistant glazing for defense-grade vehicles and mobile command units.

Restrain

-

High Cost of Raw Materials and Production May Hamper the Market Growth

The manufacture of bulletproof glass necessitates the bonding of several layers of glass and plastic materials such as polycarbonate and polyurethane under high pressure. These materials are costly, and the production process is complicated and has high energy consumption. Additionally, customization requirements for various threat levels (NIJ or EN standards) increase cost, making it unaffordable for many institutions. The situation is compounded in developing countries. Even though they have high-security requirements, this limits adoption in cost-sensitive applications such as public transport or small-scale commercial buildings. The setup and technology needed are also high-cost cost which forms a barrier for new players.

Opportunities

-

Integration of Bulletproof Glass in Public Infrastructure and Transportation Creates an Opportunity in the Market

There has been a rising apprehension about certain other sites, which include colleges, government structures, airports, and public transport hubs, being assaulted, which has resulted in greater funding on embedding bulletproof glass in public services. With the foresight of safe public spaces, governments have been implementing protective glazing at entryways, security booths, and control rooms. This trend is also spilling to higher-risk areas like buses and subways, the ballistic glass market, where new permanent opportunities for growth are emerging, driving the bulletproof glass market trends.

For example, hearing that the U.S. Department of Homeland Security (DHS) requested USD 97.3 billion in 2023, some of which goes to funding the hardening of federal buildings and public transit systems using primitive security solutions such as bullet-resistant glass.

Segmentation Analysis:

By Application

Defense & VIP Vehicles held the largest bulletproof glass market share, around 37%, in 2024. This dominance is attributed to the rising need for better protection concerning military personnel, government officials, and other high-profile individuals as geopolitical tensions, threats of terrorism, and civil unrest continue to rise. Bulletproof glass is an essential aspect of armored vehicles; it provides ballistic protection while still allowing the vehicle to see outside and have its physiological structure like others. Several fleets are being upgraded with a massive investment boost to state and even private sectors that provide advanced glazing systems that comply with stringent international safety standards. The segment also continues to lead in the market, boosted by technological developments in lightweight, multi-layered glass materials that have expanded their use in high-performing defense vehicles and even luxury low-profile vehicles.

Bank Security System held a significant Bulletproof Glass market share. It is owing to the rising focus on improving physical safety and security within financial institutions. Because of the high risk of theft, armed robbery, and vandalism to banks, bullet-resistant glass has proliferated in teller counters, transaction windows, entry doors, and ATM enclosures. With financial institutions focusing on both the protection of their staff and assets, the need for ballistic-resistant multilayered security glazing has increased significantly. Moreover, regulatory authorities and insurance mandates are pressing banks to establish certified ballistic solutions. As more of buyers’ financial needs move online, physical branches are being converted to secure, high-tech hubs of cash and personnel, and banks will continue to require bulletproof glass for their banking applications.

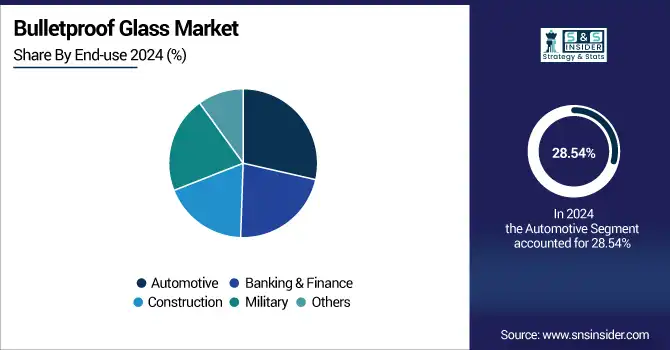

By End Use

The automotive segment held the largest market share, around 28.54%, in 2024. It is due to the increasing need for armored vehicles in civilian and military aspects is expected to drive the growth of the market. Bulletproof glass is being readily integrated into luxury vehicle and security vehicles targeting VIP, executive, diplomat, and high-net-worth individual markets in need of seamless but effective personal protection. They are also spending big bucks on bullet-resistant patrol and tactical vehicles as they face increasing threats. New technologies like lightweight laminated composites and see-through armor solutions have made it possible to include bulletproof glass in a vehicle without severely impacting performance, fuel economy, or design, which has made it a popular choice for commercial and government fleets.

Banking & Finance holds a significant market share in the bulletproof glass market. It is due to the need of the Banking & Finance sector for physical security as well as protection against armed robbery and vandalism. Bullet-resistant glass is on the rise in financial institutions such as branches of retail banks, vaults, and currency-handling centers to protect employees, assets, and critical operations. High-grade polycarbonate glass is typically used in teller counters, transaction windows, lobbies, and ATM enclosures to dissuade attacks and also adhere to industry-specific safety regulations. Furthermore, with the evolution of financial crime and physical attacks, the industry remains focused on investing in certified, robust glazing systems.

Regional Analysis:

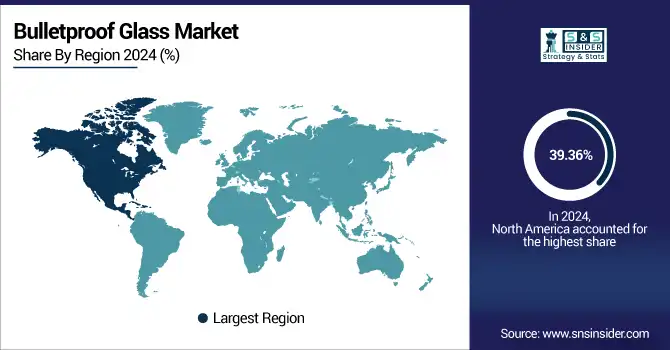

North America bulletproof glass market held the largest market share, around 39.36%, in 2024. It is owing to the high-security requirements in defense, banking, law enforcement, and civilian sectors. The U.S., in particular, massively invests in military vehicle armor, homeland security infrastructure, and upgrades to public safety. Growing school shootings, civic disruption, and threats to important infrastructure have resulted in the installation of bullet-resistant glazing in government buildings, colleges and universities, as well as commercial buildings, large and small, by both the public and private sectors. Moreover, North America consists of several stakeholders in ballistic glass, supporting the production of multi-functional & lightweight security glass that serves major applications.

In January 2023, Guardian Glass is to buy Vortex Glass, further strengthening its U.S. manufacturing footprint. Guardian Glass acquired Miami‑based Vortex Glass. It helped them add more fabrication capacity and widen their product line for security glazing and hurricane-resistant applications.

The U.S. bulletproof glass market size was USD 2.61 billion in 2024 and is expected to reach USD 5.86 billion by 2032 and grow at a CAGR of 10.64% over the forecast period of 2025-2032. It is owing to high-security infrastructure, massive defense budget, and parent presence of the key manufacturers. A major factor moving the industry forward is the growing interest of the country towards National Security, Anti-Terrorism, and Public Security leading to broad utilization of bullet-resistant glass in various sectors including government buildings, military vehicles, banks, embassies, and Educational Institutes. Moreover, the growing threat of armed violence in public areas like schools and commercial spaces has compelled the federal and state governments to make significant investments to adopt protective glazing systems. Several leading ballistic glass technology companies are also located in the U.S., which keeps up the continuous product innovations and fast supply to the U.S. demand.

Asia Pacific bulletproof glass market held a significant market share and is the fastest-growing segment during the forecast period. It is due to the growth of the defence sector, security in urban regions, and the industrial base existing in China, India, Japan, and South Korea. In recent years, particularly in the context of geo-political developments as well as domestic security concerns, we have seen a rapid advancement of military modernization efforts, upgrades in border security, and enhancements in infrastructure protection programs across the region. Furthermore, overall development of the economy and increasing numbers of investments in the fields of banking, public transport, and high-rise commercial buildings have driven up the requirement for security glazing in civilian application areas.

Europe held a significant market share in the forecast period. It is driven by sustained demand from defense and security agencies, along with banking and critical infrastructure sectors. Numerous European nations like Germany, France, the UK, and Italy are already well-versed in having established standard-defence foundations country-wide and focus on high-performance ballistic protection in military vehicles, police powers and critical civilian structures. It has also incorporated strict security measures in banks, embassies, airports, and border control stations, which in turn fuels the demand for certified bullet-proof glass. The terrorism and civil unrest, and the organized crime in a lot of places have increased the investments in protective glazing solutions, whether in the government or private sector.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major bulletproof glass companies are Saint-Gobain, Asahi Glass Co., Ltd. (AGC), NSG Group, Guardian Industries, SCHOTT AG, PPG Industries, Inc., China Specialty Glass AG, Total Security Solutions, Smartglass International, and Armass Glass.

Recent Development:

-

In 2025, Armitek launched the Home Shield Glass, which is lightweight yet the thinnest bullet-resistant product for home protection, thus increasing accessibility to high-security glazing.

-

In 2023, Guardian launched next-generation armored glazing for automotive aerospace, bulletproof glass for cars and planes, and the new multi-hit, lightweight ballistic glass from Guardian Glass.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.70 Billion |

| Market Size by 2032 | USD 19.51 Billion |

| CAGR | CAGR of10.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Bank Security System, Cash-In-Transit Vehicles, Defense & VIP Vehicles, Government & Law Enforcement, and Others) • By End Use (Automotive, Banking & Finance, Construction, Military, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Saint-Gobain, Asahi Glass Co., Ltd. (AGC), NSG Group, Guardian Industries, SCHOTT AG, PPG Industries, Inc., China Specialty Glass AG, Total Security Solutions, Smartglass International, Armass Glass |