Business Email Compromise Market Report Scope & Overview:

The Business Email Compromise Market was valued at USD 1.35 billion in 2023 and is expected to reach USD 7.24 billion by 2032, growing at a CAGR of 20.53% from 2024-2032.

To Get More Information on Business Email Compromise (BEC) Market - Request Sample Report

The Business Email Compromise market is witnessing substantial expansion as the incidence and complexity of cyberattacks aimed at companies globally keep increasing. Acronis' Cyberthreats Report for H1 2024 disclosed an astonishing 293% rise in email attacks relative to the prior year, highlighting a significant uptick in phishing and social engineering methods. Furthermore, the Internet Crime Complaint Center reports that from October 2013 to December 2023, there were more than 305,000 reported BEC cases worldwide, leading to an overall loss of USD 55.5 billion. The rise in cyber threats is primarily fueled by the growing dependence on digital communication platforms and remote work, which has heightened organizations' exposure to BEC risks. Consequently, there is an increasing need for sophisticated security measures that can identify and combat these email-related scams instantly. This increased demand for security tools is driving companies to allocate resources to systems that can avert financial losses and protect confidential data.

In response to the growing threats, the need for BEC prevention services is notably high in industries like finance, healthcare, and e-commerce, where the impacts of fraud are particularly significant. A recent report reveals that GenAI has caused a 1,760% increase in Business Email Compromise attacks, underscoring the growing magnitude of these dangers. In 2024, Abnormal Security disclosed that the manufacturing industry saw a 56% surge in BEC attacks and a 24% increase in Vendor Email Compromise attacks. As BEC strategies grow more advanced, businesses are increasingly seeking out innovative solutions driven by artificial intelligence and machine learning to maintain an edge over cybercriminals. These technologies improve the capacity to recognize questionable email behavior, automate threat identification, and simplify response measures, speeding up the expansion of the BEC prevention sector.

In 2024, Mimecast enhanced its email security solutions with AI-powered features to more effectively address Business Email Compromise attacks, underscoring the increasing trend of incorporating advanced technologies into cybersecurity systems. As we look ahead, the BEC market offers significant prospects as companies keep encountering changing cyber threats. As cybercriminals continuously evolve their tactics, companies must depend on robust cybersecurity frameworks that blend effortlessly with their current IT systems. Moreover, as businesses grow internationally, there will be a heightened demand for security solutions designed to adhere to local regulations and compliance requirements. This changing environment guarantees that the BEC market will stay vibrant, providing numerous chances for development and creativity in the future.

Market Dynamics

Drivers

-

The Shift to Remote and Hybrid Work Models Heightens Email Security Risks

The growing adoption of remote and hybrid work models has significantly altered the traditional business landscape, leading to an expanded attack surface. As employees access company emails from various locations and devices, email systems are exposed to greater vulnerabilities. Cybercriminals exploit these gaps through tactics like phishing, social engineering, and spoofing to carry out Business Email Compromise (BEC) attacks. Remote work environments often lack the same security controls and monitoring present in centralized office settings, making it more difficult to detect malicious activities. Furthermore, the blurred boundaries between personal and professional communication increase the risk of compromised accounts and fraudulent transactions. This shift underscores the urgent need for robust email security solutions to protect sensitive data and prevent significant financial losses, which fuels the demand for advanced security tools in the BEC market.

-

Technological Advancements Empower Better Detection and Prevention of BEC Attacks

Innovations in artificial intelligence, machine learning, and advanced threat detection systems are significantly enhancing the capability to identify and mitigate Business Email Compromise attacks. These technologies enable real-time analysis of email patterns and behaviors, allowing security systems to detect anomalies and suspicious activities faster than traditional methods. AI and machine learning algorithms continuously evolve, learning from new attack vectors and adapting to increasingly sophisticated phishing attempts. As a result, businesses can respond to potential threats with greater precision and speed. Additionally, predictive analytics allows for the early identification of emerging BEC tactics, enabling organizations to implement proactive defense strategies. The integration of these cutting-edge technologies into email security systems is critical to safeguarding sensitive communications and financial transactions, prompting widespread adoption across industries.

Restraints

-

Cost Barriers Limit Widespread Adoption of Advanced Email Security Solutions

The adoption of advanced email security solutions, such as AI-driven threat detection systems, can be prohibitively expensive, particularly for small and medium-sized enterprises. These businesses often face budget constraints and may find it difficult to justify the high upfront and ongoing costs associated with implementing sophisticated cybersecurity measures. While larger enterprises can absorb these expenses, SMEs may struggle to allocate sufficient resources for the necessary tools to protect against Business Email Compromise attacks. The cost of training employees, maintaining security systems, and continuously updating software further adds to the financial burden. As a result, many smaller organizations are either delayed in adopting these solutions or choose to rely on less robust, more affordable options, potentially leaving them vulnerable to evolving cyber threats.

-

The Constant Evolution of Cyberthreats Challenges Effective BEC Defense

Cybercriminals continuously adapt their tactics to bypass security systems, making it increasingly difficult for businesses to stay ahead of Business Email Compromise attacks. The dynamic nature of these cyber threats means that traditional security measures are often not enough to counter the latest phishing schemes, social engineering tactics, and email spoofing methods. As attackers refine their approaches, organizations are left scrambling to update their defenses, which can lead to gaps in protection. This rapid evolution poses a significant challenge for security solutions, requiring constant innovation and adaptation to prevent breaches. Additionally, the time it takes for businesses to implement new strategies or tools can result in missed opportunities for prevention, leaving organizations vulnerable to attacks. The fast-changing nature of cyber threats complicates the process of maintaining robust and effective BEC defenses.

Segment Analysis

By Component

In 2023, the Solution segment dominated the Business Email Compromise market, accounting for approximately 72% of the revenue share. This dominance is primarily due to the increasing demand for advanced security solutions that can prevent and detect sophisticated BEC attacks. The widespread adoption of AI-driven threat detection systems, along with robust email filtering technologies, has become essential for businesses to safeguard against rising cyber threats. As organizations prioritize proactive security measures, solutions offering enhanced protection continue to lead market growth.

The Service segment is expected to grow at the fastest CAGR of 22.24% from 2024 to 2032. This surge can be attributed to the increasing need for specialized services such as incident response, threat intelligence, and security consulting. As businesses face evolving BEC tactics, the demand for expert services to implement, manage, and optimize security solutions is growing rapidly. The increasing complexity of email-based threats has made continuous support and personalized solutions a vital aspect of comprehensive defense strategies.

By Organization Size

In 2023, the Large Enterprises segment led the Business Email Compromise market with the highest revenue share of approximately 66%. This dominance is largely attributed to their significant resources, which allow for comprehensive investments in advanced security solutions and dedicated cybersecurity teams. Large enterprises are prime targets for cybercriminals due to their valuable data and high-profile operations, making them more inclined to implement robust, multi-layered defenses against BEC attacks.

The SMEs segment is expected to grow at the fastest CAGR of about 22.14% from 2024 to 2032. As BEC attacks become more prevalent and sophisticated, SMEs are increasingly recognizing the importance of email security. Despite having fewer resources than large enterprises, SMEs are turning to more affordable and scalable security solutions, driving market growth. The rising awareness of BEC risks and the need to safeguard their operations and customer trust are key factors contributing to the rapid adoption of security measures in this segment.

By Vertical

In 2023, the BFSI segment led the Business Email Compromise market, capturing the largest revenue share of about 23%. This dominance is driven by the sector's high value and sensitivity to cyber threats, making it a prime target for BEC attacks. Financial institutions handle vast amounts of sensitive financial data and transactions, which require advanced email security solutions to prevent fraud and unauthorized access. Consequently, BFSI organizations continue to invest heavily in securing their communication channels against the growing threat of BEC.

The Healthcare segment is expected to grow at the fastest CAGR of 24.03% from 2024 to 2032. This rapid growth is fueled by the increasing digitalization of healthcare services, which has led to a surge in email-based communication. With healthcare organizations storing sensitive patient information, they are becoming more attractive targets for BEC attacks. As the sector faces mounting pressure to secure patient data and comply with regulatory requirements, the demand for specialized email security solutions is set to rise, driving the segment's expansion.

Regional Analysis

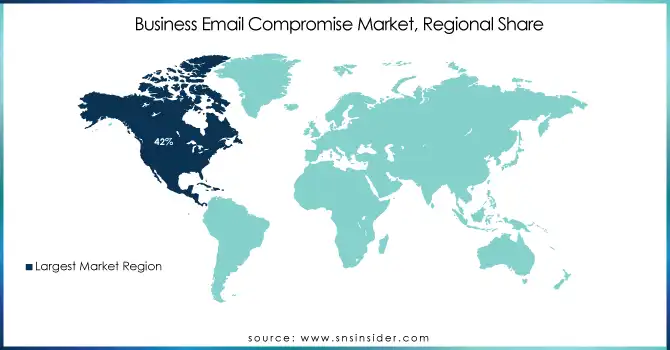

In 2023, North America dominated the Business Email Compromise market, accounting for approximately 42% of the revenue share. This leadership can be attributed to the region's highly developed infrastructure, technological advancements, and the presence of major financial institutions and corporations. As one of the most targeted regions for cyberattacks, North American businesses are increasingly adopting advanced email security solutions to protect sensitive data and prevent financial losses from BEC schemes. The growing awareness of cybersecurity risks and the regulatory landscape also contribute to the strong market presence.

The Asia Pacific region is expected to experience the fastest CAGR of 22.39% from 2024 to 2032. This rapid growth is driven by the region’s accelerating digital transformation and the expanding adoption of cloud-based services. As businesses in Asia Pacific increasingly shift to digital platforms, the need for robust email security solutions to counter BEC threats becomes more urgent. Additionally, rising awareness of cyber risks, along with improving cybersecurity frameworks, is fueling the demand for advanced protection, positioning the region for significant market expansion in the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Acronis International GmbH (Acronis Cyber Protect, Acronis True Image)

-

Broadcom (Symantec Endpoint Protection, Web Security Service)

-

Cellopoint International Corp. (CelloPoint Mail Filtering, CelloPoint Data Protection)

-

Check Point Software Technologies Ltd. (Check Point Anti-Bot, Check Point Threat Prevention)

-

Fortra, LLC (GoAnywhere, Data Security Solutions)

-

GreatHorn, Inc. (GreatHorn Email Security, GreatHorn Phishing Detection)

-

Mimecast.com (Mimecast Email Security, Mimecast Archiving)

-

Proofpoint (Proofpoint Email Protection, Proofpoint Threat Response)

-

Tessian Limited (Tessian for Gmail, Tessian for Microsoft 365)

-

Trend Micro Incorporated (Trend Micro Apex One, Trend Micro Cloud App Security)

-

Agari Inc. (Agari Phishing Defense, Agari Email Security)

-

Armorblox Incorporation (Armorblox Email Security, Armorblox Threat Intelligence)

-

Abnormal Security Inc. (Abnormal Email Security, Abnormal Behavioral AI)

-

Barracuda Networks Incorporation (Barracuda Email Security, Barracuda Web Security)

-

Clearswift GmbH (ClearSwift Secure Email Gateway, ClearSwift Secure Web Gateway)

-

Cisco Inc. (Cisco Umbrella, Cisco Email Security)

-

Check Point Inc. (Check Point SandBlast, Check Point Endpoint Protection)

-

Fortinet Corporation (FortiMail, FortiGate)

-

GreatHorn Incorporation (GreatHorn Advanced Threat Protection, GreatHorn Digital Risk Protection)

-

Heimdal Security Solutions Company Ltd. (Heimdal Security Threat Prevention, Heimdal Endpoint Protection)

-

IRONSCALES (IRONSCALES Email Security, IRONSCALES Phishing Simulation)

-

Mimecast Limited (Mimecast Targeted Threat Protection, Mimecast Secure Email Gateway)

-

Proofpoint Inc. (Proofpoint Essentials, Proofpoint Advanced Threat Protection)

-

PhishLabs Corp. (PhishLabs Security Awareness Training, PhishLabs Phishing Protection)

Recent Developments:

-

In 2024, Cellopoint partnered with Abusix to integrate its Mail Intelligence for enhanced email security, reducing spam and malware incidents, cutting false positives and negatives, and improving analyst productivity.

-

In 2024, Mimecast introduced AI-powered updates to its email security solutions, focusing on enhancing protection against Business Email Compromise attacks. The updates leverage AI and natural language processing to detect payloadless threats, improve threat detection, and reduce the risk of insider data breaches.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.35 Billion |

| Market Size by 2032 | USD 7.24 Billion |

| CAGR | CAGR of 20.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solution, Service) • By Deployment (Cloud, On-premises) • By Organization Size (SMEs, Large Enterprises) • By Vertical (BFSI, Government, IT and Telecommunications, Energy and Utilities, Manufacturing, Retail and E-Commerce, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acronis International GmbH, Broadcom, Cellopoint International Corp., Check Point Software Technologies Ltd., Fortra, LLC, GreatHorn, Inc., Mimecast.com, Proofpoint, Tessian Limited, Trend Micro Incorporated, Agari Inc., Armorblox Incorporation, Abnormal Security Inc., Barracuda Networks Incorporation, Clearswift GmbH, Cisco Inc., Check Point Inc., Fortinet Corporation, GreatHorn Incorporation, Heimdal Security Solutions Company Ltd., IRONSCALES, Mimecast Limited, Proofpoint Inc., PhishLabs Corp. |

| Key Drivers | • The Shift to Remote and Hybrid Work Models Heightens Email Security Risks • Technological Advancements Empower Better Detection and Prevention of BEC Attacks |

| RESTRAINTS | • Cost Barriers Limit Widespread Adoption of Advanced Email Security Solutions • The Constant Evolution of Cyberthreats Challenges Effective BEC Defense |