General Mobile Radio Service Market Report Scope & Overview:

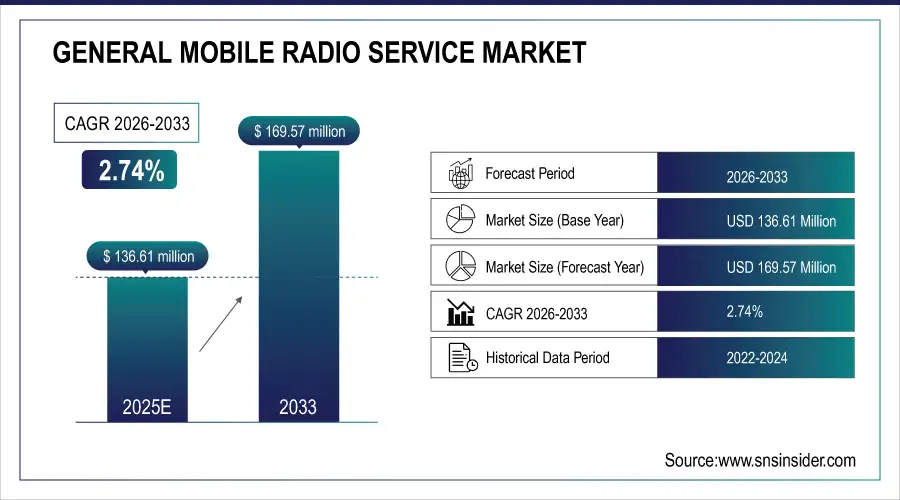

The General Mobile Radio Service Market Size was valued at USD 136.61 million in 2025E and is expected to reach USD 169.57 million by 2033 and grow at a CAGR of 2.74% over the forecast period 2026-2033.

The market is increasing steadily, driven by increased demand for consistent, short-distance communication. General mobile radio service radios, generally used in outdoor recreation, emergency services, and by small businesses, offer licensed, high-power two-way communication. The market is benefiting from growing interest in off-grid communication solutions, especially in North America, due to FCC licensing support and technological enhancements. With rising participation in hiking, camping, and other outdoor activities, general mobile radio service provides a dependable alternative to cell networks. Key players are focusing on innovation, extended range, and durability to meet the evolving needs of both personal and commercial users.

General Mobile Radio Service Market Size and Forecast:

-

Market Size in 2025E: USD 136.61 million

-

Market Size by 2033: USD 169.57 million

-

CAGR: 2.74% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on General Mobile Radio Service Market - Request Free Sample Report

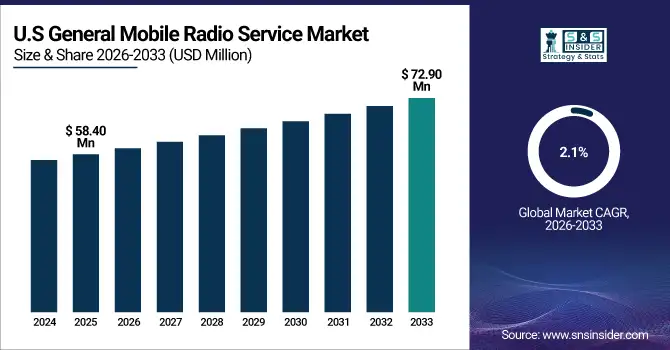

The U.S. General Mobile Radio Service (GMRS) market size was valued at an estimated USD 58.40 million in 2025 and is projected to reach USD 72.90 million by 2033, growing at a CAGR of 2.1% over the forecast period 2026–2033. Market growth is driven by steady demand for reliable short-range communication solutions across recreational users, outdoor activities, emergency preparedness, and small business operations. Increasing adoption of GMRS radios for off-road vehicles, camping, community communication networks, and disaster response scenarios is supporting market expansion. Additionally, ease of licensing, advancements in radio equipment technology, improved battery life, and integration with GPS and digital features further strengthen the growth outlook of the U.S. GMRS market during the forecast period.

General Mobile Radio Service Market Key Drivers:

-

Increased Outdoor Recreation and Emergency Preparedness Drives the General Mobile Radio Service Market Growth in Remote and Off-Grid Locations

Outdoor recreational activities are on the rise, increasing the demand for general mobile radio service devices. More individuals engaging in off-grid adventures (hiking, trekking, camping, off-roading) require reliable two-way communication. This lifestyle shift has caused general mobile radio service radios to gain traction since they offer dependable voice transmission where there is limited or no cellular coverage.

Additionally, emergency service enthusiasts and preparedness groups are increasingly adopting general mobile radio service radios for coordinated responses in disaster situations, where network infrastructure might be compromised. The growing recognition of general mobile radio service radios as vital tools for personal safety, group communication, and community alert systems has resulted in increased market demand. Manufacturers have responded by enhancing device range, battery performance, and user-friendly design features, thereby creating a positive feedback loop that supports steady market growth.

In May 2023, a leading manufacturer of general mobile radio service radios released a dual-band general mobile radio service radio with built-in emergency beacon support and solar charging capabilities targeted to outdoor survivalists. The rapid increase in consumer demand for tough, versatile, multi-function off-grid radios created this product development.

General Mobile Radio Service Market Restraints:

-

Lack of Consumer Awareness and Licensing Confusion Restrains Broader Adoption of the Market Across Key User Segments

Despite the technological benefits of general mobile radio service systems, low consumer awareness and confusion around licensing regulations have restricted market adoption in many regions. Because general mobile radio service requires a license for legal operation, many potential users misunderstand the process or assume the requirement is complex and costly. This lack of clarity has caused casual users to opt for unlicensed alternatives, such as FRS radios, which offer shorter range and fewer features.

As a result, the general mobile radio service market is suffering a large loss of potential customers-especially among outdoor enthusiasts, small businesses, and community organisations could benefit from the better reliability and longer range that general mobile radio service radios provide. Moreover, manufacturers have been slow to market the concept, and no education campaigns exist, causing a low market penetration, especially in push regions such as LATAM, where radio communications may be undervalued when compared with mobile technologies.

General Mobile Radio Service Market Opportunities:

-

Rising Integration of GPS and Bluetooth Technologies in general mobile radio service Devices Offers a Major Opportunity for Market Expansion Globally

Technological advancements in general mobile radio service devices, particularly the integration of GPS, Bluetooth, and digital mapping capabilities, are unlocking new market opportunities. These innovations have caused a shift in consumer preference toward multi-functional radios that combine navigation, location sharing, and wireless connectivity with traditional voice communication. This evolution in product design has expanded the appeal of general mobile radio service radios beyond basic communication, making them essential tools for outdoor sports, team coordination, and emergency response. In response, manufacturers are developing high-end general mobile radio service radios that include touchscreens, smart alerts, and compatibility with smartphones. These developments are enabling the general mobile radio service market to attract a wider audience, including tech-savvy users and professional operators, thereby creating new revenue streams and driving product differentiation across regions.

In January 2024, a prominent communication technology company launched a general mobile radio service with integrated Bluetooth calling and real-time GPS tracking, enabling users to navigate remote terrain while maintaining group communication. This feature-rich release marked a pivotal step in expanding the general mobile radio service market into premium segments.

General Mobile Radio Service Market Challenges:

-

Limited Frequency Availability and Interference Issues Pose Technical Challenges for the General Mobile Radio Service Market Sustainability

The general mobile radio service market is restricted by frequency bands and increasing interference, especially in densely populated or heavily used areas. Since general mobile radio service operates on shared UHF frequencies, overlapping transmissions and signal congestion can degrade communication quality, causing user dissatisfaction. This technical constraint has led to reliability issues in environments where multiple users operate radios simultaneously, especially without repeaters.

As the popularity of general mobile radio service radios continues to grow, the finite spectrum allocation becomes a bottleneck that restricts further scalability. Moreover, users in overlapping zones may experience dropped or distorted signals, create frustration and limiting the effectiveness of general mobile radio service systems for critical communication. Without proactive regulatory updates or better spectrum management technologies, this challenge could slow down market expansion and impact user confidence.

In a March 2024 radio communications forum, experts highlighted the increasing need for dynamic channel allocation and interference management tools to prevent frequency congestion in high-traffic general mobile radio service areas, signaling an urgent requirement for innovation in this space.

General Mobile Radio Service Market Segmentation Analysis:

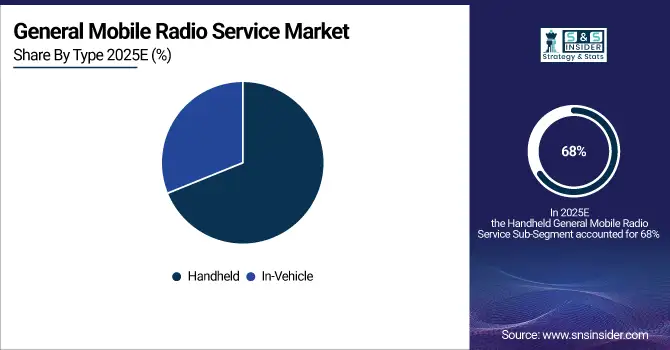

By Type, Handheld GMRS Devices Dominate 2025 Market with 68% Share, While In-Vehicle Systems Grow Steadily at 3.63% CAGR.

The dominance of the handheld general mobile radio service market share, holding a 68% revenue share in 2025, is due to its portability and ease of use, making it ideal for personal, recreational, and emergency communication. This high demand has driven manufacturers to develop rugged, waterproof, and extended-range models. As a result, product innovation, combined with high consumer preference for compact radios, has fueled consistent growth, positioning handheld devices as a core contributor to the overall general mobile radio service market expansion.

The in-vehicle general mobile radio service segment is growing at a 3.63% CAGR due to rising usage in off-road and convoy travel, where stable, mobile communication is essential. This demand has led to the development of high-powered vehicle-mounted radios with external antennas and repeater compatibility. As more consumers prioritize in-motion connectivity, especially in rural or unconnected regions, the in-vehicle segment is emerging as a vital growth area in the broader general mobile radio service market landscape.

By Application, Recreational Use Leads with 62% Share in 2025, While Off-Road GMRS Applications Grow Fastest at 4.11% CAGR.

The recreational segment dominates with a 62% revenue share in 2025, due to widespread use in camping, hiking, and outdoor events. This rising outdoor culture has created demand for reliable, license-based communication devices, causing general mobile radio service radios to gain preference over basic FRS options. In response, companies have launched lightweight, GPS-enabled radios tailored to outdoor use. This synergy between consumer behavior and product evolution continues to strengthen the general mobile radio service market's recreational application footprint.

The off-road segment has witnessed the fastest growth at a CAGR of 4.11% due to rugged terrain and remote driving, making more people rely on sturdy two-way radios. Typical Comms: General mobile radio service (GMRS) radios offer good range and are resilient to interference, making them perfect for convoys or areas with poor coverage, during disaster response in those dead zones, with 200 channels of frequencies available. Manufacturers followed in 2024, launching dustproof high-wattage general mobile radio service systems for off-road vehicles to add more enticement. This alignment of product innovation with user requirements is hastening the penetration of off-road uses in the general mobile Radio service market.

By End-User Type, Government and Public Safety Lead with 47% Revenue Share in 2025, While Commercial Use Expands at 3.69% CAGR.

Holding 47% of the market revenue in 2024, the government/public safety segment leads due to increased dependence on secure, immediate communication tools during emergencies and disaster response. This has caused investment in high-performance general mobile radio service systems compatible with public infrastructure. New devices with emergency alert integration and programmable channels have strengthened this segment, making it a critical pillar of the general mobile radio service market stability, especially in safety-critical operations.

The commercial/enterprise segment is growing at a 3.69% CAGR, driven by rising use in logistics, event management, and construction. Businesses require long-range, interference-free communication in dynamic work environments, causing the adoption of general mobile radio service radios with multi-channel support and rugged features. In 2024, commercial-grade models with noise-canceling audio and extended battery life were introduced, directly supporting workplace efficiency and contributing to the general mobile radio service market's commercial expansion.

By Frequency of Usage, Regular Operational Use Leads with 48% Share in 2025, While Occasional/Seasonal Usage Grows at 3.39% CAGR.

The regular/operational use segment leads with 48% revenue in 2025 due to consistent demand from users in security, logistics, and outdoor sectors who rely on general mobile radio service radios daily. This has caused increased development of long-lasting radios with rechargeable power sources and advanced channel programming. Such features meet ongoing communication needs, supporting the general mobile radio service market’s role in operational continuity and daily field coordination.

The occasional/seasonal use segment is growing at 3.39% CAGR, driven by spikes in recreational and event-based activities during specific months. This pattern has encouraged the launch of easy-to-use, entry-level general mobile radio service radios with basic licenses and cost-effective designs. As casual users recognize general mobile radio service reliability during peak activity periods, this segment is creating fresh growth opportunities within the overall general mobile radio service market.

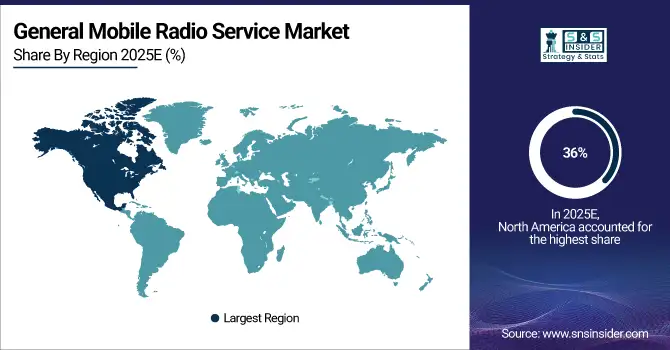

General Mobile Radio Service Market Regional Analysis:

North America Leads the GMRS Market with 36% Share in 2025, Driven by High Outdoor Activity and Strong Licensing Frameworks.

North America leads the market with a 36% share in 2025, driven by high outdoor activity participation, strong consumer awareness, and well-established licensing frameworks. Broad product availability, combined with consistent demand from recreational and commercial users, has matured the regional market. Canada dominates the North American market due to its vast rural terrain, safety regulations in remote areas, and growing dependence on general mobile radio service radios for outdoor exploration, community events, and emergency communication.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Emerges as the Fastest-Growing Region with a 6.28% CAGR in 2025, Led by Rising Emergency Communication Needs and Rural Adoption.

Asia Pacific is the fastest-growing region with a 6.28% CAGR in 2025, fueled by rising emergency communication needs, expanding rural infrastructure, and government support for off-grid connectivity. General mobile radio service radios are gaining popularity among agricultural workers, disaster response teams, and adventure travellers. India dominates Asia Pacific due to its large rural population, expanding outdoor equipment market, and increasing deployment of cost-effective general mobile radio service solutions in both commercial and personal sectors.

Europe Sees Steady GMRS Market Growth Supported by Outdoor Tourism, Public Safety Needs, and Reliable Short-Range Communication Demand.

Europe is witnessing steady growth, driven by various factors such as growing outdoor tourism, increasing public safety requirements, and the requirement for reliable, short-range communication tools. Specifically for use in mountainous and remote areas, the region is also transitioning to common mobile radio service systems for both personal and operational use. Although limited use in natural landscapes is expected in forested regions with extensive coverage, some countries are adopting safety technologies that require general mobile radio service radios for hiking and security purposes.

MEA and Latin America Grow Through Mining Safety, Security Needs, and Rural Connectivity Demand, with South Africa and Brazil Leading Their Regions.

The Middle East & Africa and Latin America, relative to mining operations, security needs, and limited cellular coverage in rural regions. High penetration of general mobile radio service used for mining safety and private security in South Africa drives the entire MEA mobile radio market. Spurred on by agricultural applications, an entrenched rural demand for dependable telecommunications, and emerging public enthusiasm for off-grid communications infrastructure throughout remote agriculture and tourism areas, Brazil controls Latin America.

General Mobile Radio Service Market Key Players:

-

Motorola Solutions

-

Midland Radio Corporation

-

Uniden America Corporation

-

Cobra Electronics Corporation

-

BaoFeng Tech (Baofeng)

-

Kenwood Corporation (JVCKenwood)

-

Icom Inc.

-

Yaesu Musen Co., Ltd.

-

Retevis

-

Wouxun Electronics

-

BTECH

-

Radioddity

-

TIDRADIO

-

Anytone

-

Puxing Electronics

-

TYT Electronics

-

Alinco Incorporated

-

SainSonic Electronics

-

BridgeCom Systems

-

Tait Communications

competitive landscape for the General Mobile Radio Service (GMRS) Market:

Motorola Solutions

Motorola Solutions is a leading U.S.-based provider of communication technologies, offering advanced two-way radio systems, including a wide portfolio of GMRS-compatible devices. The company focuses on durable, mission-ready communication tools designed for public safety, commercial operations, and recreational users. With decades of engineering expertise, Motorola Solutions integrates features such as long-range connectivity, emergency alert functions, waterproof construction, and noise-canceling audio into its devices. Its role in the GMRS market is central, setting benchmarks for reliability, ruggedness, and professional-grade performance across outdoor, enterprise, and safety-critical applications.

-

In 2025, Motorola Solutions expanded its GMRS handheld lineup with enhanced rugged radios featuring improved battery endurance, upgraded weatherproofing, and streamlined emergency-call programming tailored for outdoor and commercial use.

Midland Radio Corporation

Midland Radio Corporation is a prominent U.S. manufacturer specializing in GMRS radios known for long-distance communication, outdoor durability, and user-friendly operation. The company serves recreational users, off-road communities, emergency responders, and commercial groups with innovations such as weather alerts, repeater capability, and high-powered handheld and in-vehicle radios. Midland’s role in the GMRS market is significant, as it consistently delivers accessible, performance-driven communication tools tailored for both hobbyists and professional environments. Through product reliability and targeted outdoor-focused design, Midland reinforces its strong presence across North America.

-

In 2025, Midland introduced an upgraded series of GMRS radios for off-road and adventure users, featuring extended range, integrated GPS support, and dustproof housings designed for harsh terrain.

Uniden America Corporation

Uniden America Corporation is a well-recognized communications equipment brand offering a wide range of GMRS radios engineered for clarity, durability, and extended coverage. Known for its compact handhelds and powerful mobile units, Uniden focuses on intuitive design, robust build quality, and dependable performance for recreational, household, and field-based communication. Its role in the GMRS market is influential, particularly among outdoor users seeking simple yet effective radios with strong signal penetration and long service life. Uniden’s continued refinement of design and technology supports its position as a trusted choice in personal and semi-professional communication.

-

In 2025, Uniden launched a refreshed GMRS product line featuring enhanced display readability, improved antenna performance, and optimized power management for longer operational time in outdoor scenarios.

Cobra Electronics Corporation

Cobra Electronics Corporation is a respected manufacturer of communication and navigation technology, offering a diverse lineup of GMRS radios tailored for recreational users, outdoor adventurers, and small business operations. Renowned for its ergonomic designs and value-driven performance, Cobra integrates features such as weather-channel scanning, voice-activated transmission, and long-range communication capabilities. Cobra’s presence in the GMRS market is notable, providing practical, user-friendly solutions that blend durability with modern convenience. Its focus on innovation and portable communication needs strengthens its relevance among both entry-level and experienced users.

-

In 2025, Cobra Electronics unveiled new GMRS handheld models with upgraded weather-resistance, enhanced VOX responsiveness, and quick-pair channel presets to support faster setup for group communication.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 136.61 million |

| Market Size by 2033 | USD 169.57 million |

| CAGR | CAGR of 2.74% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Handheld General Mobile Radio Service, In-Vehicle General Mobile Radio Service) • By Application (Recreational Application, Off-Road Application, Agriculture Application) • By End-User Type (Individual/Personal Users, Commercial/Enterprise Users, Government/Public Safety) • By Frequency of Usage (Occasional/Seasonal Use, Regular/Operational Use, Emergency-Only Use) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Baofeng Electronics, Cobra Electronics, Eton Corporation, Garmin Ltd., Icom Inc., Kenwood Corporation, Midland Radio, Motorola Solutions, Puxing Electronics Co., Ltd., Retevis, Tait Communications, Uniden America Corporation, Yaesu USA, Anytone, Alinco, BridgeCom Systems, GME Radios, Grantee Communications, Wouxun, and TYT Electronics (Tytera), and Others. |