Procurement Outsourcing Services Market Key Insights:

The Procurement Outsourcing Services Market size was valued at USD 3.89 billion in 2024. It is expected to grow to USD 11.13 billion by 2032 and grow at a CAGR of 14% over the forecast period of 2025-2032.

The hybrid procurement model is gaining adoption as organizations blend in-house control with outsourced expertise for greater flexibility and scalability. According to the U.S. GAO, about 40% of federal agencies use this approach, improving adaptability, efficiency, and responsiveness to evolving market and operational demands. Moreover, to automate the procurement process, corporations are using artificial intelligence and machine learning. Furthermore, this technique enables businesses to concentrate on their core skills rather than on non-essential tasks.

Get more information on Procurement Outsourcing Services Market - Request Sample Report

Key Trends Shaping the Procurement Outsourcing Services Market

-

Hybrid Procurement Models: Increasing adoption of blended in-house and outsourced procurement functions offers flexibility, scalability, and adaptability to changing market needs.

-

Cost Optimization & Efficiency: Organizations focus on outsourcing procurement to reduce operational costs, improve supplier management, and streamline purchasing processes.

-

Technology-Driven Procurement: Integration of AI, automation, and analytics enhances sourcing, supplier evaluation, contract management, and risk assessment.

-

Compliance & Risk Management: Strict regulations and global supply chain complexities drive demand for outsourced expertise in compliance and risk mitigation.

-

Focus on Core Competencies: Enterprises outsource procurement functions to redirect internal resources toward innovation, strategy, and value-adding activities.

-

Sustainability in Procurement: Growing demand for green sourcing and sustainable supplier practices influences outsourcing decisions.

Moreover, the company focused on expansion and innovation for instance, in 2023, SAP Ariba launched a new suite of PaaS solutions designed to enhance procurement efficiency through automation and advanced analytics. This offering aims to provide organizations with streamlined procurement processes and greater access to innovative technologies without substantial upfront costs, further driving the adoption of PaaS models in various industries. In the upcoming time, the expansion is expected to be driven by companies' increasing attention to optimizing pricing & terms, purchase order, delivery, and invoicing applications in the whole transaction process.

Procurement Outsourcing Services Market Drivers:

-

With contemporary consumer trends, there is a greater need to implement new IT solutions.

-

The requirement to handle compliance standards and agreements has increased.

-

Enterprises have increased their need for procurement process simplification drives market growth.

Procurement Outsourcing Services is a growing market, and one of the key drivers of its growth is the increasing need for procurement process simplification. As supply chains become longer and increasingly complex, as technological advances complicate procurement, and as the regulatory environment is also becoming more complex, procurement processes are becoming less streamlined and less effective. Simplification of procurement processes means that a business’s operational costs are kept low, as procurement becomes more efficient. At the same time, when an enterprise simplifies its procurement process, it minimizes administrative burdens and allows the employees time to focus on strategically improving sourcing and supplier businesses, which, in turn, improves the business’s overall performance.

According to the Institute for Supply Management, nearly 70% of the organizations have expressed a desire to simplify procurement considering it has the potential of developing greater agility and responsiveness. Furthermore, Procurement Outsourcing Services allow businesses to access expert knowledge and technology, automate routine work, simplify standardization, and ensure the utmost levels of compliance. Therefore, as procurement outsourcing services allow businesses to increase simplification, they will be able to respond more quickly to changing business environments and the demands of the market, providing more businesses with a competitive edge and driving further investment in outsourcing solutions.

Procurement Outsourcing Services Market Restraints:

-

Outsourcing comes with a significant level of risk.

-

Various levels of difficulty are connected with category management.

Category management in procurement involves coordinating procurement resources to concentrate on certain products ≈ this category management can implicate different hardness levels. One of the considerable constraints is the complexity of analyzing and managing various categories and markets, different conditions of interaction with suppliers, and diverse pricing systems. Due to the need to have proper knowledge and to train personnel on a required level, not all organizations can employ category manager strategies. Also, unless the data is bad or the systems are not integrated, any company cannot understand the incapability of the adopted category management approach for proper decision-making and the implication of the supplier’s control tools due to poor visibility or problems with preparing for tender on time. As this function can be difficult to perform, companies may not focus on full implementation of such approach and, respectively, may not use the advantages obtained with procurement outsourcing services.

Procurement Outsourcing Services Market Opportunities:

-

The manufacturing and finance industries have increased their need for procurement outsourcing services as a result of fast technology improvements.

-

AI and big data technologies are widely used.

The manufacturing and finance industries are increasingly adopting procurement outsourcing services due to rapid technological advancements. In manufacturing, the rise of automation, digital supply chains, and global sourcing requires specialized expertise that outsourcing providers deliver efficiently. Meanwhile, the finance sector faces heightened regulatory requirements, digital transformation, and the need for cost optimization, making outsourced procurement a strategic choice. By leveraging external partners, both industries gain access to advanced tools, scalability, and streamlined supplier management, enabling greater agility and competitiveness in evolving markets.

Procurement Outsourcing Services Market Segmentation Analysis:

-

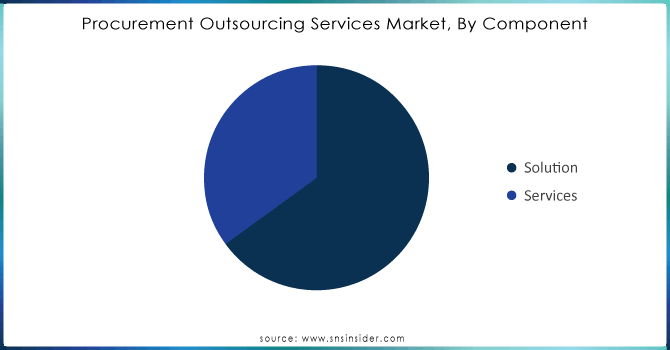

By Component, Solution Segment Leads the Procurement Outsourcing Services Market

The solution segment held the largest market share around 65% in 2024. The main reason for such a state of things is that the solutions can address a vast array of challenging procurement issues. From strategic sourcing and spend analysis to contract management and supplier relationship management, there are multiple opportunities that the given service can offer to a company. As a result, more and more organizations decide to adopt an approach to procurement that can be customized to meet their specific needs, improving the efficiency of their work. Notably, the advanced forms of IT, such as artificial intelligence, machine learning, and others, allow for making accurate decisions in procurement.

Need custom research on Procurement Outsourcing Services Market - Enquiry Now

-

By Deployment, Cloud Deployment Dominates Procurement Outsourcing Services Adoption

The cloud segment held the largest market share of around 56% in 2024. Cloud-based solutions are more flexible, scalable, and cost-effective for organizations compared to on-premise systems. With the ongoing trend of digital transformation in businesses, an increasing number of companies adopt cloud technologies to streamline procurement processes, enhance collaboration, and obtain real-time visibility across supply chains. The cloud can be integrated with multiple procurement tools or platforms to facilitate data sharing and analytics that in turn allow for better decision-making. Cloud services are also offered under a subscription-based pricing model and do not require substantial upfront capital investments, which has had additional benefits and proven to be the most prominent feature. Since procurement operations require increased efficiency and agility, the cloud segment will likely be leading the market.

-

By Enterprise Size, Large Enterprises Drive Market Growth in Procurement Outsourcing Services

In 2024, the large enterprise segment dominated the market because large enterprises usually have more complex procurement needs, higher transaction volumes, and bigger budgets, which makes outsourcing more appealing to them. Large enterprises usually have diverse supplier networks, and operations, as well as the need for specialized procurement knowledge.

-

By Application, IT-Related Services Hold the Highest Application Share

IT-related service has the highest market share around 24% in 2024. Digitization is one of the primary goals of all company representatives as a way of improving operational effectiveness and competitive advantages. It may be noted that IT-related services presuppose diverse opportunities in its framework, including software development, system integration, data collection tools application, etc., which may assist in procurement optimization. The fact is that firms may seek to develop various technologies within their companies to improve operational performance, which is why the need for diverse IT services, such as the use of Machine Learning, Artificial Intelligence, and cloud technologies increases.

-

By Industry Vertical, BFSI Sector Leads the Procurement Outsourcing Services Market

BFSI held the largest market share around 22% in 2024. This is explained by rigorous regulatory requirements of the industry and the increasing need for cost efficiency. BFSI organizations are required to improve operational efficiency in their trading process, reduce costs, and enhance service delivery, not violating the existing regulations. Consequently, local financial institutions outsource the procurement to streamline the process, receive access to expert knowledge and innovative solutions.

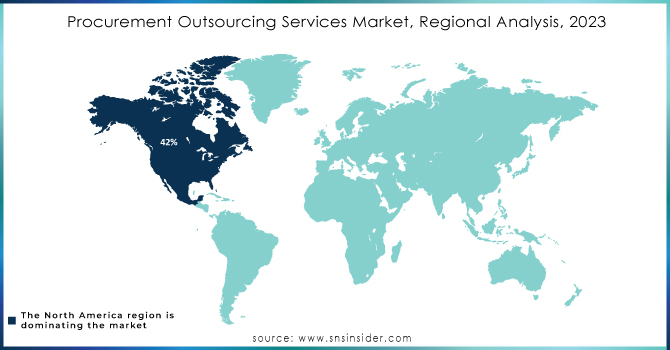

Procurement Outsourcing Services Market Regional Analysis:

-

North America Procurement Outsourcing Services Market Insights

In 2024, North America dominates the Procurement Outsourcing Services Market with an estimated share of ~38%, driven by mature digital infrastructure, strict compliance requirements, and high demand for cost optimization across industries. The region benefits from strong adoption of cloud-based procurement platforms, advanced data analytics, and AI-driven solutions, enabling organizations to streamline procurement processes, reduce operational costs, and ensure regulatory compliance. Widespread digital transformation initiatives and reliance on strategic sourcing support steady growth in procurement outsourcing adoption across North America.

-

United States Leads Procurement Outsourcing Services Market in North America

The United States dominates the North American market, supported by large enterprise adoption, diverse supplier networks, and strong demand for efficiency in procurement operations. High IT investments, coupled with rapid adoption of advanced technologies like artificial intelligence and blockchain in procurement, enhance automation and visibility. Government initiatives aimed at improving supply chain resilience and operational efficiency further strengthen the U.S. leadership position, making it the largest contributor to the region’s procurement outsourcing market growth.

-

Asia Pacific Procurement Outsourcing Services Market Insights

Asia Pacific is the fastest-growing region in 2024 with an estimated CAGR of ~10.5%, fueled by rapid industrialization, a thriving IT sector, and increasing reliance on digital procurement platforms. Rising demand from SMEs, coupled with cost advantages and availability of skilled outsourcing professionals, drives regional expansion. Government-led digitalization programs and growing cross-border trade activities further accelerate the adoption of procurement outsourcing across industries such as BFSI, manufacturing, and IT-enabled services in Asia Pacific.

-

India Leads Procurement Outsourcing Services Market Growth in Asia Pacific

India dominates the regional market due to its strong IT outsourcing ecosystem, skilled procurement workforce, and cost-effectiveness. National initiatives such as “Digital India” and “Make in India” encourage digital transformation, boosting demand for cloud-enabled procurement solutions. Multinational companies increasingly rely on Indian service providers for procurement outsourcing, leveraging the country’s expertise in technology-driven solutions, scalability, and process optimization, positioning India as a key driver of growth in the Asia Pacific procurement outsourcing market.

-

Europe Procurement Outsourcing Services Market Insights

In 2024, Europe holds a significant share in the Procurement Outsourcing Services Market, driven by stringent regulatory requirements, sustainability goals, and growing adoption of green procurement practices. Companies outsource procurement to enhance compliance with EU directives, reduce operational costs, and integrate eco-friendly sourcing into their supply chains. The region also benefits from advanced manufacturing industries and digital transformation initiatives that accelerate the adoption of AI-powered procurement solutions.

-

Germany Dominates Europe’s Procurement Outsourcing Services Market

Germany leads the European market due to its strong manufacturing base, Industry 4.0 adoption, and focus on sustainability-driven procurement strategies. German enterprises prioritize outsourcing to optimize supplier networks, ensure compliance with EU environmental policies, and reduce costs. High adoption of automation technologies, coupled with innovation in digital procurement platforms, reinforces Germany’s leadership role in shaping Europe’s procurement outsourcing market.

-

Latin America and Middle East & Africa Procurement Outsourcing Services Market Insights

The Procurement Outsourcing Services Market in Latin America and MEA is witnessing steady growth in 2024, supported by expanding IT infrastructure, increasing commercial activity, and rising demand for cost-efficient procurement processes. Organizations in these regions are embracing digital platforms and outsourcing strategies to optimize supply chains and improve operational performance.

-

Regional Leaders in Latin America and MEA

Brazil leads Latin America, driven by supply chain modernization, growing enterprise investments in procurement automation, and outsourcing by multinational corporations. In MEA, the UAE dominates, supported by smart city initiatives, digital government projects, and high demand for technologically integrated procurement outsourcing services across industries such as construction, oil & gas, and financial services.

Competitive Landscape Procurement Outsourcing Services Market:

IBM Corporation

IBM plays a pivotal role in the procurement outsourcing market by offering advanced digital procurement solutions integrated with AI, blockchain, and data analytics. Its platform emphasizes automation, transparency, and smarter supplier management, enabling organizations to optimize costs and improve efficiency. IBM’s global presence and industry expertise make it a trusted partner for enterprises seeking scalable, innovative procurement strategies aligned with digital transformation goals.

-

In 2023, IBM launched its new AI-driven procurement platform to enhance supply chain visibility and decision-making. This new launch helps the company to grow in the market.

Accenture plc

Accenture is a global leader in procurement outsourcing, providing end-to-end services including strategic sourcing, supplier management, spend analysis, and digital procurement transformation. Leveraging AI, cloud, and analytics, Accenture helps organizations drive cost savings, improve compliance, and enhance procurement agility. Its broad industry reach and consulting expertise position it as a preferred outsourcing partner for large enterprises seeking both operational efficiency and strategic value.

-

In 2023, Accenture announced the expansion of its Procurement as a Service (PaaS) offering, incorporating advanced analytics and AI to improve procurement efficiency.

GEP Worldwide

GEP specializes in procurement and supply chain outsourcing services, offering cloud-native platforms and AI-driven solutions. Its flagship product, GEP SMART, provides comprehensive capabilities in sourcing, contract management, supplier collaboration, and spend visibility. Known for innovation and sustainability, GEP supports enterprises in achieving digital transformation, cost optimization, and supply chain resilience. With a strong client base across industries, GEP is recognized as one of the fastest-growing leaders in procurement outsourcing.

-

In 2023, GEP introduced new features to its GEP SMART platform, enhancing its capabilities for managing supplier risk and sustainability.

Procurement Outsourcing Services Market Companies:

-

Infosys Limited

-

Tata Consultancy Services (TCS)

-

Wipro Limited

-

HCL Technologies

-

GEP Worldwide

-

WNS (Holdings) Limited

-

DXC Technology

-

Xchanging (a DXC Technology Company)

-

CGI Inc.

-

Corbus, LLC

-

HCL Technologies Ltd.

-

Aquanima (Banco Santander Group)

-

Proxima Group

-

Aegis Company

-

EPICOR Software Corporation

-

Infosys BPM Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 3.89 billion |

| Market Size by 2032 | US$ 11.13 Billion |

| CAGR | CAGR of 14 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •by Component (Solution and Services) • by Deployment Model (On-Premises and Cloud) • by Enterprise Size (Large Enterprises and Small & Medium Enterprises) • by Application (Marketing Related Services, IT Related Services, HR Related Services, Facilities Management & Office Services, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BASF SE, SABIC., Covestro AG, LyondellBasell Industries Inc., Eastman Chemical Company, Evonik Industries AG y, Arkema S.A., Dow Inc., Mitsubishi Chemical Corporation, Teijin Limited Asahi Kasei Corporation and others. |